Get the free Tax, Audit, Advisory Services - UHY Locations

Get, Create, Make and Sign tax audit advisory services

Editing tax audit advisory services online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax audit advisory services

How to fill out tax audit advisory services

Who needs tax audit advisory services?

Comprehensive Guide to the Tax Audit Advisory Services Form

Understanding tax audit advisory services

Tax audit advisory services encompass various professional support mechanisms designed to assist taxpayers—both individuals and businesses—during an audit process imposed by the tax authorities. These services often include expert advice on compliance, strategies for effective disclosure, and representation during audits. As tax regulations become increasingly complex, the importance of these advisory services in ensuring accurate reporting and mitigation of potential liabilities cannot be overstated.

Using tax audit advisory services can prove advantageous in numerous scenarios, including newly employed business owners unfamiliar with tax regulations, high-income earners facing scrutiny on their deductions, or anyone flagged for audit due to discrepancies in prior returns. Relying on experienced tax consultants provides peace of mind and enhances your audit preparedness.

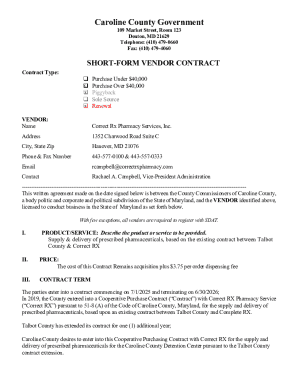

Overview of the tax audit advisory services form

The Tax Audit Advisory Services Form is an essential tool for taxpayers who need structured guidance in responding effectively to audit inquiries. This dedicated form serves to compile required documentation, responses to questions, and a comprehensive tax overview to present to auditors. Key features of the form are its integration with cloud-based document management systems that streamline collaboration, allowing multiple users to access and edit the form simultaneously.

The primary audience for this form includes both individuals preparing for tax audits and teams managing several audit cases, enhancing their workflow by centralizing all tax-related documents and communications in one platform.

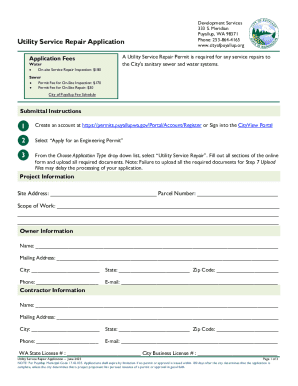

Preparing to use the tax audit advisory services form

Preparation is critical to effective use of the Tax Audit Advisory Services Form. To maximize efficiency, start by gathering necessary information such as your recent financial statements, prior tax returns, and documentation supporting each deduction and credit claimed. Maintaining organized records can significantly ease the audit process and help you confidently answer auditors’ requests.

Additionally, assembling a team of knowledgeable professionals is essential. Coordinate efforts with tax advisors skilled in audit defense, legal professionals who can offer legal protection if needed, and financial consultants to evaluate the implications of the audit outcomes. Their combined expertise will bolster your audit strategy.

Filling out the tax audit advisory services form

The process of filling out the Tax Audit Advisory Services Form requires meticulous attention to detail. Begin with the Personal Information Section, ensuring that all required details are completed accurately to avoid common pitfalls that could delay the process. Next, proceed to report your Financial Overview, carefully documenting all sources of income and corresponding expenses to ensure an accurate picture of your financial activities.

The third step involves Tax Liability Information, where you outline your relevant tax brackets and contributions. It's vital to understand these elements as they dictate your total tax obligations. Additionally, include a Supporting Documentation Checklist that verifies income, deductions, business expenses, and any other compliant disclosures. These elements form a comprehensive file that validates your tax positions.

Reviewing and editing your form

Accuracy is of utmost importance when reviewing your Tax Audit Advisory Services Form. Best practices suggest double-checking all calculations and entries to eliminate common errors, such as misreported income or overlooked deductions. Utilizing collaborative tools available on pdfFiller, such as shared access for colleagues or advisors, can significantly enhance the accuracy of the final submission through real-time feedback and editing.

Encouraging collaboration also allows for diverse perspectives, further identifying any areas of improvement before finalization. Accurate and comprehensive completion of the form reduces the likelihood of complications arising during the audit process.

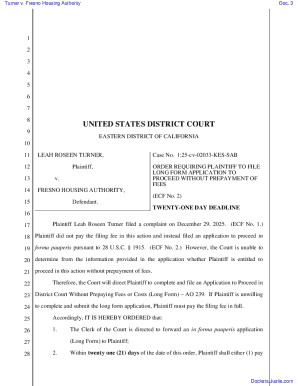

Signing and submitting the form

The importance of digital signatures cannot be underestimated when signing and submitting your Tax Audit Advisory Services Form. Digital signatures enhance the legal validity and convenience of your submission, providing immediate evidence of consent and accountability. Using tools like pdfFiller for eSignatures allows for quick and secure signing processes within the cloud-based system.

Submission guidelines vary according to the specific audit procedures. Generally, it’s essential to adhere to the directions provided by the relevant tax authorities regarding where and how to submit the completed form. Following submission, tracking your status through the cloud platform ensures you are updated throughout the audit process.

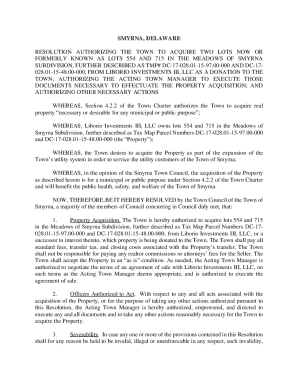

Managing and storing your tax documents

Effective management of your tax documents is crucial in ensuring clarity and readiness for any future audits. One of the best ways to handle this process is by creating an efficient filing system within pdfFiller, which allows you to tag and categorize documents as needed. This feature greatly simplifies document retrieval and assists in maintaining a well-organized audit trail.

For long-term compliance, it's beneficial to maintain digital records of all tax-related materials, ensuring they are stored securely yet remain accessible for future needs. By following best practices for documentation storage, you can protect yourself against uncertainties while also ensuring you adhere to compliance standards.

Frequently asked questions

What should you do if selected for a tax audit? First, contact a tax professional to discuss your options and prepare your documentation. Knowing how to best prepare for a meeting with your tax advisor can largely affect your audit experience. Having clear, organized documents and questions ready for discussion will facilitate a more productive meeting. After submitting the Tax Audit Advisory Services Form, follow up as required to ensure smooth communication and transparency with tax authorities.

Understanding the audit process can alleviate some of the stress often associated with it, and engaging with your advisory team can answer pressing questions and guide you through each step effectively.

Additional tools and resources

The interactive features available in pdfFiller provide ongoing support for tax-related needs. From integrated tools to convenient document management systems, pdfFiller ensures that users have access to essential resources. Some templates and forms related to tax audits and advisory services can further streamline your processes, enabling you to handle different aspects of tax management with ease.

Engaging with relevant articles and continuing to educate yourself on the evolving tax landscape can make a significant difference in your approach to audits, preparing you ahead of any potential challenges you may encounter during the audit journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax audit advisory services to be eSigned by others?

How do I complete tax audit advisory services online?

Can I create an eSignature for the tax audit advisory services in Gmail?

What is tax audit advisory services?

Who is required to file tax audit advisory services?

How to fill out tax audit advisory services?

What is the purpose of tax audit advisory services?

What information must be reported on tax audit advisory services?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.