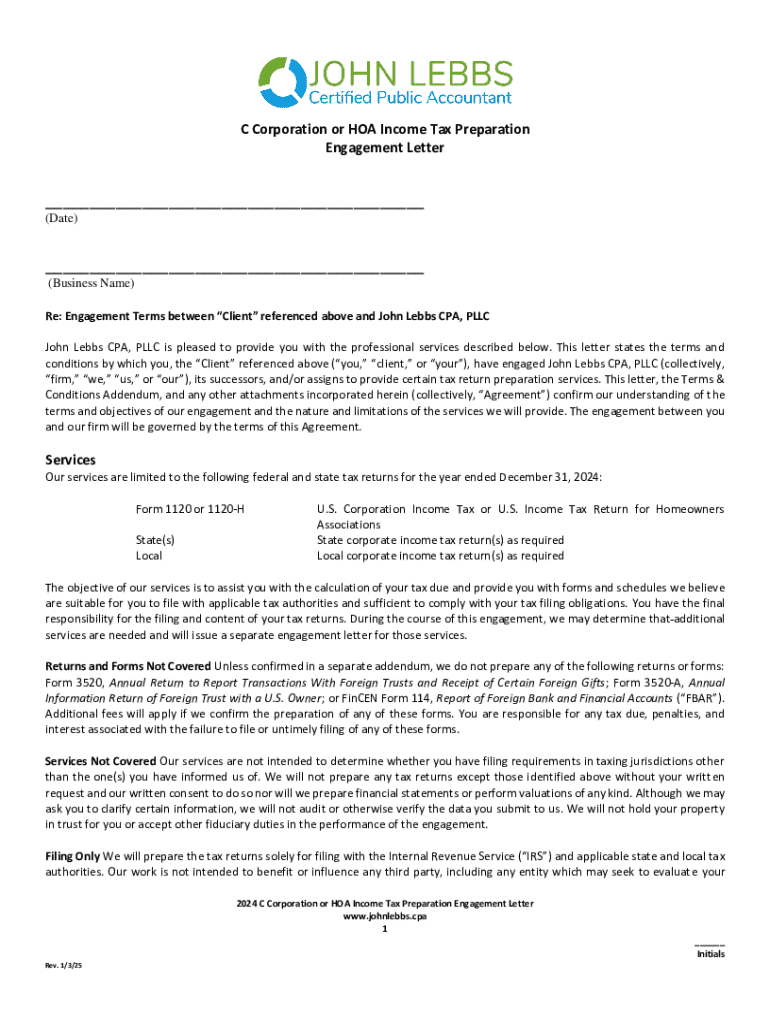

Get the free C Corporation or HOA Income Tax Preparation Engagement Letter ...

Get, Create, Make and Sign c corporation or hoa

How to edit c corporation or hoa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out c corporation or hoa

How to fill out c corporation or hoa

Who needs c corporation or hoa?

Corporation or HOA Form: Your Comprehensive Guide

Understanding Corporations and Homeowners Associations (HOAs)

C Corporations and Homeowners Associations (HOAs) are two distinct entities that serve different purposes within the business and community management landscapes. Understanding their definitions and roles can help you navigate their respective forms and filing requirements more effectively.

Definition of Corporation

A C Corporation is a legal structure for a corporation in which the owners or shareholders are taxed separately from the entity. This taxation model offers various benefits such as limited liability, which protects shareholders from personal liability for corporate debts and claims. It also allows corporations to raise capital more efficiently through the sale of stock.

However, a C Corporation also presents certain disadvantages, including double taxation on profits — both at the corporate level and upon dividends distributed to shareholders.

Overview of Homeowners Associations (HOAs)

Homeowners Associations govern communities, typically in planned developments, condos, and townhouse communities, to enforce standards and manage shared responsibilities. HOAs operate under a set of bylaws and provide essential services while ensuring the upkeep of shared spaces, contributing to the property values within the area.

The legal structure of an HOA is usually a nonprofit association, which may lead to potential tax benefits, making it distinct from a for-profit entity like a C Corporation.

The importance of proper documentation

Proper documentation is critical in both C Corporations and HOAs. The forms you use can influence compliance, legal standing, and tax implications. Clear and accurate filing ensures smooth operations, avoids penalties, and facilitates effective management.

The role of forms in Corporations

C Corporations must submit various forms, with incorporation papers being a primary step in establishing the entity. Form 1120 is particularly important for tax filings, as it reports corporate income and computes the tax liability. Accuracy in these forms is crucial — any mistakes can lead to costly audits and potential legal issues.

Timely and accurate filing is necessary not only for compliance but also for maintaining investor trust and corporate reputation.

Essential forms for HOA management

For HOAs, documentation is equally vital. Essential documents include declarations that outline the association's rules, budget forms to manage financial planning, and minutes from meetings to maintain transparency. With thorough documentation, HOAs can ensure compliance with state laws and provide transparency to homeowners.

Maintaining these documents not only helps in compliance but serves to strengthen community trust and engagement among homeowners.

Detailed insights into Corporation filing

Completing Form 1120 for a C Corporation can initially seem daunting, but breaking it down makes it manageable. This form is divided into sections, each requiring accurate financial reporting and appropriate deductions. Being meticulous ensures you don't overlook possible expenses or credits that could reduce your tax liability.

Step-by-step guide to completing Corporation Form 1120

Beginning with basic information about your corporation, the form then delves into your income and how it is taxed. You will need to detail all allowable deductions, such as operating expenses and depreciation, before arriving at your taxable income. Finally, calculations of total tax owed conclude the document.

Familiarizing yourself with the form sections enables better preparation, thus avoiding errors that could delay processing or trigger audits.

Common mistakes to avoid

Filing errors can lead to complications for C Corporations. Common mistakes include incorrectly reporting income, failing to apply for deductions, or miscalculating tax owed. Ensuring that each section is thoroughly checked before submission can prevent these issues.

Implementing a review process where a colleague or a CPA reviews the forms can save you from potential pitfalls, ensuring your submissions are accurate.

Understanding the HOA filing process

HOA filing processes vary depending on the state and whether the HOA is considered a nonprofit or for-profit organization. Understanding which forms to file and the accompanying deadlines is paramount for compliance. One crucial form for HOAs is Form 1120-H, designed specifically for associations that meet certain IRS criteria.

Key forms for homeowners associations

Form 1120-H enables HOAs to report income specifically from members (like dues) and claim specific deductions related to maintaining community services. This form allows HOAs to benefit from a favorable tax treatment, where they often only pay taxes on non-member income.

Timely completion and filing of these forms are critical to ensure that the association remains compliant and can continue to function effectively.

Filing process for HOAs: A detailed walkthrough

Completing Form 1120-H involves several key steps, starting from gathering your HOA's financial documents, including income statements and expense records. Next, accurately fill in individual sections detailing your community’s financial performance.

Important deadlines typically revolve around the end of the fiscal year and organizing timely submissions can help avoid penalties.

Comparing Corporation and HOA tax filing

Comparing the tax filings for C Corporations and HOAs reveals significant differences in structure and requirements. Understanding these distinctions aids in making informed decisions regarding the paperwork needed for your entity.

Differences between Form 1120 and Form 1120-H

Form 1120 is for C Corporations and focuses on reporting all income crediting taxes at the corporate level. In contrast, Form 1120-H is more tailored for HOAs, allowing them to generally avoid taxes on member dues, impacting their financial strategy positively.

The choice between filing under each form will depend largely on the operational model of the organization and the sources of its income.

Advantages and disadvantages of filing as an HOA

HOAs benefit from tax-exempt status on certain income, an advantage over typical C Corporations. However, the number of regulations governing HOAs may also mean a heavier burden in record-keeping and compliance. Consulting with a HOA & Condo Association CPA may be beneficial for understanding tax considerations based on your specific community structure.

Ultimately, selecting the appropriate filing strategy is crucial, as the relevant tax implications can significantly affect operations and finances.

Tax planning strategies for corporations and HOAs

Employing effective tax planning strategies is vital for C Corporations and HOAs alike. These strategies not only help in minimizing tax liabilities but also facilitate better financial management.

Effective tax planning for Corporations

C Corporations can adopt several strategies to minimize tax liabilities. These include utilizing tax credits available for research and development, making timely contributions to retirement plans, and planning for capital gains wisely to enhance cash flow and tax efficiency.

These proactive measures can greatly enhance the financial resilience of a corporation.

HOA financial management best practices

For HOAs, financial management best practices include precise budgeting, ensuring transparency in all financial dealings, and maintaining regular audits. These practices not only comply with legal requirements but also reassure homeowners that their dues are effectively managed.

By adhering to these guidelines, HOAs can effectively ensure financial stability within the community, meeting the needs of current and future homeowners.

Interactive tools and resources

Utilizing digital tools can enhance the efficiency of form management for both C Corporations and HOAs. Innovative solutions, like those provided by pdfFiller, empower users with a range of forms and templates tailored for different entities.

Forms and templates available on pdfFiller

pdfFiller offers a variety of templates for both C Corporations and HOAs, streamlining the document creation and management process. Users can access IRS forms directly, modify them as needed, and maintain compliance with ease.

By leveraging tools like pdfFiller, individuals and teams can enhance productivity and ensure accurate form management, making tax season significantly less stressful.

Collaboration features on pdfFiller

The collaborative features of pdfFiller allow users to invite team members for real-time form completion. This enhances accuracy, as multiple eyes on a document can reduce errors and promote effective teamwork.

These features contribute to an organized and efficient workflow, allowing you to focus more on strategic decision-making rather than getting bogged down by paperwork.

Reader interactions

Engaging with questions and clarifying common misconceptions allows for deeper understanding among users navigating the complexities of C Corporations and HOAs.

FAQs on Corporations versus HOAs

Frequently asked questions often pertain to the differences in filing requirements, tax liabilities, and best practices for both structures. Addressing these queries can aid in making more informed decisions about entity organization and taxation.

These questions reflect common concerns among users, providing opportunities to clarify differences and guide informed choices.

Interactive Q&A section

Encouraging user engagement through discussions and questions can foster a community of sharing knowledge. Users should feel empowered to raise specific scenarios they face, further expanding on the topic of C Corporations and HOAs.

Primary sidebar

In addition to the detailed guide provided, having quick access to resources can streamline the filing process.

Quick links to common forms

pdfFiller facilitates easy access to necessary documents for both C Corporations and HOAs, ensuring users can quickly find the forms they need without hassle.

These resources enhance the efficiency of filing processes, keeping you organized and focused throughout the year.

Helpful tips & reminders

Being observant about compliance requirements and deadlines can save stress later. Regular reminders to update and review documents help in maintaining accurate records and smooth operations.

By implementing these practices, both C Corporations and HOAs can effectively manage their respective documentation with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit c corporation or hoa online?

How do I make edits in c corporation or hoa without leaving Chrome?

How do I fill out the c corporation or hoa form on my smartphone?

What is c corporation or hoa?

Who is required to file c corporation or hoa?

How to fill out c corporation or hoa?

What is the purpose of c corporation or hoa?

What information must be reported on c corporation or hoa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.