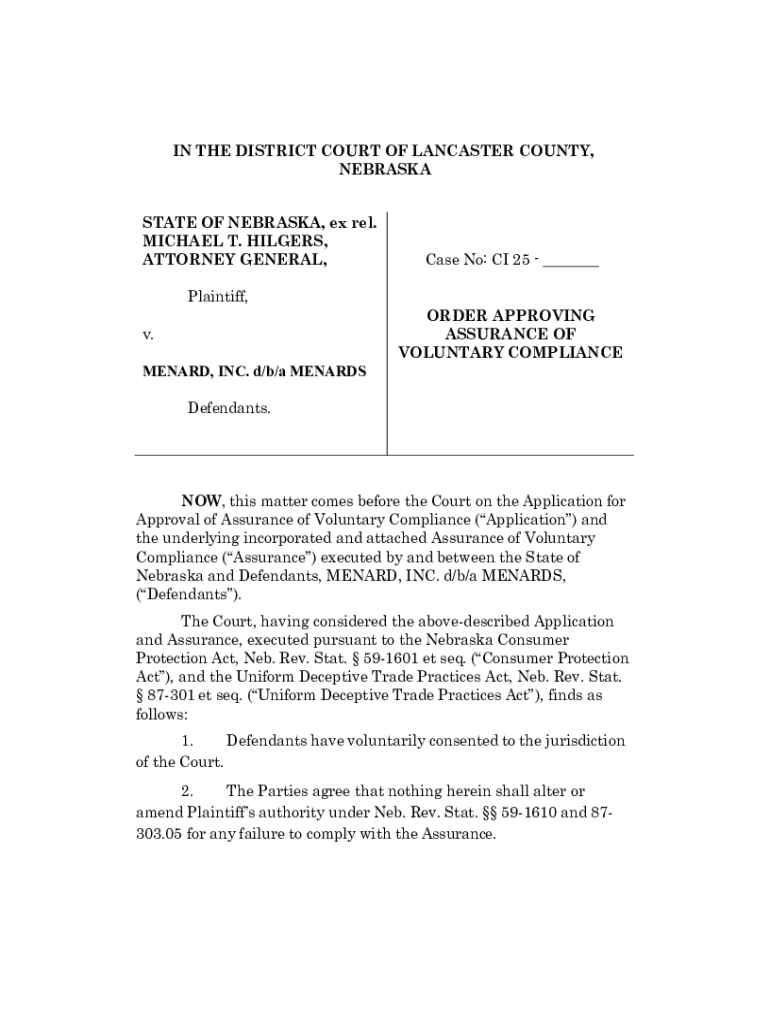

Get the free State of Nebraska ex rel. Michael T. Hilgers, Attorney ...

Get, Create, Make and Sign state of nebraska ex

How to edit state of nebraska ex online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of nebraska ex

How to fill out state of nebraska ex

Who needs state of nebraska ex?

How-to Guide on the State of Nebraska Ex Form

Overview of the Nebraska Ex Form

The Nebraska Ex Form serves as a pivotal document for individuals and organizations looking to claim property tax exemptions in Nebraska. It allows eligible taxpayers to apply for various exemptions, such as the homestead exemption, aimed at reducing their taxation burden based on specific criteria.

Understanding the purpose of the Nebraska Ex Form is crucial for efficient document management, helping to ensure that those eligible can take advantage of the benefits designed to support them. This guide provides a comprehensive look into the requirements, process, and the resources available to assist with the Nebraska Ex Form.

Understanding the Nebraska Ex Form requirements

Eligibility to use the Nebraska Ex Form primarily revolves around home ownership and specific property qualifications. Homeowners in Nebraska who meet age, disability, or income thresholds can apply for exemptions. This form is critical for those who may need immediate relief from their property tax liabilities.

When preparing to fill out the Nebraska Ex Form, gather necessary personal information documents, such as Social Security numbers and proof of residency. Supporting documentation may include tax returns, proof of income, and any relevant legal information needed to substantiate your application.

Step-by-step guide to completing the Nebraska Ex Form

Completing the Nebraska Ex Form requires careful attention to each section to ensure accuracy and compliance. Below is a detailed breakdown of how to fill out the form effectively.

To avoid common mistakes—like submission of incomplete sections—consider double-checking your entries against the criteria. Utilize checklists to ensure all necessary information is included.

Editing and customizing your Nebraska Ex Form

For those who prefer a digital format, using pdfFiller significantly enhances the editing and customizing experience for the Nebraska Ex Form. Users can easily upload existing PDF versions of the form to begin.

These features ensure that your Nebraska Ex Form is tailored to your specific needs, improving clarity and organization.

Electronic signing of the Nebraska Ex Form

The advantages of electronic signing cannot be overstated, especially when submitting the Nebraska Ex Form. eSigning through pdfFiller streamlines the process and ensures a secure transaction.

Follow these steps for eSigning via pdfFiller: log into your account, access your Nebraska Ex Form, proceed to the eSigning option, and follow the prompts to finalize your signature.

Submitting the Nebraska Ex Form

When it comes to submitting the Nebraska Ex Form, you have multiple options, including online submission via the Nebraska Department of Revenue's website or via traditional postal services.

Ensure you keep a copy of your submitted form along with tracking information when utilizing postal services to confirm successful submission.

Tracking and managing your Nebraska Ex Form post-submission

Once your Nebraska Ex Form is submitted, tracking its status becomes essential. You can periodically check the Nebraska Department of Revenue's online portal for updates on your submission.

Staying engaged with your application ensures you can respond quickly to any issues that may arise during processing.

Common questions about the Nebraska Ex Form

It is common for first-time users to encounter questions when dealing with the Nebraska Ex Form. For clarity, here are some frequently asked questions.

Being informed can alleviate the stress associated with documents and applications, ensuring you are prepared for any challenges.

Resources for further assistance

Utilize the resources available through the Nebraska government to assist with your Nebraska Ex Form. Engaging with official channels can provide vital information and support.

Connecting with these resources can fast-track your understanding and ease the complexity surrounding the Nebraska Ex Form.

Master list of related forms and documents

In addition to the Nebraska Ex Form, there are other relevant forms and documents that may be beneficial based on your needs. Familiarizing yourself with these options can provide a wider perspective on the benefits available.

Accessing these documents through the Nebraska Department of Revenue or pdfFiller simplifies management and ensures compliance with necessary guidelines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my state of nebraska ex directly from Gmail?

How can I send state of nebraska ex to be eSigned by others?

Where do I find state of nebraska ex?

What is state of nebraska ex?

Who is required to file state of nebraska ex?

How to fill out state of nebraska ex?

What is the purpose of state of nebraska ex?

What information must be reported on state of nebraska ex?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.