Get the free W2 short answer worksheet due monSociology ... - uh-ir tdl

Get, Create, Make and Sign w2 short answer worksheet

Editing w2 short answer worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w2 short answer worksheet

How to fill out w2 short answer worksheet

Who needs w2 short answer worksheet?

Understanding the W2 Short Answer Worksheet Form

Overview of the W2 short answer worksheet form

The W2 short answer worksheet form serves as a pivotal tool for individuals preparing their taxes, streamlining the process of gathering essential information from the W2 tax forms they receive from their employers. This worksheet is designed to simplify the data entry process, ensuring that taxpayers accurately report their income and tax withholdings when filing their returns. For many, understanding this tool is not just about practicality; it’s about improving accuracy in filing tax returns.

In tax preparation, the W2 short answer worksheet form holds significant importance. By breaking down complex tax information into manageable sections, it alleviates the intimidating aspects of tax filing. Moreover, its interactive features and cloud-based accessibility mean that users can fill it out from anywhere, fostering collaboration among users whether they are individual filers or teams within an organization.

Understanding the W2 form

A W2 form, officially titled ‘Wage and Tax Statement,’ is a crucial document provided by employers to their employees, summarizing annual wages and the taxes withheld from their paychecks. For taxpayers, understanding the W2's significance is essential for successful tax filing. Each W2 form contains vital information such as total earnings, Social Security, and Medicare taxes withheld, along with state tax information, ensuring that individuals have a complete picture of their earnings for the year.

There are various types of W2 forms used, depending on employment status, state regulations, and specific industries. For example, a W2 issued for a contract employee might differ in formatting compared to one generated for a full-time employee. Recognizing these different types can help taxpayers better prepare for their unique tax situations.

Utilization of the W2 short answer worksheet

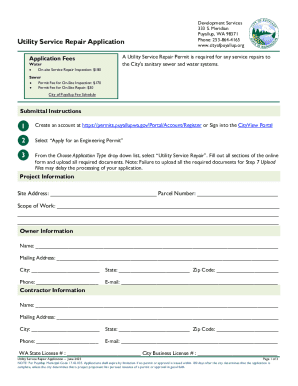

Filling out the W2 short answer worksheet form involves a straightforward yet methodical process that aids in collecting essential data efficiently. The initial setup of the worksheet requires the user to clearly state their personal details, including their name, Social Security number, and address. This step ensures that all entries correspond accurately to the individual's tax profile.

Next, it’s crucial to input income and tax withholding information from the W2 form in the designated sections of the worksheet. Users can enable features such as drop-down menus or auto-fill options, making it easier to capture this data accurately. To ensure the best possible results in tax filing, it is essential to take a moment before submission to review all the information inputted.

Analyzing 'W2 short answers' for competency

The inclusion of short answer questions within the W2 short answer worksheet form plays an essential role in assessing understanding and competency related to tax filing. Engaging in these questions allows users to interpret complex tax information while applying it to real-world scenarios. This verification process enhances the user’s relationship with their tax information and reflects their capability in managing their finances intelligently.

Common questions found in the W2 short answers may include prompts such as 'How do I interpret the various box numbers on my W2?' and 'What deductions or credits are applicable based on the information listed?' These queries encourage users to reflect on their financial situations, promoting a comprehensive understanding of tax implications.

Collaborative document features of pdfFiller

pdfFiller's platform enhances the utility of the W2 short answer worksheet form through its collaborative document features. Real-time collaboration allows multiple users to contribute or review content on the same document simultaneously, which is especially beneficial for teams or groups preparing tax documents together. This feature minimizes the risk of errors while maximizing efficiency.

In addition to collaboration, pdfFiller supports an e-signature process that adds significant value to document management. Users can invite others to provide e-signatures, ensuring authenticity and compliance without the need for printing and scanning, thus simplifying the submission process.

Adjusting and managing your W2 worksheet

Editing the W2 short answer worksheet form is a breeze within pdfFiller’s robust platform. Users can access editing tools directly on the web-based interface, allowing for seamless adjustments, whether updating figures or incorporating additional documents. This level of flexibility ensures that users can keep their tax information current and reflective of their financial situation at any time.

Another crucial aspect of using pdfFiller is the ability to save and retrieve your work instantly. Utilizing cloud storage means that your documents are stored securely online, making them retrievable from any device, which is invaluable as tax season approaches. Additionally, version control ensures that you can track changes made over time, allowing for easy management of revisions and updates.

Frequently asked questions (FAQs)

Understanding the role of the W2 form in tax filing is essential for every taxpayer. It acts as the cornerstone of income reporting and serves as a critical piece of documentation during the tax assessment process. Users often have questions about retrieving lost W2 forms or understanding what steps to take if they lack a W2 for filing. Addressing these common queries is important for empowering individuals in their tax preparation.

Key FAQs related to the W2 short answer worksheet form include questions on the timeline for receiving a W2, guidance on utilizing a substitute form when a W2 is lost, and understanding the consequences of failing to submit a W2 during tax filing.

Best practices for filing tax returns with W2 data

To enhance the accuracy and efficiency of filing tax returns, it is essential to cross-reference W2 data with other tax forms, such as W4 and 1099 forms. By comparing withholding amounts and income reported across documents, filers can identify discrepancies and ensure their data aligns with IRS requirements. This holistic approach to tax documentation enhances the credibility and accuracy of submitted returns.

Maintaining an organized filing system for tax documents is equally vital. Creating a dedicated folder for W2 forms and associated tax documents will streamline future reference and retrieval, especially when auditing or revisiting past filings. Taxpayers should also prioritize retaining copies of their W2 forms for several years, recognizing their importance during tax audits or various financial assessments.

Interactive tools and resources

pdfFiller provides additional interactive features that further enhance the user experience when dealing with the W2 short answer worksheet form. With a variety of templates available for different tax-related documents, users can quickly find the appropriate forms needed for comprehensive tax preparation. Moreover, built-in calculators enable users to estimate maximum deductions, making it easier to navigate the intricacies of tax filings.

Beyond templates and calculators, pdfFiller also offers access to a wealth of educational materials designed to improve user comprehension of taxation. Links to webinars, tutorials, and articles covering tax basics and recent regulations are readily available, empowering users to stay informed and make sound financial decisions.

Testimonials and success stories

User experiences with the W2 short answer worksheet form illustrate its effectiveness across various scenarios. For many individuals, transitioning from a paper-based tax filing method to an interactive digital worksheet has transformed their preparation experience. Not only have users reported a decrease in errors, but they also highlight the collaborative features that facilitate teamwork in tax preparation, making group efforts in large organizations much smoother and efficient.

Success stories abound with teams leveraging pdfFiller for collective tax filing, gaining valuable insights from shared knowledge, and fostering a supportive environment for financial responsibility. The powerful combination of accessibility and user-friendly features reflects a positive impact on both individuals and organizations navigating the tax landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit w2 short answer worksheet online?

Can I create an eSignature for the w2 short answer worksheet in Gmail?

How do I complete w2 short answer worksheet on an Android device?

What is w2 short answer worksheet?

Who is required to file w2 short answer worksheet?

How to fill out w2 short answer worksheet?

What is the purpose of w2 short answer worksheet?

What information must be reported on w2 short answer worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.