IRS Worksheet Solutions: Tax Legislation Process 2011-2025 free printable template

Show details

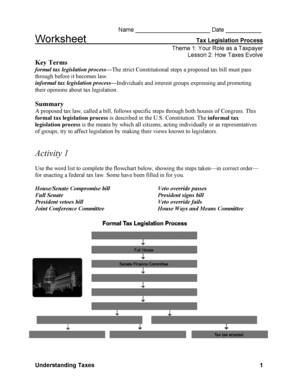

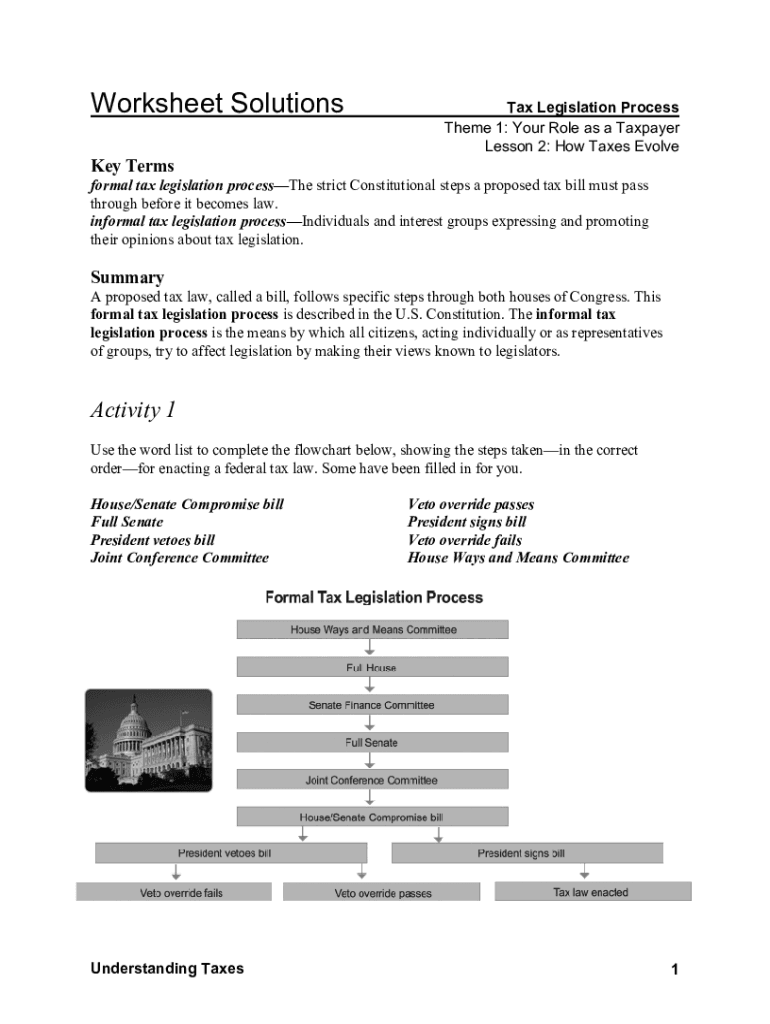

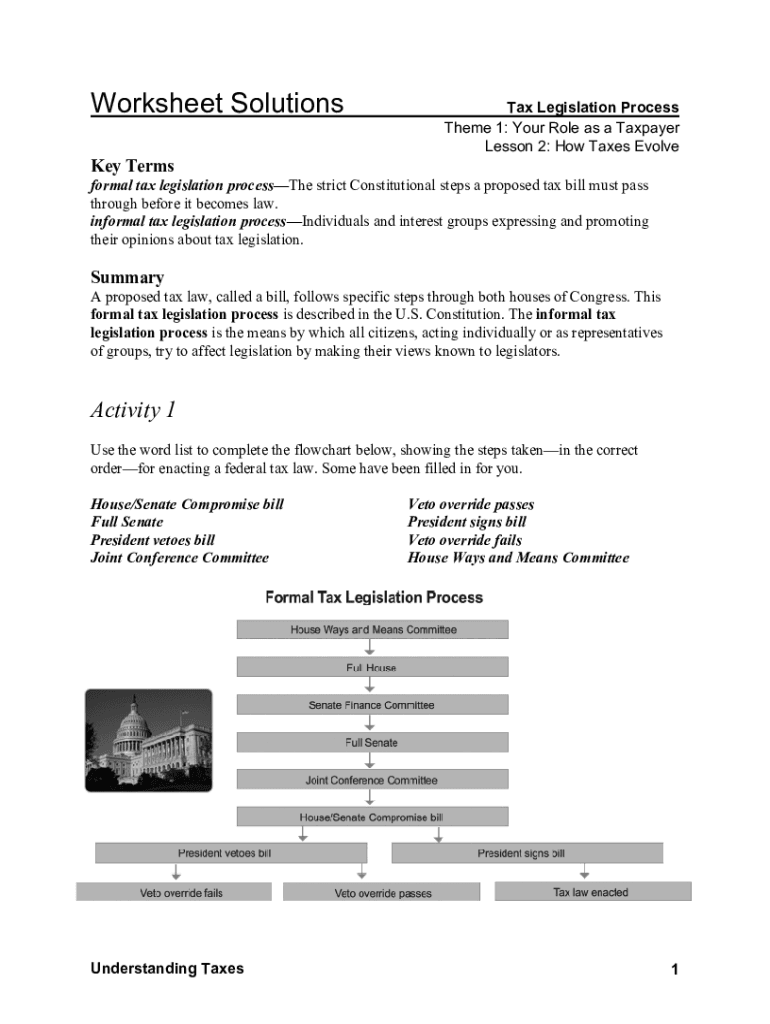

Worksheet Solutions. Tax Legislation Process. Theme 1: Your Role as a Taxpayer. Lesson 2: How Taxes Evolve. Key Terms formal tax legislation process The ...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign internal revenue service tax form

Edit your download irs forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your worksheet legislation print form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing internal revenue service worksheet tax online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax legislation process form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Worksheet Solutions: Tax Legislation Process Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out internal revenue service worksheet

How to fill out IRS Worksheet Solutions: Tax Legislation Process

01

Gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements.

02

Review the IRS Worksheet Solutions for updates regarding tax legislation that may affect your filings.

03

Start with Section 1 of the worksheet, entering your personal information including name, address, and Social Security number.

04

Move to Section 2, where you will report your income sources and amounts as instructed.

05

In Section 3, detail any deductions or credits applicable to your situation, verifying them against IRS guidelines.

06

Complete Section 4 which calculates your expected tax liability based on the information entered.

07

Review all entries for accuracy and completeness before proceeding to any electronic submission or print out.

Who needs IRS Worksheet Solutions: Tax Legislation Process?

01

Individuals preparing their annual tax returns who want to understand the impact of recent tax legislation on their finances.

02

Tax professionals advising clients on how to navigate the complexities of new tax laws.

03

Businesses assessing their tax liabilities and any eligible deductions that arise from current legislation changes.

Fill

form

: Try Risk Free

People Also Ask about

What is another name for Internal Revenue Service?

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law.

Why would Department of Treasury send me a letter 2022?

This letter helps determine whether it is possible to claim the recovery refund credit on the 2021 tax return. About 36 million families should be waiting for the letter, which will be important to receive any refund when it comes time to file taxes for 2021.

What are the four divisions of the IRS?

Four primary IRS Divisions at-a-glance: Large Business and International. Small Business/Self-Employed. Tax-Exempt and Government Entities. Wage and Investment.

Why would I get a letter from the Internal Revenue Service?

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

Is the IRS and Internal Revenue Service the same?

The Internal Revenue Service (IRS) is the tax administrator and collector of the United States of America. It's a bureau of the Department of the Treasury. In July of 1862, Congress established the Office of the Commissioner of Internal Revenue under the Department of the Treasury.

Where are IRS forms available?

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores.

What is the easiest way to pay estimated taxes?

Making payments online is the fastest, easiest way to pay quarterly taxes. If you prefer, you can also make payments by mail. To avoid any tax penalties, take time to learn how much you'll need to pay in quarterly taxes, when quarterly tax payments are due and how to make your payments to the IRS.

When can I pay 2022 estimated taxes?

The remaining deadlines for paying 2022 quarterly estimated tax are: June 15, September 15, and January 17, 2023. Taxpayers can check out these forms for details on how to figure their payments: Form 1040-ES, Estimated Tax for IndividualsPDF.

What is the official name of the IRS?

About IRS | Internal Revenue Service.

Are the 2022 IRS tax forms available?

The 2022 Tax Forms can be uploaded, completed, and signed online. Then download, print, and mail the paper forms to the IRS. Detailed information on 2022 State Income Tax Returns, Forms, etc.

How do you know if you owe taxes or get a refund?

Whether you owe taxes or you're expecting a refund, you can find out your tax return's status by: Using the IRS Where's My Refund tool. Viewing your IRS account information. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.)

What are the two types of IRS?

The IRS comprises two branches, Indian Revenue Service (Income Tax) and Indian Revenue Service (Custom & Indirect Taxes), controlled by two separate statutory bodies, the Central Board of Direct Taxes (CBDT) and the Central Board of Indirect Taxes and Customs (CBIC).

Is the IRS sending out letters 2022?

October 4, 2022 — The IRS will begin mailing letters in October on behalf of the Center for Medicare & Medicaid Services, sharing information about obtaining Marketplace healthcare coverage.

How do I contact the IRS by phone?

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

Should I be worried if I get a letter from the IRS?

Don't ignore it. Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes specific instructions on what to do. Don't throw it away.

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Where can I get IRS Forms 2022?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify internal revenue service worksheet without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like internal revenue service worksheet, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make edits in internal revenue service worksheet without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your internal revenue service worksheet, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit internal revenue service worksheet straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing internal revenue service worksheet, you can start right away.

What is IRS Worksheet Solutions: Tax Legislation Process?

IRS Worksheet Solutions: Tax Legislation Process refers to a structured approach used by the IRS to implement and track changes in tax legislation, ensuring compliance and proper handling of tax-related matters.

Who is required to file IRS Worksheet Solutions: Tax Legislation Process?

Taxpayers and tax professionals who are affected by new tax laws or regulations are generally required to file IRS Worksheet Solutions related to the Tax Legislation Process.

How to fill out IRS Worksheet Solutions: Tax Legislation Process?

To fill out the IRS Worksheet Solutions, taxpayers should accurately provide relevant financial information, adhere to guidelines provided by the IRS, and ensure all fields required by the worksheet are populated correctly.

What is the purpose of IRS Worksheet Solutions: Tax Legislation Process?

The purpose of the IRS Worksheet Solutions: Tax Legislation Process is to facilitate the implementation of tax laws, assist in determining eligibility for deductions and credits, and ensure accurate reporting and compliance.

What information must be reported on IRS Worksheet Solutions: Tax Legislation Process?

Information that must be reported includes taxpayer identification details, income sources, deduction claims, credits sought, and any other relevant financial data as specified by the IRS guidelines.

Fill out your internal revenue service worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Internal Revenue Service Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.