Understanding Proposed Amendments to Form: A Comprehensive Guide

Overview of proposed amendments

The proposed amendments to form are designed to address evolving needs within the financial sector, particularly focusing on transparency and compliance in reporting practices. As regulatory landscapes shift, these revisions aim to enhance oversight and facilitate better management of data by financial advisers and funds.

Key stakeholders involved in this amendment process include the Securities and Exchange Commission (SEC), financial advisory firms, private equity funds, and investors who are all impacted by changes in reporting requirements. Addressing their concerns and requirements is paramount in establishing a balanced approach that promotes both compliance and operational efficiency.

Background context

Historically, forms utilized within the financial advisory space have undergone significant changes to reflect the complexity and demands of modern investment strategies. Previous amendments have aimed at various aspects of reporting, focusing on both investor protection and enhancing the availability of information. Understanding the historical context of these changes is crucial for grasping the rationale behind the current proposed amendments.

The regulatory framework surrounding these forms is primarily governed by federal securities laws, which mandate disclosure requirements. Recent events revealed gaps in oversight, underscoring the necessity for updated reporting standards that better serve both investors and the firms managing their assets.

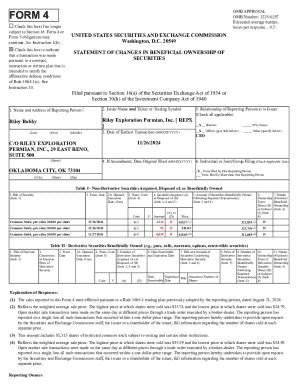

Detailed description of proposed amendments

The proposed amendments introduce new current reporting requirements, notably impacting large hedge fund advisers. This group will need to adjust their reporting practices to reflect updated expectations regarding disclosure and risk management. Hedge funds, being central players in the financial ecosystem, face heightened scrutiny; thus, their transparency is vital for market integrity.

Impact on large hedge fund advisers includes updated disclosure obligations that necessitate timely reporting of relevant financial information.

Expectations for all private equity advisers reflect a uniform approach to risk assessment, pushing firms to provide more comprehensive data about their investments.

Additionally, the amendments detail expanded reporting obligations. For large private equity advisers, new specifics delineate data points and metrics required by the SEC. This push for transparency ensures that investors receive thorough insight into how funds are managed, fostering greater accountability.

The introduction of new reporting requirements also includes stipulations for large liquidity fund advisers, responding to the growing need for liquidity management in volatile markets. Compliance with these new frameworks is critical, as they will not only impact operational procedures but also affect investor trust in fund management.

Implications for document management

The proposed amendments significantly affect document creation processes. More rigorous requirements necessitate that firms pay great attention to accuracy and compliance when filling out revised forms. Any discrepancies or errors could result in penalties, making it essential for advisers to ensure that documentation reflects the new standards without fail.

Utilizing document management tools like pdfFiller can streamline this process. By providing a centralized platform for document creation and management, pdfFiller allows firms to maintain compliance effortlessly while ensuring document accuracy. Emphasizing the importance of tracking changes can lead to better oversight throughout the financial documentation process.

Cloud-based platforms offer collaborative features that facilitate ease of updates, ensuring that all team members have access to the latest document versions.

Tools like pdfFiller provide features designed to assist users through guided workflows, making compliance with the proposed amendments intuitive.

Interactive tools for compliance and reporting

To successfully adapt to the proposed amendments, having access to interactive tools for compliance and reporting becomes invaluable. pdfFiller provides clear, step-by-step instructions for users to efficiently edit their PDFs according to the updated requirements.

Features such as editing PDFs allow financial advisers to customize their forms quickly, ensuring that they adhere to all updated guidelines seamlessly. E-signing and secure submission processes add another layer of efficiency, enabling firms to move quickly from creation to compliance.

Editing tools include options for annotations, reordering, and formatting documents to meet precise specifications.

E-signing functionalities facilitate timely submissions and enhance security throughout the document management lifecycle.

Collaboration is key in quickly adapting to new amendments. pdfFiller enables multiple users to edit and sign documents simultaneously, providing built-in features for real-time feedback and document tracking. This fosters efficient teamwork, ensuring compliance is coordinated across different levels of the organization.

Benefits of adopting the proposed amendments

Adopting the proposed amendments offers a range of benefits for financial advisers. First and foremost, improved compliance leads to a reduction in potential penalties that could arise from non-compliance. With clearer and modestly structured reporting protocols, advisers can better navigate their obligations, minimizing risks.

Further, enhanced clarity in reporting encourages transparency, which can ultimately improve trust between advisers and their clients, creating a more conducive environment for investor confidence. This clarity serves not only individual clients but also the broader financial universe.

Improved compliance can lead to a reduction in potential penalties, enabling firms to operate more freely.

Enhanced clarity and transparency in reporting encourages trust between clients and advisers.

Long-term benefits for the private fund industry include fostering greater investor confidence and smoother operational processes.

Preparing for implementation

Preparedness is crucial for advisers and organizations as they transition towards the new reporting framework introduced by the proposed amendments. To facilitate this process efficiently, firms should create a checklist to ensure all key steps are covered. Staying ahead of deadlines for implementation is essential to avoid disruptions.

Key dates and timelines should be diligently tracked; this helps in aligning the documentation processes with the compliance requirements. Resources, such as those available through pdfFiller, offer additional support for organizations navigating this transitional phase.

Develop a checklist for all necessary adjustments required for compliance.

Identify key deadlines and communicate them clearly within your organization.

Utilize pdfFiller's tutorials and guides to familiarize your team with the updated processes.

Frequently asked questions (FAQs) about the proposed amendments

Common concerns surrounding the proposed amendments often involve uncertainty about compliance impacts and potential challenges in the transition process. Many financial advisers are apprehensive about adapting existing practices to align with the new frameworks. It’s important to approach these concerns with informed strategies to mitigate disruptions.

Another significant consideration is the timing and manner of engaging with compliance experts or legal advisors. Seeking professional guidance can help advisers navigate complexities efficiently, providing insights that ensure firms are not just compliant but also proactively adapting to the changes.

Address uncertainties about compliance through proactive internal communication and training.

Clarify potential headaches in the transition process by developing clear timelines.

Engage with compliance experts and legal advisors early in the process to gain comprehensive insights.