Get the free 2026 W-234 Form WT-4A Worksheet for Employee ...

Get, Create, Make and Sign 2026 w-234 form wt-4a

Editing 2026 w-234 form wt-4a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 w-234 form wt-4a

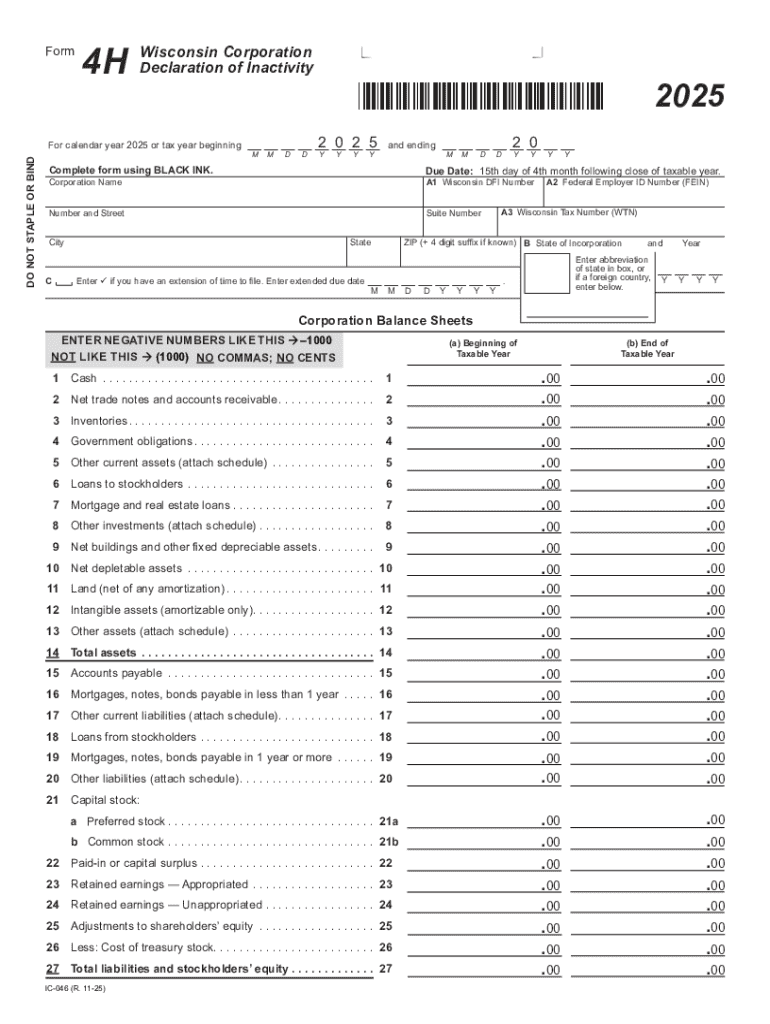

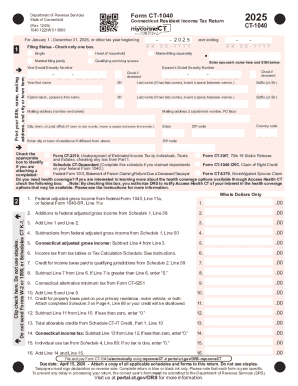

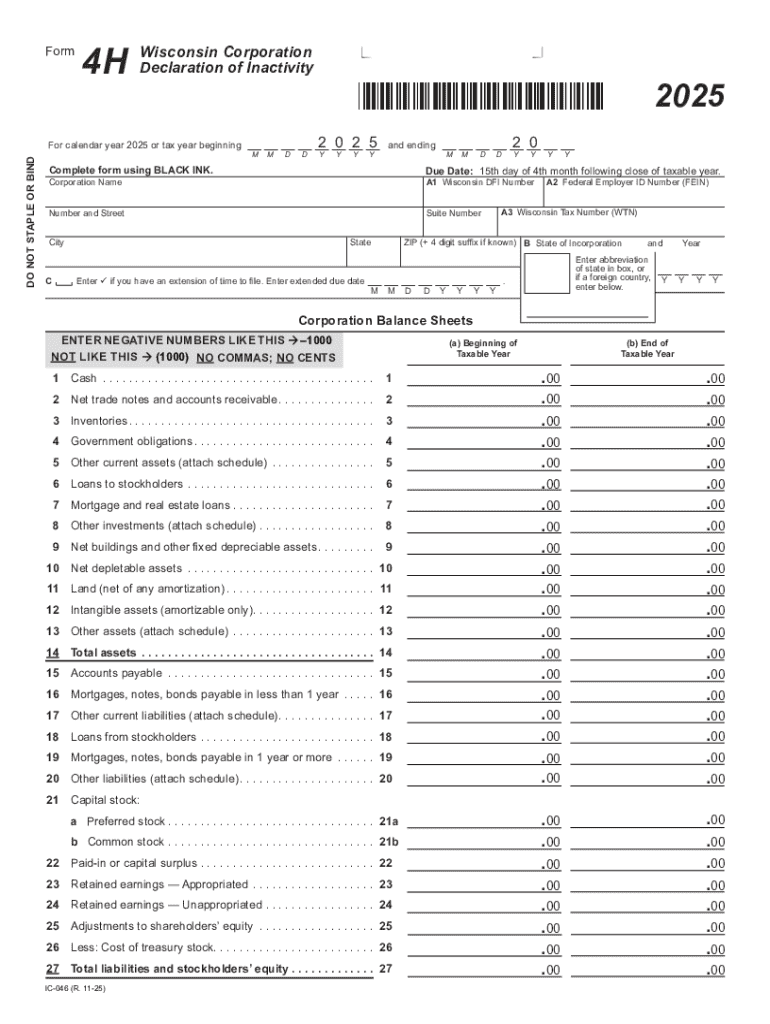

How to fill out 2025 ic-046 form 4h

Who needs 2025 ic-046 form 4h?

A Comprehensive Guide to the 2025 -046 Form 4H

Overview of the 2025 -046 Form 4H

The 2025 IC-046 Form 4H serves as a vital document for individuals and teams engaged in financial transactions that require transparency and accountability. This form is utilized mainly in tax-related matters, ensuring that all reported information is accurate and compliant with current regulations. Understanding its purpose and the intricacies of the form is essential for anyone looking to navigate their financial responsibilities.

The importance of accurately completing the 2025 IC-046 Form 4H cannot be understated; errors could lead to significant legal consequences or financial penalties. Therefore, it’s crucial to educate oneself on the specific requirements for filing this form to mitigate any potential pitfalls.

Key features of the 2025 -046 Form 4H

The 2025 IC-046 Form 4H features several sections that guide the filer through the necessary information. Primarily, it includes sections on personal identification data, financial information, and declarations that affirm the accuracy of the provided information. Each of these components plays a crucial role in validating the form.

Common use cases for this form arise during tax assessments, audits, or applications for financing. Knowing when to file and what specific details to include is essential for ensuring that one remains compliant with the guidelines established by relevant tax authorities.

Step-by-step instructions for filling out the 2025 -046 Form 4H

Filling out the 2025 IC-046 Form 4H can be efficient when approached methodically. Here's how:

Avoid common mistakes such as leaving sections blank or misreporting figures. Always double-check your entries against your records before submission.

Editing and modifying the 2025 -046 Form 4H

Editing the 2025 IC-046 Form 4H is straightforward, particularly with the tools available on pdfFiller. Users can easily modify the document in electronic format, streamlining the workflow for both individuals and teams.

To use pdfFiller for changes, simply upload your form to the platform. From there, you can make edits, highlight key areas, and fill in any missing information. Additionally, pdfFiller allows you to save different versions, ensuring you maintain a history of modifications and enhancements.

eSigning the 2025 -046 Form 4H

Digital or electronic signing has become essential for the validity of the 2025 IC-046 Form 4H. Utilizing eSignature solutions through pdfFiller adds a layer of convenience while ensuring compliance with legal standards.

To securely sign the form using pdfFiller, follow these steps: Select the eSignature option, draw or type your signature, and place it in the appropriate section of the form. Verification methods are also integrated to ensure that all signatures are legitimate and securely tied to the submitter.

Collaborating on the 2025 -046 Form 4H

Collaboration on the 2025 IC-046 Form 4H is made efficient with pdfFiller’s built-in features. Teams can work together in real-time, allowing multiple contributors to provide input and feedback seamlessly.

With pdfFiller's collaboration tools, users can comment on different sections, share insights, and make the necessary adjustments as needed. This functionality enhances productivity, making it easier to create an accurate and comprehensive form collectively.

Managing and storing the 2025 -046 Form 4H

Effective document management is crucial for the 2025 IC-046 Form 4H. Best practices involve organizing files into specific folders and utilizing cloud storage options provided by pdfFiller for accessibility.

To securely store the completed form in the cloud, simply upload your finalized document. Cloud storage ensures you can access your forms from any device, anywhere, enabling flexibility and ease of retrieval.

Related topics and resources

Understanding the 2025 IC-046 Form 4H often requires insight into associated forms and documents. Familiarizing yourself with these can provide a fuller context around tax obligations and compliance.

Additional guides and articles within pdfFiller may also assist in clarifying any uncertainties you may have while completing your form. Reviewing Frequently Asked Questions can also aid in navigating common challenges.

Eligibility rules & forms for using the 2025 -046 Form 4H

Certain eligibility criteria dictate whether an individual or entity must fill out the 2025 IC-046 Form 4H. It's vital to ensure compliance with these provisions to avoid complications.

Additionally, there may be other forms required based on individual financial circumstances, such as supporting documentation and accompanying declarations. Understanding these additional requirements can facilitate smoother processing.

User experiences and case studies

Many users have successfully navigated the complexities of the 2025 IC-046 Form 4H using pdfFiller. Testimonials highlight the platform's ease of use and efficiency, allowing individuals and teams to manage their documents effectively.

Real-life scenarios also showcase how pdfFiller has transformed the process of completing and submitting the 2025 IC-046 Form 4H, illustrating the advantages of having an all-in-one document management solution.

Troubleshooting common issues

Common issues may arise when filling out, editing, or submitting the 2025 IC-046 Form 4H. These can range from technical glitches in document formatting to details left incomplete.

Guidance on resolving these challenges is readily available through pdfFiller's support resources, providing users with a clear pathway to find help and resolve issues as they arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2026 w-234 form wt-4a online?

How do I make changes in 2026 w-234 form wt-4a?

How do I fill out 2026 w-234 form wt-4a using my mobile device?

What is 2025 ic-046 form 4h?

Who is required to file 2025 ic-046 form 4h?

How to fill out 2025 ic-046 form 4h?

What is the purpose of 2025 ic-046 form 4h?

What information must be reported on 2025 ic-046 form 4h?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.