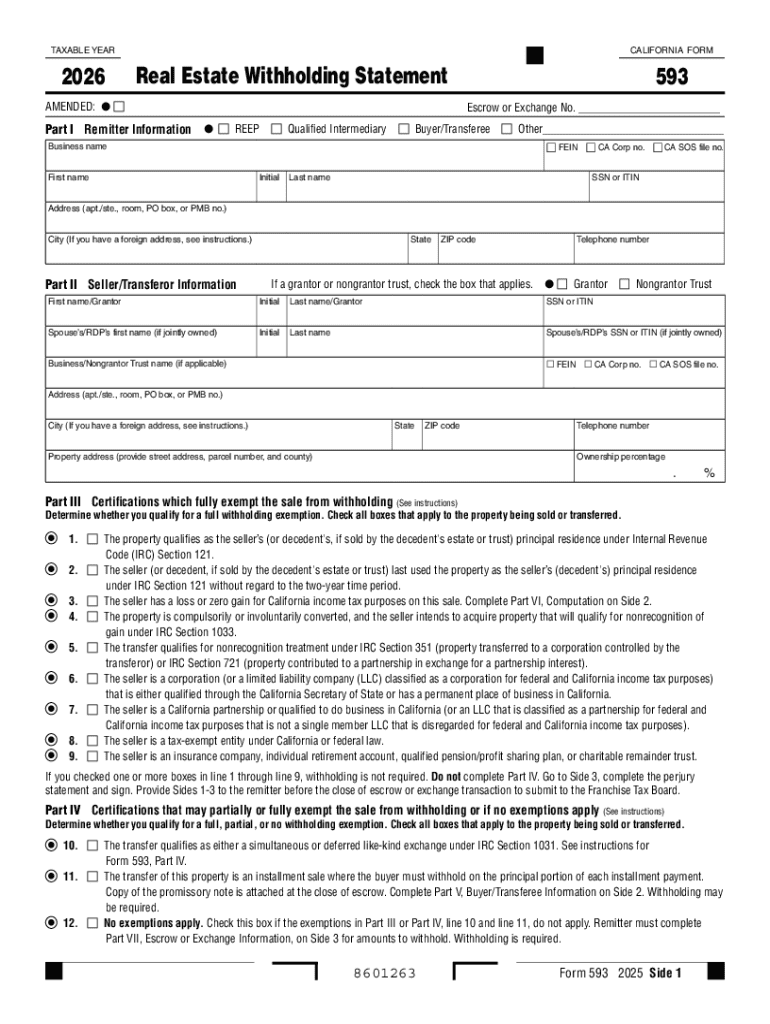

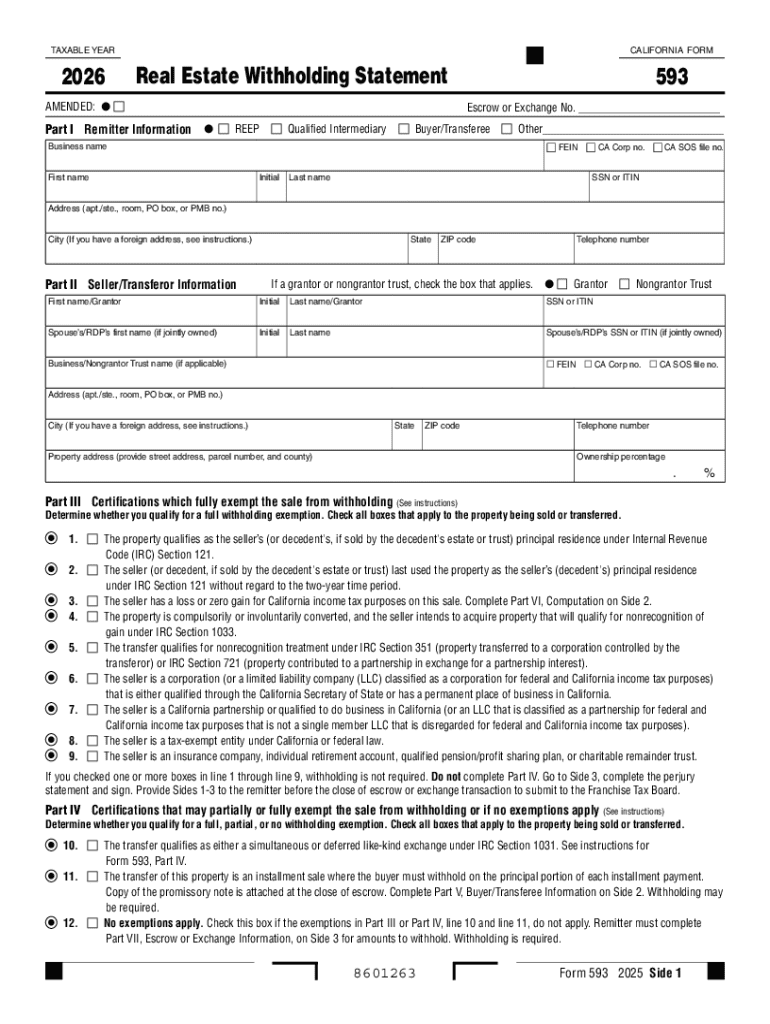

Get the free 2026 Form 593 Real Estate Withholding Statement. 2026, Form 593, Real Estate Withhol...

Get, Create, Make and Sign 2026 form 593 real

How to edit 2026 form 593 real online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 form 593 real

How to fill out 2026 form 593 real

Who needs 2026 form 593 real?

2026 Form 593 Real Estate Withholding Statement: A Comprehensive Guide

Understanding Form 593

Form 593 is crucial in the realm of California real estate transactions, serving as the Real Estate Withholding Statement. This form is required when a transferor (the seller) sells real property and is the main document for calculating the withholding tax owed to the state. This tax is levied primarily to ensure the collection of the seller’s income tax liabilities. Understanding its significance is paramount for both buyers and sellers involved in real estate dealings.

The stakeholders involved in the form submission process include the transferor, the remitter (the buyer or someone else acting on behalf of the buyer), and the state tax authority. Each of these parties plays an integral role in ensuring compliance with California tax laws. Properly filling out and timely submitting Form 593 can prevent tax-related problems down the line, making it essential for anyone participating in real estate transactions.

What's new for the 2026 Form 593

The 2026 version of Form 593 brings updates designed to streamline the filing process and more accurately reflect current tax policies. Notably, changes pertain to tax rates and updated instructions for various exemptions. These adjustments reflect California's ongoing efforts to adapt to economic conditions and improve revenue collection efficiency. Filers should pay close attention to these changes, as failure to adhere to updated requirements may lead to penalties or delayed processing.

A comparison with last year's form highlights several differences that can impact taxpayers significantly. For instance, there are clearer guidelines on calculating withholding for installment sales versus conventional sales. The implication for filers is straightforward: familiarity with the new guidelines is necessary for making accurate computations and fulfilling obligations without unnecessary complications.

General information on Form 593

Form 593 must be filed by anyone selling real estate in California unless an exemption applies. Real estate transactions that mandate the submission of this form include conventional sales, exchanges, and installment sales. In each case, the seller must disclose pertinent details about the transaction, influencing the withholding obligations for both parties.

The timeline for submission requires that Form 593 be filed concurrently with the closing of the transaction. Delays in submitting the form can lead to penalties, including additional tax liabilities or penalties enforced by the California Franchise Tax Board (FTB). It’s crucial to adhere to the deadlines to avoid these repercussions and ensure a smooth transaction.

Detailed breakdown of the form sections

Purpose of Form 593

Form 593 serves as documentation for the withholding tax that applies to certain real estate sales. When a transferor sells property, a portion of the sale proceeds may be withheld to cover potential tax liabilities. Sellers may seek exemptions for specific transactions, typically under certain circumstances defined by California law, such as loss transactions or those involving real estate transferred between certain family members.

Identifying information

Filling in accurate personal and property information is critical to the process. This includes the transferor’s details, buyer’s information, and specifics about the property being sold. Ensuring accuracy here will prevent delays in processing and any potential disputes regarding the transaction.

Specific instructions for completing Form 593

Completing Form 593 can seem daunting, but it is straightforward when broken down into manageable parts. Each section requires particular information and should be approached as follows:

Common errors include incorrect property addresses, miscalculation of withholding amounts, and incomplete signatures. Example scenarios may include a traditional sale of property, where accurate entry of all relevant details could avoid complications during tax processing.

Interactive tools for Form 593

Using pdfFiller's platform can simplify the completion of Form 593, providing a range of interactive tools designed for efficiency. Users can easily access the form online, enabling real-time collaboration with team members or partners involved in the transaction. The platform allows for document editing, signing, and secure sharing, making it a comprehensive solution for real estate transactions.

The editing features are particularly beneficial, allowing users to make necessary adjustments or updates directly within the form. Cloud-based accessibility ensures that whether you're at home, in the office, or on the go, your documents are readily available.

Troubleshooting common issues with Form 593

It’s not uncommon for filers to experience issues with Form 593 submission. From minor errors leading to rejection of forms to more significant tax implications, knowing how to troubleshoot problems beforehand is essential. Commonly asked questions revolve around the reasons for form rejections, which often include missing signatures or incorrect information.

If a form is rejected, filers should refer to the guidelines provided by the California FTB or seek assistance through the resources available at pdfFiller. Having this information at hand can make the process less stressful and more manageable.

Managing your Form 593 submission

After completing Form 593, understanding how to submit it is the next step. Electronic submission has become more common, and pdfFiller offers a straightforward way to submit directly from its platform. Users can track the status of their submissions, ensuring their documents are received and processed timely.

Keeping accurate records of the submission and payment for your records is crucial. PdfFiller aids in document management, ensuring that copies of submissions are stored securely and can be accessed whenever necessary, further reducing anxiety surrounding compliance with tax obligations.

Maximizing the benefits of using pdfFiller

PdfFiller provides expansive document management capabilities tailored to the needs of individuals and teams engaged in real estate transactions. By allowing users to compile multiple forms and relevant documents in one centralized platform, it simplifies organization and retrieval. This access is cloud-based, which means documents can be edited and completed anytime and from anywhere, making it a perfect fit for those with busy, mobile schedules.

Leveraging pdfFiller not only boosts efficiency but also enhances collaboration, allowing various stakeholders to work together seamlessly on a single document. Whether working on Form 593 or any other necessary paperwork, pdfFiller streamlines the entire process.

Final reminders and best practices

To ensure compliance with California tax regulations, familiarize yourself with the deadlines associated with Form 593 submission. Key deadlines often align with property sale closings, so aligning your document preparation and submissions is imperative. Additionally, reviewing the entire form for completeness and accuracy before submission can prevent common issues.

Cultivating a habit of double-checking all entries and calculations will help facilitate a smoother transaction. These reminders can turn the process of filling out Form 593 into a more manageable task where compliance becomes an expectation, not an afterthought.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out 2026 form 593 real using my mobile device?

How can I fill out 2026 form 593 real on an iOS device?

How do I fill out 2026 form 593 real on an Android device?

What is 2026 form 593 real?

Who is required to file 2026 form 593 real?

How to fill out 2026 form 593 real?

What is the purpose of 2026 form 593 real?

What information must be reported on 2026 form 593 real?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.