MT CIT (CLT-4) 2025-2026 free printable template

Get, Create, Make and Sign MT CIT CLT-4

Editing MT CIT CLT-4 online

Uncompromising security for your PDF editing and eSignature needs

MT CIT (CLT-4) Form Versions

How to fill out MT CIT CLT-4

How to fill out 2025 montana corporate income

Who needs 2025 montana corporate income?

2025 Montana Corporate Income Form: A Comprehensive How-to Guide

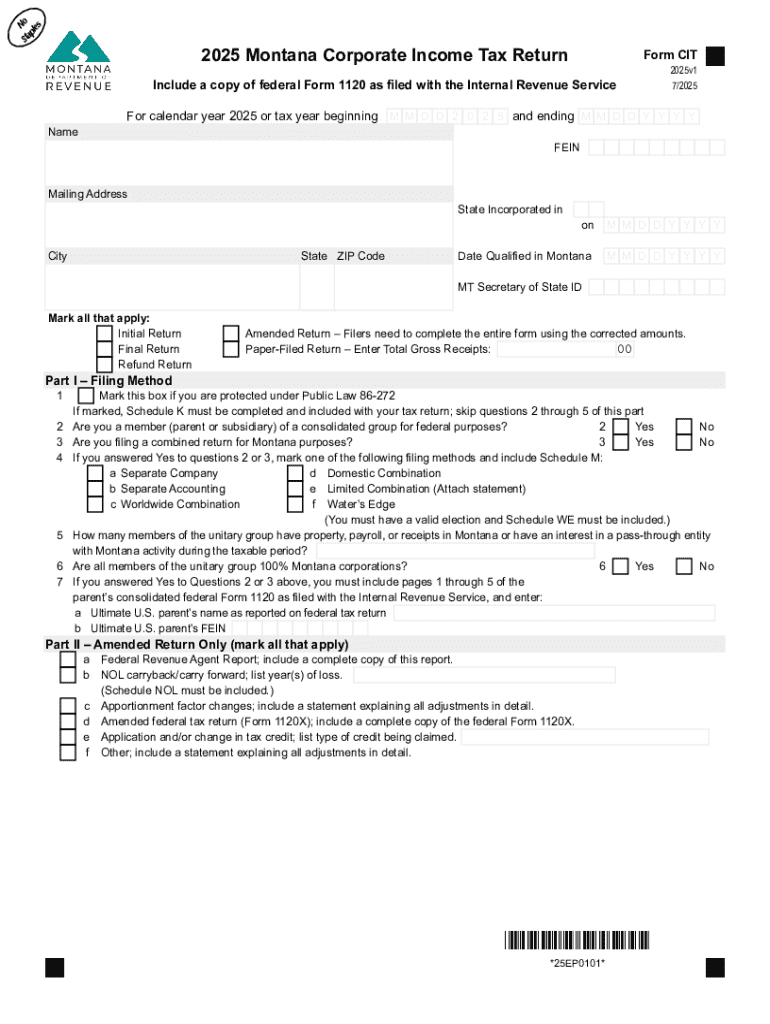

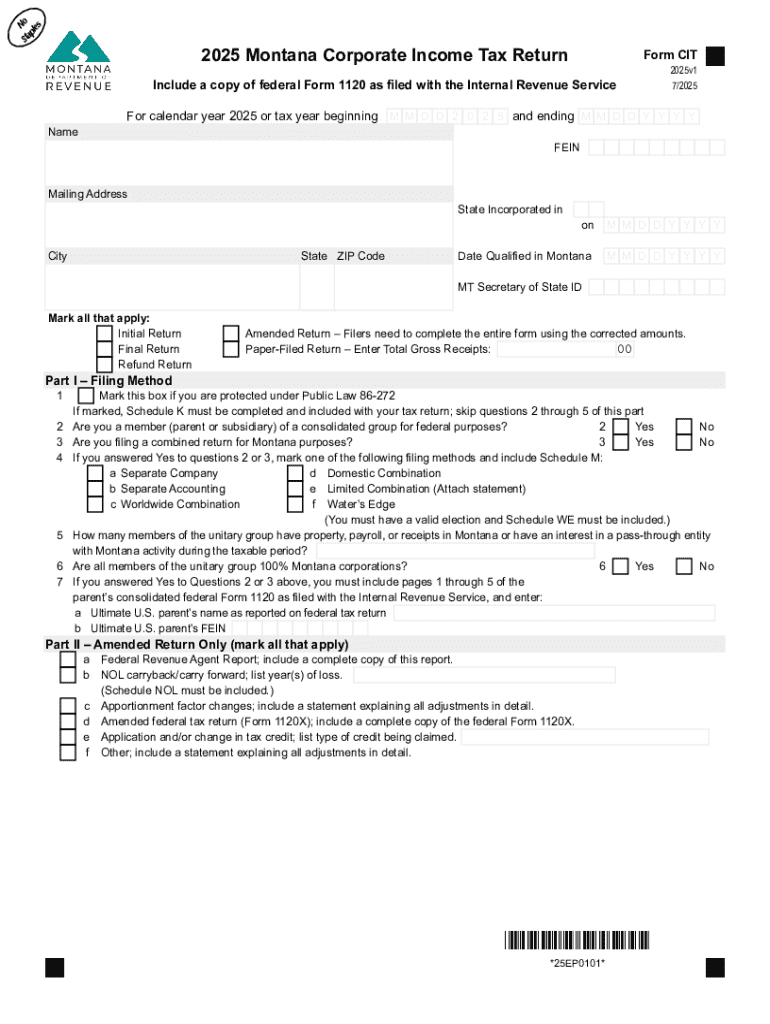

Overview of the 2025 Montana Corporate Income Form

The 2025 Montana Corporate Income Form serves as a vital instrument for businesses operating in the state to report their income and calculate the associated tax liability. This form is not only crucial for compliance but also plays an essential role in the state's revenue system, affecting public services and local infrastructure funding.

In 2025, businesses may notice several key changes compared to previous years. Enhanced reporting requirements and updated tax rates reflect the state's objective to streamline tax administration and increase transparency. As a result, it is imperative for organizations to stay informed on these modifications to meet their filing obligations.

Primarily, corporations conducting business in Montana with gross receipts exceeding the threshold must file the 2025 form. This includes both domestic and foreign corporations that derive income from Montana sources. Understanding who falls under this obligation ensures timely compliance and helps avoid potential penalties.

Eligibility and filing requirements

Eligibility for filing the 2025 Montana Corporate Income Form is primarily determined by the nature and scale of business operations. Corporations with gross receipts surpassing the specified threshold, as mandated by the Montana Department of Revenue, are required to file. This section focuses on delineating who must submit the form and the conditions under which exemptions may apply.

Exemptions exist, particularly for certain nonprofit organizations, small businesses, and entities classified under specific tax categories. Businesses should verify their eligibility to identify whether they qualify for any federal or state exemptions that could influence their reporting requirements.

The filing deadline for the 2025 Montana Corporate Income Form is typically set for the 15th day of the fourth month following the end of the tax year. For those who may require additional time, the option for filing extensions exists but must be formally requested beforehand. Understanding these timelines is essential for maintaining compliance.

Detailed overview of the form components

The 2025 Montana Corporate Income Form comprises multiple sections, each designed to capture distinct aspects of a corporation’s financial situation. Understanding these components is crucial for accurate reporting and tax calculation, thereby facilitating a smoother submission process.

The primary sections of the form include: income reporting, deductions and credits, and the calculation of tax liability. Corporations must provide accurate figures in these areas, including revenue generated, allowable expenses, and potential incentives that can decrease taxable income.

Common mistakes often occur in areas such as misreporting income, excluding eligible deductions, or failing to carry forward credit amounts from prior years. Attention to detail in each section can significantly minimize the likelihood of errors and audits.

Step-by-step instructions for completing the form

Completing the 2025 Montana Corporate Income Form requires careful preparation and thorough documentation. Start by gathering essential financial records, including balance sheets, income statements, and tax documents from the previous year. By compiling these details in advance, the form-filling process becomes significantly more manageable.

Next, move through the form’s sections methodically. For income reporting, ensure all streams of revenue—from both domestic and international operations—are fully documented. Use precise language and double-check for consistencies with your financial records, noting any discrepancies.

Before submitting, reviewing the form is non-negotiable. Create a checklist to verify all sections are filled out completely, numbers are correctly tallied, and no essential documents are missing. This simple practice can save businesses from rejection or revision requests.

Useful tools and resources for completing the form

Utilizing interactive tools can streamline the process of completing the 2025 Montana Corporate Income Form significantly. pdfFiller offers a range of online tools designed specifically for creating, editing, and submitting tax forms effectively and securely.

Features such as PDF editing and e-signature capabilities enhance the overall experience, allowing users to maintain control over their documents without unnecessary hassle. With pdfFiller, users can access templates that simplify the form-filling process, ensuring they can focus on accuracy.

Additionally, pdfFiller provides comprehensive support and a dedicated FAQ section that addresses common questions about the 2025 Montana Corporate Income Form, enhancing accessibility for users needing further assistance.

Managing your filed corporate income forms

After submission, it is crucial to understand how to manage your filed forms effectively. Businesses may occasionally need to edit and resubmit forms, particularly if discrepancies arise or additional data becomes available post-filing.

To ensure a smooth process after filing, maintain meticulous records of all submissions. Implement best practices in document management, retaining copies of filed forms, receipts, and supporting documentation for potential audits. This organized approach builds a solid foundation for efficient information retrieval when required.

If faced with an audit notice, don’t panic. Assembling financial records and correspondence related to your corporate tax filings will facilitate the process and lessen potential disruptions.

Frequently asked questions (FAQs)

The complexity of tax forms often raises questions among corporate filers. Addressing common inquiries helps demystify the process and provides clarity in navigating the 2025 Montana Corporate Income Form requirements.

These FAQs aim to empower businesses by providing relevant information, ensuring they feel equipped when approaching the tax filing process.

Additional insights into Montana’s corporate tax regulations

Understanding Montana's corporate tax environment goes beyond just filling out the 2025 Corporate Income Form. It encompasses grasping the broader implications of corporate liabilities within a state tax system that seeks to balance revenue needs with attracting business investment.

Montana's state tax structure includes several layers, such as the motor fuels and tobacco tax sections, reflecting diverse revenue streams necessary for funding public services. Businesses should stay informed on these aspects as they could impact operational costs and strategic planning.

Upcoming changes in corporate tax regulations are likely to surface, driven by shifts in local governance and evolving economic landscapes. Corporate entities should engage in regular reviews of tax code updates and legislative changes that could affect their future tax obligations.

People Also Ask about

Does Montana have an efile form?

Which states do not require tax returns?

How much do you have to make in Montana to file taxes?

Does an LLC have to file a tax return in Montana?

Where do I send my MT state tax return?

Does Montana require you to file a tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the MT CIT CLT-4 form on my smartphone?

Can I edit MT CIT CLT-4 on an iOS device?

How can I fill out MT CIT CLT-4 on an iOS device?

What is 2025 montana corporate income?

Who is required to file 2025 montana corporate income?

How to fill out 2025 montana corporate income?

What is the purpose of 2025 montana corporate income?

What information must be reported on 2025 montana corporate income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.