Get the free Health Care Flexible Spending Account (FSA) Request for ...

Get, Create, Make and Sign health care flexible spending

How to edit health care flexible spending online

Uncompromising security for your PDF editing and eSignature needs

How to fill out health care flexible spending

How to fill out health care flexible spending

Who needs health care flexible spending?

Health Care Flexible Spending Form: A Comprehensive How-to Guide

Understanding Health Care Flexible Spending Accounts (FSAs)

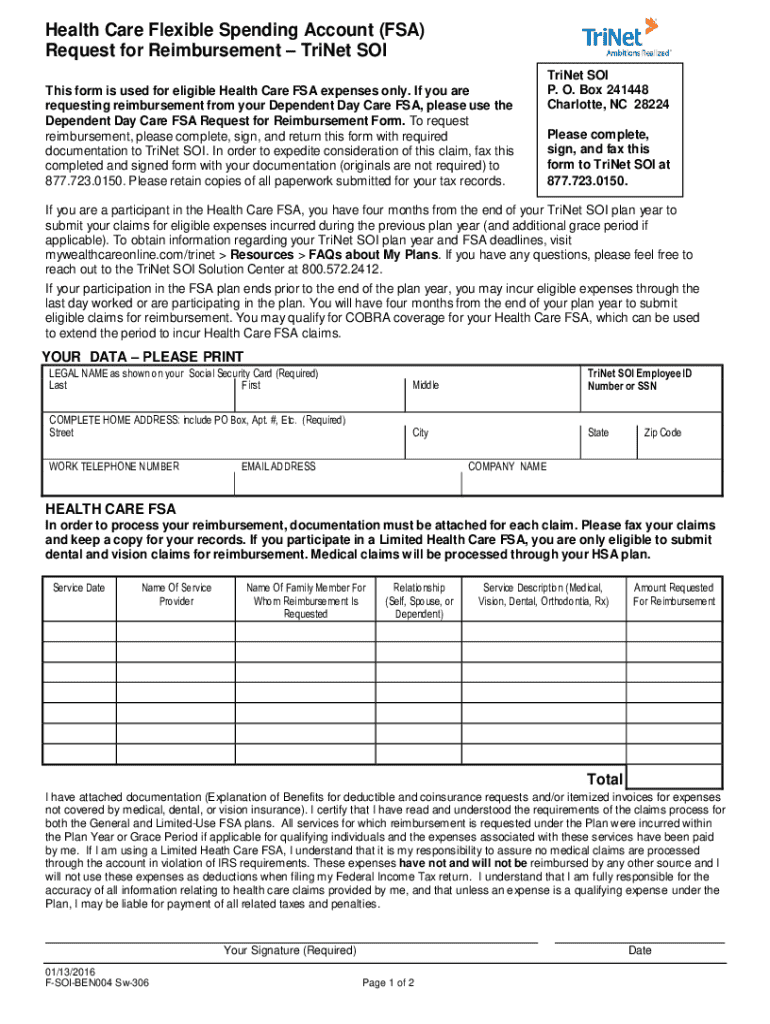

A Health Care Flexible Spending Account (FSA) is a tax-advantaged financial account you can set up through your employer to pay for out-of-pocket health expenses. Contributions to the FSA are made through salary reduction agreements, which allow you to set aside pre-tax money for eligible medical expenses. This can result in significant savings on your overall health care costs.

The primary benefits of using a Health Care FSA include tax savings, control over your health expenses, and the flexibility to use funds for a variety of medical costs. Notably, contributions are deducted from your taxable income, effectively lowering your tax bill for the year.

Health Care FSAs differ from Health Savings Accounts (HSAs) primarily in terms of eligibility and fund rollover options. HSAs are often paired with high-deductible health plans and allow you to carry over unspent funds into the next year, while FSAs typically have a use-it-or-lose-it feature, which means you might forfeit any unspent funds at the end of the plan year.

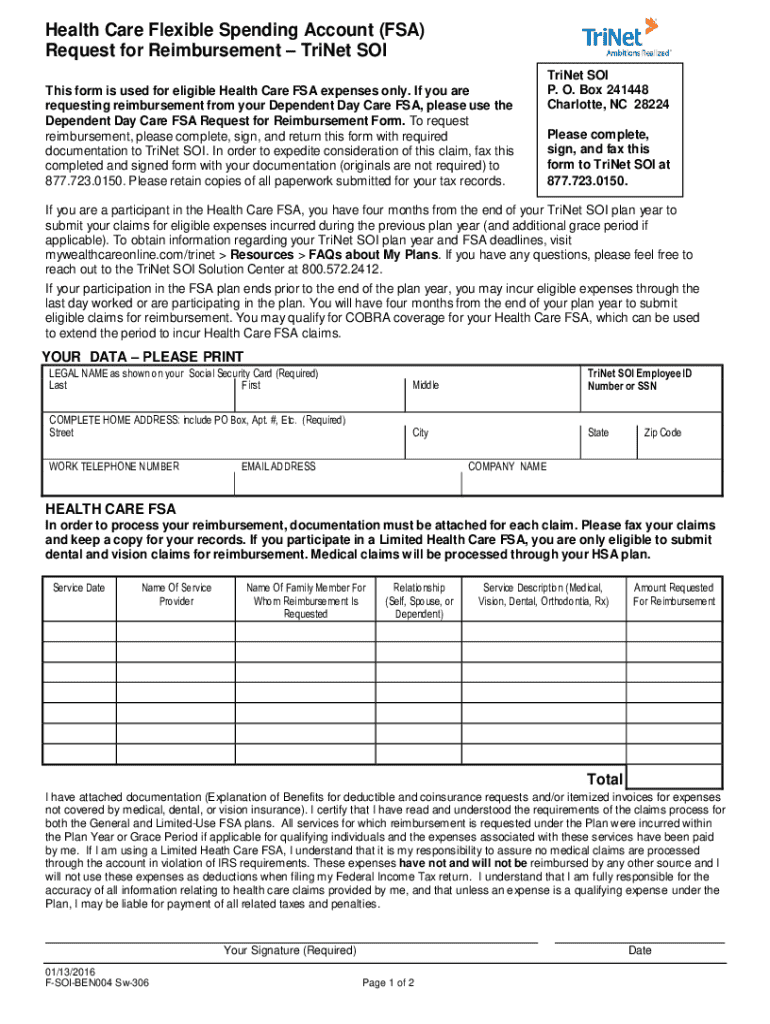

Overview of the Health Care Flexible Spending Form

The Health Care Flexible Spending Form is a critical document required to claim reimbursements for eligible medical expenses incurred throughout the plan year. Completing this form accurately ensures that your claims are processed efficiently, allowing you to get reimbursed quickly.

Common uses of the Health Care Flexible Spending Form include seeking reimbursements for expenses such as prescriptions, deductibles, dental work, and vision care. Understanding the key terms and definitions outlined in the form can assist in making sure you are submitting a complete claim.

Step-by-step guide to filling out the health care flexible spending form

Filling out the Health Care Flexible Spending Form correctly is vital for ensuring you receive reimbursement for eligible expenses. Follow this step-by-step guide to understand what information is required.

3.1 Gathering required information

Before filling out the form, gather all necessary information, including your personal information and details of your health care expenses. Typically, this includes your name, social security number, employer's name, and the dates and amounts of your expenses.

3.2 Completing the form

Now that you have all required information, you can proceed to fill out the form by following these sections:

3.3 Common mistakes to avoid

While filling out the form, it's essential to be attentive to avoid common pitfalls:

Editing and managing your flexible spending form with pdfFiller

pdfFiller offers a convenient way to access and manage your Health Care Flexible Spending Form. Using pdfFiller, you can easily edit the form to ensure all details are accurate before submission.

Accessing the form on pdfFiller

To access the Health Care Flexible Spending Form, simply navigate to pdfFiller's platform, either via your computer or mobile app. Once logged in, search for the specific template linked to your Health Care FSA.

Utilizing editing tools

pdfFiller provides several editing tools to make customizing your form a breeze. You can add notes, reorder sections, or even highlight critical fields that need attention.

How to save and share your completed form

Once you've filled out the Health Care Flexible Spending Form and ensured its accuracy, you can save it directly to your pdfFiller account or export it to your device. Sharing your completed form with your benefits administrator or HR department can also be done easily through pdfFiller's sharing features.

eSigning the health care flexible spending form

Using eSignatures is a quicker and more efficient method of signing your Health Care Flexible Spending Form. pdfFiller integrates eSigning functionalities that are compliant with legal regulations, ensuring that your signature is valid.

How eSigning works in pdfFiller

With pdfFiller, signing the form digitally is straightforward. After completing your form, simply choose the eSign option. You can draw your signature, upload an image of your signature, or choose from a selection of pre-styled signatures provided by pdfFiller.

Benefits of using eSignatures for FSAs

Using eSignatures helps in streamlining the submission process of your Health Care Flexible Spending Form. Not only does it save paper by going digital, but it also reduces the waiting time compared to traditional mailing methods.

Submitting your health care flexible spending form

Once your Health Care Flexible Spending Form is completed and signed, it's time to submit it for processing. pdfFiller simplifies this process with multiple submission options tailored for your needs.

Various submission options

You can choose to submit your form online, directly through your employer’s system, or print it out for mailing. The ease of submitting your completed form online can significantly speed up the reimbursement process.

Understanding timelines and what to expect after submission

After submitting your Health Care Flexible Spending Form, it's essential to be aware of the processing timelines set by your employer. Typically, you can expect a response within a few weeks, depending on the complexity of your claim.

Tracking your FSA claims

Keeping tabs on your FSA claims is important for managing your health care expenses efficiently. Many employers provide an online portal where you can track the status of your claims and any reimbursements due to you.

How to monitor the status of your claims

Reviewing your claims online will give you insights into what has been approved and what remains outstanding. If any issues arise, having a clear line of communication with your HR department or benefits administrator can help resolve them quickly.

Resources for resolving issues with claims

If you encounter problems with your claims, check the FAQ section in the online portal or reach out to your employer's HR or benefits team. Keeping copies of all submitted forms and related documentation is vital for reference.

Importance of keeping records for tax purposes

Maintaining accurate records of all health care expenses claimed is crucial for tax purposes. When filing your taxes, consider how your FSA contributions can affect your tax returns, as the IRS requires documentation of expenses for potential audits.

Go green: The benefits of going digital with your FSA forms

Transitioning to digital forms for your FSA management can offer significant environmental benefits. By opting for digital documentation, you can reduce paper usage substantially, contributing to a more sustainable future.

How pdfFiller supports sustainable practices

pdfFiller encourages going green by providing tools and alternatives for electronic form management. Utilizing these tools not only helps reduce your carbon footprint but also enhances your document management strategies.

Tips for reducing paper use in your FSA management

Frequently asked questions (FAQs) about health care FSAs

Understanding some common questions surrounding Health Care FSAs can illuminate the finer details of managing your account effectively.

Can use my FSA for over-the-counter medications?

Yes, FSAs can be used for over-the-counter medications as long as they are considered eligible expenses. Always check with your FSA plan details for specific inclusions.

How does my employer contribute to my FSA?

Employers may contribute to your FSA depending on the structure of your employee benefit programs. Some may match contributions or provide a set amount yearly, but this varies by employer.

What happens to unused funds at the end of the year?

Unused FSA funds typically follow a 'use-it-or-lose-it' policy, meaning any remaining balance at the end of the plan year may be forfeited, unless your employer offers a grace period or carryover provision.

Using your health care FSA account effectively

Maximizing your Health Care FSA benefits requires strategic planning. Start by estimating your expected health care expenses for the year and fund your account accordingly to avoid losing any money.

Planning for eligible expenses throughout the year

Keep track of eligible expenses that crop up throughout the year, from routine visits to unforeseen medical needs. By staying organized, you ensure that you make the most of your contributions without incurring losses.

How changes in employment affect your FSA

If you change jobs, your FSA will react differently depending on your new employer's plan. Generally, you may have limited access to your funds, so it's crucial to understand the terms during the transition to avoid losing accrued benefits.

Additional tools and resources on pdfFiller

pdfFiller is not only your go-to for managing your Health Care Flexible Spending Form but also provides access to a multitude of related forms and templates that simplify document creation.

Accessing other related forms and templates

Explore additional resources on pdfFiller to find forms related to other employee benefits, tax documentation, and general health care administration. These templates offer structure while ensuring compliance with regulations.

Using interactive tools offered by pdfFiller

pdfFiller provides unique interactive tools that enhance your document management experience, offering options such as form collaboration and cloud storage to ensure ease of access.

Support and customer service options for users

Should you need assistance, pdfFiller’s customer service team is readily available to support you, guiding you through the usage of forms, and resolving any issues that may arise during your experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out health care flexible spending using my mobile device?

How can I fill out health care flexible spending on an iOS device?

Can I edit health care flexible spending on an Android device?

What is health care flexible spending?

Who is required to file health care flexible spending?

How to fill out health care flexible spending?

What is the purpose of health care flexible spending?

What information must be reported on health care flexible spending?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.