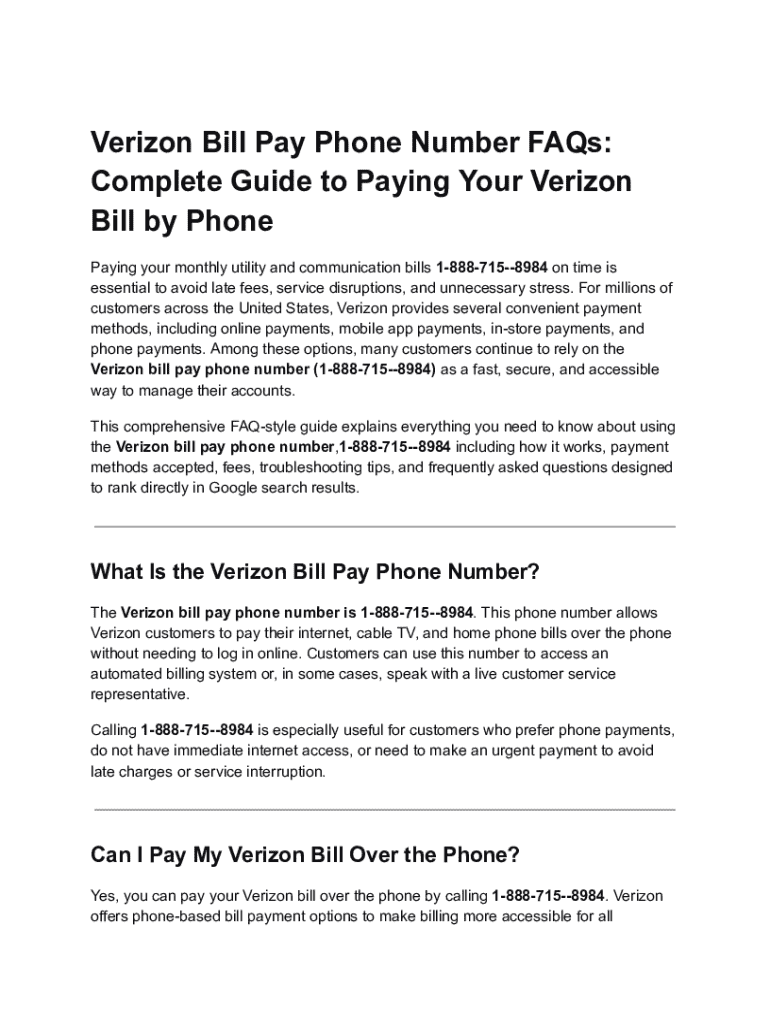

Get the free Complete Guide to Paying Your Verizon Bill by Phone

Get, Create, Make and Sign complete guide to paying

How to edit complete guide to paying online

Uncompromising security for your PDF editing and eSignature needs

How to fill out complete guide to paying

How to fill out complete guide to paying

Who needs complete guide to paying?

Complete guide to paying form

Understanding the complete guide to paying form

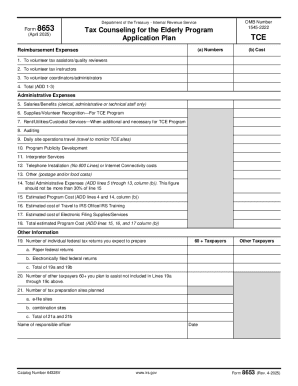

A paying form is a crucial document often required for various financial transactions, such as tax withholding, payroll setup, and other payments. Its primary purpose is to provide necessary information that enables employers or other entities to process payments accurately and comply with legal standards.

Key components of a paying form typically include sections for personal identification, payment details, and authorization. Accurate completion of this form is vital for ensuring correct tax withholding, which can significantly impact your paycheck and potential tax refund.

Importance of accuracy in completing your paying form

Filling out a paying form requires utmost attention to detail, as errors can lead to substantial consequences. Incorrect information might result in improper tax withholding, leading to underpayment or overpayment, both of which can cause complications with the Internal Revenue Service (IRS) and may affect your financial standing.

To maintain accuracy when completing your form, consider best practices such as double-checking all entries, using resources like a tax withholding estimator, and seeking guidance if uncertain about any section. This diligence helps ensure that your financial records remain clear and accurate.

Step-by-step instructions to complete your paying form

Completing your paying form involves several straightforward steps. First, gather the necessary information. This includes personal identification details such as your name, address, Social Security number, and financial information which may include your income tax bracket and any additional allowances.

When filling out the form, break it down into sections. In Section 1, include your personal information accurately. In Section 2, provide precise payment details to ensure proper tax withholding calculations. Finally, in Section 3, the authorization section, ensure you legally consent to the details proposed in the form.

Common mistakes to avoid

While completing the paying form, it's easy to overlook certain fields or miscalculate figures, leading to complications down the line. Common mistakes include failing to provide a signature in the authorization section, overlooking the need for updated tax information, and miscalculating changes in tax withholding amounts.

To mitigate these risks, ensure you carefully review the form before submission. Utilizing pdfFiller's tools can assist in identifying potential errors, allowing for corrections before it's too late.

Editing and modifying your paying form

If you need to modify an existing paying form, pdfFiller offers several convenient tools for editing PDF forms. You can easily make changes such as updating personal or payment details and correct any errors present in your original submission.

To streamline your editing process, utilize cloud-based features that allow real-time collaboration with team members. This can enhance teamwork and ensure that everyone involved has access to the most current information.

Sign your paying form with ease

Signing your paying form is a critical final step, and understanding the eSignature requirements is essential. Electronic signatures are legally binding and widely accepted, making them a convenient option for users.

To apply your signature digitally, follow this step-by-step eSigning process using pdfFiller. Simply upload your document, select the signature option, and either draw your signature, upload an image, or type your name. You can also add initials or dates wherever necessary.

Managing your paying form efficiently

Once your paying form is completed and signed, efficiently managing this document is of utmost importance. Consider utilizing cloud storage options with pdfFiller to save and store your forms securely. Organizing your saved documents into appropriate folders can help reduce time spent searching for necessary files later.

To ensure easy access and collaboration, share your paying form through various methods such as email or sharing a direct link. This feature allows team members or stakeholders to view and sign the document as needed.

Frequently asked questions (FAQs) about the paying form

It is common to have queries while navigating through the paying form process. A frequent concern might be, 'What if I submitted a form incorrectly?' If you realize an error post-submission, it’s crucial to contact your employer or the entity administering the form promptly to rectify it.

Another common question pertains to tracking the status of your paying form. Keeping note of submission dates and inquiring about processing times can provide insights into when you might expect responses or actions.

Keeping up with updates and changes to the paying form

Staying informed about changes to the paying form is crucial, as regulations can evolve regularly. Following regulatory announcements or consulting resources from the IRS can keep you in the loop.

Additionally, leveraging pdfFiller's notification settings can alert you to modifications in form standards or requirements, allowing you to maintain compliance and accuracy in your submissions.

Getting help when you need it

Should you encounter challenges while completing or managing your paying form, a wealth of resources is available through pdfFiller. Customer support options, including live chat and phone assistance, can provide timely help.

Moreover, pdfFiller offers tutorials and webinars, making it easier for users to understand the platform's features. Engaging with community forums can also be beneficial, giving you access to shared experiences and tips from other users.

Summary

The complete guide to paying form serves as an essential resource for individuals and teams navigating the complexities of financial documentation. With pdfFiller, users can efficiently create, edit, eSign, and manage their forms from a single, cloud-based platform. The comprehensive tools available empower users to ensure accuracy and compliance while streamlining their document management processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my complete guide to paying in Gmail?

Can I create an electronic signature for signing my complete guide to paying in Gmail?

How do I fill out the complete guide to paying form on my smartphone?

What is complete guide to paying?

Who is required to file complete guide to paying?

How to fill out complete guide to paying?

What is the purpose of complete guide to paying?

What information must be reported on complete guide to paying?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.