Get the free Connecticut Employers Must File Form CT-941 Even If ...

Get, Create, Make and Sign connecticut employers must file

Editing connecticut employers must file online

Uncompromising security for your PDF editing and eSignature needs

How to fill out connecticut employers must file

How to fill out connecticut employers must file

Who needs connecticut employers must file?

Connecticut employers must file form: A complete guide for compliance

Overview of employer filing obligations in Connecticut

Connecticut employers must navigate several compliance requirements regarding tax and employee-related filings. Ensuring timely and accurate submissions not only fosters a good standing with state authorities but also protects employers from potential penalties. Key forms often required include various tax filings that reflect payroll details, employee status, and compliance with state labor laws.

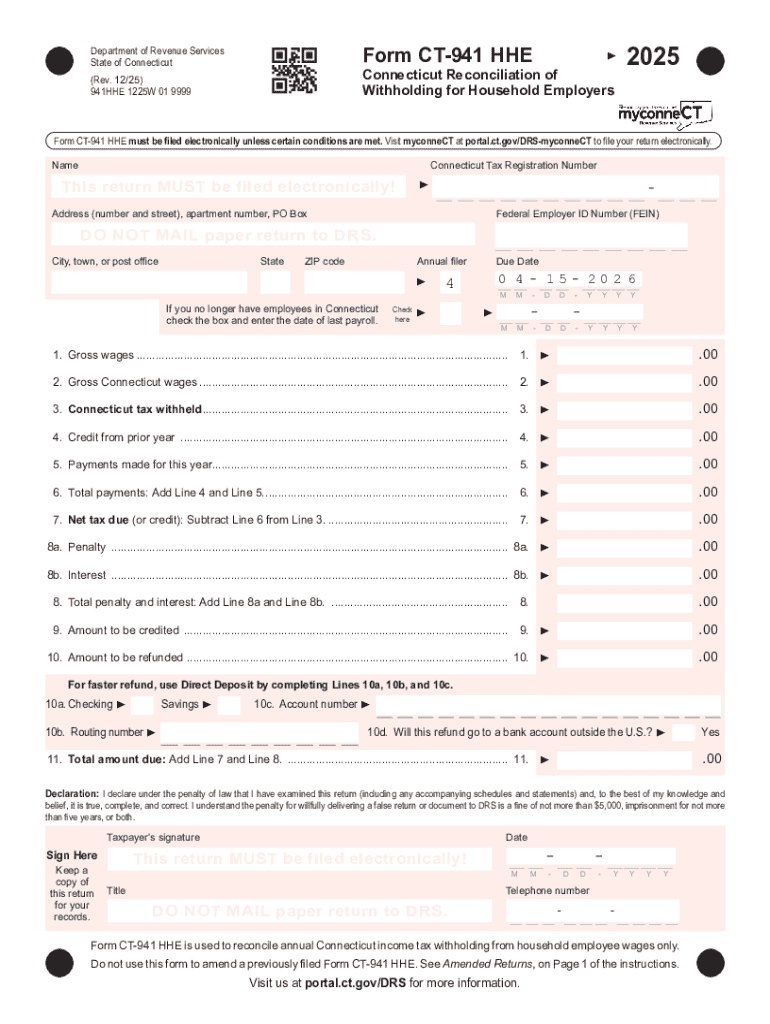

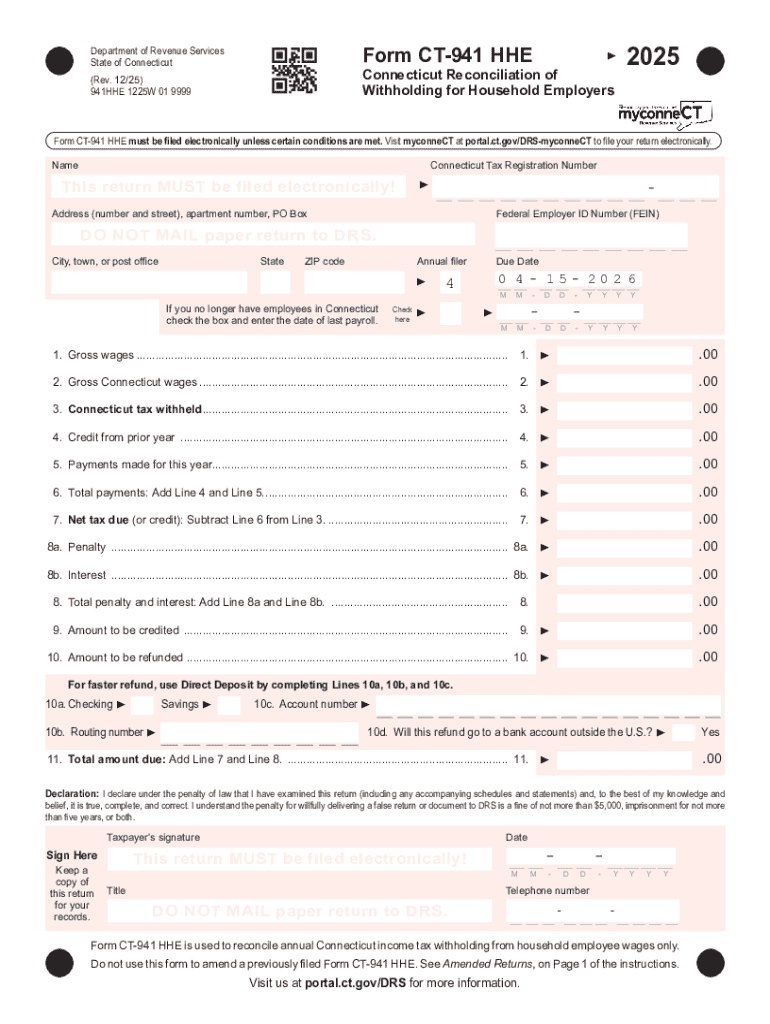

The primary form that Connecticut employers must focus on is the Connecticut Quarterly Reconciliation of Wages form, also known as the CT-941. This form consolidates vital payroll data and helps ensure that state tax requirements are met properly. Non-compliance with these filing obligations can lead to severe repercussions, including fines and potential audits.

Understanding the required form for Connecticut employers

The specific form Connecticut employers must file is the CT-941. This document is crucial for reporting wages and withholding taxes on behalf of employees to the Connecticut Department of Revenue Services. Its primary purpose is to maintain transparency in payroll and tax deductions, which ultimately supports the state's financial and economic structure.

Anyone classified as an employer under Connecticut law, defined as a business entity that employs one or more individuals, must file this form if they withhold state income tax from wages. It's essential for newly established companies to recognize their obligations before onboarding employees to avoid compliance headaches down the road.

Step-by-step guide to filling out the form

Filling out the CT-941 form can be straightforward if employers are prepared. To begin, employers should gather necessary information including:

Once the necessary data is collected, employers can move to the next step: completing the form. Each section requires careful attention to detail, and common mistakes to avoid include incorrect tax calculations or omitted employee information, which can lead to discrepancies and potential penalties for late filings.

Filing deadlines and important dates

Connecticut employers must adhere to specific annual filing deadlines for the CT-941. The general timeframe requires that the form be filed quarterly, with deadlines typically set for the last day of the month following the quarter. Thus, for the first quarter (January - March), the submission deadline is April 30, and similarly for the subsequent quarters. Employers should prioritize these deadlines to avoid penalties.

Missed deadlines can result in significant fines, which may accrue daily until the required paperwork is filed. Therefore, establishing reminders and maintaining an organized filing calendar can greatly reduce the risk of missing critical dates.

Electronic filing options for Connecticut employers

To streamline the submission process, Connecticut employers can file the CT-941 electronically. This method offers several benefits including faster processing times and increased security for sensitive information. Employers looking to file electronically can utilize platforms like pdfFiller, which provides intuitive tools for document completion and submission.

To file using pdfFiller, the process is simple:

For those who prefer traditional methods, mailing the form is viable but comes with drawbacks, such as longer processing times and risk of paperwork getting lost.

Additional forms required when filing in Connecticut

Along with the CT-941, employers may need to submit additional forms, such as the CT-W4 (Employee’s Withholding Certificate) for reporting employee tax withholding. It's essential for employers to understand when these supplementary documents are needed; for instance, the CT-W4 must accompany the initial employment paperwork for new hires.

Failure to submit these additional forms can lead to incomplete reporting and possible compliance issues, so employers should be diligent in ensuring that all required documents are collected and submitted together. Additional resources for downloading necessary forms can be found on the Connecticut Department of Revenue Services website.

Common questions and issues faced by employers

Employers often have questions around penalties associated with late or non-filing. Typically, late submissions may incur fines, which escalate the longer the delay continues. For example, employers may face fines ranging from $50 to $500 depending on how late the form is filed. Therefore, prompt and accurate submissions are vital.

Errors on the CT-941 can be rectified, but it is crucial to take immediate action. Employers should contact the Connecticut Department of Revenue Services to inquire about the best steps for correction and resubmission. For additional support, various online resources and state contacts are available to guide employers through the filing process.

Best practices for managing employer filing

To ensure accuracy and compliance, Connecticut employers should adopt best practices in document management. Maintaining organized records of employee information and filing dates is essential. Utilizing platforms such as pdfFiller not only helps in creating and editing forms but also aids in tracking filing deadlines, making the filing process more efficient.

Additionally, fostering collaboration within teams can enhance the filing process. For instance, assigning roles for data collection, form completion, and final reviews can assure comprehensive oversight and lessen the likelihood of errors.

Resources for Connecticut employers

Employers seeking guidance on filing obligations can access official state resources, including the Connecticut Department of Revenue Services website, where comprehensive information and downloadable forms are readily available. Additionally, utilizing platforms like pdfFiller offers features that simplify document management, allowing easy edits, collaboration, and electronic signatures.

These tools are invaluable for enhancing document handling efficiency which aligns perfectly with the needs of employers facing ongoing compliance requirements.

Staying updated on filing regulations and changes

For Connecticut employers, staying informed about changes in filing requirements is essential for ongoing compliance. Frequent updates in regulations can directly impact reporting obligations. Subscribing to state newsletters or following official channels can provide timely updates.

Employers should also regularly review their filing practices to identify any areas for improvement in light of new regulations, ensuring they are always compliant with the current state laws governing employer obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my connecticut employers must file directly from Gmail?

Can I create an electronic signature for the connecticut employers must file in Chrome?

Can I edit connecticut employers must file on an iOS device?

What is connecticut employers must file?

Who is required to file connecticut employers must file?

How to fill out connecticut employers must file?

What is the purpose of connecticut employers must file?

What information must be reported on connecticut employers must file?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.