Get the free Form 11 - Notice of Temporary Cessation of Business of a ...

Get, Create, Make and Sign form 11 - notice

How to edit form 11 - notice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 11 - notice

How to fill out form 11 - notice

Who needs form 11 - notice?

Form 11 - Notice Form: A Comprehensive Guide

Overview of form 11 - notice form

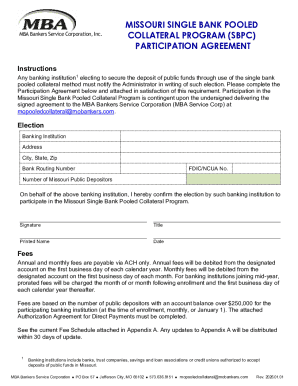

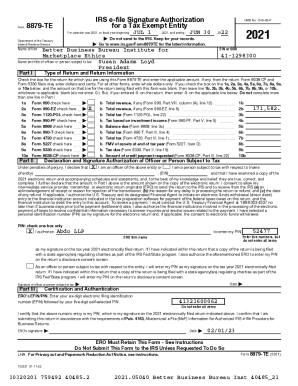

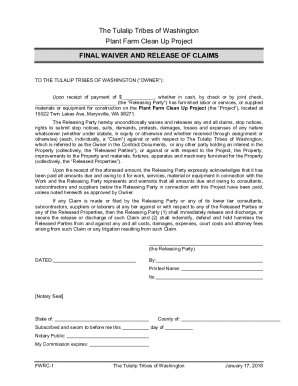

The form 11 - notice form serves as an essential document in various legal and official contexts, primarily designed to communicate important information to relevant parties. This notice form is crucial for formal notifications across a host of scenarios, including property assessments, land use changes, and official appeals. It ensures that all stakeholders, especially taxpayers and assessors, are informed about critical developments that may affect their interests or responsibilities.

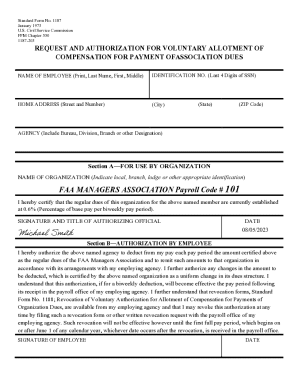

Key components of form 11

Understanding the structure of the form 11 is vital for accurate completion. It generally includes specific sections, each serving a distinct purpose to facilitate effective communication. The header information typically includes the title, date, and subject, while the recipient details encompass the names and addresses of individuals or entities involved. The body of the notice must clearly articulate the intended message—whether it concerns assessment notices, appeal rights, or directives.

Additionally, the form requires signatures along with dates to validate authenticity. Attachments might also be necessary, especially when providing supporting documents such as assessment reports or prior notice letters. This level of detail ensures that all legal requirements are met and that the information is efficiently conveyed.

Frequently asked questions about form 11

There are numerous inquiries surrounding the specifics of the form 11 - notice form, making it crucial for users to understand its essentials. Common questions include what exactly is included in the notice form, who is obligated to submit it, and the manner in which it should be submitted. Generally, all parties involved in property assessment processes, including taxpayers and assessors, are required to submit this form. Submission is typically through mail or electronically, emphasizing the importance of understanding submission deadlines and related timelines.

Filling out form 11: step-by-step guide

Accessing and completing the form 11 is a straightforward process that can be done efficiently using pdfFiller. First, users can download the PDF from pdfFiller's website, ensuring they have the latest version. This platform allows for easy access via cloud storage, enhancing convenience and flexibility.

Filling in personal and case information is next. Users should adhere to clear instructions for entering required details such as the name of the taxpayer, property identification, and specifics regarding the assessment notices. Careful attention to accurate information is crucial to prevent misunderstandings and legal issues.

How to manage your notice form

Managing your completed form 11 is vital, and pdfFiller makes it easier than ever. Users should save and store the document digitally, allowing for quick access and retrieval. Sharing the form with others, whether by email or through cloud links, ensures that all relevant parties have immediate access to necessary information.

Furthermore, collaborating on the form with team members can streamline updates and corrections. Using pdfFiller's cloud-based features, multiple users can make modifications in real time, enhancing productivity and ensuring that everyone remains on the same page.

Tracking the status of your submission

Once the form 11 is submitted, tracking its status becomes essential. Users are encouraged to utilize tracking options to confirm receipt by the recipient, whether a county assessor or other relevant authority. Maintaining communication will help address follow-ups or additional requirements that may arise.

State-specific guidance for filing form 11

It's crucial to recognize that requirements for filing form 11 can vary significantly by state. Factors like jurisdictional differences and specific deadlines can impact how and when users should submit their forms. Therefore, being informed about the local regulations is vital, as it helps avoid potential legal penalties.

Users should consult state-specific resources that outline the unique requirements and processes for filing form 11 in their locality. This awareness supports taxpayers in navigating the assessment of land and improvements with confidence and compliance.

Recap of key takeaways

Completing form 11 accurately is essential for effectively managing notices related to assessments. Understanding the importance of this form, alongside diligent attention to detail when filling it out, is crucial to achieving favorable outcomes. Equally, employing best practices for document management ensures that users remain organized and compliant.

Staying updated on the latest requirements for form 11, alongside utilizing platforms like pdfFiller, equips users to handle their documentation needs adeptly and efficiently.

Additional tips for using pdfFiller with form 11

Leveraging pdfFiller's robust features enhances document creation and management capabilities. Users can utilize tools for collaboration, ensuring that every change is tracked and managed seamlessly. Additionally, the platform’s cloud access means that form 11 can be edited and signed from any location, adding a layer of convenience for users on the go.

Client testimonials often highlight how pdfFiller has simplified their processes, enabling efficient document management that aligns with their specific needs. By sharing success stories, potential users gain confidence in the platform's effectiveness for legal documents and official notices.

Troubleshooting common issues

Many users may experience common pitfalls when filling out form 11. Recognizing these mistakes—such as incomplete fields or incorrect signatures—can save considerable time and hassle. pdfFiller provides specific guidelines to avoid such errors, ensuring that users can submit their forms confidently.

Additionally, should technical issues arise with pdfFiller documents, users can rely on the platform’s customer support and resources for swift resolutions. Having access to responsive help allows users to navigate difficulties without undue stress.

Interactive tools

To further enhance user experience, pdfFiller offers interactive tools that simplify the form-filling process. One notable feature includes an interactive demo specifically for filling out a sample form 11, which can greatly assist users in visualizing the process.

An editable template for form 11 is also available for practice, allowing individuals to familiarize themselves with the form’s structure while refining their filling skills. This hands-on approach guarantees a more nuanced understanding of what is required.

Conclusion

Mastering the form 11 - notice form is imperative for anyone involved in property assessments or official county communications. Embracing the capabilities of pdfFiller can significantly empower users, enabling them to edit, sign, collaborate, and manage their documents efficiently from a single, cloud-based platform. By following the structured guidance outlined in this article, users will be equipped to handle their documentation needs with confidence and ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form 11 - notice electronically in Chrome?

Can I create an electronic signature for signing my form 11 - notice in Gmail?

How do I edit form 11 - notice on an Android device?

What is form 11 - notice?

Who is required to file form 11 - notice?

How to fill out form 11 - notice?

What is the purpose of form 11 - notice?

What information must be reported on form 11 - notice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.