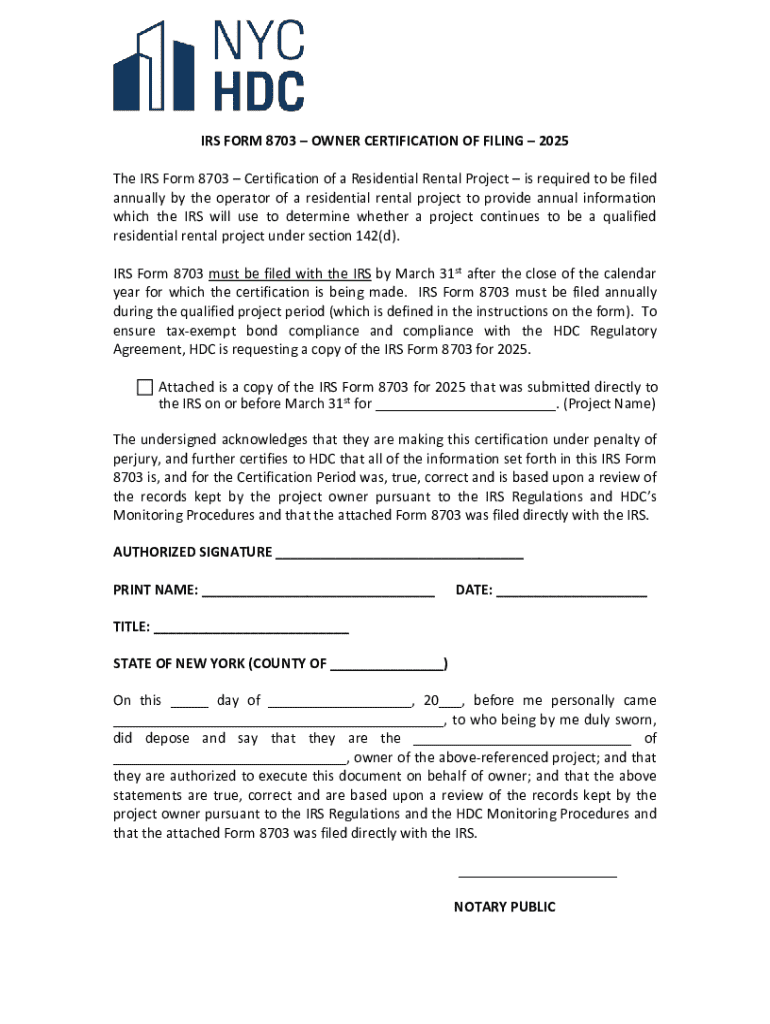

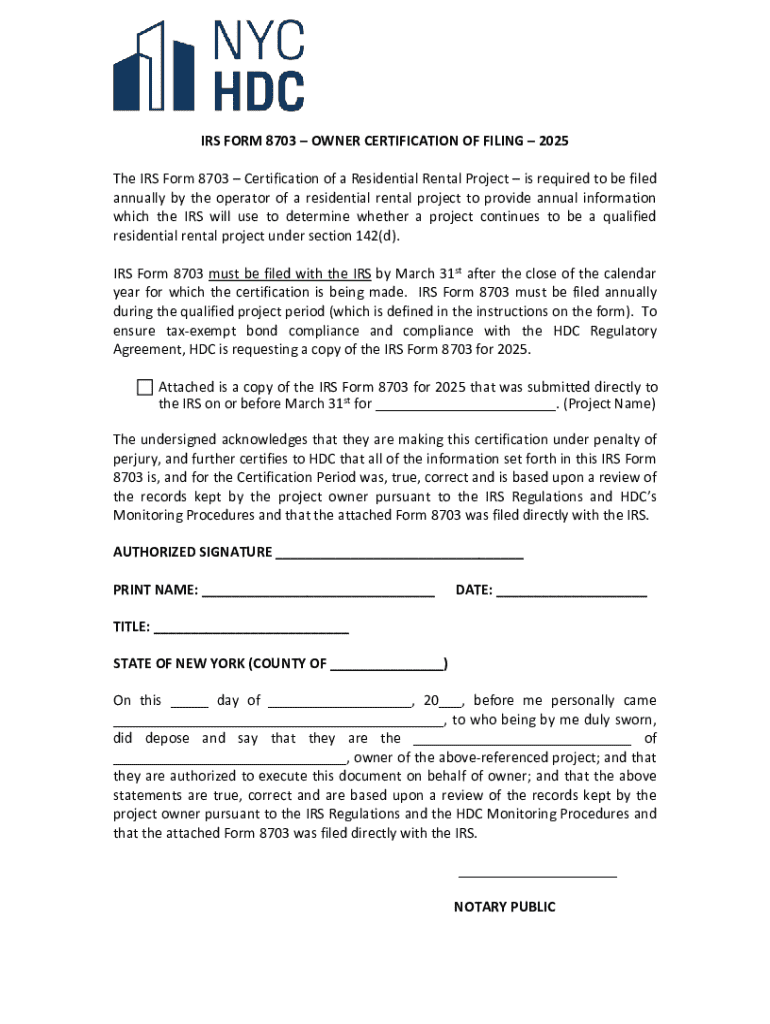

Get the free IRS FORM 8703 OWNER CERTIFICATION OF FILING 2025

Get, Create, Make and Sign irs form 8703 owner

Editing irs form 8703 owner online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 8703 owner

How to fill out irs form 8703 owner

Who needs irs form 8703 owner?

IRS Form 8703 Owner Form: Comprehensive Guide

Understanding IRS Form 8703

IRS Form 8703, also known as the Owner Form, is a crucial document for owners of residential rental properties involved in a low-income housing project. This form serves not only as a means to report important ownership information to the IRS but also as part of the annual certification required for tax compliance. Property owners need to be aware of its relevance, especially as it pertains to potential tax exemptions or reductions.

Understanding the intricacies of IRS Form 8703 is vital since it directly impacts how property owners manage their tax obligations. Given the specific requirements set forth by the IRS, completing this form accurately can save money and provide compliance with federal housing programs designed to support low-income tenants and projects.

Key terminology explained

To navigate IRS Form 8703 effectively, it’s essential to grasp some important terms associated with it. These include:

Importance of filing IRS Form 8703

Filing IRS Form 8703 is significant for property owners who wish to maintain their tax credits and benefits associated with low-income housing projects. Mismanagement or overlooked filings can lead to the loss of valuable exemptions, which may substantially increase tax liabilities on rental properties. Thus, understanding and adhering to Form 8703's requirements is crucial.

Moreover, the repercussions of failing to file this form can be severe. Property owners who neglect this obligation may face potential penalties, including fines and retroactive tax liability for not complying with program requirements. The importance of timely and accurate filing cannot be overstated.

Who needs to file IRS Form 8703?

Certain property owners are required to file IRS Form 8703. These typically include owners of residential rental properties participating in programs that provide housing for low-income individuals or families. Below are the eligibility criteria to determine if you need to file:

Additionally, there are special cases where new owners or those experiencing ownership transfer must also file IRS Form 8703. This includes properties that have recently changed hands or situations where new compliance requirements may apply.

Information required on Form 8703

Before completing IRS Form 8703, gathering the necessary information is key. Here’s a checklist of the essential data you will need:

Completing each section accurately is critical. Below is a brief breakdown of the form's sections:

1. **Identification details**: Enter the name, Tax ID, and contact information of the owner. 2. **Property information**: Provide detailed descriptions of the property, including physical and financial characteristics. 3. **Ownership structure**: Indicate how the ownership is structured, whether it's held by an individual, corporation, or partnership.

How to fill out IRS Form 8703

Filling out IRS Form 8703 requires careful attention to detail. Here’s a step-by-step guide to help you complete the form effectively:

Utilizing tools from pdfFiller can significantly ease the process. The platform allows users to fill out forms electronically and save them securely in the cloud, streamlining document management.

Electronic submission of IRS Form 8703

One of the key advantages of using pdfFiller is the option to e-file IRS Form 8703. Electronic submissions not only simplify the process but also ensure timely delivery to the IRS. E-filing reduces the risk of paperwork getting lost and can often expedite processing times.

If you choose to submit your form electronically, follow these straightforward steps:

Editing and managing your form

After submitting IRS Form 8703, ensuring proper management of all documents related to your rental property is essential. Utilizing pdfFiller’s advanced features, you can easily edit, sign, and manage your PDFs securely.

For safeguarding your information, consider the following best practices:

Common mistakes to avoid

When filling out IRS Form 8703, certain pitfalls can lead to complications. Being aware of these common mistakes can save you from headaches later on.

If mistakes are discovered after submission, don’t panic. The IRS allows corrections to submitted forms but ensure to follow the proper procedures for amendments and keep a record of changes made.

FAQs about IRS Form 8703

Navigating IRS Form 8703 can raise numerous questions. Here are some frequently asked questions that shed light on common concerns:

Additionally, tax professionals advise staying informed about changes in tax laws that may affect Form 8703 or related documentation.

Final thoughts on managing IRS Form 8703

Once IRS Form 8703 is filed, ongoing responsibilities must be maintained. Property owners should regularly review their compliance with housing regulations and ensure timely submissions for any updates or changes, particularly for annual certification of a residential rental project.

Leveraging platforms like pdfFiller can aid in document management well beyond the initial filing of Form 8703. The cloud-based solution allows users to access, edit, and sign documents as needed, ensuring continuous compliance and convenience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit irs form 8703 owner in Chrome?

Can I edit irs form 8703 owner on an iOS device?

How do I complete irs form 8703 owner on an Android device?

What is irs form 8703 owner?

Who is required to file irs form 8703 owner?

How to fill out irs form 8703 owner?

What is the purpose of irs form 8703 owner?

What information must be reported on irs form 8703 owner?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.