Get the free Tax Information for Businesses - Utah State Tax Commission

Get, Create, Make and Sign tax information for businesses

Editing tax information for businesses online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax information for businesses

How to fill out tax information for businesses

Who needs tax information for businesses?

Tax information for businesses form: A comprehensive guide

Understanding tax forms for businesses

Tax forms are essential tools that ensure businesses comply with federal, state, and local tax obligations. These forms facilitate the proper reporting of various types of income, payroll, and sales tax, which are critical for maintaining the financial integrity of a company. Accurate completion of tax forms is not only a legal obligation but also plays an integral role in the operational success of a business.

Businesses encounter different forms based on their operations, structure, and revenue. Understanding which forms are applicable can streamline the tax reporting process, reduce errors, and enhance financial reporting. Below are three primary categories of tax forms relevant to businesses.

Key tax information every business should know

Understanding your tax obligations is crucial for business compliance and planning. Businesses need to be aware of various tax deadlines, which can differ significantly at federal and state levels. It's vital to stay informed about these deadlines to avoid penalties or interest on unpaid taxes, which can accumulate quickly.

Additionally, recognizing which deductions are available can significantly impact a business’s bottom line. For instance, common expenses such as operating costs, employee wages, and certain employee benefits may qualify for deductions, effectively lowering tax liabilities.

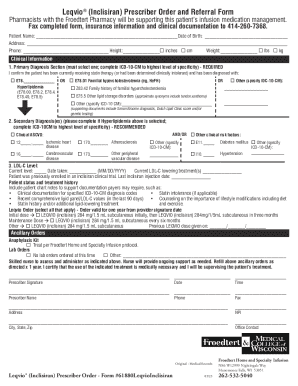

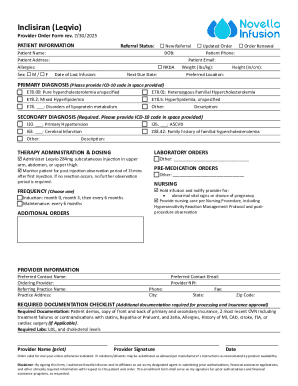

Navigating the tax information form

The tax information form is a formal document required by the government that collects essential specifics needed to calculate taxes accurately. Without proper understanding and navigation of this form, businesses risk confusion and potential penalties. Ensuring that all required information is submitted correctly is the first step towards successful tax compliance.

The form typically requires basic business information, including the legal name, business structure, tax identification number, and financial details. Breaking this down into manageable sections can help make filling it out much easier.

How to fill out the tax information form

Filling out the tax information form may seem daunting, but following a structured approach can simplify the process. Start by gathering all necessary documents such as financial statements and prior tax forms to have all information accessible as you complete the form.

Next, pay particular attention to business identification sections that include the name, address, and tax ID. Following that, accurately report your income and any deductions. Once filled, reviewing and verifying all entered details can help catch any discrepancies before submission.

Editing and managing your tax information form

Once you've completed the tax information form, ensuring that you can edit and manage the document effectively will save time and effort in the future. Using tools such as pdfFiller provides you with features that not only allow editing and filling out PDFs easily but also support collaboration and version control.

With pdfFiller, businesses can keep track of changes made to the form and store different versions. This is critical for referencing any previous submissions or when needing to update information.

eSigning your tax information form

In today's digital age, eSigning your tax information form is becoming the norm. Digital signatures offer a secure and efficient method of signing documents without the need for physical paperwork. Understanding the importance and legality of eSignatures can enhance your business’s document workflow significantly.

Using pdfFiller, eSigning your tax form is simple and fully compliant with legal standards. A digital signature confirms the identity of the signatory, ensuring that every submission is a valid and secure representation of the business.

Submitting your tax information form

After completing and eSigning the tax information form, the subsequent step is submitting it. Businesses can choose between online submission through designated government websites or traditional paper filing. Each method has its advantages, and understanding them can help streamline the submission process.

Once submitted, businesses should expect a confirmation from the relevant tax authority. It's crucial to establish best practices for storing tax documents to be able to quickly reference them in the future, especially during audits or queries from tax authorities.

Managing business taxes year-round

Tax management is not solely a year-end activity; it requires ongoing attention to ensure compliance and capitalize on potential deductions. Tools and practices like utilizing tax software or hiring a professional are effective ways to keep track of tax obligations throughout the year.

Staying updated on tax changes is vital, as tax laws can evolve based on economic conditions and government policies. By keeping informed, businesses can adjust their tax strategy accordingly, ensuring optimal management of their tax duties while leveraging solutions like pdfFiller for document management.

Frequently asked questions (FAQs)

As businesses navigate the complexities of tax information forms, questions and concerns are bound to arise. Common queries often include details about the required forms, how to correct mistakes, and where to seek assistance. Addressing these concerns helps demystify the tax process and empowers business owners to take charge of their financial obligations.

Resources such as the IRS website, state tax authority websites, and even tax software can provide additional insights or answers. Awareness of these resources can aid businesses in resolving specific tax-related issues as they arise.

Additional considerations

Consulting with tax professionals can provide invaluable assistance in navigating the complexities of tax compliance and planning. Tax professionals are well-versed in changing laws and can advise on how to structure your business to maximize deductions and minimize liabilities.

Ultimately, ensuring compliance with tax regulations is essential for any business aiming for long-term growth and stability. Leveraging technology, such as pdfFiller, can significantly enhance the efficiency of document management and facilitate smoother operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax information for businesses in Chrome?

How do I complete tax information for businesses on an iOS device?

How do I complete tax information for businesses on an Android device?

What is tax information for businesses?

Who is required to file tax information for businesses?

How to fill out tax information for businesses?

What is the purpose of tax information for businesses?

What information must be reported on tax information for businesses?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.