Get the free CURRENT ACCOUNT CONVERSION FORM v4PDF

Get, Create, Make and Sign current account conversion form

Editing current account conversion form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out current account conversion form

How to fill out current account conversion form

Who needs current account conversion form?

Current Account Conversion Form How-to Guide

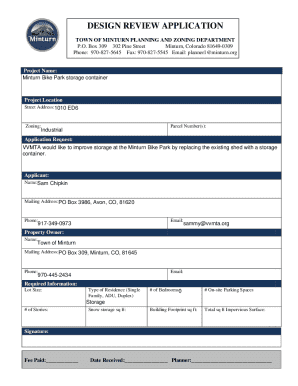

Understanding current account conversion forms

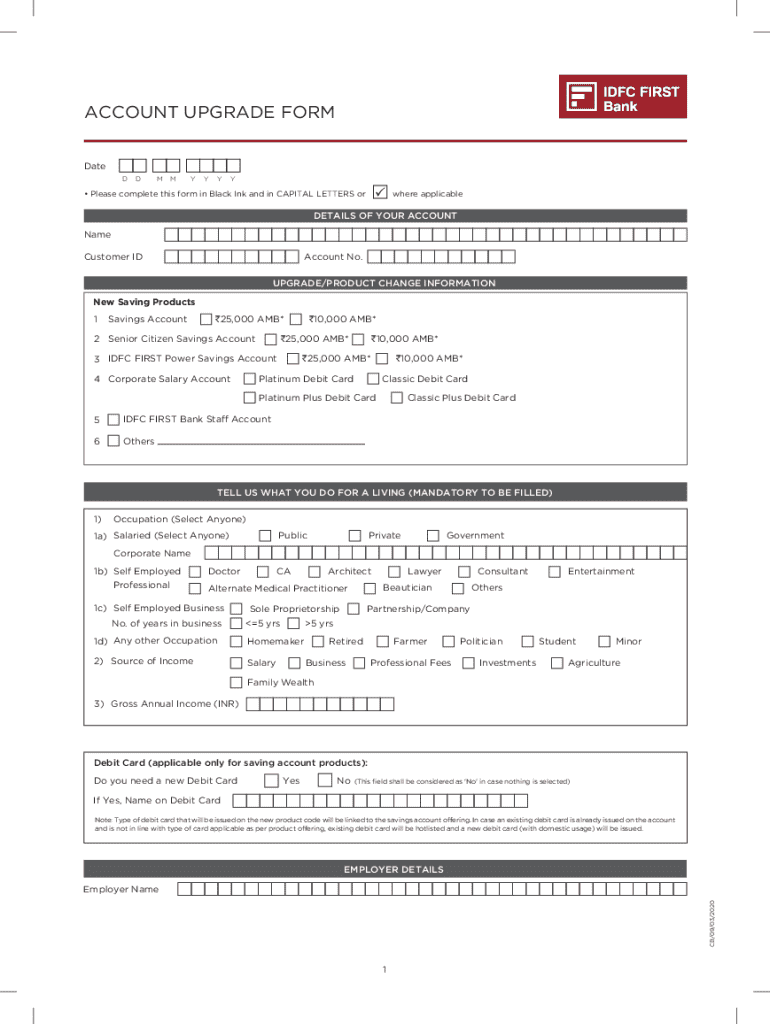

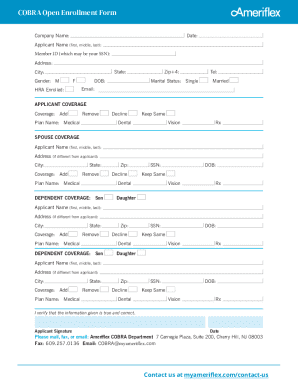

A current account conversion form is a document used by account holders to change their existing current account type to another variant offered by the same financial institution. This form is crucial for maintaining optimal banking services that align with your evolving financial needs.

Converting your account can significantly impact your day-to-day banking experience, enabling you to access tailored features and benefits specific to your financial situation. Account conversion typically becomes necessary during life changes such as starting a business, experiencing a change in income, or simply looking for better incentives from your bank.

Types of current accounts

Current accounts can vary significantly in terms of features and fees. Here are some commonly available types:

Each type of current account brings its own set of benefits, making it essential to choose one that best matches your financial habits and future objectives.

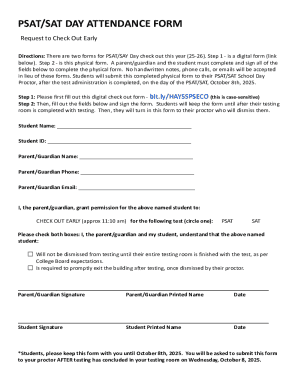

Steps to complete your current account conversion form

Completing your current account conversion form involves several steps to ensure all necessary information is provided and accurately filled out. Here’s how you can navigate this process smoothly:

Preparing for conversion

Begin by gathering the required documentation. Typically, banks need proof of identity, current account statements, and possibly financial documents related to your new account type.

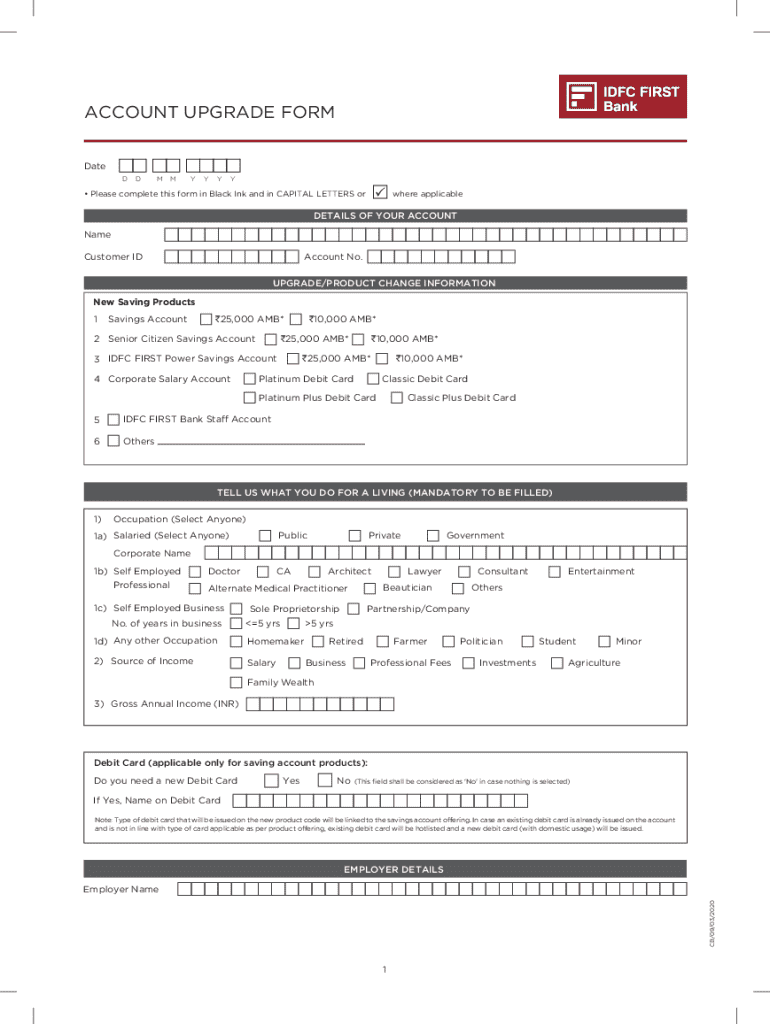

Filling out the conversion form

After filling out the form, it's crucial to review all the information to ensure accuracy, as errors can lead to delays or complications with your account conversion.

Submitting the conversion form

Decide whether to submit the form online or in person. Online submission can be faster, but ensure you have the right digital documentation at hand. Alternatively, in-person submission may provide immediate responses to any questions you might have.

Interactive tools for account management

Managing your current account effectively can be streamlined using interactive tools such as those offered by pdfFiller. These robust features assist not just in filling out forms but also in editing and managing your documents efficiently.

Additionally, if you're working within a team, pdfFiller's collaboration tools allow for shared access and editing, enhancing productivity and ensuring everyone stays on the same page throughout the conversion process.

Frequently asked questions about account conversion

Navigating your current account conversion can lead to many questions. Here are some common inquiries along with their answers:

Troubleshooting common issues

As with any process, issues might arise during your account conversion. Knowing how to troubleshoot common problems can save you time and frustration.

After your account conversion

Once your account conversion is successful, there are several important steps to take to ensure a smooth transition.

Best practices for future account changes

To ensure your banking needs are always met, keep best practices in mind as you move forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find current account conversion form?

How do I make changes in current account conversion form?

How can I fill out current account conversion form on an iOS device?

What is current account conversion form?

Who is required to file current account conversion form?

How to fill out current account conversion form?

What is the purpose of current account conversion form?

What information must be reported on current account conversion form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.