Get the free 2019-2025 form mn dor st3 fill online, printable, fillable ...

Get, Create, Make and Sign 2019-2025 form mn dor

How to edit 2019-2025 form mn dor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2019-2025 form mn dor

How to fill out 2019-2025 form mn dor

Who needs 2019-2025 form mn dor?

Comprehensive Guide to the 2 Form MN DOR Form

Overview of the 2 Form MN DOR Form

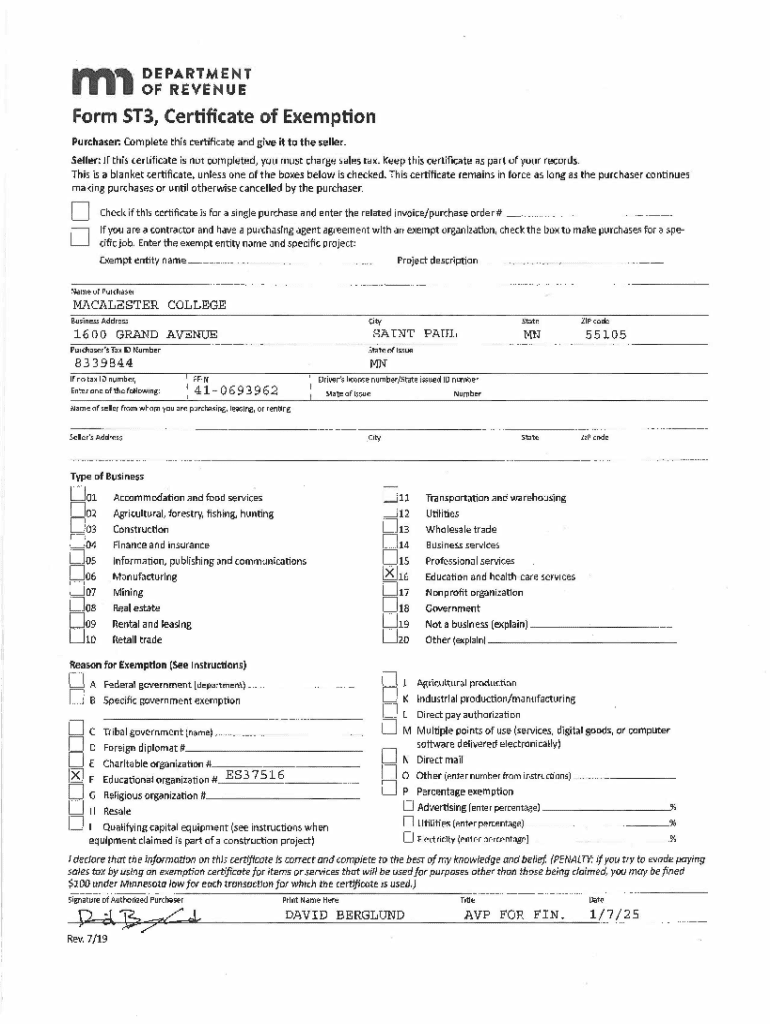

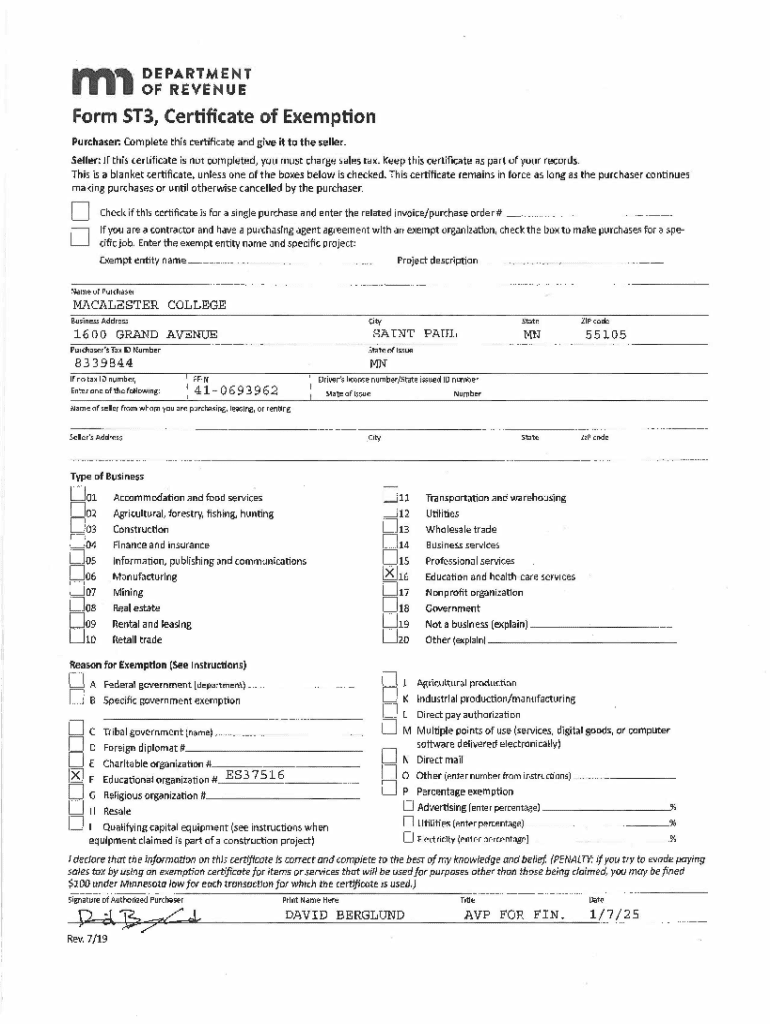

The MN DOR Form, released by the Minnesota Department of Revenue, is a crucial document for reporting tax information for individuals and businesses operating within the state. This form facilitates compliance with state tax laws, ensuring that all necessary financial details are disclosed accurately.

The purpose of the MN DOR Form is to provide a standardized method for taxpayers to report various types of income, claim deductions, and take advantage of applicable tax credits. For the 2 period, several updates have been introduced, including modifications in income categories and eligibility criteria for certain deductions. Understanding these changes is essential for filing accurate tax returns.

Steps for accessing the MN DOR Form

Obtaining the correct version of the MN DOR Form is the first step towards ensuring proper filing. Individuals can access the form online through the Minnesota Department of Revenue's official website. The website is structured to assist users in finding the necessary forms quickly.

To begin, navigate to the Minnesota Department of Revenue webpage using this direct link: [insert link here]. The homepage offers a user-friendly interface to guide you to the forms section where you can search for the MN DOR Form relevant to the 2 period.

Detailed instructions for filling out the MN DOR Form

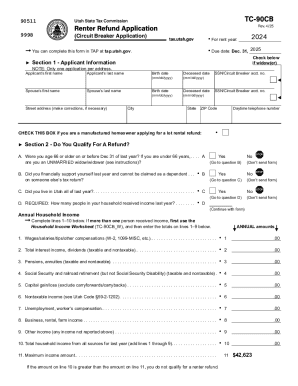

Filling out the MN DOR Form requires attention to detail as each section captures critical financial information. Begin with Section 1, which focuses on personal information. This includes your name, address, and taxpayer identification number. It’s crucial to ensure the correctness of these details as errors can lead to delays in processing.

Next, Section 2 pertains to income reporting. Here, you must differentiate among various income categories such as employment income, self-employment income, and investment income. Accurately reporting these will prevent complications with the Department of Revenue.

Editing and signatures

Before submitting the MN DOR Form, it's advisable to review and edit the document as needed. Tools available on pdfFiller make it easy to edit PDFs online. By using these tools, you can modify text, add comments, or correct mistakes efficiently.

When it comes to signatures, the option for e-signing offers convenience and is legally valid in Minnesota. Follow our step-by-step guide to add a digital signature to ensure your submission includes the necessary legal affirmation.

Submitting the MN DOR Form

After completing your MN DOR Form, the next step is submission. You have several methods to ensure your form reaches the appropriate department. You can submit online through the MN DOR portal for immediate processing or mail it to the designated address provided on the form.

Be aware of the deadlines for submissions. Missing these deadlines can lead to penalties or complications. Stay informed about crucial dates for the 2 forms to avoid any mishaps.

Managing your MN DOR form submission

Once your form is submitted, it’s essential to manage and track its status effectively. The Minnesota Department of Revenue offers online tracking features to keep you updated on your submission. Knowing how to access these features can help you stay on top of your filings.

If you need to amend your form post-submission, understanding the amendment process is crucial. Familiarize yourself with the procedures for submitting corrections or additional information as required.

Common issues and solutions

Filing the MN DOR Form can come with its challenges. Common problems include incomplete submissions, lost documents, or challenges during the e-signing process. When faced with these issues, troubleshooting is key.

The Minnesota Department of Revenue also provides a help desk that can assist with your concerns. Keep this phone number handy for immediate support, and also check their website for additional resources that address frequently asked questions.

Interactive tools for form management

To enhance the experience of managing the MN DOR Form, using tools like pdfFiller can offer substantial advantages. The platform not only allows for easy document editing and signing but also offers collaboration features that enable teams to work together seamlessly on form completion.

Utilizing these interactive tools streamlines your workflow, making the submission process less stressful. Plus, integration with other platforms provides added versatility for your document management needs.

Final tips for a smooth filing experience

Preparing your documents in an organized manner can significantly boost the efficiency of your filing experience. Create a checklist of necessary items such as W-2 forms, income statements, and any applicable deductions to prevent last-minute scrambles.

Maintaining meticulous records is essential not just for this year’s forms, but also for future reference. Learn from your previous filing experiences by keeping track of what strategies worked well for you, and apply those successes to your upcoming submissions.

Feedback and updates

Providing feedback on your experience with the MN DOR Form submission process is crucial for continued improvement. Engaging with the Minnesota Department of Revenue can help shape future iterations of the form.

Stay updated on any changes to the MN DOR Form by regularly visiting the Minnesota Department of Revenue website. Community forums are also excellent resources where you can share insights and tips with other filers, helping everyone navigate the process more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2019-2025 form mn dor online?

How do I edit 2019-2025 form mn dor straight from my smartphone?

How can I fill out 2019-2025 form mn dor on an iOS device?

What is 2019-2025 form mn dor?

Who is required to file 2019-2025 form mn dor?

How to fill out 2019-2025 form mn dor?

What is the purpose of 2019-2025 form mn dor?

What information must be reported on 2019-2025 form mn dor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.