Get the free MINNESOTA REVENUE - Certificate of Exemption - StPaul.gov

Get, Create, Make and Sign minnesota revenue - certificate

Editing minnesota revenue - certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minnesota revenue - certificate

How to fill out minnesota revenue - certificate

Who needs minnesota revenue - certificate?

Minnesota Revenue - Certificate Form: A Comprehensive Guide

Understanding the Minnesota Revenue Certificate Form

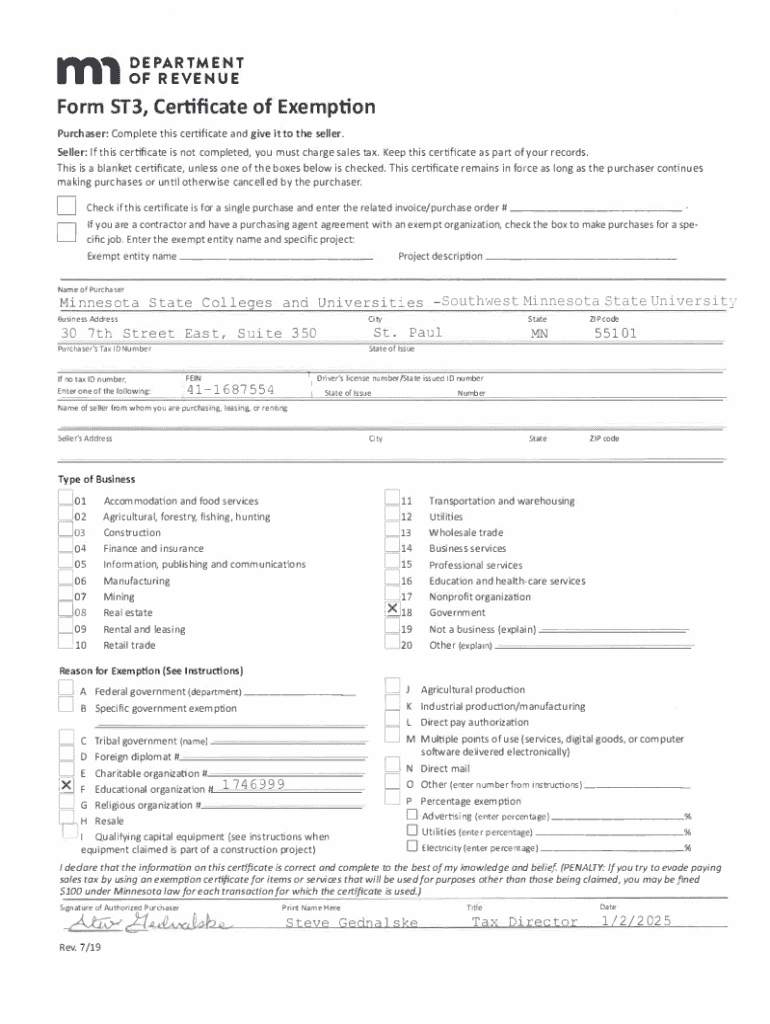

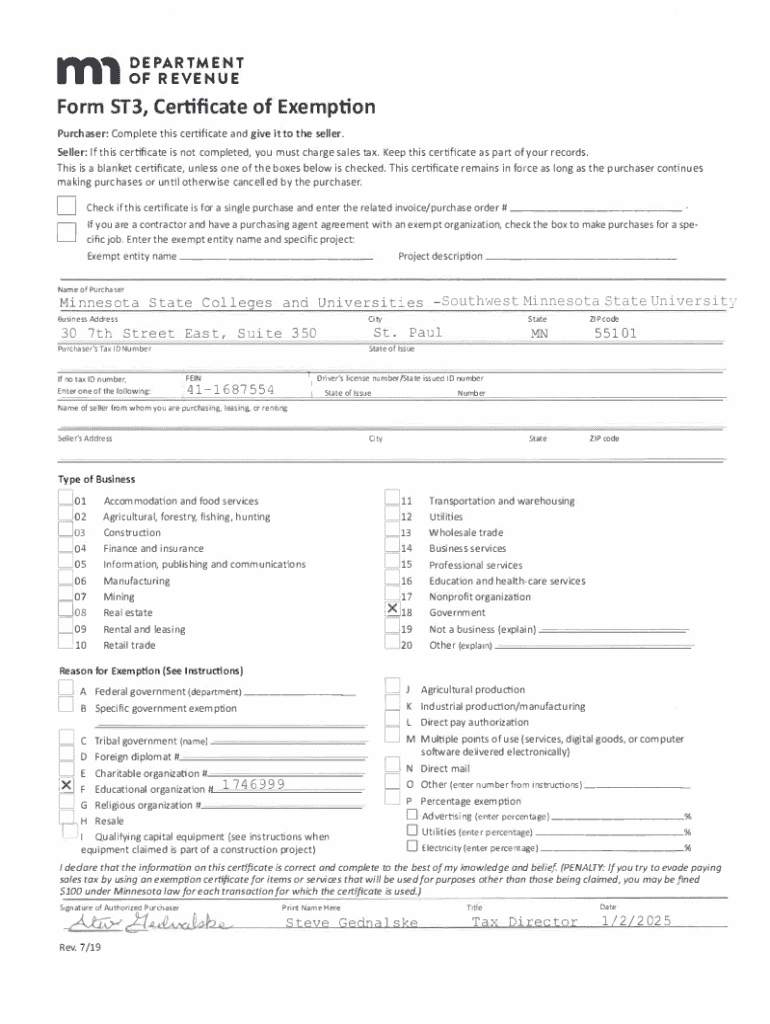

The Minnesota Revenue Certificate Form is a crucial document used to manage and document various tax obligations in the state. Its primary purpose is to attest to a taxpayer's status, exemption, or to set parameters around certain financial activities, making it foundational for compliance with state tax regulations. Individuals and businesses rely on this form to validate their tax-exempt status or to streamline their tax obligations.

Moreover, the importance of the Certificate Form cannot be overstated. It not only facilitates correct tax dealings but also provides assurance to both taxpayers and the Minnesota Department of Revenue that all regulations are adhered to appropriately. Key users of this form typically include business owners, accountants, and tax professionals who need clear documentation for varied tax-related scenarios.

Types of Minnesota Revenue Certificates

Minnesota offers several types of Revenue Certificates, each catering to specific needs and tax circumstances. A clear understanding of these certificates is vital for ensuring compliance and proper record-keeping.

Specific use cases for each type range from obtaining necessary exemptions on purchases to fulfilling ongoing sales tax collection obligations. Understanding when and how to use these certificates is crucial in maintaining your business’s tax health.

Accessing the Minnesota Revenue Certificate Form

Accessing the Minnesota Revenue Certificate Form is a straightforward process. The official Minnesota Department of Revenue website serves as the primary resource for downloading all forms related to taxes and exemptions. Ensuring you have the latest version of any form is critical to maintain compliance.

In addition to the official website, platforms like pdfFiller offer interactive templates and forms that streamline the process of filling out and submitting these certificates online. This can significantly reduce the time spent on managing documentation.

Step-by-step instructions for filling out the certificate form

Filling out the Minnesota Revenue Certificate Form requires careful attention to detail. Start with your essential information, which includes your full name, address, and contact information. If you are completing the form on behalf of a business, include the business's name, address, and the tax identification number.

Next, you will need to provide relevant tax information. Specify why you are submitting this form and include any pertinent details that may affect your tax standing or exemption status. It is crucial to ensure accuracy here to avoid any future discrepancies.

Tips for completing each section include double-checking your information for accuracy and clarity. Common mistakes to avoid include omitting critical details or hypothesizing about tax statuses without proper evidence.

Editing and customizing the certificate form with pdfFiller

Editing the Minnesota Revenue Certificate Form can easily be managed with pdfFiller. This platform allows users to modify PDF documents directly online, making it an ideal tool for those who need flexibility in their documentation process.

Using pdfFiller's interactive features, users can highlight important sections, add comments or notes, and ensure clarity in communication. This not only makes your document more understandable but can also aid in collaboration with team members or advisors.

E-signing the Minnesota Revenue Certificate Form

E-signatures have revolutionized the way forms are submitted today, including the Minnesota Revenue Certificate Form. The legality of eSignatures in Minnesota is well established, meaning that properly executed eSignatures hold the same weight as traditional handwritten signatures.

Using pdfFiller, users can easily eSign their forms, adding another layer of convenience to the filing process. This feature allows for faster turnaround times and ensures that submissions are officially recognized without the delays associated with physical mail.

Submitting the Minnesota Revenue Certificate Form

Once you have filled out and eSigned your form, the next step is submission. Minnesota provides multiple avenues to submit your Certificate Form: by mail, online, or in-person. Choosing the correct option usually depends on your urgency and convenience.

After submission, it's important to understand what to expect. You may receive confirmation of your submission via email or a physical letter, depending on your submission method. Keep an eye on deadlines and any follow-up correspondence to ensure your submitted form is processed without issue.

Frequently asked questions

Errors on official forms can cause delays or complications. If you realize you have made a mistake on your Minnesota Revenue Certificate Form, it’s important to address this promptly. Generally, you may need to submit a corrected version of the form to ensure that the new version replaces any prior submissions correctly.

If you need to update or modify your certificate after submission, reach out to the Minnesota Department of Revenue for guidance on the specific process you must follow. For further assistance, always explore resources available on the state’s revenue website, which can provide clarity on any complex scenarios.

Collaborating with others on your certificate form

For businesses and teams, collaborating on the Minnesota Revenue Certificate Form can simplify the process. pdfFiller allows users to share the form with team members, ensuring that all necessary individuals can contribute and make amendments as needed.

Real-time collaboration features enhance the collective effort while ensuring compliance and accuracy in submissions. This collaborative approach can be especially useful when multiple stakeholders are involved in the registration or tax exemption process.

Conclusion on effective document management

Managing certificates and documents effectively is critical for compliance and organizational efficiency. The Minnesota Revenue Certificate Form is just one part of an overarching need for diligent documentation practices. Utilizing tools like pdfFiller can empower users to streamline future document needs significantly.

By leveraging cloud-based solutions, users can ensure that their documents are accessible from anywhere and editable as circumstances change. This adaptability is vital in maintaining good standing with tax obligations and facilitating smooth operations.

Connect with pdfFiller

If you have questions about the Minnesota Revenue Certificate Form or require additional assistance, pdfFiller is here to help. We encourage you to sign up for updates on new features and related tools to enhance your document management experience.

Explore our extensive resources and utilize pdfFiller for all future form needs, enabling you to navigate the paperwork associated with tax obligations with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify minnesota revenue - certificate without leaving Google Drive?

How do I edit minnesota revenue - certificate on an iOS device?

How do I fill out minnesota revenue - certificate on an Android device?

What is minnesota revenue - certificate?

Who is required to file minnesota revenue - certificate?

How to fill out minnesota revenue - certificate?

What is the purpose of minnesota revenue - certificate?

What information must be reported on minnesota revenue - certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.