IRS 8960 2025-2026 free printable template

Show details

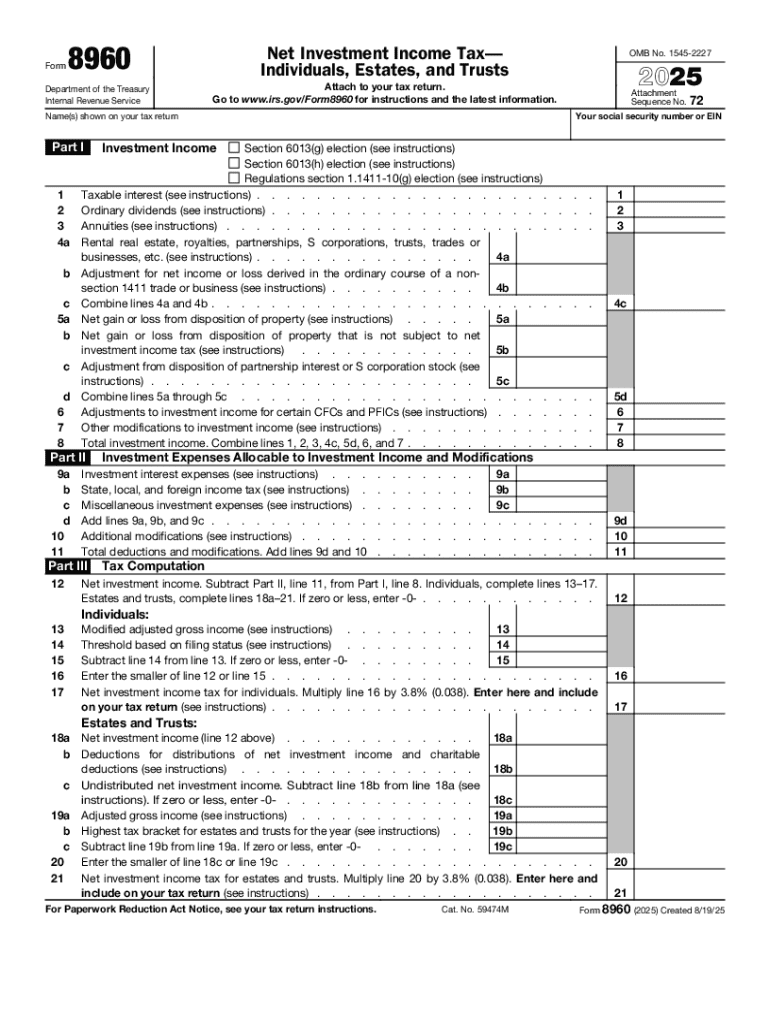

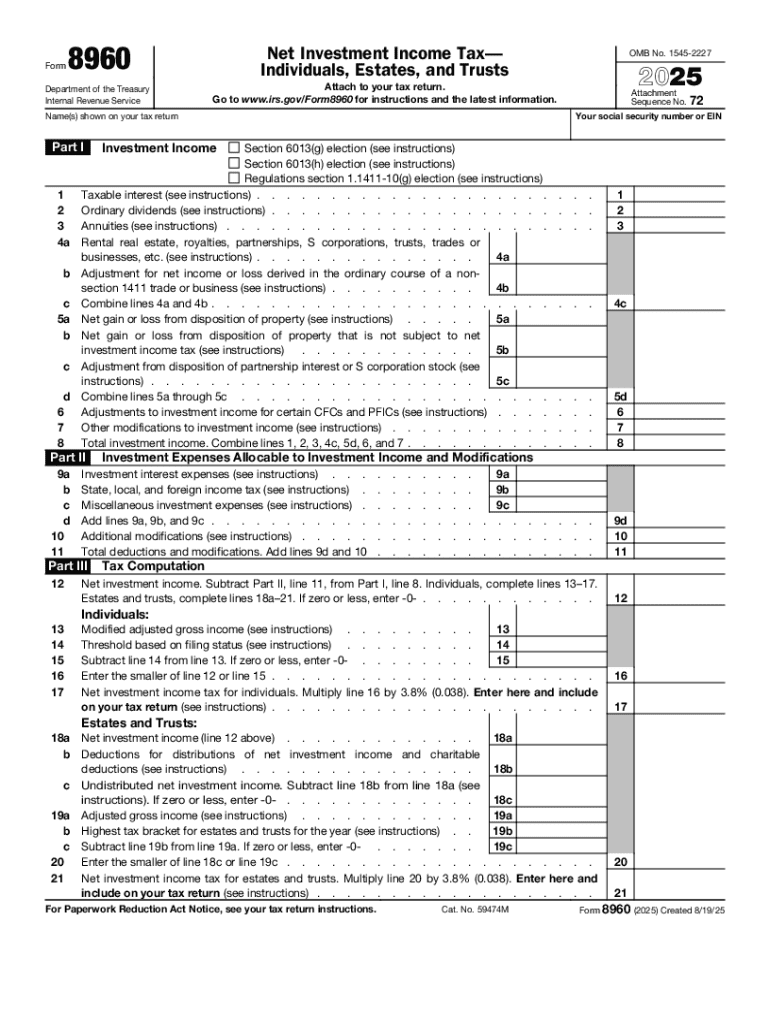

Form8960Department of the Treasury

Internal Revenue ServiceNet Investment Income Tax

Individuals, Estates, and TrustsOMB No. 154522272025Attach to your tax return.

Go to www.irs.gov/Form8960 for instructions

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8960

Edit your IRS 8960 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8960 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 8960 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 8960. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8960 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8960

How to fill out 2025 form 8960

01

Gather your income information, including wages, dividends, interest, and capital gains.

02

Calculate your adjusted gross income (AGI) and any applicable deductions.

03

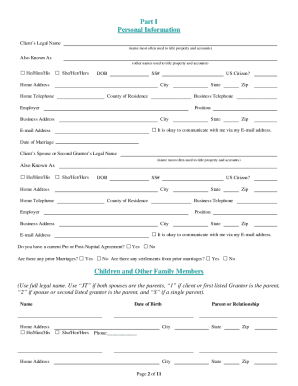

Complete Part I of the form, reporting your net investment income.

04

Fill out Part II to determine your threshold amount based on your filing status.

05

Compute your investment income tax by following the instructions for Part III.

06

Review all calculations for accuracy before submitting the form.

Who needs 2025 form 8960?

01

Individuals with net investment income who have modified adjusted gross income above the specified threshold.

02

High earners who are subject to the Net Investment Income Tax (NIIT).

03

Taxpayers filing jointly or separately who meet the income criteria set by the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Can I deduct state income taxes on form 8960?

The total of the state, local, and foreign income taxes that you paid for the current tax year is entered on line 9b of form 8960. Enter only the tax amount that is attributed to the net investment income. Do not include sales tax or any foreign income taxes paid for which you took a credit.

What is 8960 for?

Taxpayers use this form to figure the amount of their net investment income tax (NIIT).

How is Form 8960 calculated?

If your net investment income is $1 or more, Form 8960 helps you calculate the NIIT you might owe by multiplying the amount by which your MAGI exceeds the applicable threshold or your net investment income—whichever is the smaller figure—by 3.8 percent.

Can you deduct brokerage fees on Form 8960?

For instance, brokerage fees that are not properly allocable will not be allowed as a deduction. The instructions to Form 8960 provides examples of deductions that are not deductible for NII purposes. For example, deductions for contributions to IRAs or other qualified plans.

Do I need a 8960?

If you earn income from any of your investments this year, you may have to pay the net investment income tax, in addition to the regular income taxes you owe. You won't know for sure until you fill out Form 8960 to calculate your total net investment income.

Does 3.8% net investment income tax apply?

If you have investment income and go over the MAGI threshold, the 3.8% tax will apply to your net investment income or the portion of your MAGI that goes over the threshold—whichever is less.

How do you avoid net investment income tax?

If we can increase investment expenses to lower our net income, that is another way to avoid the Net Investment Income Tax. Examples of expenses are rental property expenses, investment trade fees, and state and local taxes.

What is tax form 8960 used for?

Attach Form 8960 to your return if your modified adjusted gross income (MAGI) is greater than the applicable threshold amount. Use Form 8960 to figure the amount of your Net Investment Income Tax (NIIT).

Who needs to file form 8960?

If you earn income from any of your investments this year, you may have to pay the net investment income tax, in addition to the regular income taxes you owe. You won't know for sure until you fill out Form 8960 to calculate your total net investment income.

Who pays 3.8 net investment tax?

The net investment income tax is a 3.8% tax on investment income that typically applies only to high-income taxpayers. 1 It applies to individuals, families, estates, and trusts, but certain income thresholds must be met before the tax takes effect. Net investment income can be capital gains, interest, or dividends.

Who is subject to NIIT?

A 3.8 percent Net Investment Income Tax (NIIT) applies to individuals, estates, and trusts that have net investment income above applicable threshold amounts.

What is excluded from net investment income tax?

Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income. Additionally, net investment income does not include any gain on the sale of a personal residence that is excluded from gross income for regular income tax purposes.

Who pays 3.8 net investment tax?

Your net investment income is less than your MAGI overage. Let's say you have $30,000 in net investment income and your MAGI goes over the threshold by $50,000. You'll owe the 3.8% tax.

Who fills out 8960?

IRS Form 8960 Applies If The Following Are True… You have investment income. Your Modified Adjusted Gross Income (MAGI) is above the threshold outlined below.

Who is subject to net investment income?

3. What individuals are subject to the Net Investment Income Tax? Filing StatusThreshold AmountMarried filing jointly$250,000Married filing separately$125,000Single$200,000Head of household (with qualifying person)$200,0001 more row

Do I have to pay net investment income tax?

As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT). But you'll only owe it if you have investment income and your modified adjusted gross income (MAGI) goes over a certain amount. As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT).

What is the 3.8% tax called?

Effective Jan. 1, 2013, individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

Who must pay net investment income tax?

As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT). But you'll only owe it if you have investment income and your modified adjusted gross income (MAGI) goes over a certain amount.

What income is subject to NIIT?

Not everyone will need to pay the NIIT, and only those who fall above certain income thresholds will be subject to it. The IRS statutory income thresholds are as follows: Married filing jointly — $250,000. Married filing separately — $125,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my IRS 8960 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your IRS 8960 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit IRS 8960 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing IRS 8960.

How do I fill out IRS 8960 using my mobile device?

Use the pdfFiller mobile app to fill out and sign IRS 8960 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is 2025 form 8960?

Form 8960 is used by individuals to calculate and report the Net Investment Income Tax (NIIT) for tax year 2025. This tax is imposed on certain net investment income of individuals, estates, and trusts.

Who is required to file 2025 form 8960?

Taxpayers with modified adjusted gross income (MAGI) above certain thresholds are required to file Form 8960. For individuals, the thresholds are $200,000 for single filers and $250,000 for married couples filing jointly.

How to fill out 2025 form 8960?

To fill out Form 8960, start by providing your personal information, then calculate your net investment income. After that, determine your MAGI and compare it to the filing thresholds. Finally, complete the relevant sections to compute the Net Investment Income Tax due.

What is the purpose of 2025 form 8960?

The purpose of Form 8960 is to report and calculate the Net Investment Income Tax, which applies to high-income individuals and aims to ensure that they contribute additional taxes on their investment income.

What information must be reported on 2025 form 8960?

Form 8960 requires reporting of various types of income including interest, dividends, capital gains, rental income, and other investment income. It also requires the reporting of any deductions related to that income.

Fill out your IRS 8960 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8960 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.