Get the free SEP IRA Application - Load

Get, Create, Make and Sign sep ira application

Editing sep ira application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sep ira application

How to fill out sep ira application

Who needs sep ira application?

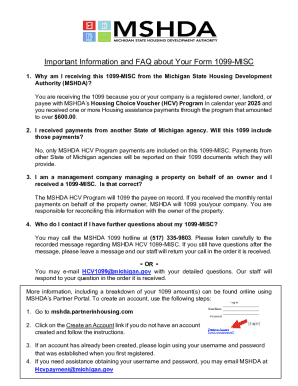

Understanding the SEP IRA Application Form

Understanding the SEP IRA application process

A Simplified Employee Pension (SEP) IRA is a type of retirement plan primarily for self-employed individuals and small business owners. It allows employers to make tax-deductible contributions to their employees’ retirement savings, offering flexibility and simplicity compared to other retirement plans. Under this arrangement, employers can contribute, but employees are not required to do so.

One significant advantage of a SEP IRA is its high contribution limit, making it an attractive option for small business owners wishing to save more for retirement. Additionally, it’s relatively easy to set up and maintain, with minimal paperwork.

Preparing to fill out your SEP IRA application form

Before you begin filling out your SEP IRA application form, it’s essential to gather the necessary documents. This ensures a smooth application process and avoids potential delays.

First, compile your personal identification. This may include your Social Security number and required identification documents. If applicable, gather business information as well, including the business name, address, and tax identification number. These elements are crucial for both individual applicants and business owners.

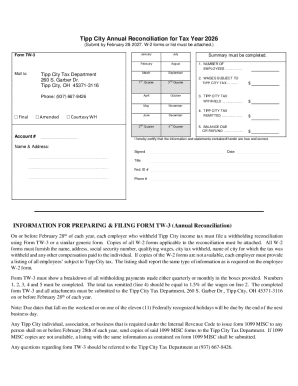

Understanding contribution limits

Knowing contribution limits is vital when applying for a SEP IRA. For 2023, employers can contribute up to 25% of an employee's compensation or $66,000, whichever is less. It’s important to understand that these contributions are made by the employer and that employees cannot contribute directly to a SEP IRA.

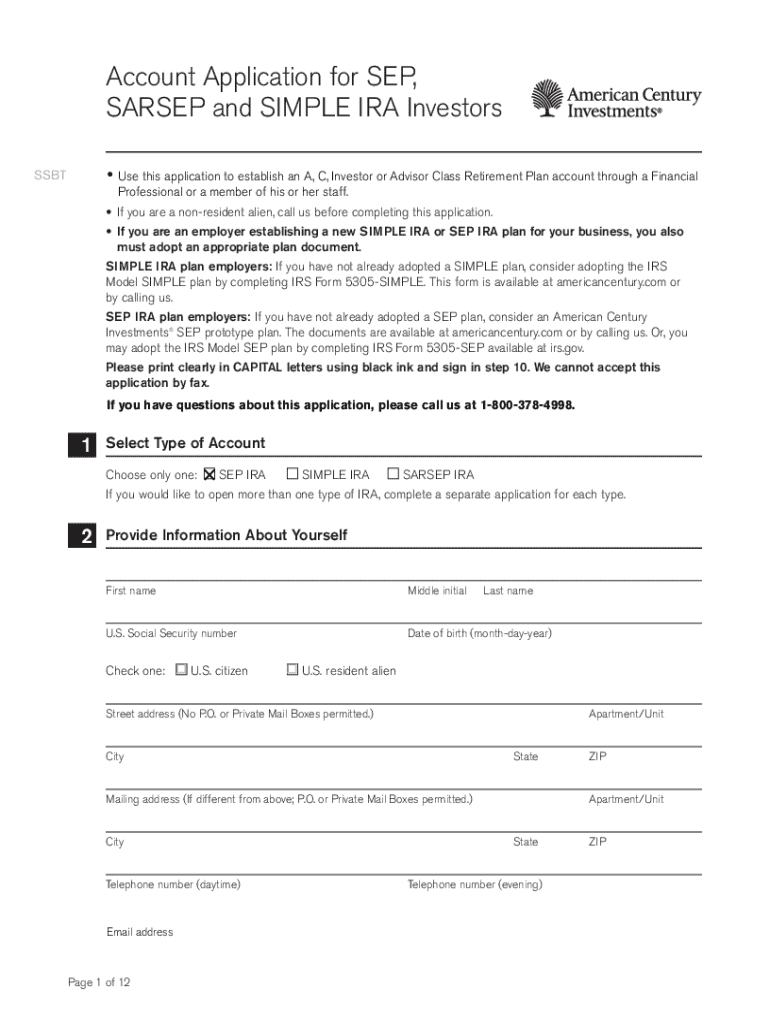

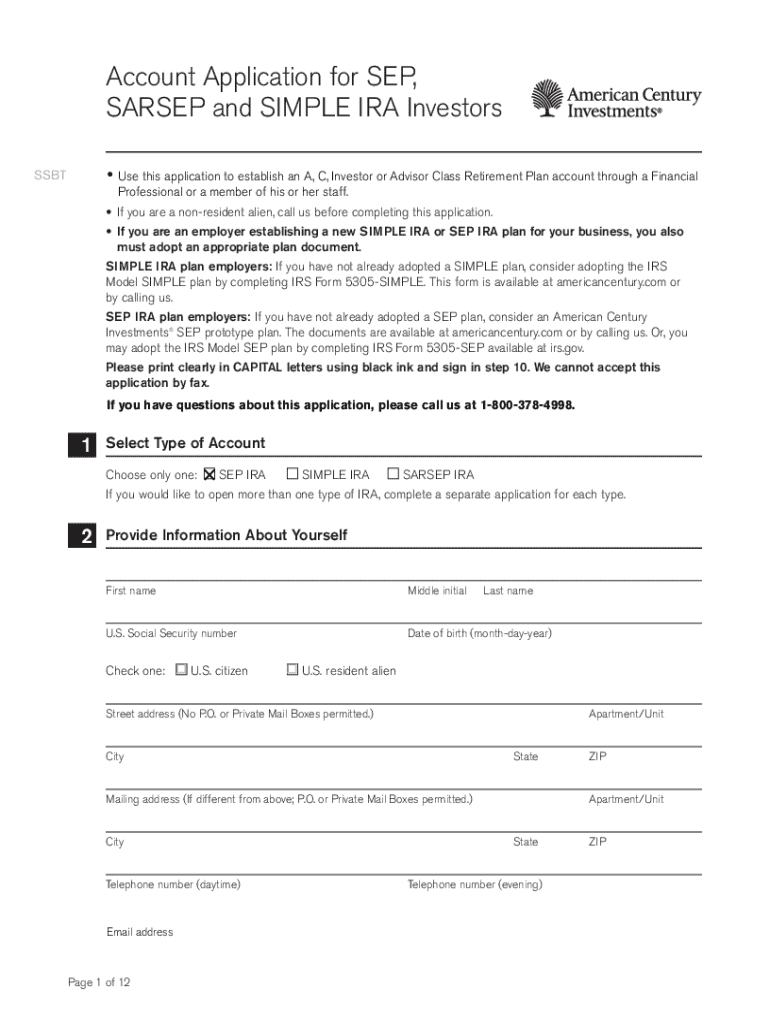

Step-by-step guide to completing the SEP IRA application form

Filling out the SEP IRA application form consists of several straightforward steps. Let’s break down the process to facilitate understanding.

Step 1: Personal information

Begin by entering your full name, contact information, and date of birth. This information verifies your identity and ensures that all correspondence regarding your account is directed to you.

Step 2: Employment information

Provide your employer's name and address, along with your position or role within the company. This section clarifies your designation and employment status.

Step 3: Fund selection

In this step, you will choose how to invest your SEP IRA contributions. Options typically include stocks, bonds, mutual funds, and other investment vehicles. It is crucial to consider factors such as risk tolerance, time horizon, and market conditions when selecting investments.

Step 4: Beneficiary designation

Designating a beneficiary is essential for ensuring your assets are distributed according to your wishes after your passing. Consider selecting someone who understands your financial goals and needs.

Step 5: Signing and submission

Finally, read all terms and conditions carefully before signing your application. With pdfFiller, eSigning your document is easy. Just follow the prompts to submit your application electronically.

Common mistakes to avoid when filling out the SEP IRA application

Filling out the SEP IRA application form doesn’t have to be daunting. However, several common errors could delay your approval. Awareness can help you avoid these pitfalls.

Alternatives to the SEP IRA application form

While the SEP IRA is a superior choice for many, various alternatives exist for retirement planning. Understanding these options can help you make an informed decision.

Comparison with other retirement plans

For instance, a Solo 401(k) might be more beneficial for self-employed individuals who wish to maximize contributions and allow employee deferrals. In contrast, traditional and Roth IRAs cater to a broader audience with different tax benefits and withdrawal rules.

Managing your SEP IRA after application approval

Once your SEP IRA application is approved, managing the account responsibly is vital for maximizing your retirement savings. Keeping track of contributions ensures you remain within IRS limits, avoiding penalties.

Understanding withdrawal rules and penalties is equally important. Withdrawals from a SEP IRA can be taxed as ordinary income and may incur a 10% penalty if taken before age 59½. Regularly reviewing your investment choices will help ensure that your retirement portfolio aligns with your goals and risk tolerance.

Utilizing pdfFiller for your SEP IRA application

Using pdfFiller to complete your SEP IRA application form enhances your experience significantly. With its user-friendly features, you can easily edit and customize your applications.

The platform offers seamless eSigning capabilities, allowing you to sign and submit documents quickly and securely. Additionally, you can access your completed forms from anywhere, making it convenient to manage your documents remotely.

FAQs about the SEP IRA application process

Understanding the nuances of the SEP IRA application can be challenging. Here are some frequently asked questions that address common concerns.

Interactive tools and resources

To further assist with your retirement planning, various online calculators can help estimate contributions and growth projections for your SEP IRA. Exploring these tools can provide clarity on how your investments might perform over time.

Additionally, pdfFiller provides links to valuable resources and additional guides that will aid in your journey toward retirement savings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in sep ira application?

How do I make edits in sep ira application without leaving Chrome?

How do I complete sep ira application on an Android device?

What is sep ira application?

Who is required to file sep ira application?

How to fill out sep ira application?

What is the purpose of sep ira application?

What information must be reported on sep ira application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.