Get the free W-8BEN, Certificate of Foreign Status of Beneficial Owner ...

Get, Create, Make and Sign w-8ben certificate of foreign

Editing w-8ben certificate of foreign online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-8ben certificate of foreign

How to fill out w-8ben certificate of foreign

Who needs w-8ben certificate of foreign?

A Comprehensive Guide to the W-8BEN Certificate of Foreign Form

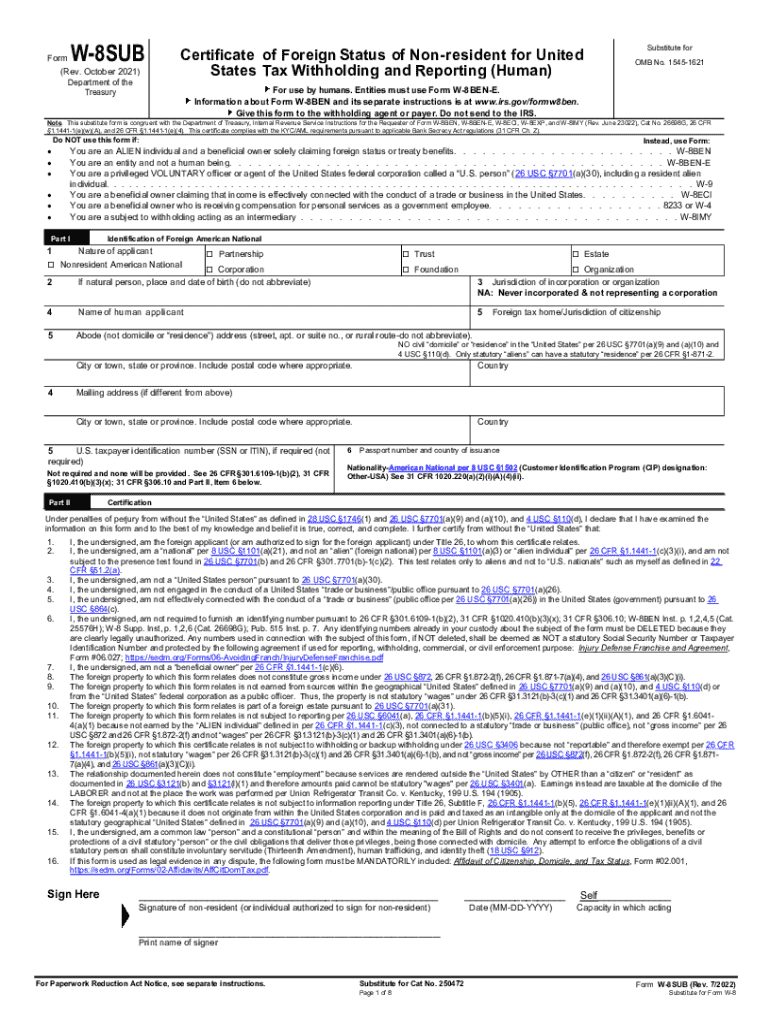

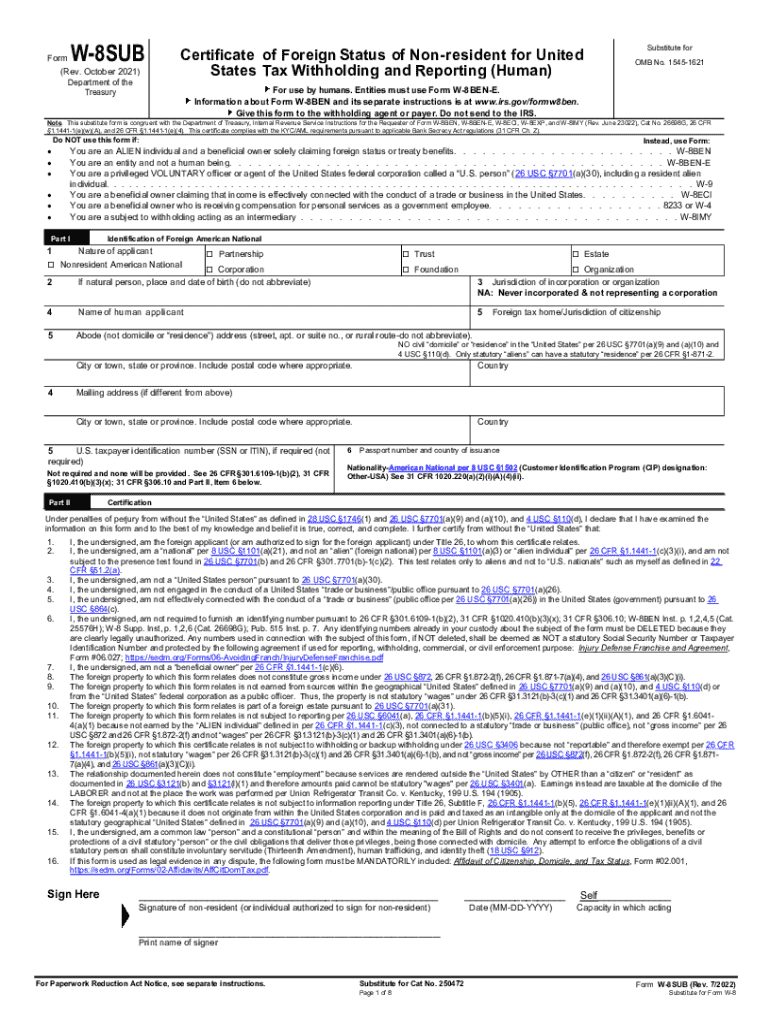

Understanding the W-8BEN Certificate

The W-8BEN form, officially known as the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals), is a crucial document for foreign individuals receiving income from U.S. sources. Essentially, it certifies the foreign status of an individual and claims any tax treaty benefits that may be applicable.

For foreign individuals, the W-8BEN form is vital. It holds the power to reduce or even eliminate withholding taxes that would otherwise be applied to payments made by U.S. entities. Without this certification, foreign individuals risk being taxed at the maximum withholding tax rate, which can significantly diminish their income.

Who needs to fill out the W-8BEN?

Generally, non-resident alien individuals must fill out the W-8BEN form. This applies to anyone who is not a U.S. citizen and does not meet the substantial presence test in the U.S. Criteria for individuals typically include receiving income types such as dividends, interest, royalties, and payments for services.

There are exceptions, however. For instance, certain types of income, like compensation for personal services performed in the U.S., may require a different approach or additional forms. Additionally, students or researchers may be eligible for special tax treaty benefits that necessitate careful evaluation.

Purpose of the W-8BEN form

The primary role of the W-8BEN form lies in its ability to reduce U.S. withholding tax on income that non-resident foreign individuals receive. The Internal Revenue Service (IRS) mandates withholding taxes on payments made to foreign entities, which can be as high as 30%. The W-8BEN allows taxpayers to claim a lower rate or exemption if a tax treaty exists between their country and the U.S.

When utilized appropriately, the W-8BEN form creates avenues for multiple types of income, including interest, royalties, dividends, and certain service payments. The form must be provided to the U.S. payers to ensure that withholding taxes are minimized based on eligible treaty rates.

How to get the W-8BEN form

Acquiring the W-8BEN form is straightforward. The official IRS website offers access to all necessary tax forms, including the W-8BEN. Users can easily download the PDF version of the form and fill it out from there.

By using pdfFiller’s tools, users can even fill out and edit documents directly online without needing to download them first. This saves time and ensures real-time collaboration within teams managing multiple forms.

Step-by-step guide to filling out the W-8BEN

Filling out the W-8BEN properly is critical to ensuring your tax benefits are recognized. Begin by gathering necessary identification details such as your name, address, and taxpayer identification number, if applicable.

The form is composed of several parts that must be filled out correctly:

Common errors to avoid when filling out the W-8BEN include misentering your personal information and mistakenly claiming tax treaty benefits for which you do not qualify. Double-check all entries.

Navigating additional requirements

Once the W-8BEN form is filled out, it’s essential to submit it correctly. Typically, forms should be sent to the U.S. withholding agents or financial institutions from which you are receiving income. Ensure that you meet any applicable deadlines to avoid withholding at higher rates.

Importantly, the validity period of the W-8BEN is not indefinite. Generally, the form is valid for three years from the date it is signed or until there is a change in circumstances that affects the information contained in the form. It is vital that you renew or resubmit the W-8BEN before the expiration period to maintain your tax status.

Answers to common questions about the W-8BEN

Many individuals have questions about the necessity of submitting the W-8BEN form. Not submitting it could result in the withholding agent applying the maximum withholding tax rate on your U.S.-sourced income, which can significantly impact your earnings.

For personalized advice, consider consulting a tax professional familiar with international tax laws. Additionally, pdfFiller offers support resources for users needing assistance with the W-8BEN form.

Additional insights on W-8BEN usage

The W-8BEN form is commonly utilized by foreign authors, independent contractors, and other non-residents who collaborate with U.S. entities. For example, a Canadian software developer may use the W-8BEN when contracting with a U.S. company to minimize withholding tax on their income.

As businesses grapple with increasing paperwork and compliance demands, leveraging technology for form management becomes indispensable. With tools available on pdfFiller, users can fill out, edit, and securely store W-8BEN forms – minimizing potential disruptions in the documentation process.

Signature requirements and related laws

When signing the W-8BEN form, it is crucial to understand the significance of the signature. It acts as a formal declaration that the information provided is true, and any fraudulent submission can result in severe penalties.

Electronic signatures are accepted by the IRS for the W-8BEN form. Utilizing pdfFiller’s eSigning solutions ensures compliance while enhancing the ease of submission. However, always consider the authenticity of your signature, as incorrect or incomplete submissions may lead to fines.

Exploring alternatives to the W-8BEN

While the W-8BEN form is pivotal, it is not the only option for foreign entities. Related forms, such as W-8ECI, W-8EXP, and W-8IMY, serve specific purposes for income types that may not fit the W-8BEN criteria. For example, use the W-8EXP for foreign governments or international organizations.

Choosing the appropriate form based on individual scenarios is essential. Relying solely on the W-8BEN may limit your ability to manage tax implications effectively, particularly for specialized cases like investment income from a U.S. source.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my w-8ben certificate of foreign in Gmail?

How do I make edits in w-8ben certificate of foreign without leaving Chrome?

How do I edit w-8ben certificate of foreign on an iOS device?

What is w-8ben certificate of foreign?

Who is required to file w-8ben certificate of foreign?

How to fill out w-8ben certificate of foreign?

What is the purpose of w-8ben certificate of foreign?

What information must be reported on w-8ben certificate of foreign?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.