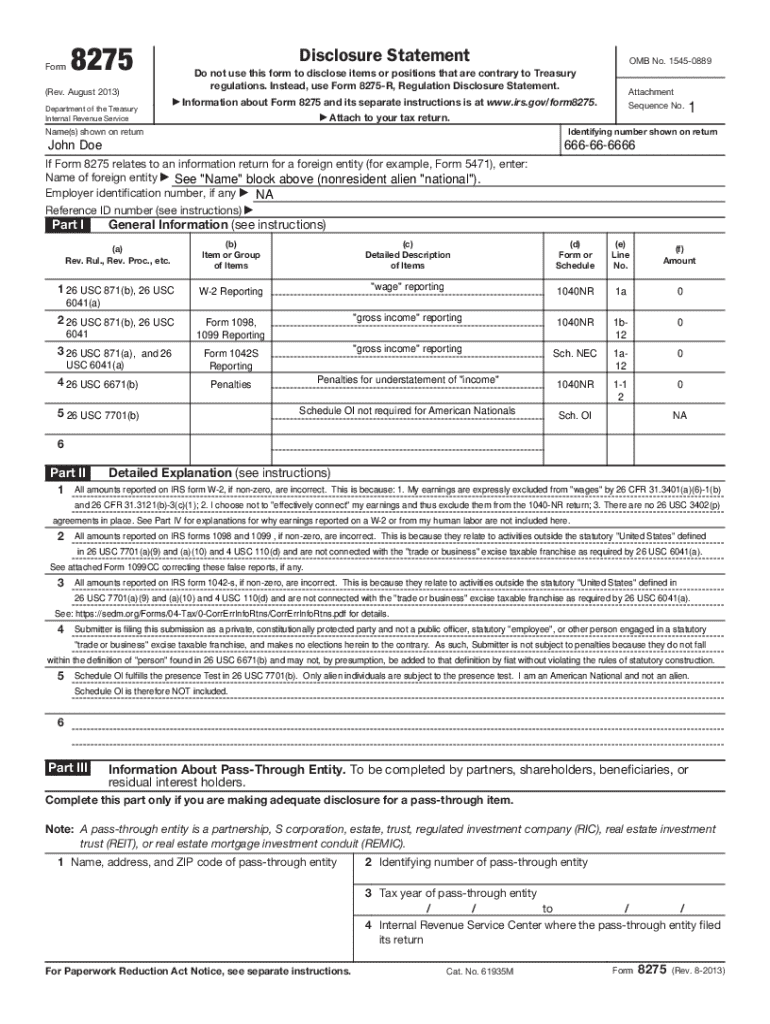

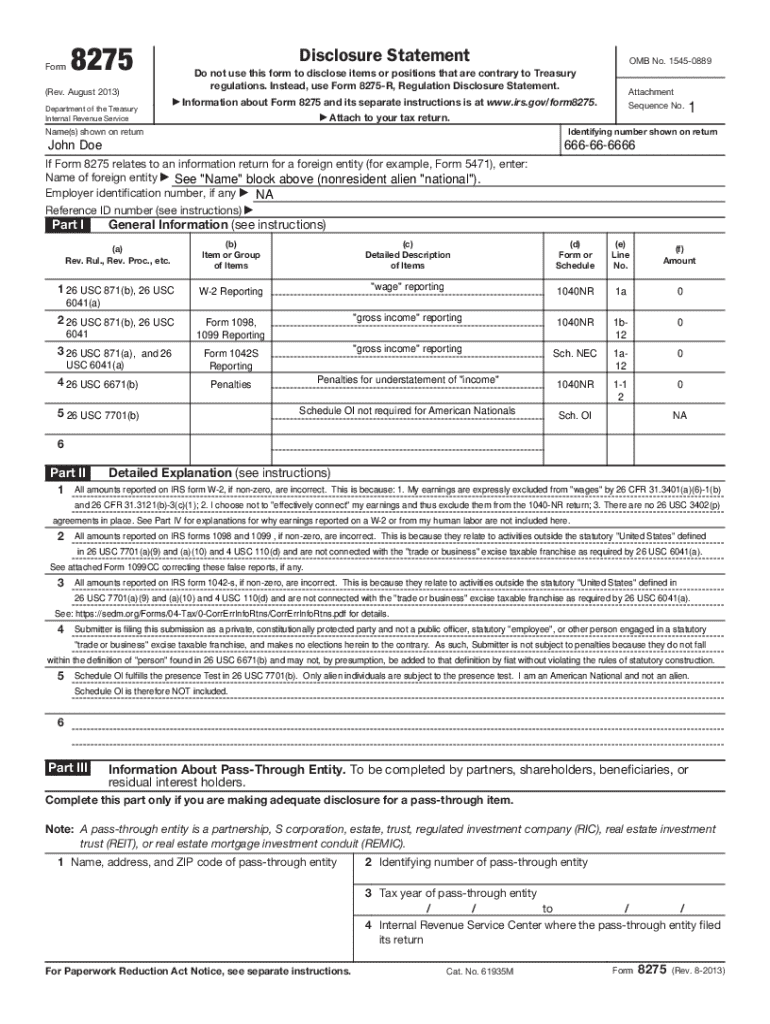

Get the free 1040NR Attachment, Form #09.077. Disclosure Statement

Get, Create, Make and Sign 1040nr attachment form 09077

How to edit 1040nr attachment form 09077 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1040nr attachment form 09077

How to fill out 1040nr attachment form 09077

Who needs 1040nr attachment form 09077?

A comprehensive guide to the 1040NR attachment form 09077

Understanding the 1040NR form

The IRS Form 1040NR is a crucial document for nonresident aliens in the United States, specifically designed for individuals who do not meet the criteria of U.S. residency for tax purposes. This form enables nonresident aliens to report their income effectively and claim any tax refunds that might be due. Those who have earned income in the U.S., whether from employment, investments, or other sources, must file Form 1040NR with their appropriate details to comply with U.S. tax laws.

Understanding who needs to file the 1040NR is vital. Nonresident students, scholars, and foreign nationals who spend fewer than 183 days in the U.S. during the tax year are generally required to submit this form. Moreover, individuals receiving a stipend, scholarship, or grant may also need to file depending on the specifics of their situation. Notably, the 1040NR differs significantly from the standard 1040 form used by residents, particularly regarding tax rates, allowable deductions, and credits.

Overview of attachment form 09077

Attachment Form 09077, also known as the 'Note for Nonresident Aliens,' plays an essential role in the 1040NR filing process. This form is primarily used to specify details regarding your income sources and claimed deductions. It also provides additional explanations needed for certain line items that may not be adequately explained on the main 1040NR form.

Certain situations may necessitate the use of Form 09077. For example, if a nonresident alien believer is claiming substantial tax treaty benefits or has special adjustments relevant to their residency status, this form can provide clarification and support their claims. Additionally, those who have non-traditional income sources, such as royalties or rental income, can also benefit from the detailed sections of Form 09077 that allow for greater clarity on how income should be taxed.

Detailed step-by-step guide to filling out the 1040NR form with attachment 09077

Filing your 1040NR with Attachment Form 09077 requires thorough preparation. First, gathering all necessary documents is crucial for effective completion. Key documents include proof of identity (like a passport), Form 1042-S for income earned, and any relevant tax treaty documents. An organized approach ensures that you have everything at hand for an accurate filing process.

When filling out the 1040NR section by section, begin with your personal information. This includes your name, address, and taxpayer identification number which is often a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Following that is the income section where details about hourly wages, scholarships, or investment income must be clearly stated. Don't forget to report the amounts correctly and to reference any applicable documentation on Attachment Form 09077. The deductions and credits section allows nonresident aliens to maximize potential return benefits, but you must ensure proper compliance with deductions allowable under U.S. tax law.

Common mistakes to avoid include missing or incorrect information and failing to include all income sources. To maximize accuracy, consider double-checking all figures and ensuring that tax correspondence is addressed accurately. The clear completion of the 1040NR and attachment 09077 will facilitate the smooth processing of your tax return.

Editing and managing your 1040NR submission

An efficient method for managing your tax documents, including the 1040NR and attachment Form 09077, is by utilizing tools like pdfFiller. This cloud-based platform allows you to not only fill out your forms but also edit them as needed. Editing features like the ability to insert or remove information easily can significantly reduce the chances of paperwork errors that can delay your filing process. Here’s a step-by-step guide: start by uploading your 1040NR onto pdfFiller. Once uploaded, you can click on any field to input necessary information.

Moreover, you can use pdfFiller’s interactive features to enhance your filing process. For instance, it offers templates that can be filled out directly, making it simpler to add, adjust, or even construct the needed paperwork in real-time. Once you have completed the documents, signing the forms electronically via eSign can significantly speed up your submission process and provide a timestamped record of your submission.

Collaboration on your 1040NR form

Working with tax professionals can make the 1040NR form submission process much smoother. pdfFiller provides sharing options that allow you to share your documents in real-time with tax advisors or team members. This feature is particularly valuable for discussing specific income sources, deductions, or eligibility for tax credits under U.S. law, as it permits direct communication and immediate feedback.

Field-specific collaboration tools can significantly enhance your document management experience by making it easier to highlight areas of concern and ask specific questions as needed. You’ll benefit from having multiple experts weigh in on your returns, ensuring you don't miss out on potential deductions or other relevant tax strategies available to nonresident aliens.

Submitting your 1040NR and attachment 09077

Once your 1040NR and attachment Form 09077 are completed, you have various filing options available. E-filing is becoming increasingly popular due to its convenience and efficiency, allowing for faster processing times and timely confirmations. To e-file, simply follow the IRS guidelines directly on their authorized e-filing services or through tax preparation software that includes Form 1040NR. Alternatively, you can opt for paper filing, which requires printing out your documents and mailing them to the appropriate IRS address.

It's crucial to pay attention to filing deadlines to avoid any penalties or late fees. The typical deadline for filing your 1040NR is April 15 of the following year, following the tax year that pertains to your filing. Once submitted, the IRS will provide confirmation of receipt, which allows you to track the status of your return. Ideally, you should keep copies of all documents submitted, as these will assist in case of future inquiries or discrepancies.

Troubleshooting common issues with the 1040NR and attachment 09077

Filing tax forms can often lead to complications or misunderstandings with the IRS. Therefore, understanding the common feedback from the IRS related to 1040NR submissions is essential. Frequent issues might arise from mismatched personal information, discrepancies in income reporting, or missing documentation such as attachment Form 09077. If you receive a letter or notice from the IRS, it may require a prompt response, and knowing how to navigate these communications effectively is crucial.

If corrections are needed, amending your 1040NR is a straightforward process. You can do this using Form 1040X to report changes to your originally filed tax return. Always make sure to file your amendment promptly and maintain accurate records reflecting these changes, as this ensures clarity for both you and the IRS.

Additional tips for nonresident alien filers

When filing taxes, nonresident aliens should also become familiar with U.S. tax treaties. These treaties can provide significant tax relief by preventing double taxation on income earned in the U.S. If you are eligible for benefits under any applicable treaties, be sure to specify these on your 1040NR and attachment Form 09077. This incorporation can help you avoid unnecessary taxes and maximize your return.

Moreover, leveraging pdfFiller can simplify the filing process beyond the 1040NR. The platform provides access to various templates for other necessary tax forms and documents, making it a versatile solution for all tax-related tasks. With its range of tools, pdfFiller allows users to efficiently create, edit, and manage not just tax documents but also other important records that may accompany your tax filings.

FAQs about the 1040NR and attachment form 09077

Navigating U.S. tax obligations can bring up many questions, particularly around the 1040NR and Attachment Form 09077. Common queries include understanding the filing requirements for different visa statuses, guidelines for reporting income from diverse sources, and the implications of claiming deductions as a nonresident alien. Addressing these queries early on can ease the stress associated with tax season and ensure greater compliance.

Clarifying complex topics like eligibility for tax treaty benefits or specific deductions can lead to more informed decisions when filing your 1040NR. Resources provided by the IRS or tax professionals can greatly enhance understanding and set a clear path toward meeting all necessary obligations adeptly and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 1040nr attachment form 09077?

How do I edit 1040nr attachment form 09077 in Chrome?

How do I fill out the 1040nr attachment form 09077 form on my smartphone?

What is 1040nr attachment form 09077?

Who is required to file 1040nr attachment form 09077?

How to fill out 1040nr attachment form 09077?

What is the purpose of 1040nr attachment form 09077?

What information must be reported on 1040nr attachment form 09077?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.