Get the free 650% Senior Notes due 2033

Get, Create, Make and Sign 650 senior notes due

How to edit 650 senior notes due online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 650 senior notes due

How to fill out 650 senior notes due

Who needs 650 senior notes due?

Understanding the 650 Senior Notes Due Form: A Comprehensive Guide

Understanding the 650 senior notes due form

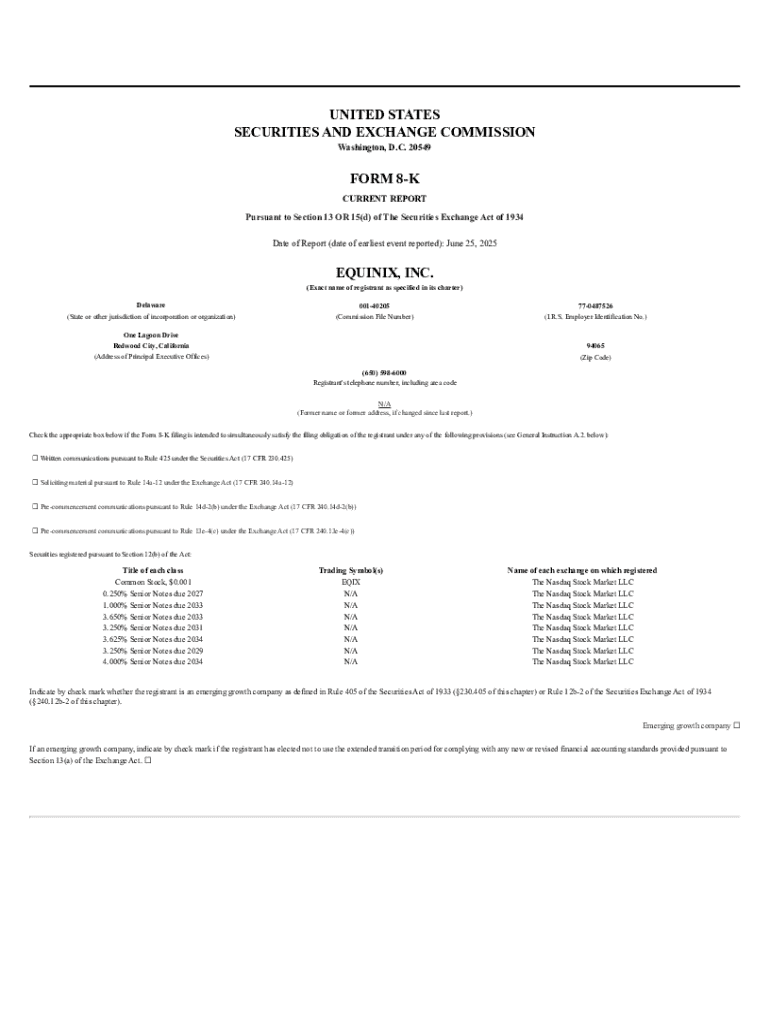

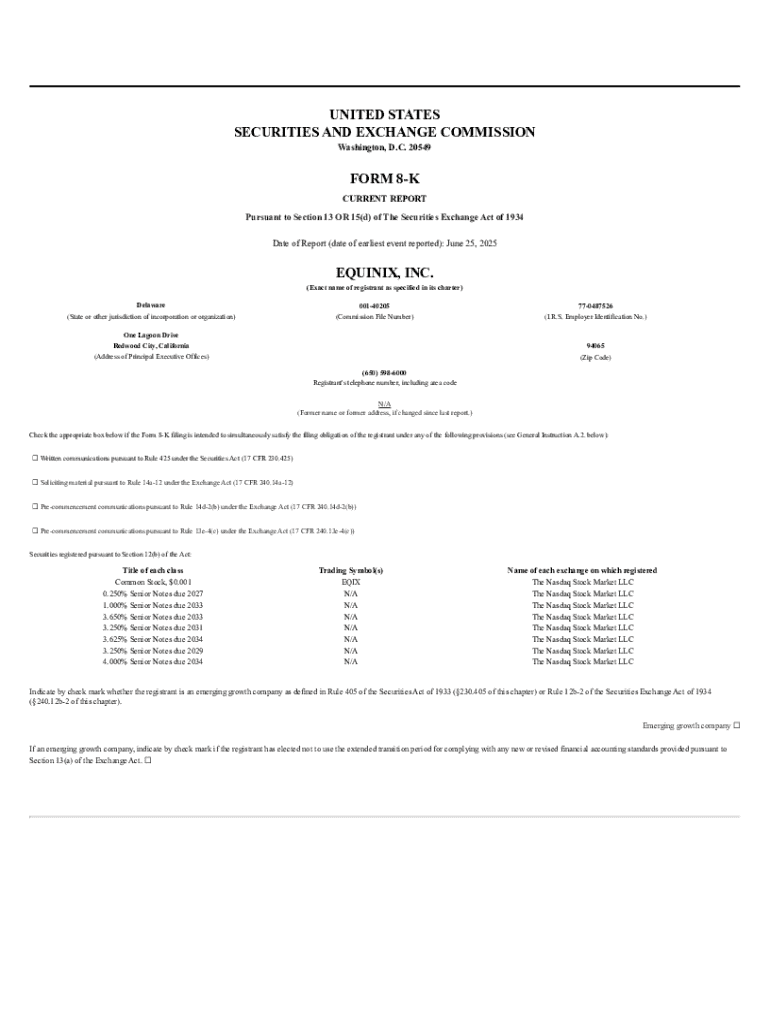

Senior notes are a type of debt security that businesses often issue to raise capital. These notes are prioritized over other unsecured debts during bankruptcy proceedings, ensuring noteholders are paid before other creditors. This characteristic makes senior notes a vital component of corporate finance, often used to finance growth, acquisitions, or to refinance existing liabilities.

The 650 senior notes due form plays a crucial role in managing these instruments, ensuring that all parties involved understand the terms and obligations associated with the debt. It is utilized predominantly in contexts where there are significant financial transactions or corporate restructuring, highlighting the obligation and repayment terms of the senior notes.

Key components of the 650 senior notes due form

Filling out the 650 senior notes due form requires specific information to ensure clarity and compliance. Essential details include the issuer's identity, loan terms, interest rates, and noteholder information. Each data point is critical as it affects the overall transaction and legal standing of the involved parties.

The sections of the form each serve a distinct purpose. For example, the issuer section identifies the entity responsible for repayment, while the noteholder section provides information about the individual or entity holding the notes. Standard pitfalls during completion of the form could involve inaccurate data entry or failure to disclose necessary information.

Step-by-step guide to filling out the 650 senior notes due form

Before starting to fill out the form, it's crucial to have all necessary documentation in hand. This includes the issuer's financial statements, details about the noteholder, and the specific terms of the loan such as interest rates and repayment schedules. Having accurate and complete information minimizes the risk of errors that could delay processing.

Editing and modifying the 650 senior notes due form

Using pdfFiller for document editing offers numerous advantages when working with complex forms. This platform allows for seamless editing of PDF forms, ensuring that all modifications can be tracked and updated accurately without compromising the integrity of the original document.

Customizing your completed 650 senior notes due form can enhance clarity and professionalism. You can add notes for clarification, format text for readability, and highlight critical sections to draw attention to important information. Achieving a polished final document is easier with tools that streamline this process.

Signing and submitting the 650 senior notes due form

The inclusion of an electronic signature streamlines the signing process, aligning with modern contract laws. Understanding eSignature laws is critical, as they vary across different jurisdictions, particularly in the United States. Once the form is filled out, it can be signed directly within pdfFiller, ensuring legality and validity.

Submission of the completed form must follow specific guidelines to ensure it is properly filed. Typically, the form can be submitted through electronic channels or mailed to the appropriate entity. Be aware of processing timelines, and consider follow-up actions to confirm receipt and processing of the submission.

Frequently asked questions about the 650 senior notes due form

Mistakes on the 650 senior notes due form can be stressful, but they can usually be addressed easily. If you notice an error after submitting the form, contact the entity receiving it to discuss correction options. It’s also wise to maintain records of your submission to assist with tracking the status.

Leveraging pdfFiller for ongoing document management

Beyond handling the 650 senior notes due form, pdfFiller provides comprehensive solutions for managing a wide range of documents. This cloud-based platform offers features that allow users to edit, sign, and store documents securely, facilitating efficient workflows across organizations.

Collaboration within teams becomes seamless through pdfFiller, as members can access, review, and edit documents in real-time. Leveraging these capabilities ensures consistency in document management while tracking changes and maintaining a clear history of modifications, which is crucial for regulatory and compliance purposes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 650 senior notes due in Chrome?

Can I edit 650 senior notes due on an iOS device?

How do I complete 650 senior notes due on an iOS device?

What is 650 senior notes due?

Who is required to file 650 senior notes due?

How to fill out 650 senior notes due?

What is the purpose of 650 senior notes due?

What information must be reported on 650 senior notes due?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.