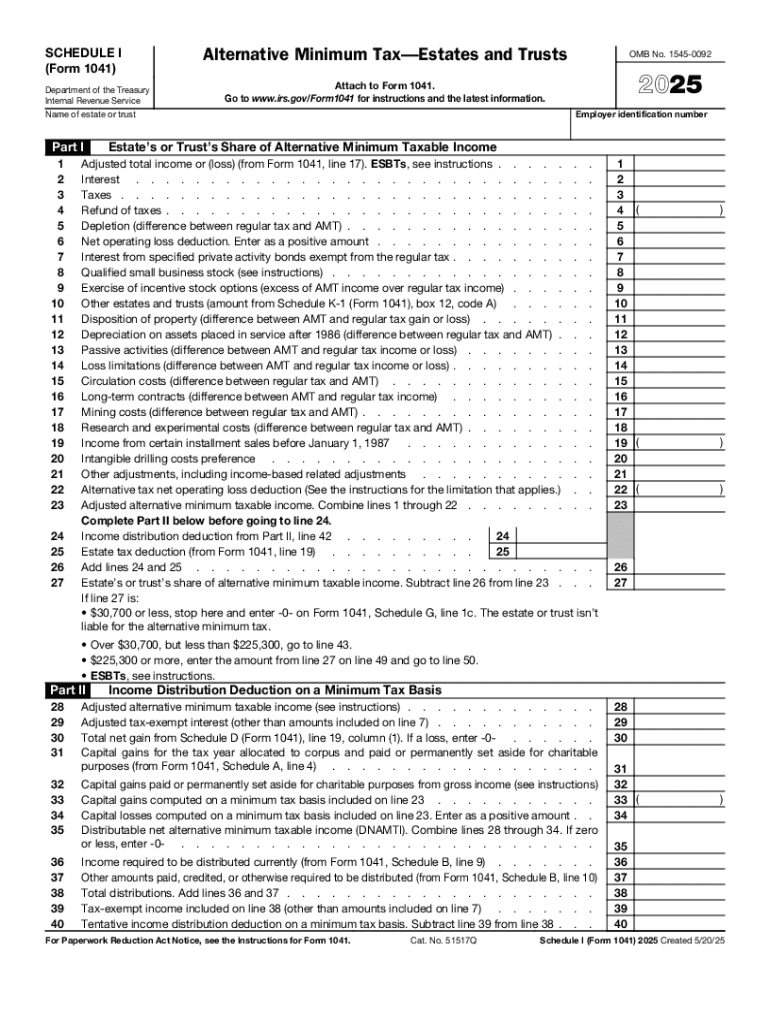

IRS 1041 - Schedule I 2025-2026 free printable template

Instructions and Help about IRS 1041 - Schedule I

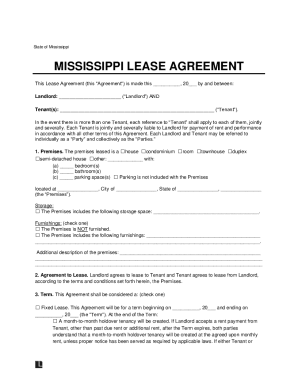

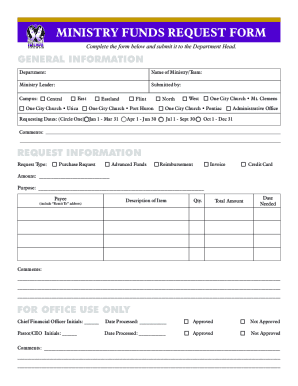

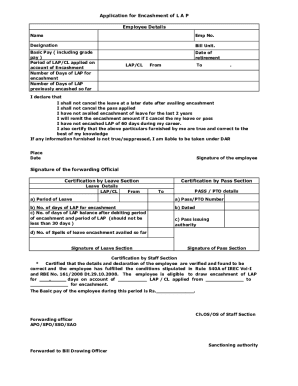

How to edit IRS 1041 - Schedule I

How to fill out IRS 1041 - Schedule I

Latest updates to IRS 1041 - Schedule I

All You Need to Know About IRS 1041 - Schedule I

What is IRS 1041 - Schedule I?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1041 - Schedule I

What should I do if I realized I made a mistake on my IRS 1041 - Schedule I after submitting it?

If you find an error after submitting your IRS 1041 - Schedule I, you can correct it by filing an amended return. Ensure that you clearly indicate the changes made and provide the correct information. It’s crucial to keep documentation of the corrected submission for your records.

How can I verify if my IRS 1041 - Schedule I has been received or processed?

To check the status of your IRS 1041 - Schedule I, you can use the IRS 'Where's My Refund?' tool if you filed electronically. If you mailed your submission, it's advisable to wait several weeks and potentially reach out to the IRS through their contact methods for further assistance.

Are there specific common errors to avoid when filing the IRS 1041 - Schedule I?

Common errors when filing the IRS 1041 - Schedule I include mismatched tax identification numbers and incorrect entries of income or deductions. Double-check your figures and make sure all required sections are completed accurately to minimize any potential issues.

What should I do if I receive a notice from the IRS regarding my IRS 1041 - Schedule I?

If you receive a notice or letter from the IRS concerning your IRS 1041 - Schedule I, carefully review the communication to understand the issue. Prepare any required documentation and respond promptly, ensuring that you address all points raised within the notice.

Is it possible to e-file the IRS 1041 - Schedule I and what are the requirements?

Yes, you can e-file the IRS 1041 - Schedule I through approved e-filing software or through a certified tax professional. Ensure that your software is compatible with IRS requirements, and keep in mind that e-filed returns usually process more quickly than those submitted by mail.