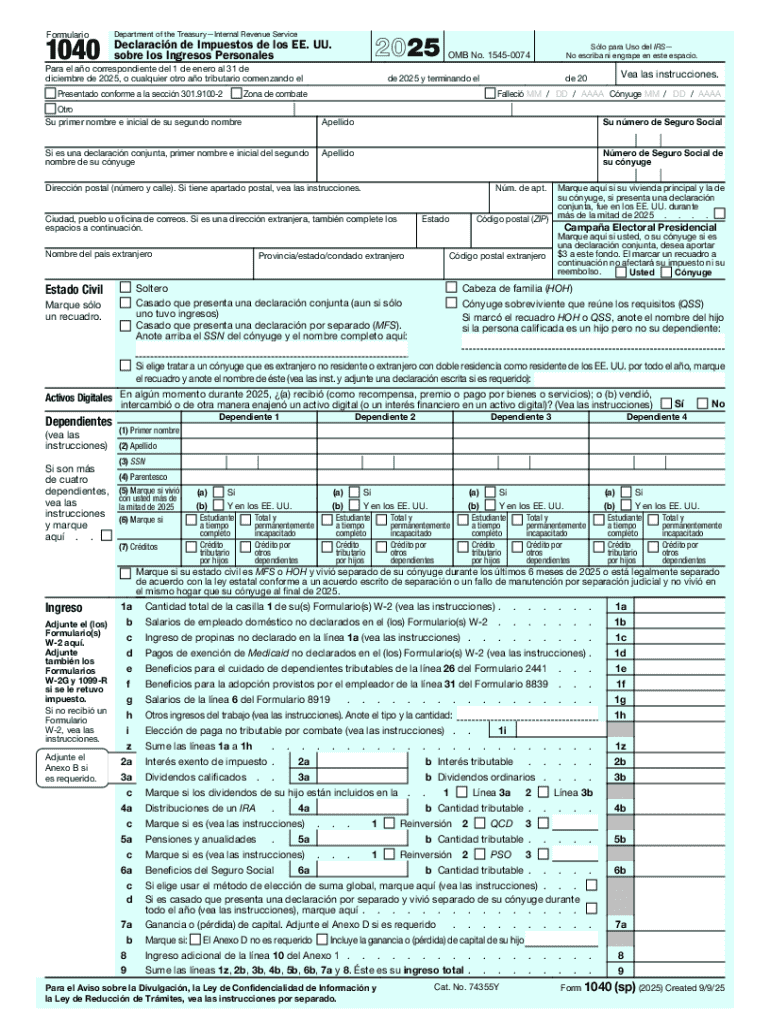

IRS 1040 (SP) 2025-2026 free printable template

Get, Create, Make and Sign IRS 1040 SP

How to edit IRS 1040 SP online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040 (SP) Form Versions

How to fill out IRS 1040 SP

How to fill out 2025 form 1040 sp

Who needs 2025 form 1040 sp?

Comprehensive Guide to the 2025 Form 1040 SP Form

Understanding the 2025 Form 1040 SP

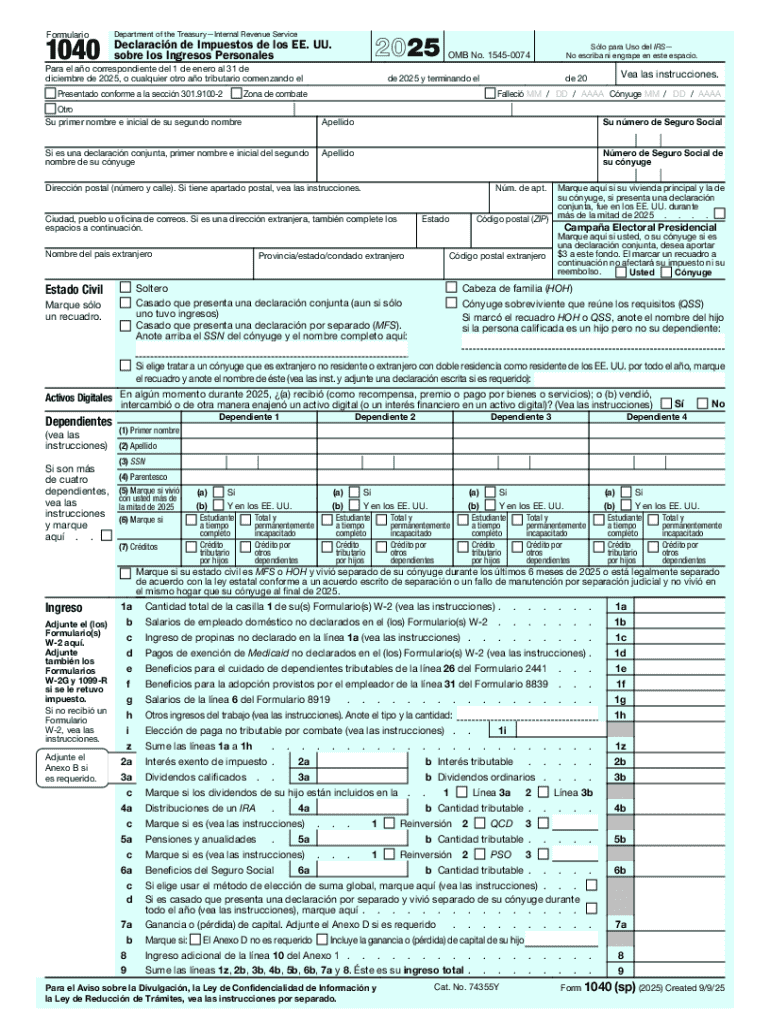

The 2025 Form 1040 SP is a simplified version of the standard 1040 tax form designed specifically for individuals aged 65 or older who meet certain criteria. This form aims to streamline the tax-filing process and reduce the complexity typically associated with completing a full Form 1040. A significant distinction of the 1040 SP is that it features larger text and clearer instructions, catering to its intended demographic.

In addition to its user-friendly design, the Form 1040 SP varies from the regular 1040 in that it omits some of the more intricate calculations and can be used primarily for basic income and deductions. Furthermore, when compared with the 1040-SR and traditional 1040 forms, the 1040 SP serves a niche, focusing more on those with straightforward tax situations.

Who should use Form 1040 SP?

The eligibility criteria for using the 2025 Form 1040 SP primarily revolve around age and income type. Individuals aged 65 or older, who are U.S. citizens or resident aliens, generally qualify for this form. Additionally, the tax situations most suitable for the 1040 SP include those who primarily receive Social Security benefits, pensions, and interest income without any complicated investment scenarios or business income.

In particular, seniors with largely straightforward financial profiles—such as retirees who have limited income or those who do not itemize deductions—should consider using this form. Its simplicity can help minimize the stress and confusion that often accompany tax season, enabling users to focus on their financial well-being instead.

Key features of Form 1040 SP

The Form 1040 SP comprises several essential sections, each serving a distinct purpose related to your tax filings. Among these sections, the personal information section collects basic details such as your name, address, and Social Security number. Following this, the income details section requires you to disclose various income types, including social security benefits and retirement income.

Careful attention is needed in reporting income, as misreporting can lead to common errors or delays in processing. Each section is designed with clarity in mind, but it's critical for users to avoid common pitfalls, such as skipping lines or providing contradictory information.

Step-by-step instructions for filling out Form 1040 SP

Before completing the 2025 Form 1040 SP, it's essential to gather all the required documents to ensure you're well prepared. Key documents typically include W-2 forms from employers, 1099 forms for other income sources, and records of any tax-deductible expenses—such as medical expenses—which can provide significant savings.

When completing the Form 1040 SP, each section has specific instructions. Below is a detailed walkthrough for filling each section:

Utilizing pdfFiller’s interactive tools can significantly simplify the process of completing your 1040 SP form. With these features, users can easily input their information, and utilize helpful prompts to avoid common errors throughout the form.

Be mindful of common errors, such as inconsistent information across fields or miscalculations on tax owed. To troubleshoot these problems, identifying the specific line where an error occurred and double-checking against your documentation can help resolve discrepancies efficiently. pdfFiller offers features designed to flag potential errors even before submission.

Editing and managing your 2025 Form 1040 SP

Editing capabilities are essential for any user intending to perfect their 2025 Form 1040 SP. With pdfFiller, users can easily edit the form directly through the platform by accessing a variety of editing tools, including options to highlight, annotate, or insert text as needed. To facilitate smoother management, users might choose to create multiple copies of their forms or save frequently used information for quick retrieval.

Collaboration features allow users to share their documents with tax professionals or family members for additional input. pdfFiller offers straightforward sharing options, enabling you to send invites easily while controlling permissions to ensure that your information remains secure. Tracking changes made by collaborators can further maintain the integrity of your documentation.

Submitting your Form 1040 SP

When it comes time to submit your 2025 Form 1040 SP, you'll have options for how to file—a critical decision that can impact both processing time and ease of submission. E-filing is generally the most efficient method, as it allows you to electronically submit your tax return, while paper filing involves mailing a physical form to the IRS.

pdfFiller simplifies this process, providing clear guidance for both e-filing and paper submission. Users can follow straightforward prompts to ensure they meet IRS guidelines and deadlines, never missing crucial dates. Missing a filing deadline can lead to penalties or interest, so keeping track of important dates—like the filing deadline for the 2025 tax year—is imperative.

Frequently asked questions about 2025 Form 1040 SP

Clarifications on common concerns regarding the 2025 Form 1040 SP can greatly assist potential filers in navigating their tax responsibilities. Many users inquire about specific line items and what information is necessary for accurate completion. Knowing what to include helps users avoid confusion when filing, ensuring that all necessary data is reported correctly.

Another frequent topic of concern is the process for tracking tax refunds and addresses related payments. Users often want to know typical timeframes for receiving refunds once a return has been filed. The IRS usually processes e-filed returns faster than paper forms, and planning for any outstanding payments after submission is vital to avoid interest accrual.

Additional support and resources

Accessing the Form 1040 SP and related documents is straightforward with pdfFiller. The platform provides not only the necessary forms but also a collection of resources—such as guides, tutorials, and FAQs tailored to assist any potential user in completing their filings without a hitch.

For personalized assistance, pdfFiller offers various support channels to help navigate tax forms. Whether users prefer direct chat support or community forum discussions, options are readily available. Additionally, pdfFiller features such as tax planning tools help users strategize their submissions and optimize tax benefits.

Real user experiences and testimonials

Success stories from existing users of pdfFiller highlight the platform's utility in managing the 2025 Form 1040 SP. Many filers express satisfaction with the ease of editing and submitting their forms quickly. Testimonials illustrate user experiences that convey reduced stress during tax periods and the confidence that comes from having accurate documents.

Community feedback continues to play a crucial role in developing features within pdfFiller. Insights collected from users help update tools that meet evolving needs, while getting feedback on form-related experiences can demonstrate a continuous commitment to improving functionalities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 1040 SP for eSignature?

How do I edit IRS 1040 SP straight from my smartphone?

How do I fill out IRS 1040 SP on an Android device?

What is 2025 form 1040 sp?

Who is required to file 2025 form 1040 sp?

How to fill out 2025 form 1040 sp?

What is the purpose of 2025 form 1040 sp?

What information must be reported on 2025 form 1040 sp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.