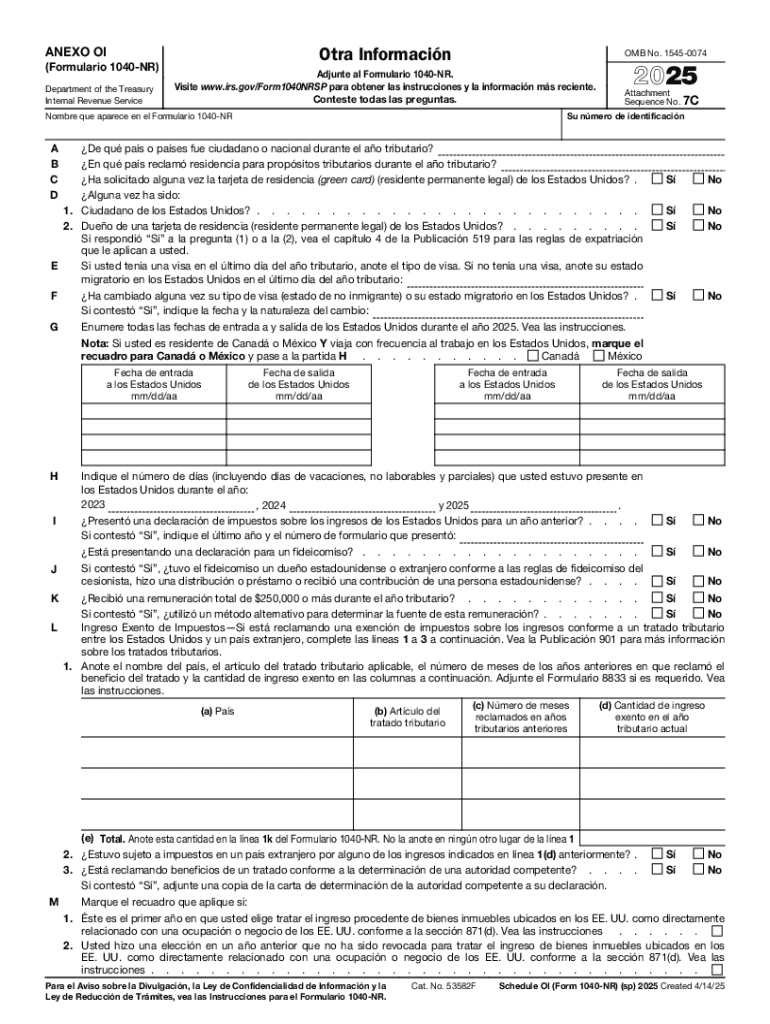

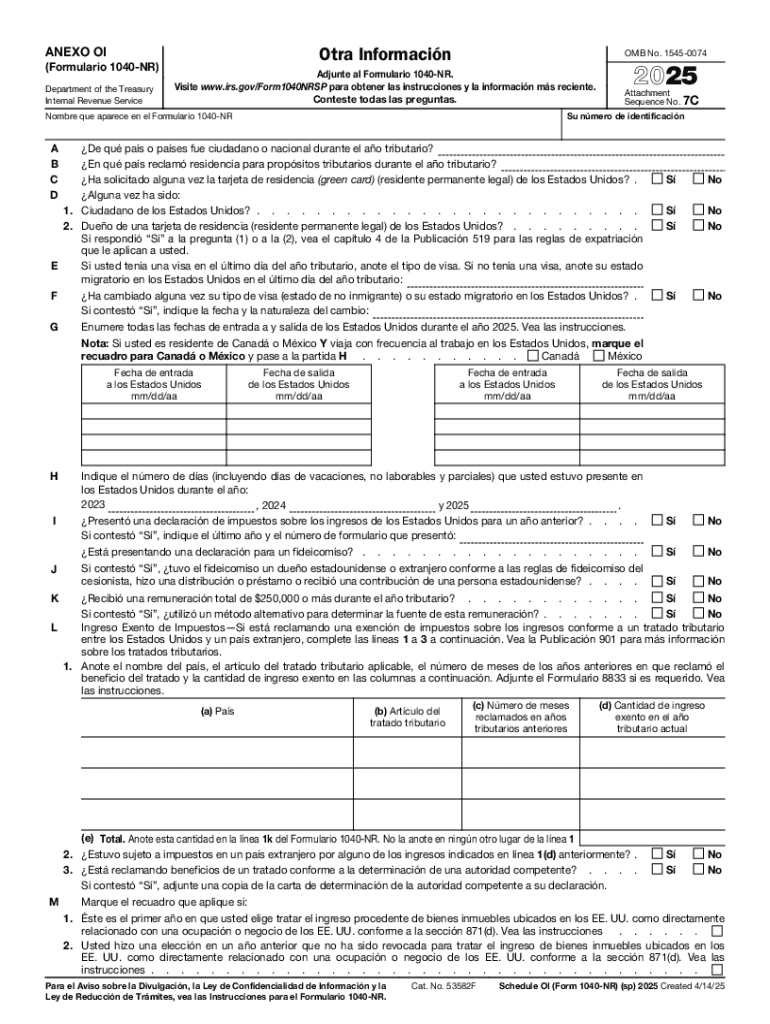

IRS 1040-NR - Schedule OI (SP) 2025-2026 free printable template

Get, Create, Make and Sign IRS 1040-NR - Schedule OI SP

Editing IRS 1040-NR - Schedule OI SP online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040-NR - Schedule OI (SP) Form Versions

How to fill out IRS 1040-NR - Schedule OI SP

How to fill out 2025 schedule oi form

Who needs 2025 schedule oi form?

Comprehensive Guide to the 2025 Schedule OI Form

Understanding the 2025 Schedule OI Form: An Overview

The 2025 Schedule OI Form is a crucial document for U.S. taxpayers, especially for those with specific eligibility criteria that may not apply to the standard forms. Essentially, this form integrates various aspects of income and deductions that fall outside the general reporting guidelines seen in other tax forms. It is primarily designed for non-resident aliens or individuals who have unique income sources that need to be reported differently according to U.S. tax laws.

The primary purpose of the Schedule OI Form is to assist in the accurate reporting of income while ensuring compliance with tax obligations. By specifying income types, it serves to clarify elements that could be easily omitted or misreported. Notably, the Schedule OI provides explicit guidance on items that require detailed explanations or may be subject to special tax treatment, such as that applicable to non-residents.

Importance of the 2025 Schedule OI Form

Filing the 2025 Schedule OI Form correctly is paramount for taxpayers. An accurate submission can significantly impact your overall tax return and your interaction with the IRS. Misfiling or omitting necessary information could not only complicate your tax situation but may also lead to penalties and interest accrued on unpaid taxes. Understanding what to file and how serves as a safeguard against potential legal and financial repercussions.

The implications of errors in your Schedule OI filing are serious. Mistakes can range from minor inaccuracies affecting your taxable income to significant misrepresentations that could lead to audits or increased scrutiny from tax authorities. Emphasizing diligence in the form's completion is important, especially since the IRS utilizes these forms to assess compliance and identify discrepancies in taxpayer reporting.

Who needs to file the 2025 Schedule OI Form?

The eligibility criteria for filing the 2025 Schedule OI Form primarily focus on the nature of income rather than on income levels alone. This form is especially relevant for non-resident aliens or any taxpayer receiving income that does not fall under traditional categories, like wages or salaries. Taxpayers who receive specific types of investment income, royalties, or have income from foreign sources may also need to file this form.

Common scenarios requiring Schedule OI submission include instances of receiving income from partnerships, employment with foreign entities, or having capital gains that originate outside the U.S. Taxpayers should also consider special situations that pertain to their residency status and foreign investments, which can complicate their tax obligations.

How to obtain the 2025 Schedule OI Form

Obtaining the 2025 Schedule OI Form is simple and can be done through various avenues. The official IRS website provides direct access to the required forms with the most recent tax year updates. This is critical as forms can change annually, and utilizing the latest version is necessary for accurate filings.

PDFfiller also streamlines the process by offering the Schedule OI Form in an easily accessible format. Users can download the form directly in PDF format, which can be filled out and signed electronically. Additionally, other tax preparation websites and resources often offer the latest forms along with useful guides on proper completion.

Step-by-step instructions for completing the 2025 Schedule OI Form

When it comes to completing the 2025 Schedule OI Form, precise preparation is essential. Start by gathering the necessary documentation such as your income statements, W-2s, and other supporting documents that reflect your income and deductions clearly. The information provided must be complete and accurate, as the IRS will use it to calculate your tax responsibilities.

The Schedule OI Form breakdown goes as follows: First, start with your personal information including your name, address, and taxpayer identification number. Next, accurately report income categorized under miscellaneous sources, such as unique investments or rental properties, ensuring all numbers are supported by documentation. Deductions and adjustments must also be meticulously noted, with specific guidelines on how to credit various types of income.

Filing process and important deadlines for the 2025 Schedule OI Form

Navigating deadlines is critical when it comes to tax filing. The 2025 Schedule OI Form must typically be submitted alongside your primary tax return, which is often due by April 15 of the following year. Certain extensions may apply to specific taxpayers, particularly those residing abroad or under special conditions. It's imperative to keep track of these dates to avoid unnecessary penalties.

Regarding submission methods, taxpayers can choose between electronic filing and physical mail. Electronic filing is generally favored for its speed and efficiency, allowing for quicker processing times. Paper submissions are still accepted but may lead to longer wait times for confirmatory processes. Understanding these methods will help streamline your filing experience.

Consequences of late filing or incompletion

Failing to file the 2025 Schedule OI Form on time can lead to significant repercussions, including penalties and accrued interest on unpaid taxes. The IRS is stringent about deadlines, and delays often complicate future filings, potentially flagging your accounts for audits. Taxpayers who do not accurately complete and submit the form risk being subject to further penalties for misrepresentation of their income. If needed, amending a submission is possible, but this process brings about additional layers of complexity.

To rectify an incomplete or incorrect filing, begin by reviewing the guidelines on how to amend a tax return. It's critical to use the correct amendment forms and ensure any revisions are submitted promptly to limit further complications. IRS resources offer support for taxpayers encountering challenges with late or erroneous submissions, helping to clarify processes and ensure compliance.

Utilizing PDFfiller to make filling the 2025 Schedule OI Form easier

PDFfiller enhances the tax filing experience, streamlining the completion of the 2025 Schedule OI Form through interactive tools designed for ease of use. This platform allows users to fill out, edit, and eSign documents directly in the cloud, ensuring you can access your forms from anywhere. PDFfiller's user-friendly interface promotes efficiency, making the filing process less daunting for individual users and teams alike.

Additional features such as collaboration tools enable users to share and review forms with tax professionals or team members. This is particularly advantageous in complex tax situations, where multiple inputs may yield a complete and accurate filing. Users can also add necessary annotations or comments, ensuring every aspect of the tax return is accounted for.

Frequently asked questions about the 2025 Schedule OI Form

Many taxpayers have misconceptions about the 2025 Schedule OI Form. Understanding what the form covers can resolve issues before they arise. Common questions include eligibility requirements, how to report specific income types, and the nuances of special considerations for non-residents. Knowing the answers can help alleviate anxieties and encourage taxpayers to submit accurate forms timely.

For complex tax situations, it's advisable to consult resources or professionals who are knowledgeable in U.S. tax laws. Utilizing platforms providing extensive FAQs can also illuminate common concerns surrounding the Schedule OI, guiding individuals toward successful completion. Depending on your financial situation, reaching out to certified tax professionals can demystify the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the IRS 1040-NR - Schedule OI SP form on my smartphone?

How do I edit IRS 1040-NR - Schedule OI SP on an iOS device?

How do I fill out IRS 1040-NR - Schedule OI SP on an Android device?

What is 2025 schedule oi form?

Who is required to file 2025 schedule oi form?

How to fill out 2025 schedule oi form?

What is the purpose of 2025 schedule oi form?

What information must be reported on 2025 schedule oi form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.