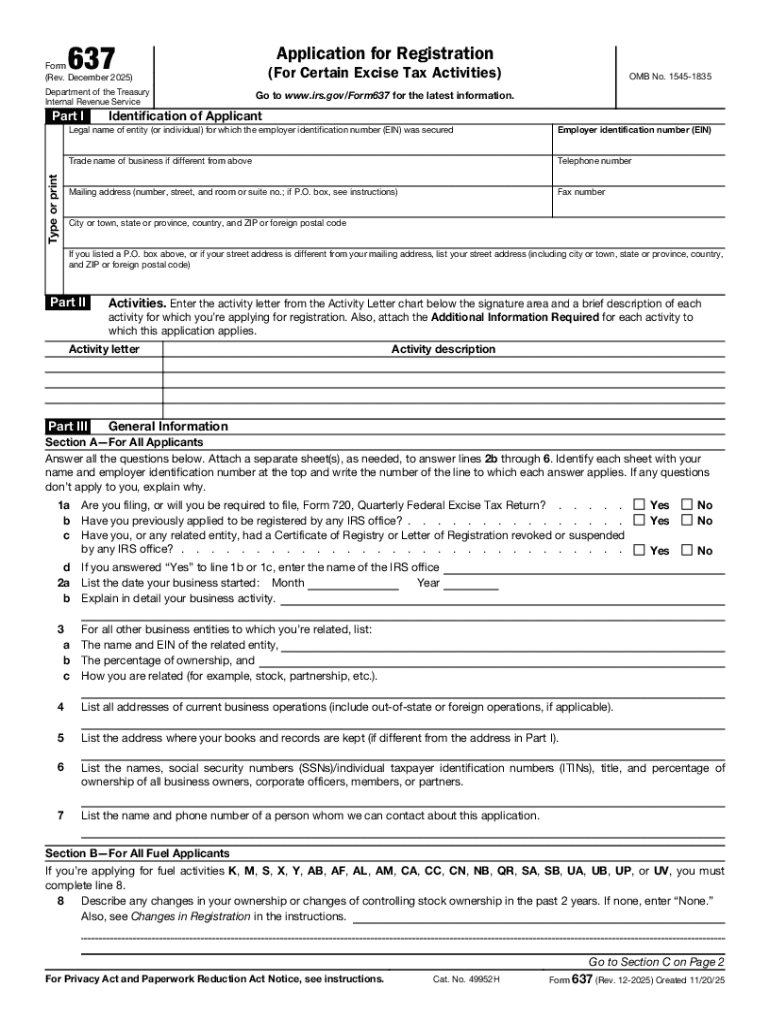

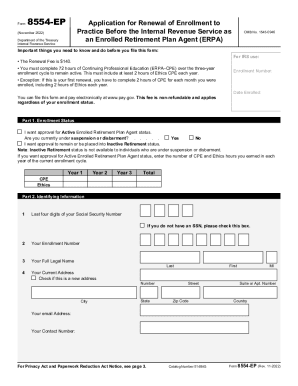

IRS 637 2025-2026 free printable template

Get, Create, Make and Sign IRS 637

How to edit IRS 637 online

Uncompromising security for your PDF editing and eSignature needs

IRS 637 Form Versions

How to fill out IRS 637

How to fill out form 637 rev december

Who needs form 637 rev december?

Understanding Form 637 Rev December Form: A Comprehensive Guide

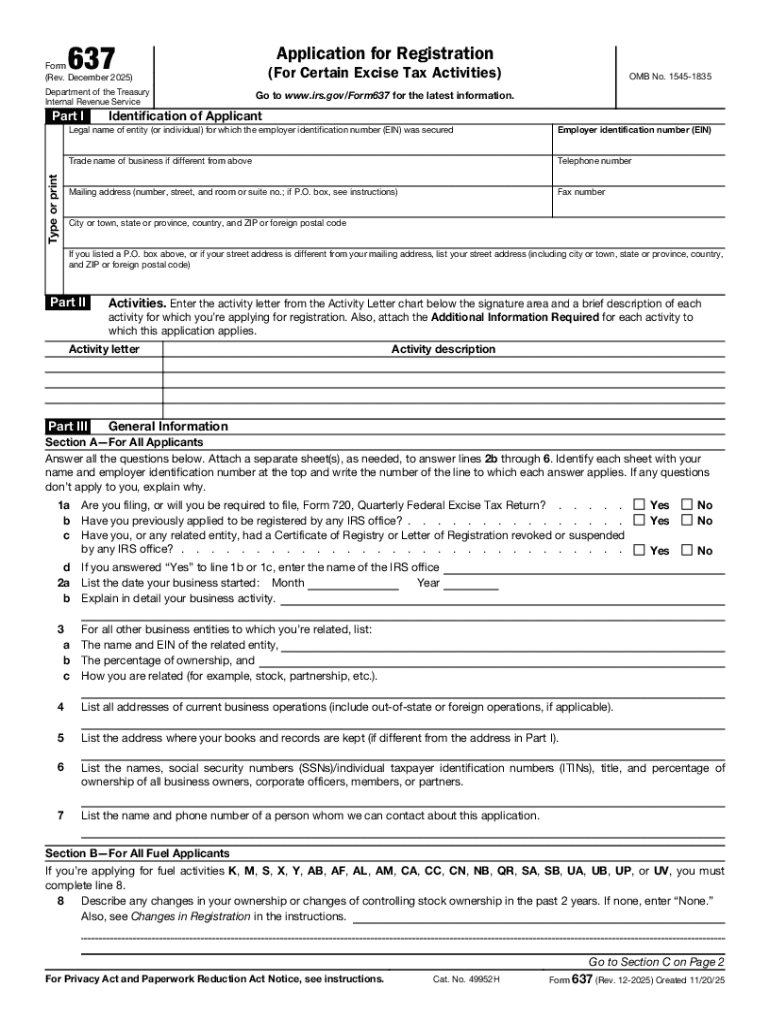

What is Form 637 Rev December?

Form 637 Rev December is an essential document required for specific regulatory compliance. Its purpose centers around the reporting of fuel-related transactions, particularly concerning users of tax-exempt and exempt fuels. The primary aim of this form is to facilitate accurate tracking and reporting, thus ensuring adherence to tax obligations enforced by the IRS.

Historically, Form 637 has undergone several revisions that reflect ongoing changes in federal regulations and administrative processes. The December revision includes critical updates such as enhanced sections for user classification and operational details. By streamlining information gathering, it increases the form’s utility across various industries, ensuring users can swiftly comply with legislative requirements.

This form holds particular importance in industries such as transportation, agriculture, and manufacturing, where fuel expenditures are substantial and regulatory compliance is vital to operational success.

Who needs to fill out Form 637?

Form 637 is primarily targeted at businesses and individuals engaging in activities where exempt fuel usage is pertinent. This includes anyone utilizing fuel for off-highway farming, marine, or certain commercial activities that qualify for tax exemptions. Consequently, truck drivers, farmers, and companies involved in trucking logistics will find themselves needing to fill out this form.

The specific professions that commonly use Form 637 include those involved in freight transportation, agricultural production, and construction industries. These sectors frequently face situations where determining eligibility for fuel tax exemptions is essential, thus necessitating the completion of this form to ensure compliance with tax regulations and prevent unnecessary penalties.

Key features of Form 637 Rev December

The structure of Form 637 includes various segments that capture vital information to assess tax exemption eligibility. Major sections typically include personal information, operational details, and a declaration of eligibility status. Each segment has been designed to collect only the most relevant information, simplifying the filing process for users.

The December version of Form 637 introduces unique elements such as updated definitions for exempt fuels and clearer guidelines on eligibility criteria. By doing this, the IRS aims to reduce confusion and improve accuracy in filing, thereby improving compliance rates across the board.

Step-by-step instructions for completing Form 637

Before starting with Form 637, it’s vital to prepare all necessary documents, including identification, proof of operational capacity, and details about the fuel types used. These documents will provide essential context and data to complete the form accurately.

By following these steps, you ensure a smoother filing process and increase the likelihood that your application for tax exemption will be approved without issues.

Tips for editing and signing Form 637

Utilizing pdfFiller features for editing PDFs provides numerous advantages, including the ability to modify and enhance the document as needed before submission. Features such as text editing, annotations, and form field filling simplify the process and ensure clarity in communication.

For faster processing, electronically signing Form 637 is highly recommended. Doing so reduces mail times and minimizes the risk of losing crucial documents in transit. Leveraging collaboration tools within pdfFiller allows teams to share, review, and approve the form seamlessly, which is particularly beneficial in professional environments.

Common mistakes to avoid when submitting Form 637

Several frequent errors are seen during the submission of Form 637. These include incorrect personal information entries, failing to include required signatures, and misunderstanding exemption eligibility requirements. Such mistakes can lead to delays or eligibility rejections.

Double-checking your entries before submission is crucial. Utilizing pdfFiller’s error-checking tools can help prevent these mistakes, as many features automatically flag incomplete sections or inconsistencies in data. It’s advisable to take advantage of these tools to streamline your filing process.

Interactive tools available on pdfFiller for Form 637

pdfFiller offers several interactive form-filling tools designed to enhance the user experience when completing Form 637. These tools include easy drag-and-drop features, customizable templates, and integrated help guides that provide step-by-step assistance.

Accessing these tools is straightforward. Simply log into your pdfFiller account, navigate to the Form 637 section, and utilize the interactive features to complete your document seamlessly. This approach not only saves time but ensures that your form is filled out accurately.

Frequently asked questions about Form 637 Rev December

Common inquiries about Form 637 often include concerns about the consequences of mistakes made on the form. Generally, errors can lead to processing delays or disqualified exemptions, emphasizing the importance of accuracy. Users often wonder how frequently Form 637 is updated; it typically sees revisions annually or as regulations change.

For any additional questions about Form 637, various support resources are available on the IRS website, as well as customer service at pdfFiller. Utilizing these resources can clarify common doubts and assist in proper filing.

You might also like

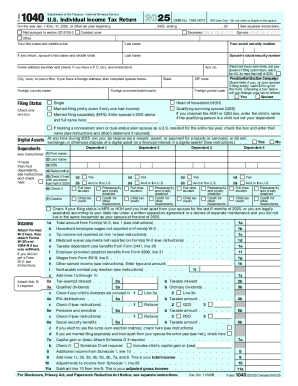

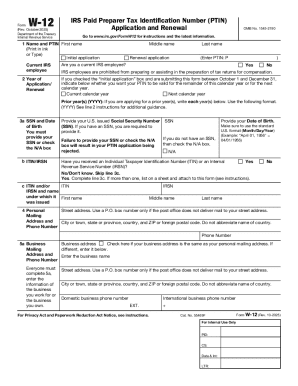

Users who engage with Form 637 often inquire about related forms such as Form 720 and Form 8849, which also pertain to fuel tax returns. Managing multiple forms is made easier with pdfFiller’s comprehensive solution, enabling users to create and manage all necessary documents seamlessly.

For those looking to streamline their documentation processes, visiting additional guides on pdfFiller can provide further tips on effective management of similar regulatory forms and enhance overall productivity.

Next steps after completing Form 637

Once Form 637 is complete, understanding the submission process is the next critical step. Submit the form via e-filing or standard mail as directed by the IRS guidelines. After submission, tracking your form becomes important for ensuring its processing status.

Keeping records organized is essential. Utilizing pdfFiller’s document management features allows for easy access to your submitted forms and any supporting documents, ensuring you have everything at your fingertips for future reference or audits.

People Also Ask about

What does 459 mean?

What does 143 637 mean?

What does 637 mean?

What does 831 mean code?

What is 637 love code?

What is the meaning of 143 637?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my IRS 637 in Gmail?

How can I edit IRS 637 on a smartphone?

How do I fill out IRS 637 using my mobile device?

What is form 637 rev december?

Who is required to file form 637 rev december?

How to fill out form 637 rev december?

What is the purpose of form 637 rev december?

What information must be reported on form 637 rev december?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.