IRS 8725 2025-2026 free printable template

Get, Create, Make and Sign IRS 8725

Editing IRS 8725 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8725 Form Versions

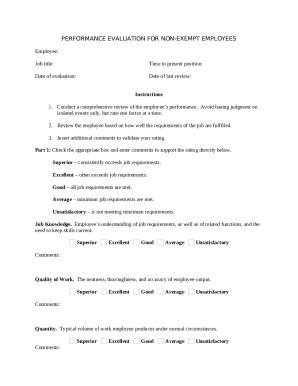

How to fill out IRS 8725

How to fill out form 8725 rev december

Who needs form 8725 rev december?

Form 8725 Rev December: A Comprehensive Guide

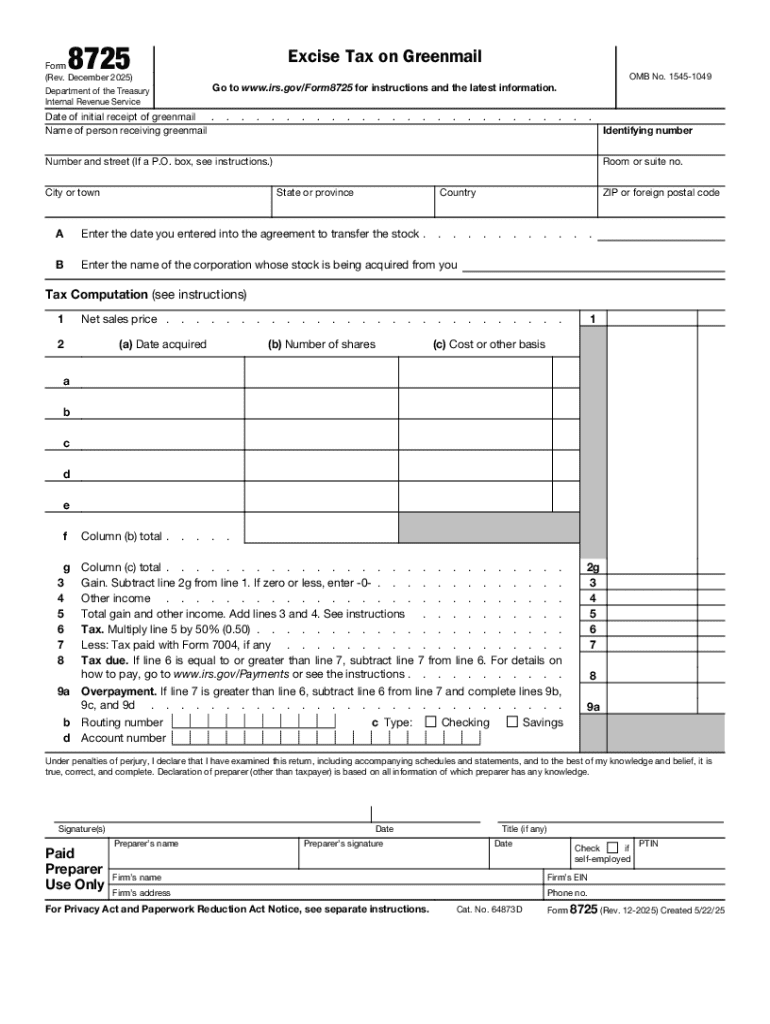

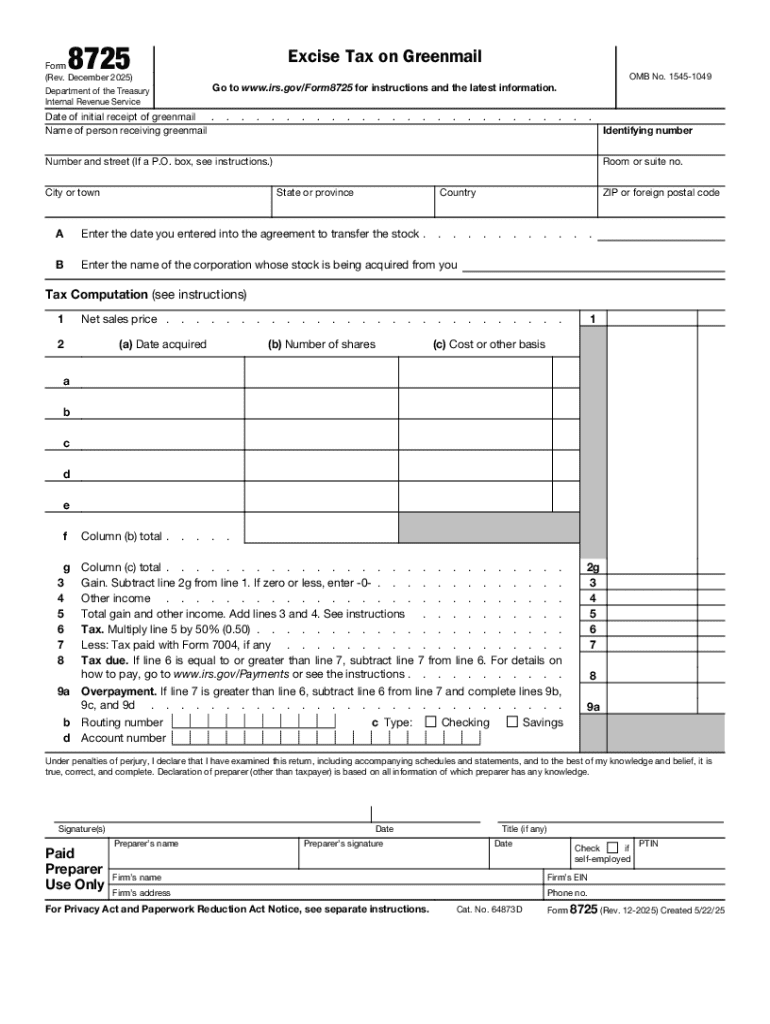

Understanding Form 8725

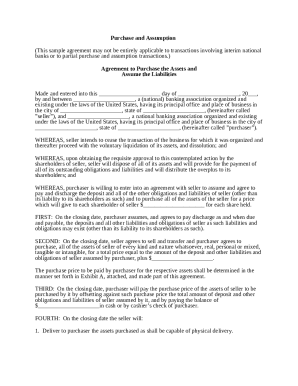

Form 8725 Rev December is a crucial document used in the tax process, particularly for taxpayers who have a reporting requirement concerning their tax-exempt bonds. Its primary purpose is to report on the private business use of property financed with tax-exempt bonds. By completing this form accurately, filers help the IRS track compliance with federal tax regulations.

Who needs to file Form 8725?

Eligible filers for Form 8725 include governmental entities, nonprofit organizations, and other tax-exempt entities that have financed their property with tax-exempt bonds. If your organization has received tax-exempt bond financing, you must file this form to report private business use of the financed property. This requirement arises particularly when the bond proceeds are used for projects that may have a mix of public and private uses.

Key features of Form 8725

Form 8725 comprises several key sections, each designed to capture specific information regarding the use of tax-exempt bond proceeds. Each section serves an important purpose, ranging from identifying users of the bond-financed property to detailing the revenue received from business activities associated with the property.

Ensuring accurately completed sections is essential, as it can affect compliance with federal tax laws. Each section requires specific documentation, and the accuracy and completeness of information can prevent costly penalties.

Step-by-step guide to filling out Form 8725

Before filling out Form 8725, it’s imperative to prepare adequately. Start by gathering all necessary documents, including original agreements related to tax-exempt financing, business leases, and any revenue records associated with the property. This prep work is crucial to ensure you understand the specific instructions for each section.

Filling out each section of Form 8725

Begin with Section A, where you will provide basic information about your organization and the bonds involved. Move to Section B to report private business use, ensuring you detail the nature of the use and the parties involved. Finally, in Section C, report any revenue generated from business activities related to the financed property. Ensure accuracy by referring to the information gathered in your preparation.

It's essential to avoid common mistakes, such as omitting required information, using vague language when describing business use, or failing to submit the form on time. Regular consultation with a tax advisor can help mitigate errors.

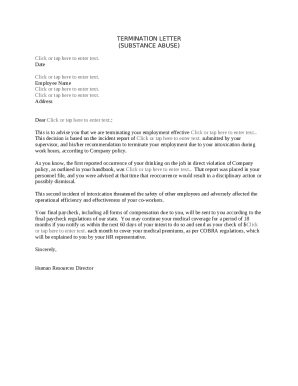

Editing and managing your Form 8725

pdfFiller offers intuitive editing features for Form 8725 that simplify the process of filling out and managing your tax documents. With pdfFiller's platform, users can easily edit existing PDFs, add information, and also utilize templates to ensure consistency in their submissions. This feature is particularly useful for organizations handling multiple forms or those keen on reducing the workload during tax season.

Using pdfFiller for eSigning Form 8725

E-signing your Form 8725 with pdfFiller is straightforward and secure. After completing the form, utilize pdfFiller's seamless eSign feature that allows for an official digital signature, greatly expediting the submission process. This simplifies the typically cumbersome task of obtaining wet signatures from multiple stakeholders.

Submitting Form 8725

Once you have completed Form 8725 and signed it, the next step is submission. You have options for both electronic submission and physical mailing. The choice between these methods often hinges on organizational policy and convenience, but electronic submission generally provides quicker processing and confirmation of receipt.

Bear in mind the deadline for submitting Form 8725 to avoid penalties. Generally, this is aligned with the calendar year for reporting, but specific circumstances may lead to variations based on fiscal years or project completions.

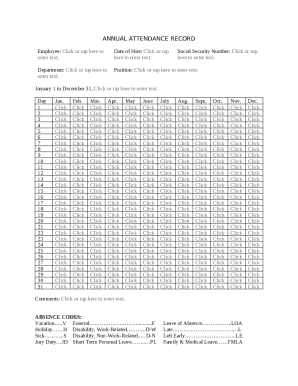

Frequently asked questions about Form 8725

There are numerous inquiries that frequently arise concerning Form 8725. These include questions about eligibility for filing, whether past reporting can be amended, and what constitutes private business use. Understanding the common concerns can alleviate the anxiety tied to the filing process.

For troubleshooting common issues, such as understanding unexpected IRS correspondence or errors on the form, consulting the FAQ section on the IRS's website or engaging with a tax advisor can provide clarity and assistance.

Practical tips for managing your tax documents

Keeping organized tax documents is essential for both compliance and operational efficiency. Utilize pdfFiller's cloud-based solution to manage and store your Form 8725 and related documents securely. This enables easy access for authorized team members, promotes collaboration, and helps in auditing processes.

Additional considerations

Staying updated on changes to Form 8725 is vital, particularly since tax laws can evolve. Subscribe to IRS updates or engage with tax professionals to remain informed about any alterations in requirements or the filing process. They can provide insights into impacts on tax-exempt financing and reporting obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 8725 without leaving Google Drive?

How do I execute IRS 8725 online?

Can I create an eSignature for the IRS 8725 in Gmail?

What is form 8725 rev december?

Who is required to file form 8725 rev december?

How to fill out form 8725 rev december?

What is the purpose of form 8725 rev december?

What information must be reported on form 8725 rev december?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.