Get the free HOAs Must File The FINCEN BOI Form And Here Is How

Get, Create, Make and Sign hoas must file the

Editing hoas must file the online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hoas must file the

How to fill out hoas must file the

Who needs hoas must file the?

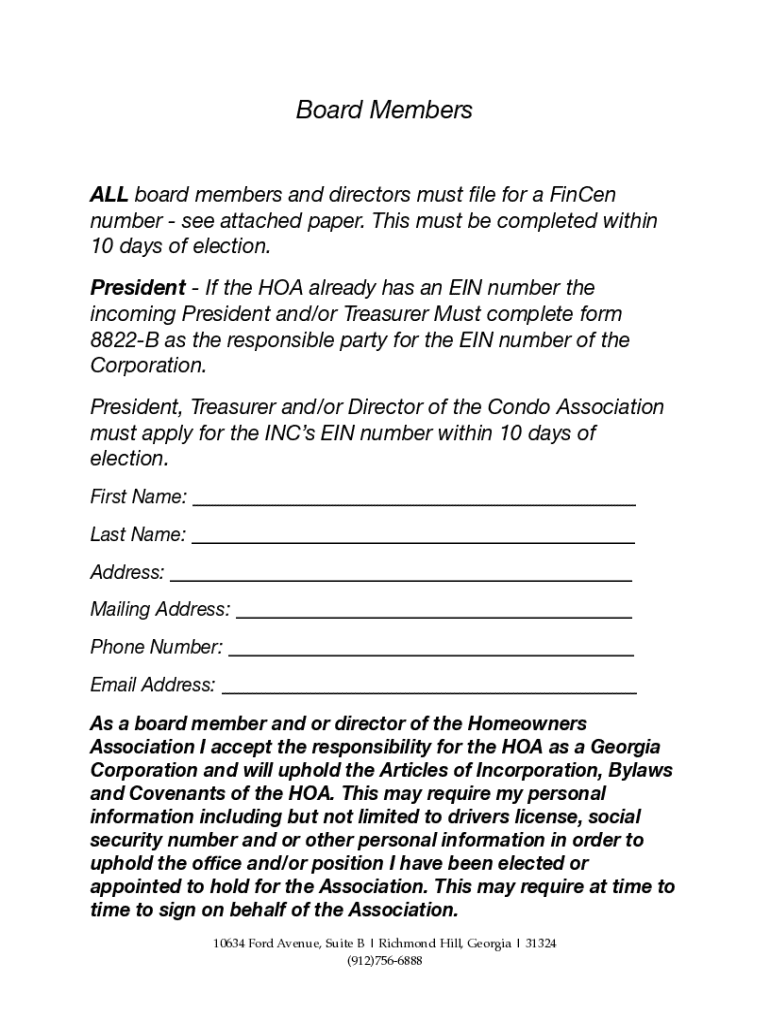

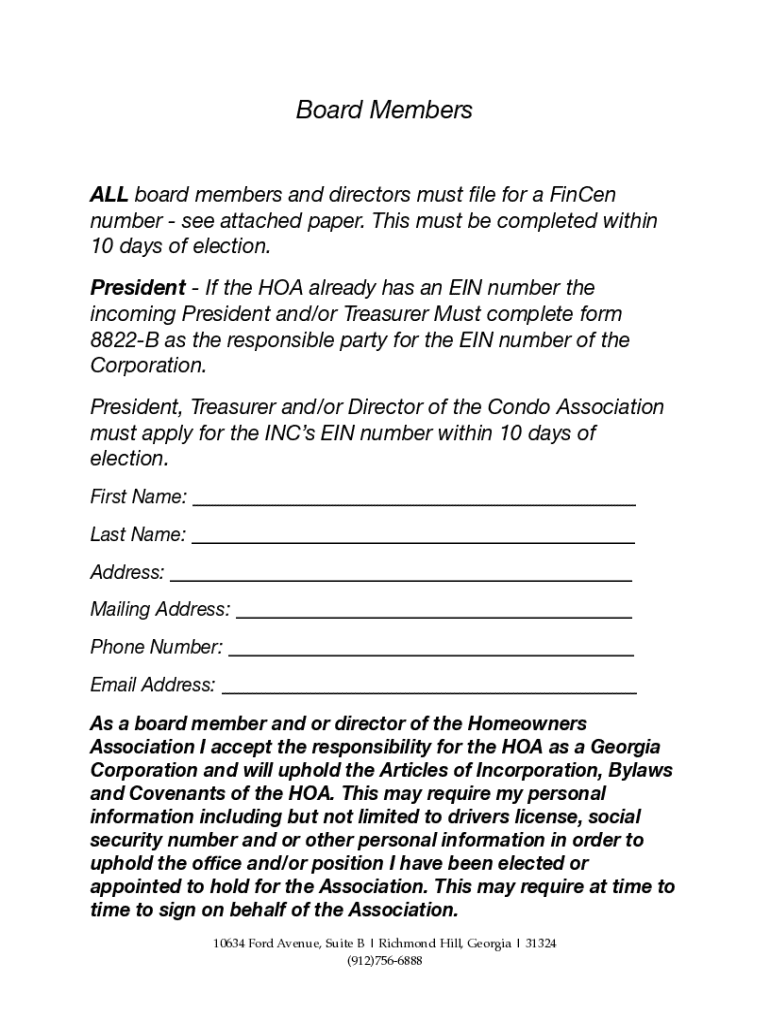

HOAs must file the form: A comprehensive guide for homeowner associations

Understanding the filing requirement for HOAs

Homeowner associations (HOAs) play a crucial role in managing residential communities, ensuring compliance with governing documents, and maintaining property values. One essential responsibility for many HOAs is the need to file specific tax forms with the IRS. Understanding this filing requirement is vital for board members and HOA administrators to maintain compliance and avoid penalties.

Filing is crucial for HOAs as it establishes their adherence to tax laws and ensures transparency to residents. Proper filing demonstrates that the association is operating within its legal parameters and preserves its tax-exempt status, if applicable. Failure to file can lead to adverse consequences, including financial penalties and the potential loss of tax-exempt status, which can significantly impact an HOA's operations.

Key forms for HOA tax filing

The primary form that many HOAs need to consider is Form 1120-H, specifically designed for homeowners associations. This form caters to specific tax needs and provides a simplified way for eligible associations to report income and expenses to the IRS. Understanding the eligibility requirements and purpose of Form 1120-H is essential for compliance.

It's important to note the differences between Form 1120 and Form 1120-H. While Form 1120 is a corporate tax return for C corporations, Form 1120-H is tailored for the unique financial conditions of homeowner associations. Choosing the right form directly impacts how the HOA manages its finances and tax responsibilities.

Detailed steps to file HOA forms

Filing HOA forms doesn't have to be overwhelming. By breaking the process down into manageable steps, associations can ensure that they meet their obligations smoothly and efficiently. Here are the steps to follow:

Step 1: Gather necessary documentation

Before filling out any tax forms, it’s essential to collect all necessary documentation. This includes detailed financial statements, evidence of income, and summaries of expenditures throughout the year. Accurate records will streamline the filing process.

Step 2: Determine your HOA's tax status

Next, assess your HOA's tax status. Determine if your association qualifies for non-profit status or tax-exempt eligibility under Section 528. This eligibility typically applies to HOAs that meet specific income requirements and primarily derive revenue from member assessments.

Step 3: Fill out the form correctly

When it comes to filling out Form 1120-H, accuracy is paramount. It's integral to report all revenue correctly and understand which expenses are deductible. Examples of deductible expenses include maintenance costs and utility payments relevant to community upkeep.

Step 4: Review and validate your filing

After completing the forms, reviewing the information thoroughly is crucial to avoid common pitfalls such as misreporting income or overlooking deductible expenses. Consider seeking validation from an accountant familiar with HOAs, particularly a CPA specializing in HOA and condo associations.

Step 5: Submit the form

Finally, it's time to submit your forms. Depending on the situation, HOAs can file electronically or send paper forms to the IRS. Be aware of important filing deadlines to avoid penalties — typically, HOA tax returns are due on the 15th day of the 4th month following the end of the tax year.

Interactive tools for HOA filing

Utilizing digital tools can greatly enhance the efficiency of the filing process. Platforms like pdfFiller offer interactive solutions to create, manage, and submit HOA filing documents seamlessly. With tools for document creation, users can easily convert paper forms into fillable PDFs, fostering collaboration within HOA teams.

Additionally, eSignature features allow HOA board members to approve documents quickly, further expediting the submission process. These collaborative tools enable various stakeholders to engage in the filing process, ensuring everyone is on the same page regarding compliance and documentation.

FAQs about HOA filing requirements

HOAs often have numerous questions regarding tax filing. Here are some common inquiries that arise:

Tips & tricks for a smooth filing process

Ensuring a smooth filing process requires proactive organization and attention to detail throughout the year. Here are several tips to enhance the efficiency of your HOA's filing procedures:

Special considerations for different types of HOAs

Different types of HOAs, such as those governing condominiums versus single-family homes, present unique filing challenges. For instance, condo associations may have additional local regulations to consider compared to standard homeowner associations. Awareness of state-specific laws can also affect filing obligations and deadlines.

Understanding these nuances helps HOAs avoid compliance issues. Engaging with a CPA experienced in HOA tax matters can significantly benefit associations, guiding them through unique requirements based on their structure and locale.

Building a compliance strategy for your HOA

Creating a compliance strategy takes careful planning and organization. Steps may include developing an annual filing calendar to track important tax dates and deadlines, ensuring that all board members are informed and involved in the filing process. Regular financial reviews can also help identify any discrepancies throughout the year.

Furthermore, engaging with tax professionals familiar with HOA regulations can provide essential guidance and peace of mind. These experts can clarify complex tax situations and support HOAs in maintaining compliance and managing their finances responsibly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute hoas must file the online?

How do I fill out hoas must file the using my mobile device?

Can I edit hoas must file the on an Android device?

What is hoas must file the?

Who is required to file hoas must file the?

How to fill out hoas must file the?

What is the purpose of hoas must file the?

What information must be reported on hoas must file the?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.