Get the free Download Banking FormsAccount, Loan & Service Forms

Get, Create, Make and Sign download banking formsaccount loan

How to edit download banking formsaccount loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out download banking formsaccount loan

How to fill out download banking formsaccount loan

Who needs download banking formsaccount loan?

Download banking forms: Account loan form

Understanding account loan forms

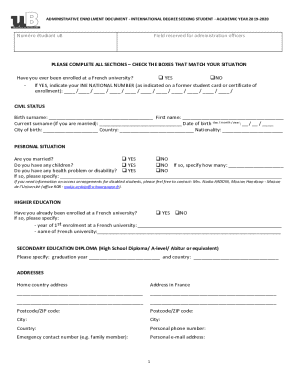

An account loan form is a crucial document used by financial institutions to gather necessary information from loan applicants. These forms serve a dual purpose: they help individuals articulate their requests for loans while enabling institutions to assess the suitability of such requests. Accurate information is vital as it influences approval decisions and interest rates.

Different types of account loan forms cater to various financial needs, which include personal loans, student loans, home loans, and business loans. Understanding the purpose of each allows applicants to select the right form tailored to their situation.

Types of banking forms you may need

Banking institutions provide specific forms for different types of loans. Here’s an overview of the common loan forms you may encounter:

How to download your banking forms

To access an account loan form, you can easily navigate to pdfFiller, a platform that offers various templates. Here’s a step-by-step guide on how to download the form you need:

To ensure successful downloads, it is important to check your internet connection and ensure that your device supports the compatible file formats available for download.

Filling out your account loan form

Once you have downloaded your account loan form, the next step is completing it accurately. Essential sections typically include personal information, financial history, and the loan amount requested. Providing thorough and precise information increases your chances of loan approval.

A few common mistakes to avoid include: overlooking mandatory fields, providing inaccurate information, and failing to double-check your calculations. If you're using pdfFiller, you can take advantage of its features to edit the form, such as adding text, signature fields, checkboxes, or radio buttons to make your application more comprehensive.

E-signing and submitting your form

E-signing has become a popular method to formalize loan applications, thanks primarily to its convenience and time efficiency. The pdfFiller platform supports a straightforward e-signing process, ensuring that your documents remain secure and compliant with regulations.

Once your account loan form is completed and signed, you can submit it directly via your banking portal. Alternatively, options for sending completed forms via email or postal services are also available if preferred. Always take precautions to secure your personal information when sending forms electronically.

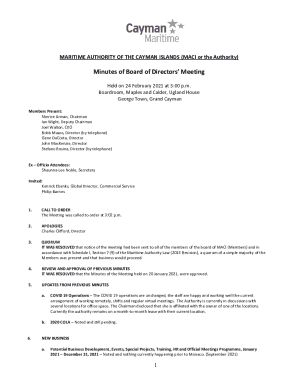

Managing your loan application

After submitting an account loan application, managing your loan status becomes essential. Many banking institutions allow you to track the progress of your application through their online portals. Staying informed can help reduce anxiety and equip you with the knowledge necessary for future financial planning.

Familiarizing yourself with common borrower concerns can significantly ease the loan management process. Resources are available for further guidance on managing loans effectively.

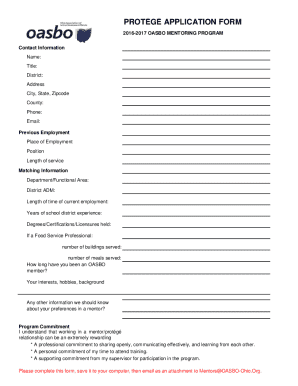

Collaborating on loan applications

For teams working on a single loan application, collaboration tools such as those provided by pdfFiller become invaluable. These tools foster an environment of shared responsibility and allow multiple users to contribute information, which can enhance accuracy and cohesiveness.

These collaborative features simplify the complexities of loan applications by fostering open communication and detailed contributions from all involved parties.

FAQs about account loan forms

Understanding account loan forms can often lead to more confidence when navigating the lending landscape. Here are common questions answered:

Addressing these FAQs helps demystify the application process and empowers users to make informed decisions.

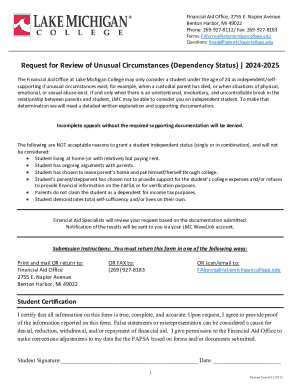

Ensuring compliance and security in loan applications

In the digital age, data protection and security in loan applications are paramount. Being aware of regulations like the GDPR helps applicants understand their rights and the obligations of financial institutions.

pdfFiller prioritizes document security through encryption and secure storage practices, ensuring that your data remains safe throughout the loan application process. Adopting best practices such as using strong passwords and enabling two-factor authentication can play a significant role in keeping your information secure.

Accessing additional templates and tools

In addition to account loan forms, pdfFiller offers a myriad of related financial forms and templates which can facilitate different aspects of your financial journey. From personal finance documents to insurance forms, accessing these templates simplifies the process of documentation.

Expanding your knowledge on these topics can streamline financial management and improve document preparedness long term.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify download banking formsaccount loan without leaving Google Drive?

How do I make changes in download banking formsaccount loan?

How do I complete download banking formsaccount loan on an Android device?

What is download banking formsaccount loan?

Who is required to file download banking formsaccount loan?

How to fill out download banking formsaccount loan?

What is the purpose of download banking formsaccount loan?

What information must be reported on download banking formsaccount loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.