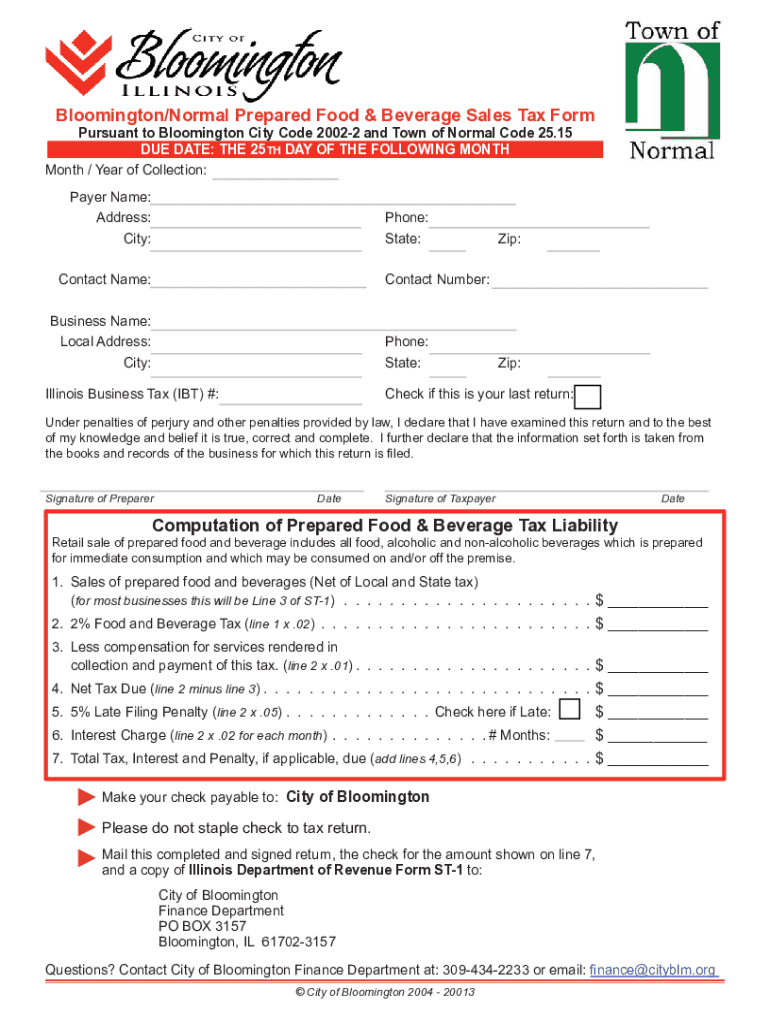

Get the free Bloomington/Normal Prepared Food & Beverage Sales Tax Form

Get, Create, Make and Sign bloomingtonnormal prepared food beverage

How to edit bloomingtonnormal prepared food beverage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bloomingtonnormal prepared food beverage

How to fill out bloomingtonnormal prepared food beverage

Who needs bloomingtonnormal prepared food beverage?

Comprehensive Guide to the Bloomington-Normal Prepared Food Beverage Form

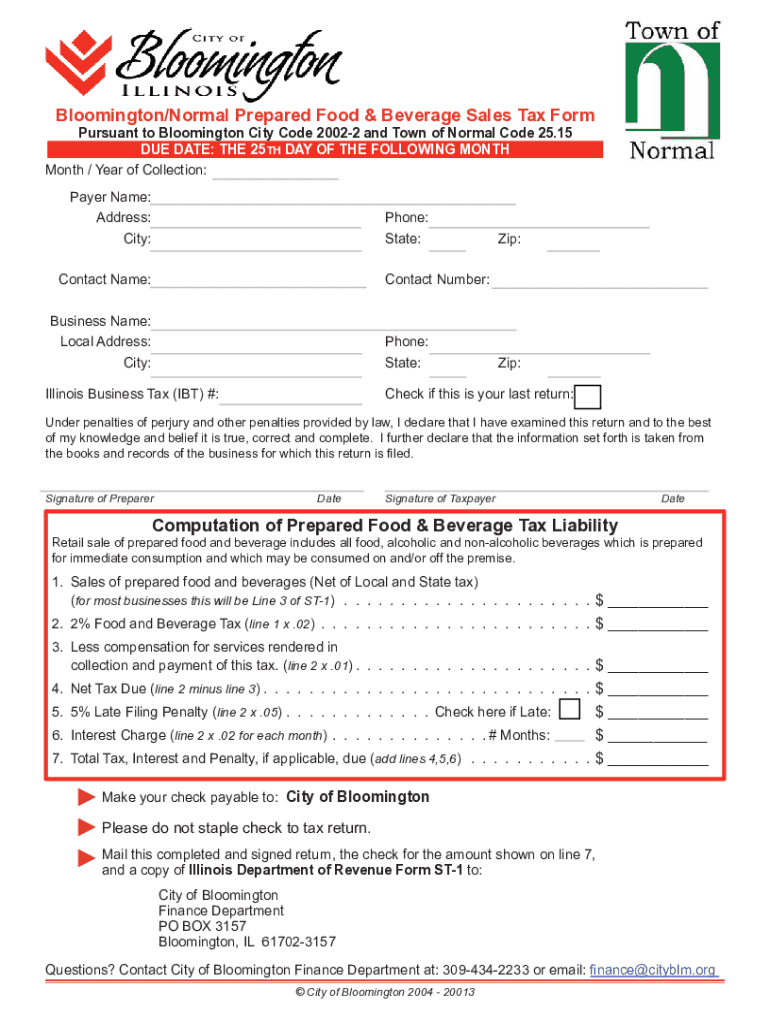

Overview of Bloomington-Normal prepared food beverage form

The Bloomington-Normal prepared food beverage form is an essential documentation process implemented to regulate the sale and distribution of prepared food and beverages in the Bloomington-Normal area. This form plays a pivotal role in ensuring that all vendors comply with local laws and tax obligations, ultimately fostering a well-regulated food industry.

For local businesses and residents, the importance of this form cannot be overstated. It provides clarity surrounding tax responsibilities—particularly pertinent given the complexities surrounding sales tax, including state and local rates. By establishing clear guidelines, the form helps to maintain standardization across vendors in the area.

Legal compliance is a significant aspect of the prepared food beverage process, governed by the Illinois Administrative Code and various local ordinances. Understanding these regulations is crucial for vendors aiming to operate within the legal framework without incurring penalties.

Eligibility criteria for filing the Bloomington-Normal form

Not every vendor is required to fill out the prepared food beverage form. Typically, any business involved in the sale of prepared food and beverages—including restaurants, food trucks, and caterers—must submit this form. However, some entities may qualify for exemptions, which vary based on specifics like their operations and products served.

Key considerations for different types of vendors include:

While exemptions exist for certain organizations, understanding where your business fits within this framework is critical to ensuring compliance and avoiding potential fines.

Step-by-step guidelines for completing the form

Completing the prepared food beverage form requires gathering several necessary pieces of information. Firstly, ensure you have your business identification details at hand, such as the legal name of the business, its location, and all owners' information. Secondly, you must estimate your sales volume for the prepared food and beverages to determine applicable tax rates and responsibilities.

Follow these detailed instructions for navigating the form:

Common mistakes to avoid include inaccurate estimates of sales or overlooking local tax rates. Ensure all calculations reflect current guidelines to facilitate smooth processing.

Editing and managing your form with pdfFiller

Utilizing pdfFiller significantly eases the process of editing the prepared food beverage form. This platform provides interactive tools that allow for straightforward completion. Users can easily navigate between sections, input data seamlessly, and even collaborate with team members, ensuring each detail is accurate before submission.

The pdfFiller platform not only allows for document completion but ensures secure document management as well. Users can save their work, sign electronically, and send the finalized document with just a few clicks. This process is fortified with a secure eSigning feature, which adds an additional layer of security and integrity to your submissions.

Insights into Bloomington-Normal regulatory practices

The local ordinances affecting prepared food and beverage sales in Bloomington-Normal are guided by both state and local regulations. It's vital for vendors to remain updated on these ordinances, as recent changes may directly affect tax obligations stemming from the Illinois Department of Revenue mandates.

Changes in tax policies can have significant impacts on your business. For example, revisions in the local sales tax rates can affect your pricing structure and profitability. Therefore, fostering a good working relationship with local government entities can help in understanding these dynamics and ensuring your business remains compliant.

Best practices for managing prepared food beverage sales

Effective record keeping and documentation should be a core component of any business strategy for vendors in food and beverage sales. This not only helps in streamlining tax filings but also aids in tracking sales trends and consumer preferences, allowing for strategic business planning.

Understanding tax obligations is equally vital. Here are some strategies to consider:

Implementing these practices can simplify the filing process, boost your compliance rate, and ultimately contribute to better business performance.

Frequently asked questions (FAQs)

Understanding the intricacies of the Bloomington-Normal prepared food beverage form can be challenging. Numerous inquiries arise, ranging from who needs to file to how to properly complete the form.

Some common questions include:

These FAQs can provide a foundation for navigating the filing process more effectively, ultimately easing concerns regarding compliance.

Case studies/examples of successful compliance

Many local businesses have successfully navigated the requirements of the Bloomington-Normal prepared food beverage landscape, leading to positive outcomes both financially and operationally. Learning from these case studies can provide invaluable insights for new vendors.

For instance, a local restaurant recently streamlined its filing process by adopting digital tools such as pdfFiller. This shift allowed them to navigate tax calculations and filing effectively, seeing an increase in compliance rates and a significant decrease in erroneous submissions.

These successes illustrate the positive outcomes that arise from utilizing tools for efficiency and compliance. By sharing lessons learned, vendors can better adapt to the regulatory landscape.

Conclusion & next steps for users

Accurate filings regarding the Bloomington-Normal prepared food beverage form are vital to maintaining compliance and avoiding penalties. By understanding the filing requirements, employing resources such as pdfFiller, and staying informed of local regulations, vendors can manage their documentation efficiently.

As the food industry continues to evolve, embracing technology for document management can streamline processes and ensure a focus on growth rather than administrative burdens. Remain proactive in recognizing changing regulations and adapt your filing practices accordingly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute bloomingtonnormal prepared food beverage online?

How do I edit bloomingtonnormal prepared food beverage in Chrome?

Can I edit bloomingtonnormal prepared food beverage on an Android device?

What is bloomingtonnormal prepared food beverage?

Who is required to file bloomingtonnormal prepared food beverage?

How to fill out bloomingtonnormal prepared food beverage?

What is the purpose of bloomingtonnormal prepared food beverage?

What information must be reported on bloomingtonnormal prepared food beverage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.