Get the free SSA-1945 - Statement Concerning Your Employment in a ...

Get, Create, Make and Sign ssa-1945 - statement concerning

Editing ssa-1945 - statement concerning online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ssa-1945 - statement concerning

How to fill out ssa-1945 - statement concerning

Who needs ssa-1945 - statement concerning?

SSA-1945 - Statement Concerning Form: A Comprehensive Guide

Overview of SSA-1945

The SSA-1945 form, officially known as the Statement Concerning Your Request for Payment of Benefits, is a crucial document in the Social Security Administration's suite of forms. This specific statement gathers essential information for determining eligibility and aids in the assessment of benefits that individuals may qualify for under various Social Security programs.

The primary purpose of the SSA-1945 is to collect pertinent statements regarding an individual’s circumstances—specifically related to any government pension plans or similar windfall elimination provisions that could affect their Social Security benefits. Understanding the SSA-1945's role is essential for anyone navigating their retirement benefits. By accurately completing this form, it ensures that the Social Security Administration (SSA) can make well-informed decisions regarding claims.

Individuals who hold (or have held) employment that qualifies under these provisions, such as government employees or those participating in specific pension plans, need to complete the SSA-1945. The form is particularly pertinent for those who might be faced with the Government Pension Offset (GPO) that can reduce Social Security benefits based on retirement pay from certain types of employment.

Key features of the SSA-1945

The SSA-1945 is structured to collect essential information in several key areas. A detailed breakdown of its sections not only helps users to fill it out correctly but also clarifies what specific details are necessary from each applicant.

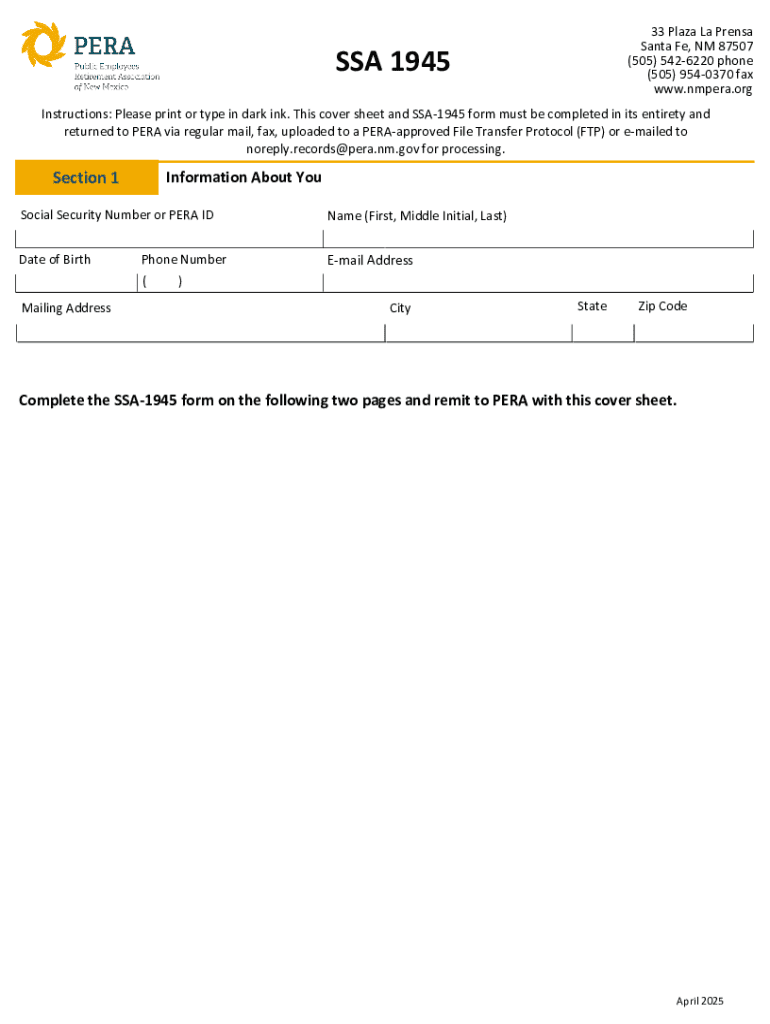

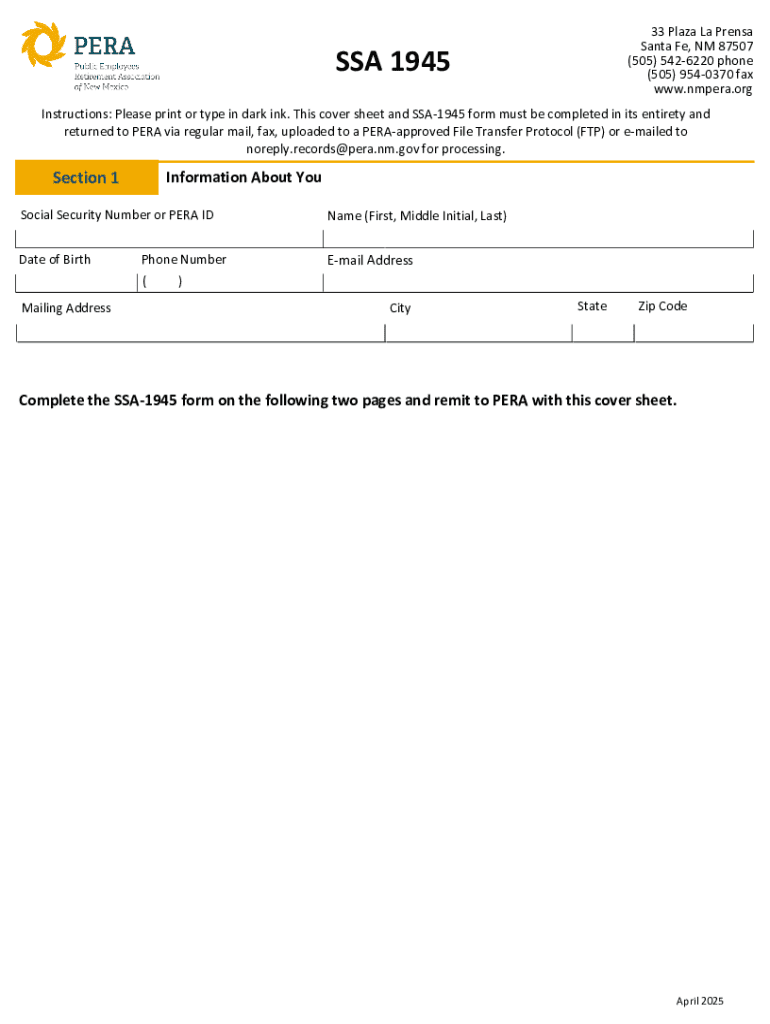

In the initial Personal Information Section, applicants are required to provide basic details such as their name, address, Social Security number, and contact details. Missing or incorrect information in this section can lead to processing delays.

Understanding the requirements outlined in the eligibility section is crucial. Applicants must accurately report aspects of their work history, including the nature of any pensions received, to avoid complications such as an unexpected denial later in the process. Tips for effectively communicating your situation include clearly presenting dates of employment, the nature of the benefits in question, and ensuring that all statements reflect your current circumstances.

Step-by-step guide to completing the SSA-1945

Completing the SSA-1945 involves several critical steps to ensure accuracy and efficiency. The first phase entails preparation: gather all necessary documents such as your previous employment records, details of any pension plans, and identification documents. Compiling a checklist of required information before filling out the form can streamline the process.

Once you have your documentation ready, filling out the SSA-1945 becomes much smoother. Follow these detailed steps:

Best practices during this process include readability—writing clearly and avoiding jargon. If you leverage interactive tools available at pdfFiller, including templates and form-filling assistance, you can avoid confusion and errors.

After filling out the form, the importance of a thorough review cannot be overstated. Double-check all entries, confirm the accuracy of information, and amend any mistakes promptly before submission to prevent delays in service.

Common questions about the SSA-1945

Misunderstandings regarding the SSA-1945 are not uncommon. A few frequently asked questions can help clarify the process and expectations. For example, after you submit the SSA-1945, you may wonder, "What happens next?" Typically, the SSA will review the information provided and notify you within a few weeks, depending on the complexity of your case.

In cases where applications are denied, individuals often ask, "Can I appeal?" Absolutely! There are well-defined processes to appeal SSA decisions regarding benefits, including providing additional documentation or clarifying details in your original submission.

Supporting tools and resources for SSA-1945 completion

Utilizing technology can significantly enhance your form-filling experience. Platforms like pdfFiller not only provide a way to edit and fill forms but also integrate e-signature functionalities, making it easier to finalize your SSA-1945 smoothly. The convenience of accessing forms and resources online can save valuable time.

One of the notable features offered by pdfFiller is the collaborative aspect. You can share the SSA-1945 form with family members or advisors for review before submission. Collaboration can minimize errors and strengthen your application as you benefit from others’ insights and knowledge.

Navigating updates and changes related to SSA-1945

Social Security forms, including the SSA-1945, occasionally undergo changes. Maintaining awareness of recent updates and modifications is crucial for compliance. By regularly checking SSA compliance news or the official SSA website, users can familiarize themselves with any revisions that may affect form completion.

Best practices for remaining compliant involve setting reminders to revisit the SSA site periodically for updates and subscribing to alerts for any changes affecting worker eligibility and pension plan impacts that could alter benefits. Matching your submissions with current regulations is fundamental to ensure timely processing.

Action items: What you need to do next

Before submitting the SSA-1945 form, there are critical action items to check off your list. Ensuring that all supporting documents are in order will facilitate a smoother transition in processing your request. It’s recommended to do a final review to make sure everything is filled out accurately.

Consider the specific submission options available to ensure you select the method that best serves your needs: online submissions can offer efficiencies, while traditional mail may be required for some cases. Understand what submission type aligns with your situation.

Additional insights on Social Security and related topics

Understanding the broader context of Social Security benefits can significantly affect how individuals perceive their retirement funding. The interplay between pensions, the windfall elimination provision, and Social Security can directly impact the amount received by individuals years into retirement. Knowledge of these connections is key for effective planning.

The SSA-1945 serves as a vital link within the extensive network of Social Security administration forms. Its proper completion can make a substantive difference in an individual's monthly retirement benefits. For those looking for additional education on these topics, many resources are available that explore the implications of social security, how to manage it alongside private pensions, and relevant tax implications.

Contacting Social Security Administration for clarifications

If uncertainty arises during the SSA-1945 completion process, reaching out to the Social Security Administration is strongly advised. Customer service representatives are equipped to provide guidance on how to accurately fill out the form and can clarify any concerns related to specific eligibility criteria.

Utilizing the SSA's official website provides multiple contact methods, including phone, online chat, and in-person visits. If you opt for phone inquiries, be prepared with relevant information to facilitate a smooth conversation. Documenting the responses you receive will help you later if you need to reference them.

Leveraging technology to simplify document management

In today's age, leveraging technology plays a pivotal role in simplifying the document management process. Cloud-based solutions allow users to access, edit, and manage their SSA-1945 forms from virtually anywhere. Services like pdfFiller ensure that this is not just a pipe dream but a daily reality for many individuals and businesses alike.

By utilizing pdfFiller's capabilities, you can streamline your form completion process—making it efficient to handle necessary paperwork, eliminating the hassle of printing and physically signing forms. The ability to organize and store documents securely adds an extra layer of convenience to your experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ssa-1945 - statement concerning in Chrome?

Can I create an electronic signature for signing my ssa-1945 - statement concerning in Gmail?

Can I edit ssa-1945 - statement concerning on an Android device?

What is ssa-1945 - statement concerning?

Who is required to file ssa-1945 - statement concerning?

How to fill out ssa-1945 - statement concerning?

What is the purpose of ssa-1945 - statement concerning?

What information must be reported on ssa-1945 - statement concerning?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.