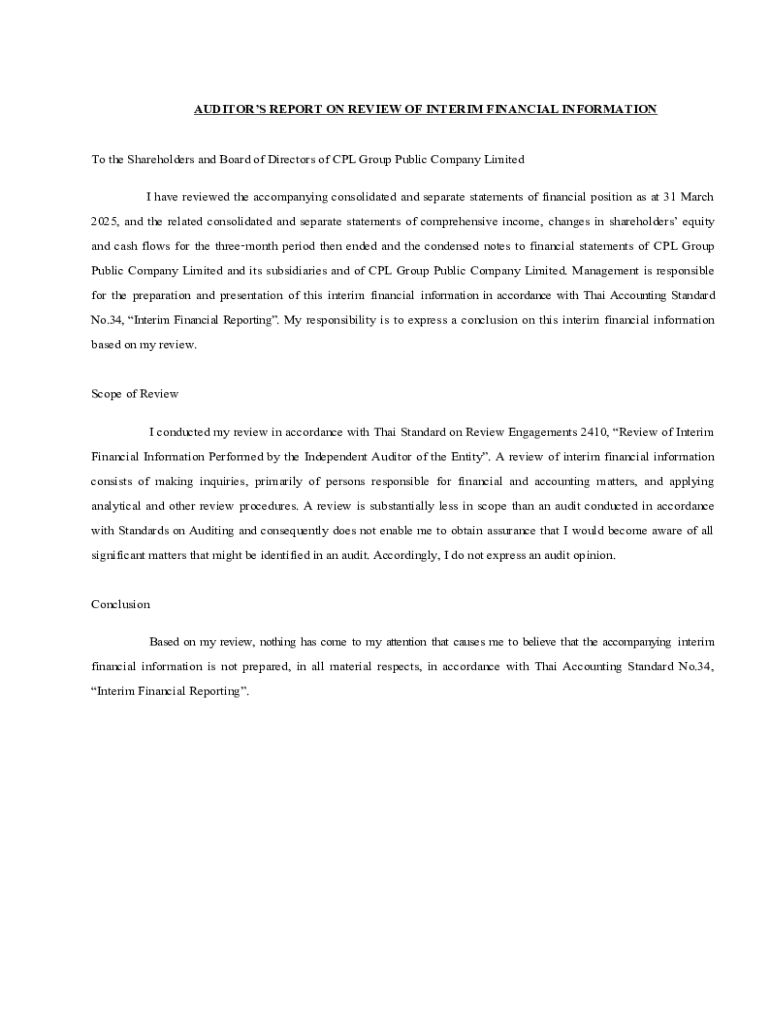

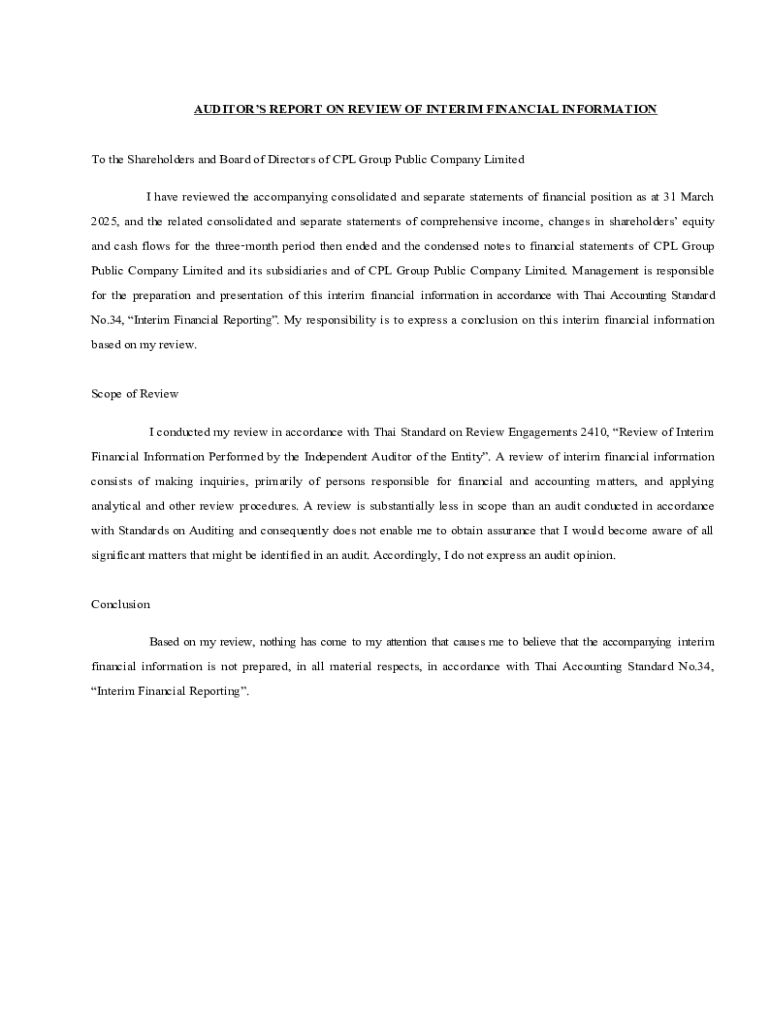

Get the free To the Shareholders and Board of Directors of CPL Group Public Company Limited

Get, Create, Make and Sign to form shareholders and

Editing to form shareholders and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out to form shareholders and

How to fill out to form shareholders and

Who needs to form shareholders and?

How to form shareholders and form

Understanding shareholder structure

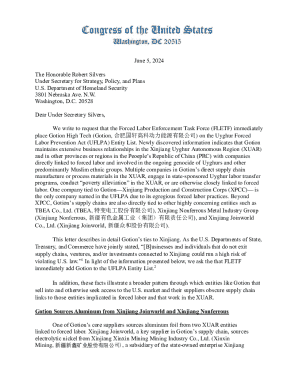

Shareholders are integral to the structure of a business, representing individuals or entities that own shares in a company. In the United States, shareholders can be categorized primarily into two types: common and preferred shareholders. Common shareholders typically have voting rights in company decisions and may receive dividends, while preferred shareholders enjoy priority for dividend payments and during liquidation but often lack voting rights. Understanding these distinctions is crucial for any business owner aiming to create a robust shareholder structure.

The role of shareholders extends beyond mere ownership; they play a pivotal role in governance and oversight. Their collective input can significantly impact company decisions, including management hiring and major strategic initiatives. A solid understanding of shareholder roles helps businesses align their strategies with shareholder expectations, ensuring sustainable growth and enhancing overall financial health.

Preparing to form shareholders

Before formalizing shareholders, business owners must select an appropriate business structure. Various structures like corporations, limited liability companies (LLCs), and partnerships offer different implications for shareholder formation. For instance, corporations can readily issue shares to numerous shareholders, while LLCs may require additional steps for consent among members. Recognizing these effects is vital when drafting shareholder agreements and planning for future business growth.

Identifying potential shareholders involves assessing candidates based on their skills, networks, and capital contributions. Diverse backgrounds and experiences foster a richer environment, catalyzing innovative ideas and solutions. Ensuring alignment in vision and strategy among prospective shareholders is equally essential, as it strengthens the company's overall foundation.

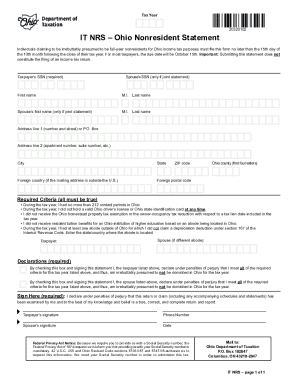

Legal considerations

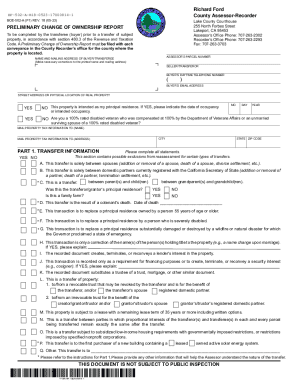

A comprehensive understanding of shareholder agreements is essential for protecting both the business and its owners. A well-drafted shareholder agreement typically includes essential clauses such as rights and obligations, exit strategies, and terms of share transfers. Legal consultations are crucial in navigating these complexities, ensuring that all necessary components are present and compliant with applicable laws.

Compliance with state and federal regulations cannot be overlooked. Each jurisdiction in the United States has unique requirements regarding the formation and reporting of shareholders. Companies must file the appropriate documentation, including articles of incorporation or organization, and maintain compliance to avoid penalties or legal disputes that can arise from non-compliance.

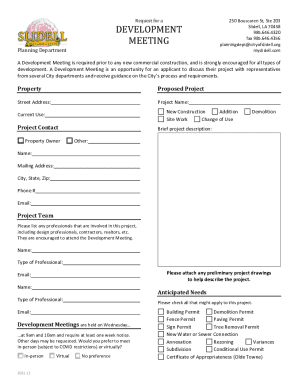

Steps to form shareholders

Drafting a shareholder agreement is the first key step in forming shareholders. This involves including essential clauses ranging from voting rights to profit-sharing arrangements, ensuring that everyone’s rights and responsibilities are crystal clear. Open negotiation fosters consensus-building among shareholders, generating buy-in for the business’s vision.

The next step involves issuing shares to shareholders. This process typically includes numbering the shares, determining the value, and establishing a transparent pricing strategy. Proper valuation ensures that each shareholder understands their investment and corresponding ownership stake.

Maintaining an up-to-date shareholder register is essential for compliance and management purposes. This register documents the ownership structure and tracks any changes, such as new issuances or transfers. Digital tools can significantly streamline this process, helping businesses maintain clarity and organization.

Managing shareholders post-formation

Open and transparent communication with shareholders is crucial. Best practices involve providing regular updates on company performance, financial health, and future strategies. Utilizing collaborative tools enhances engagement and ensures all shareholders can contribute meaningfully to discussions and decisions.

Managing shareholder relations also requires developing strategies to address conflicts and disputes effectively. Regularly scheduled check-ins foster a culture of openness and allow stakeholders to voice concerns, which can preempt larger issues. Engaging shareholders as key partners rather than mere investors will promote a more harmonious business environment.

Tools for managing forms and documents

Utilizing solutions like pdfFiller simplifies document management for shareholder agreements, compliance documents, and ongoing communications. The platform allows users to create, edit, and eSign PDFs seamlessly, reducing administrative burdens on management teams while maintaining focus on critical business operations.

Effective document sharing fosters collaboration, aiding in streamlined decision-making processes. Features of pdfFiller support maintaining document security in a cloud-based environment while allowing for flexible access. Implementing strong security protocols is critical, particularly in safeguarding proprietary business information.

Common challenges in forming shareholders

Identifying and overcoming legal hurdles can be daunting in shareholder formation. Common pitfalls include improper documentation, ambiguous agreements, and overlooking state-specific regulations. Proactively seeking legal advice can aid in navigating these complex waters, ensuring a smoother formation process.

Managing expectations among shareholders is another critical factor for success. Each shareholder may possess diverse interests, and striking a balance can be challenging. Effective communication strategies, such as regular updates and open forums for feedback, can help foster a collaborative environment where all voices are heard.

Best practices for long-term shareholder relationships

Establishing regular performance reviews and check-ins is vital for fostering effective shareholder relationships. By routinely evaluating contributions and alignments with business goals, companies can improve engagement and adapt as necessary. Regular business assessments empower shareholders to remain informed and invested in the company's future.

Fostering an inclusive business culture is equally important. Encouraging input from all shareholders not only enhances decision-making but also cultivates loyalty and commitment. Implementing strategies to enhance stakeholder engagement, such as inclusion in major decisions and recognition of contributions, can significantly improve long-term relationships.

Case studies: Successful shareholder formations

Analyzing successful businesses provides valuable insights into effective shareholder structures. Companies known for strong shareholder relations demonstrate that open communication and well-defined roles contribute to their success. For instance, well-structured corporations often utilize a diverse shareholder base that reflects the company's core values and business objectives.

Insights from these case studies reveal several key takeaways, such as the importance of crafting clear agreements, regular stakeholder engagement, and adaptability to change. Learning from these models can inspire emerging businesses to refine their own shareholder strategies, ensuring long-term viability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify to form shareholders and without leaving Google Drive?

Can I create an electronic signature for signing my to form shareholders and in Gmail?

Can I edit to form shareholders and on an iOS device?

What is to form shareholders and?

Who is required to file to form shareholders and?

How to fill out to form shareholders and?

What is the purpose of to form shareholders and?

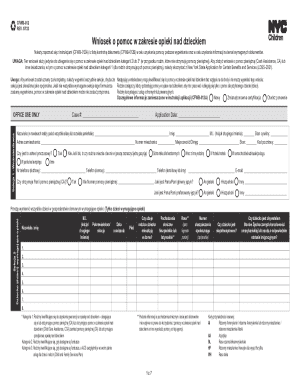

What information must be reported on to form shareholders and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.