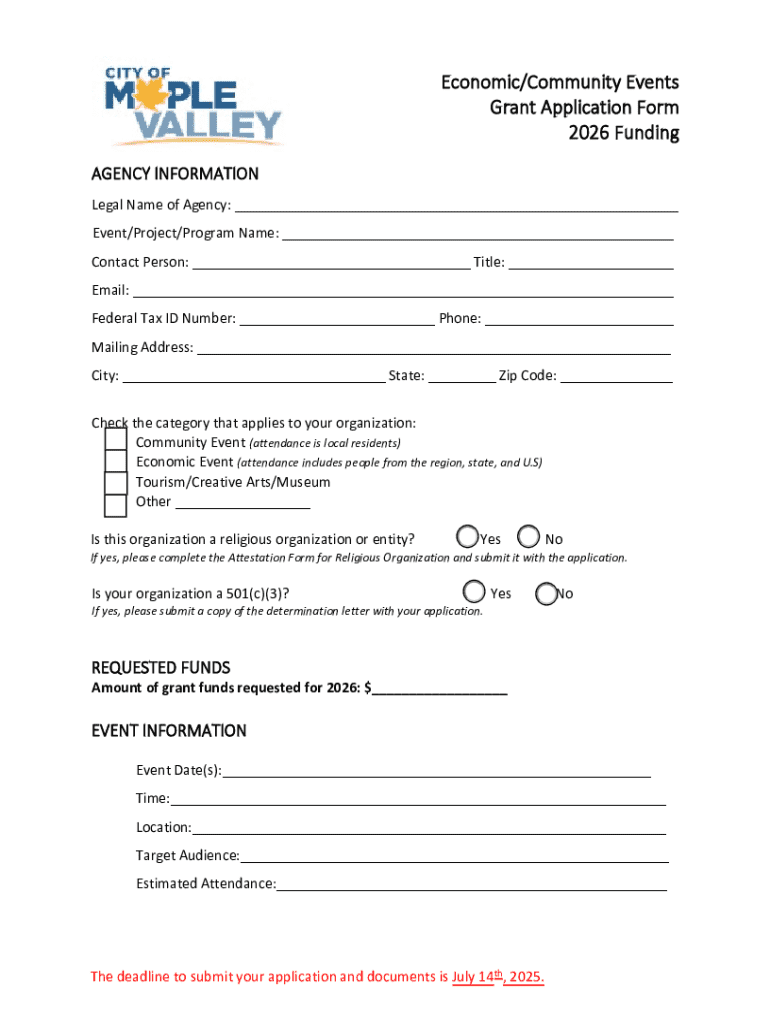

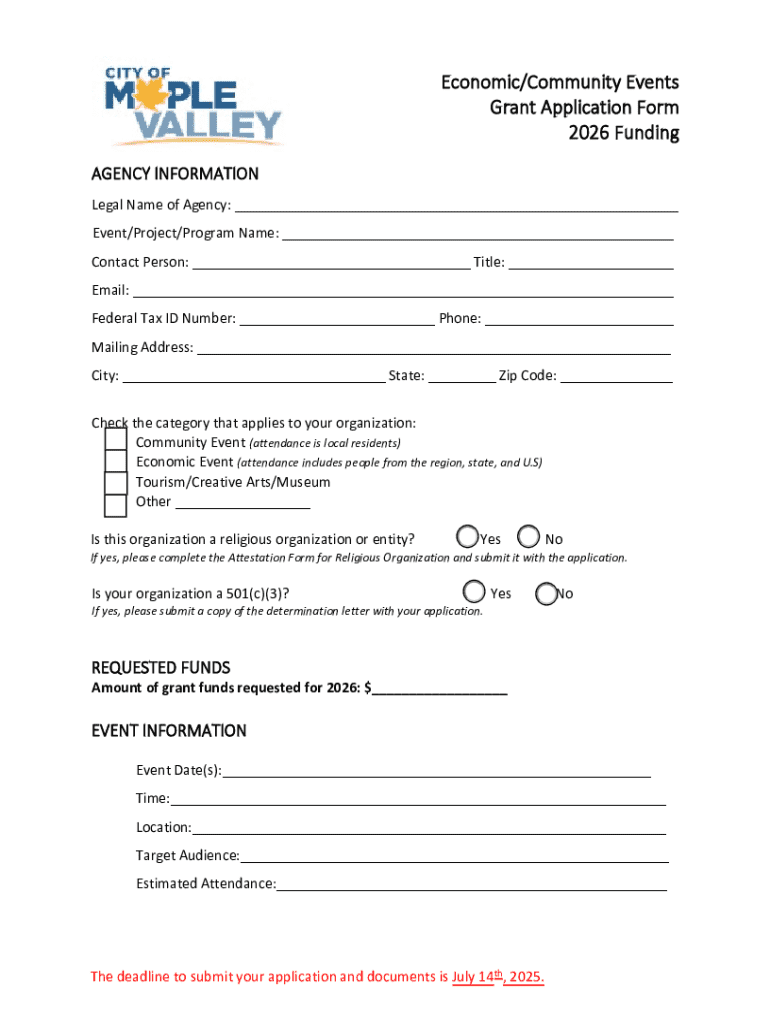

Get the free Application for Lodging Tax Funding

Get, Create, Make and Sign application for lodging tax

Editing application for lodging tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for lodging tax

How to fill out application for lodging tax

Who needs application for lodging tax?

Application for lodging tax form: A comprehensive guide

Understanding the lodging tax

Lodging tax is a crucial revenue source for municipalities, enabling local governments to support infrastructure, tourism, and community services. By assessing a percentage of the cost paid by guests staying in hotels, motels, or short-term rentals, lodging tax helps fund essential services that enhance the stay for visitors and benefit the community.

The collected lodging tax is typically allocated for various public uses, such as improving local roads, maintaining parks, and promoting tourism initiatives. These funds play a significant role in creating a thriving local economy by attracting tourists and encouraging them to explore the area.

History and evolution of lodging tax regulations

The concept of lodging taxes has roots dating back to the 1970s in the United States when cities began to recognize the need for a fair system to benefit from the influx of tourists. Over the years, the regulations surrounding lodging taxes have evolved, influenced by factors such as economic conditions, tourism rates, and community needs. Today, lodging tax regulations can vary significantly by region, reflecting local priorities and the structure of the tourism industry.

As tourism has expanded, so have the complexities of lodging tax compliance. Accommodations, from hotels to bed and breakfasts, must now navigate a plethora of state and local laws, making understanding the lodging tax landscape more vital for service providers.

Who is required to file an application for lodging tax?

Understanding who is required to file an application for lodging tax is fundamental for any accommodation provider. Typically, this includes hotels, motels, bed and breakfasts, and even short-term rentals like those found on platforms such as Airbnb or VRBO. Each of these entities is subject to lodging tax regulations to varying degrees, depending on their revenue and occupancy levels.

Identifying taxable entities

Generally, lodging tax applies to any business that provides accommodations for guests in exchange for a fee. This encompasses a broad array of establishments, including: - Hotels - Motels - Bed and breakfasts - Vacation rentals It’s important to note that even residential properties offering rental services may fall under lodging tax regulations depending on the duration of the stay and occupancy rates.

Thresholds for tax collection

Many areas set specific thresholds regarding revenue and occupancy that determine whether lodging tax applies. For instance, in some municipalities, if an establishment earns above a certain revenue limit—often in the range of $1,000 per month—then lodging tax filing becomes a legal requirement. Additionally, occupancy rates can influence tax obligations, as properties rented for a limited number of nights may be exempt.

The importance of filing the lodging tax form

Filing the lodging tax form is not only a legal obligation for lodging providers; it is also an essential component of operating a responsible business. Failure to comply can lead to serious consequences, including fines, penalties, or even cessation of business operations, especially if a hotel or another lodging entity consistently neglects its tax duties.

Legal obligations for lodging providers

Compliance with lodging tax regulations is mandatory. Local governments often conduct audits to ensure that lodging entities fulfill their tax obligations. Non-compliance can have detrimental effects, such as increased scrutiny from tax authorities and potential legal repercussions. Establishing a routine to ensure timely filing can significantly mitigate these risks.

Benefits of proper filing

Proper filing of the lodging tax form conveys legitimacy and responsibility, assuring guests that the accommodation respects local laws and contributes to community welfare. Furthermore, these taxes help support local infrastructure, tourism campaigns, and community services that can improve the guest experience and drive future business.

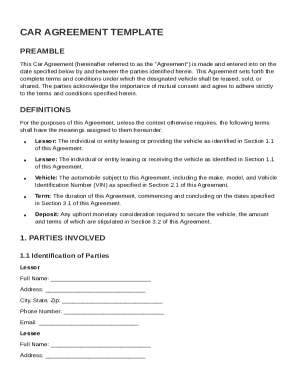

Preparing to apply for the lodging tax form

Before initiating the application process for the lodging tax form, accommodation providers must gather necessary information and documents. Essential data typically includes business entity details, revenue records, occupancy rates, and the proof of the correct lodging tax rate based on the locality. Preparing these details in advance can expedite the application process significantly.

Understanding local regulations

Awareness of local lodging tax laws is critical, as regulations can differ dramatically by state or municipality. For example, Delaware County has its own specific lodging tax rate and rules. Therefore, providers must review local ordinances to remain compliant.

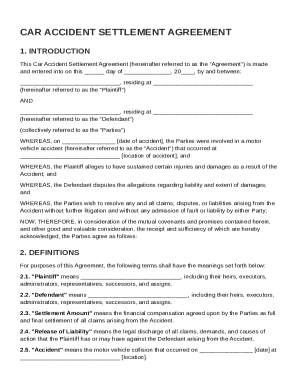

Step-by-step guide to completing the application for lodging tax form

Accessing the lodging tax form

To begin, lodging providers must access the appropriate lodging tax form online. Many local government websites offer downloadable PDFs or online filling options. Users can also utilize platforms like pdfFiller for easy access, editing, and secure submission of the application.

Filling out the application

Once in possession of the form, it is crucial to fill out each section accurately. This includes providing details regarding your lodging establishment, such as the name, address, and type of service offered. Make sure to include the correct lodging tax rate based on your locality. Users should avoid common mistakes such as incorrect calculations or incomplete fields.

Reviewing your application

Before submitting, it’s essential to double-check all information provided in the application. Errors can lead to delays in processing and potential issues with tax authorities. Review calculations, verify addresses, and ensure your contact information is correct.

Submitting the application

Upon completion and review of your application, the next step is submission. Depending on local regulations, lodging tax forms may be submitted online, via mail, or in person. It’s important to adhere to local deadlines to avoid penalties. Keeping track of submission receipts or confirmations is advisable for future reference.

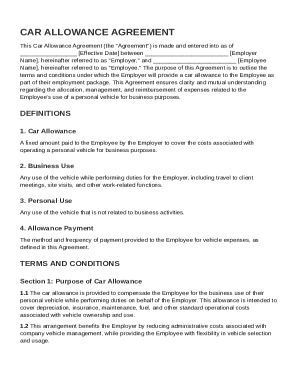

Managing your lodging tax obligations

Record-keeping best practices

Maintaining organized records is vital for any lodging provider. Essential documents include past tax returns, receipts of payments made, and occupancy records. Generally, it’s prudent to keep these records for at least seven years, as this is typically the timeframe in which tax authorities can audit lodging providers.

Tracking payments and filing deadlines

To ensure compliance and timely payments, lodging providers can utilize tools such as pdfFiller’s management features, which allow users to set reminders and track submissions. This proactive approach can significantly reduce the risk of missing critical filing deadlines.

FAQs about the lodging tax application process

Common questions from lodging providers

Some of the most frequent questions lodging providers face include what happens if a filing deadline is missed or whether lodging tax payments can be completed online. Generally, tax authorities offer potential remittance options, including online payment platforms, and clarify penalties that may arise from missed filings.

Clarifications on specific situations

Providers often inquire about potential exemptions for certain types of lodgings. For instance, smaller vacation rentals or accommodations that host guests for infrequent short stays might sometimes qualify for an exemption. Temporary closures or renovations may also influence tax responsibilities, but these situations typically require explicit communication with local tax authorities.

Related forms and interactions

Other tax forms for lodging providers

Lodging providers should also be aware of additional paperwork that may be required in conjunction with the lodging tax form. This can include business license applications and sales tax registrations. It’s vital to have a comprehensive understanding of the local tax landscape to ensure compliance across all areas.

Integrating your lodging tax form with other financial documents

The lodging tax form has implications beyond just local taxes. It often intersects with income tax and business taxes, so lodging providers should adeptly integrate these within their financial documentation. Thorough documentation can offer clarity during tax time and enable lodging providers to plan their tax strategies effectively.

Leveraging PDF editing tools for your lodging tax needs

Advantages of using pdfFiller for lodging tax forms

Using pdfFiller for lodging tax forms streamlines the application process significantly. This cloud-based platform offers powerful editing tools, e-signing capabilities, and collaborative features that enable lodging providers to manage documents efficiently. With robust functionalities, users can enjoy seamless access to forms and ensure all paperwork is compliant and complete.

User testimonials and success stories

Many users have shared positive experiences of how pdfFiller has simplified their tax documentation. From streamlined editing to collaborative insights, users praise the platform for transforming complex tax submission processes into manageable tasks. These testimonials reflect pdfFiller's role in enhancing productivity for lodging providers.

Contact information for further assistance

Where to seek help regarding lodging tax

For lodging providers seeking assistance with lodging tax forms, contacting local tax authorities or state tax offices is a great starting point. These entities can provide valuable resources, guidelines, and specific information customized to the user's locality.

How to reach pdfFiller support for document management queries

Users can easily contact pdfFiller customer support through their website for guidance on document management and specific functionalities. Comprehensive resources, FAQs, and support services are specifically designed to aid providers in leveraging the platform efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit application for lodging tax online?

Can I sign the application for lodging tax electronically in Chrome?

How do I edit application for lodging tax straight from my smartphone?

What is application for lodging tax?

Who is required to file application for lodging tax?

How to fill out application for lodging tax?

What is the purpose of application for lodging tax?

What information must be reported on application for lodging tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.