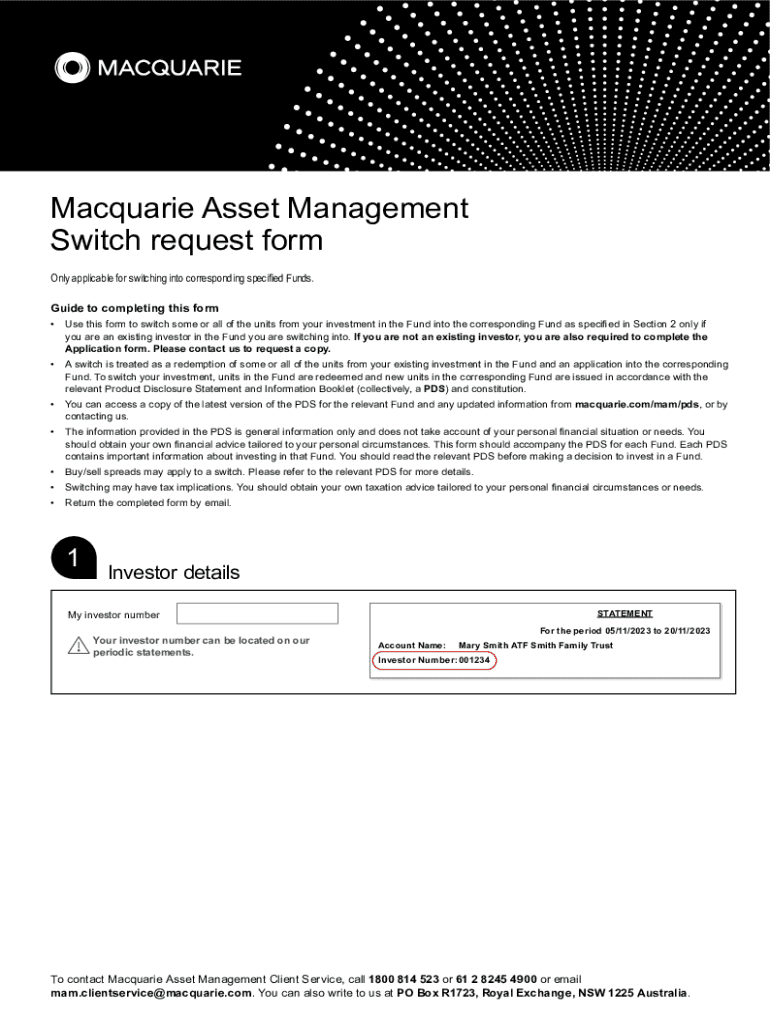

Get the free Macquarie Asset Management Switch request form

Get, Create, Make and Sign macquarie asset management switch

How to edit macquarie asset management switch online

Uncompromising security for your PDF editing and eSignature needs

How to fill out macquarie asset management switch

How to fill out macquarie asset management switch

Who needs macquarie asset management switch?

Macquarie Asset Management Switch Form How-to Guide

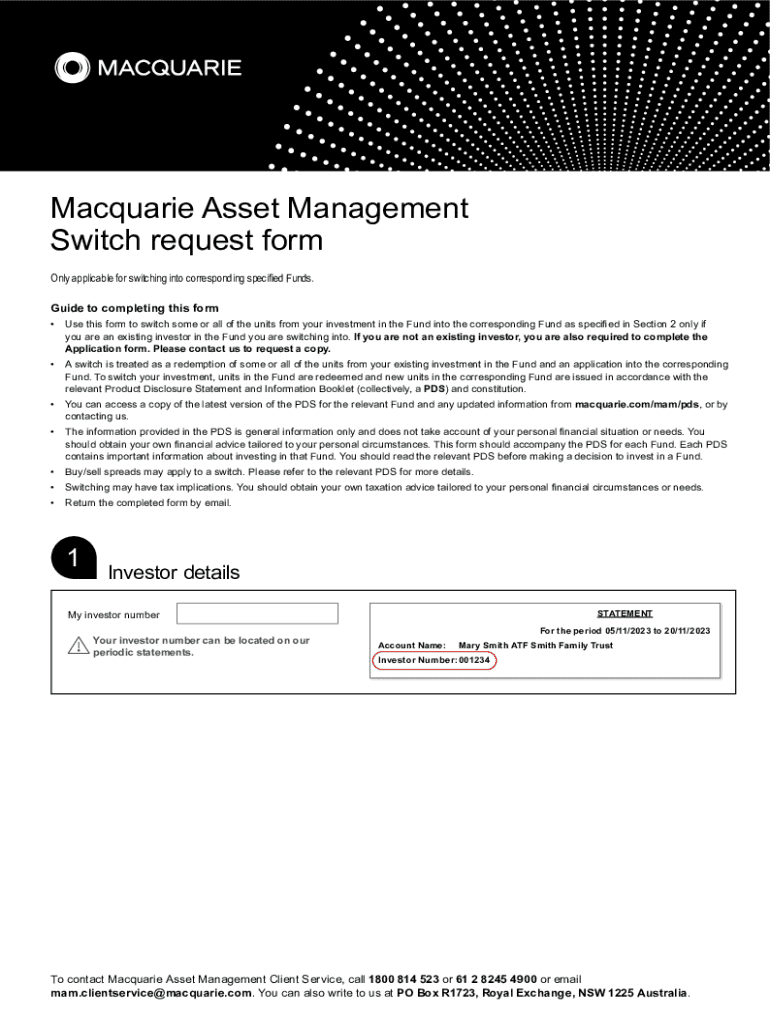

Understanding the Macquarie Asset Management Switch Form

The Macquarie Asset Management Switch Form is a critical document used to manage and modify investments within the Macquarie asset management framework. This form allows investors to switch between different funds or investment options within their portfolio efficiently. By providing a structured approach to asset management, the switch form plays an essential role in ensuring that investors can optimize their investment strategies according to changing market conditions or personal financial goals.

Understanding the importance of the switch form is vital for individuals and teams involved in asset management. It serves as a formal request for changes in investment allocations, making it a cornerstone for maintaining an organized and effective asset management strategy. Completing this form accurately can significantly impact investment growth, return on investment (ROI), and overall portfolio performance.

Who needs to use the switch form?

The switch form is primarily used by individuals and teams managing Macquarie assets, such as personal investors, financial advisors, and asset management professionals. There are several scenarios when using this form becomes necessary, including:

Accessing the Macquarie Asset Management Switch Form on pdfFiller

Accessing the Macquarie Asset Management Switch Form has never been easier thanks to pdfFiller's user-friendly platform. To find the form, follow this step-by-step guidance:

Using a cloud-based platform like pdfFiller also provides several advantages, such as the ability to access your documents from anywhere, collaborate with others in real-time, and save your progress automatically, ensuring that your work is never lost.

Detailed instructions for filling out the switch form

Completing the Macquarie Asset Management Switch Form requires careful attention to detail to ensure accuracy and compliance with investment guidelines. Here's how to do it step by step:

Gathering required information

Before you start filling out the form, gather the following necessary personal and financial details:

Step 1: Entering personal information

Begin by inputting your personal details, including your full name, address, and contact information. Be sure to double-check for any typos, as accuracy in this section is crucial for identification and communication purposes.

Step 2: Specifying your investment preferences

In this section of the form, you will select your desired investment preferences. Options may include asset types, fund selections, and percentage allocations. It’s essential to choose investments that align with your financial goals and risk tolerance.

Step 3: Understanding fee structures and terms

Before submitting the switch request, ensure you understand the associated fee structures and terms. This includes any fees for switching funds, potential tax implications, and how your choices may impact your investment's performance.

Step 4: Reviewing performance reports

Evaluating your current performance reports is essential before making any switches. Reviewing these reports can help you make informed choices about which assets to retain or switch, ensuring that your investment strategy remains optimized.

Editing and managing your switch form with pdfFiller

One of the significant advantages of using pdfFiller is its powerful suite of editing tools designed to make form management seamless. After accessing the switch form, here are features you can utilize:

Additionally, collaborating with team members becomes easier. You can share the form for review and approval, enabling multiple stakeholders to provide feedback and suggestions. The comments and feedback functions within pdfFiller ensure that everyone stays on the same page throughout the process.

Signing and submitting the switch form

After completing the switch form, it’s time to sign and submit it. Here’s how to do it:

eSigning the document

To electronically sign the switch form, you can use pdfFiller’s eSigning feature. Simply click on the designated signature field, integrate your eSignature, and place it accurately. Make sure you are comfortable with the legal implications of using an eSignature, as it carries the same validity as a handwritten signature.

Finalizing your submission

Once you have signed the form, it’s crucial to save your work and submit it officially. pdfFiller provides a clear pathway for submission and even allows you to track the status of your submission to ensure that your request is processed timely.

Frequently asked questions about the Macquarie Asset Management Switch Form

As with any financial documentation process, questions may arise. Here are some common issues and resolutions regarding the Macquarie Asset Management Switch Form:

Common issues and resolutions

Common problems during the completion process include missing information or misunderstanding the instructions. Ensure that you carefully read each section of the form to avoid errors. If unsure about any details, consult with a financial advisor for assistance.

Tips for a successful switch

To ensure a smooth transition when submitting your switch form, consider these best practices:

Key takeaways for effective management of your assets

Managing your assets effectively requires diligence and regular reviews of your investment options. The following points emphasize the importance of this process:

Being proactive in managing your investments through the Macquarie Asset Management Switch Form can help set you on a path to financial success. Utilize the features available on pdfFiller to enhance your document management experience, ensuring that you remain in control of your investment journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send macquarie asset management switch for eSignature?

How do I edit macquarie asset management switch straight from my smartphone?

How do I edit macquarie asset management switch on an iOS device?

What is macquarie asset management switch?

Who is required to file macquarie asset management switch?

How to fill out macquarie asset management switch?

What is the purpose of macquarie asset management switch?

What information must be reported on macquarie asset management switch?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.