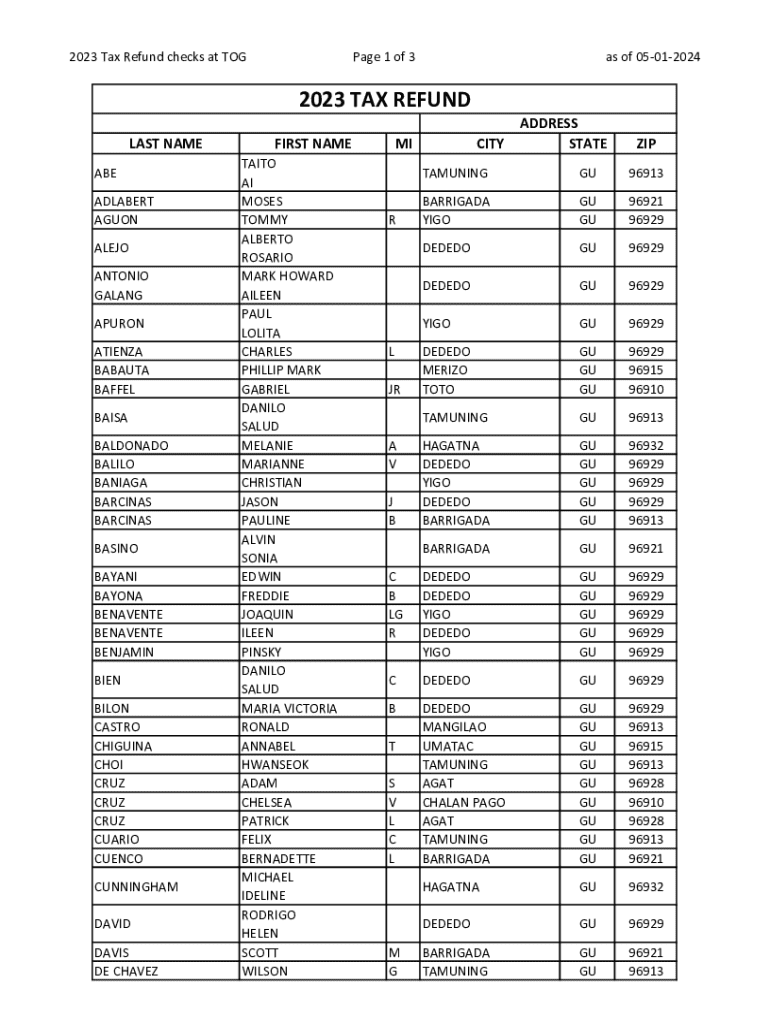

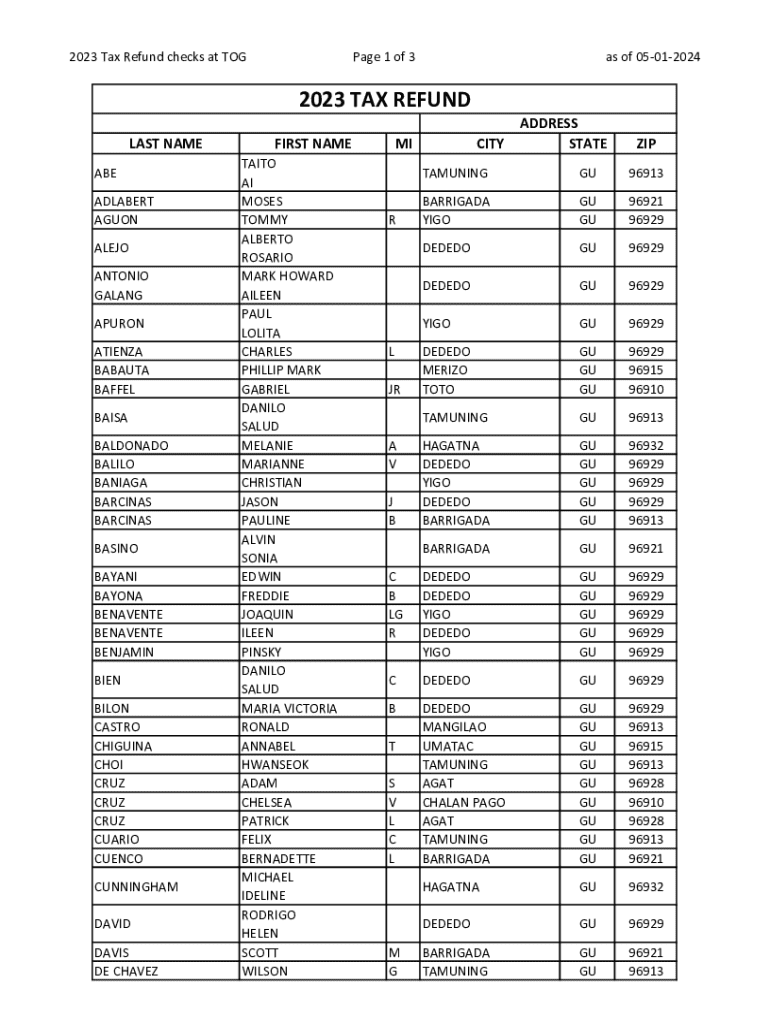

Get the free 2023 TAX REFUND - doa guam

Get, Create, Make and Sign 2023 tax refund

Editing 2023 tax refund online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 tax refund

How to fill out 2023 tax refund

Who needs 2023 tax refund?

2023 Tax Refund Form: A Comprehensive Guide

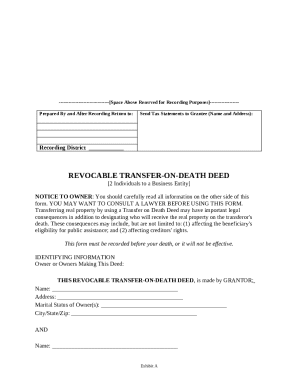

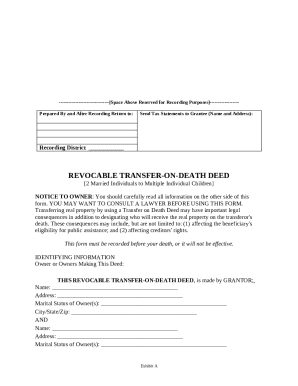

Understanding the 2023 tax refund form

The 2023 tax refund form is critical for taxpayers looking to claim their refunds accurately and efficiently. As tax laws and regulations can frequently change, it's essential to understand the processes involved in filing for a refund this year. This year's tax refund process emphasizes accuracy and thorough documentation, ensuring that taxpayers do not miss out on valuable credits or deductions.

Essentially, filing the correct 2023 tax refund form not only helps you receive your due refund but also avoids delays that could result from inaccurate submissions. A robust knowledge of the modifications surrounding the tax refund process this year can make a notable difference in how swift your reimbursement arrives. These changes include updates to tax brackets, additional deductions, and new eligibility criteria for certain credits.

Important information regarding the 2023 tax refund form

Eligibility for a tax refund in 2023 is primarily determined by your income level, tax paid, and any refundable tax credits you may qualify for. Taxpayers should be aware that several changes have taken place regarding what constitutes qualifying income and the limits for allowable deductions. For instance, updates surrounding family credits and healthcare-related deductions are noteworthy.

As you prepare your 2023 tax refund form, it’s vital to familiarize yourself with the types of refunds available. This includes unemployment refunds, earned income tax credit (EITC), and credits for education expenses. Importantly, common mistakes can easily derail your entire refund process. For instance, neglecting to include all necessary income documentation or miscalculating your credits can lead to significant delays or denials of your refund claim.

Quick links

For users ready to access everything they need regarding the 2023 tax refund form, the following links are vital:

Resources for filing your 2023 tax refund form

If you are looking for more information on how to file your 2023 tax refund form, the IRS provides a wealth of resources. These resources include comprehensive guides on tax preparation and tax law updates so taxpayers can stay informed throughout the year.

Additionally, recommended tax preparation software can simplify the process of filling out your refund application. Many of these programs not only assist in completing the forms but also offer additional documentation management capabilities and direct filing options. Furthermore, a variety of educational infographics and videos are available to help demystify the tax filing process.

Step-by-step guide to filling out the 2023 tax refund form

Filing your 2023 tax refund form can feel daunting, but breaking it down into manageable steps can simplify the process. Follow this structured guide to help ensure that your form is completed correctly and submitted on time.

Step 1: Gather necessary documentation

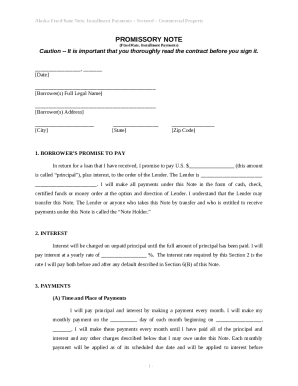

Begin by gathering all necessary documentation that supports your income and eligibility for refunds. This includes W-2 forms from employers, 1099s for freelance work, and other income statements, which will provide a clear record of your earnings for the year. Additionally, documentation related to deductions and credits—such as mortgage interest statements, medical expenses, and education costs—should be compiled as well.

Step 2: Completing the form

Once you have all corresponding documentation, start filling out the 2023 tax refund form. Pay particular attention to each section of the form, as it will have specific line items for the information you’ve gathered. Common line items to be aware of include total income earned, various deductions, and tax credits, each vital for the accurate calculation of your tax liability and refund.

Step 3: Review and double-check your entries

After completing the form, it is essential to carefully review your entries. Double-check mathematical calculations and ensure every line item matches the corresponding documentation to avoid any discrepancies, which can lead to delays in processing. Utilizing tools that assist in reviewing your tax forms can significantly reduce the risk of errors.

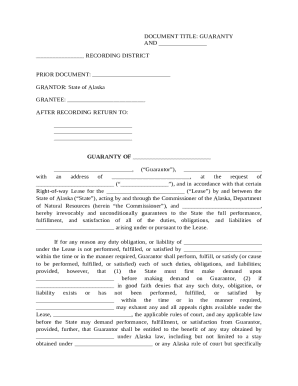

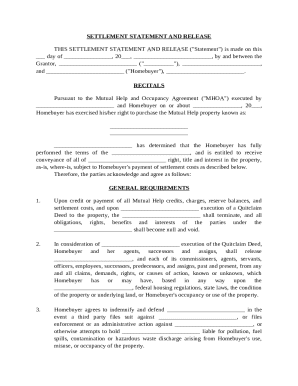

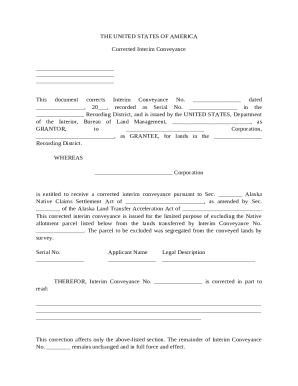

Seamless eSigning and document management

Today, the convenience of eSigning your 2023 tax refund form online cannot be overstated. Various online platforms facilitate easy eSignature solutions, allowing you to sign the form without needing to print it. This not only saves time but also ensures that your documents remain organized and readily accessible.

Furthermore, collaborating with tax professionals has never been easier thanks to cloud-based document management solutions like pdfFiller. These platforms allow users to share their tax forms securely and make necessary adjustments in real time. Meanwhile, securely storing all tax documentation in the cloud ensures that they are safe, organized, and available when needed.

Submitting your 2023 tax refund form

Submitting your completed 2023 tax refund form is the next critical step in securing your refund. You can choose between e-filing or paper filing. E-filing is generally faster and eliminates the risk of mail delays, as the IRS typically processes electronic submissions more quickly.

It’s crucial to adhere to the deadlines for filing your taxes in 2023, as late submissions can result in penalties. For those opting for paper filing, it’s also important to send your forms to the correct IRS address to ensure they are processed efficiently.

Tracking your refund status

Once you’ve submitted your 2023 tax refund form, tracking the status of your refund becomes essential. You can easily check your tax refund status on the IRS website or through their official mobile app. These tools usually provide real-time updates on where your refund is in the process, which can help mitigate any concerns about the timing of your reimbursement.

If your tax refund is delayed, understanding the reasons behind the delay is crucial. Common issues might include discrepancies in the information submitted, outstanding tax liabilities, or additional documents needed to process your claim. Knowing how to resolve these issues can save time and stress.

Addressing common issues with tax refund claims

After filing, it’s essential to be prepared for possible issues that may arise with your tax refund claim. If your claim is denied for any reason, the first step is to understand the reason for the denial and how to respond adequately. Common reasons for denials include incorrect information or missing documentation that the IRS requires.

Furthermore, in cases where disputes with the IRS occur—whether regarding the denials or other issues—knowing when and how to contact the IRS can expedite the resolution process. The IRS offers various channels for communication, including phone calls, online inquiries, and even local offices. Maintaining a systematic approach will aid you in resolving any complications seamlessly.

Conclusion: Final thoughts on using the 2023 tax refund form

In conclusion, using the 2023 tax refund form effectively requires careful planning and an understanding of the entire refund application process. By leveraging tools like pdfFiller for seamless document management and eSigning, you can streamline your filing experience, ensuring that your tax forms are accurate and submitted on time.

It’s crucial to think proactively about tax planning for future years. Staying updated with tax law changes and compliance requirements will not only prepare you for upcoming tax seasons but also help you capitalize on every opportunity for refunds down the line.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2023 tax refund online?

How do I edit 2023 tax refund straight from my smartphone?

Can I edit 2023 tax refund on an Android device?

What is 2023 tax refund?

Who is required to file 2023 tax refund?

How to fill out 2023 tax refund?

What is the purpose of 2023 tax refund?

What information must be reported on 2023 tax refund?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.