Get the free Application of Non-Resident Fiduciary to Deposit Assets ...

Get, Create, Make and Sign application of non-resident fiduciary

How to edit application of non-resident fiduciary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application of non-resident fiduciary

How to fill out application of non-resident fiduciary

Who needs application of non-resident fiduciary?

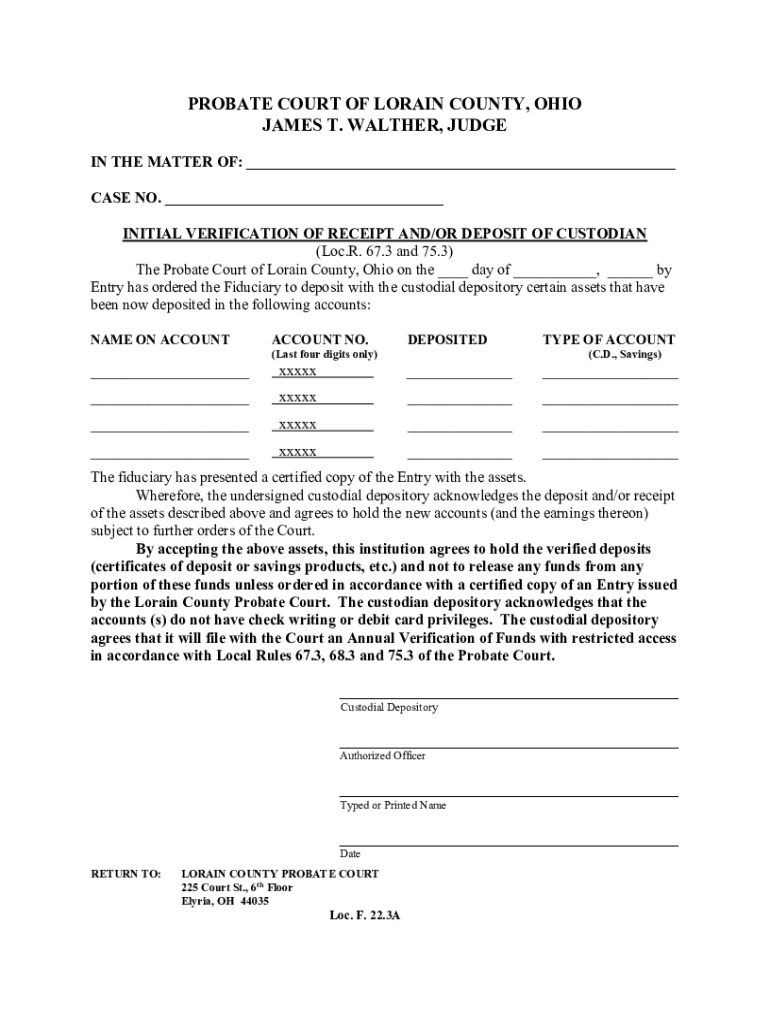

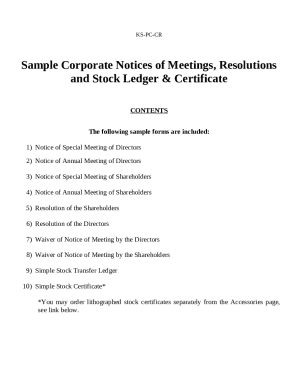

Application of Non-Resident Fiduciary Form

Understanding the non-resident fiduciary form

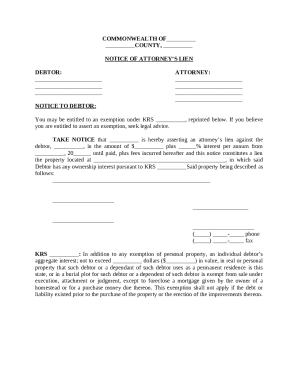

A non-resident fiduciary is an individual or entity that manages the assets of another person or estate but does not reside in the jurisdiction where the estate is located. This status is crucial because it can significantly influence how estates are handled in terms of law and taxation. By designating a non-resident fiduciary, beneficiaries may navigate regulations that pertain to out-of-state investments and estates.

The purpose of the non-resident fiduciary form is to establish legal recognition of the fiduciary’s role and responsibilities regarding the estate. This form serves as an essential document in various financial and legal contexts, especially in estate management, where clear delineation of authority and accountability is necessary.

Key components of the non-resident fiduciary form

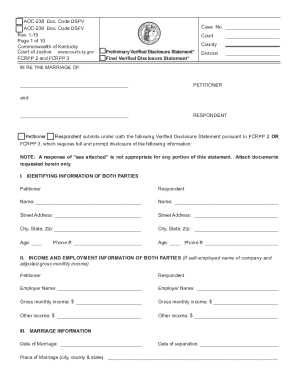

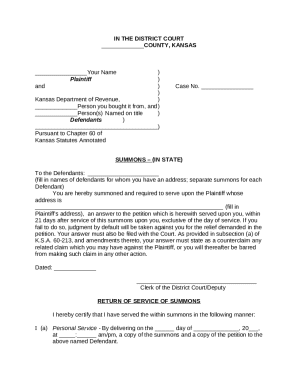

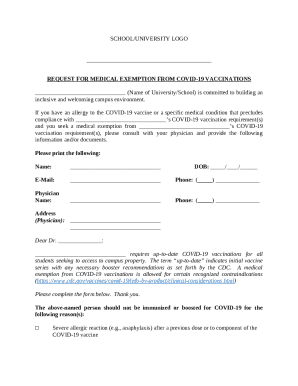

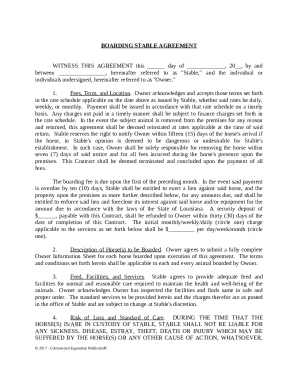

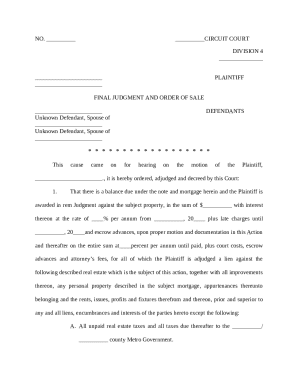

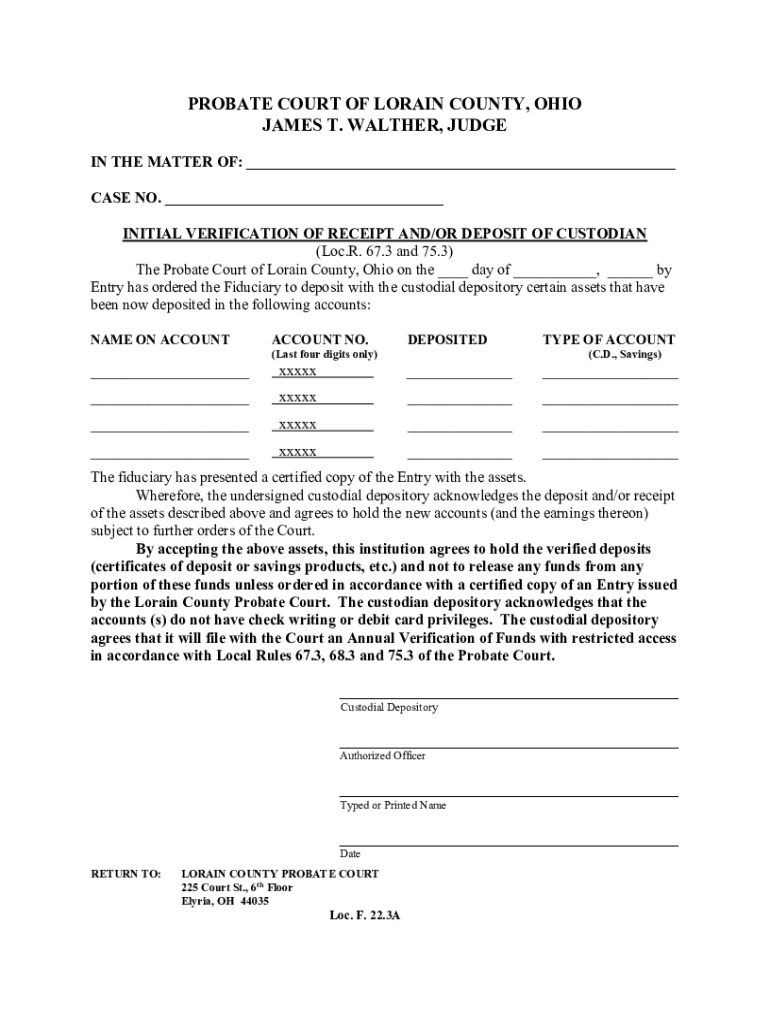

The non-resident fiduciary form includes several essential elements that clarify the relationships between the involved parties and the estate itself. Key components typically consist of the names and identifiers of the fiduciary and the beneficiaries, as well as important details about the property or estate being managed, such as its location, value, and relevant governing laws.

Alongside the form, certain supporting documentation is often required. This can include wills, death certificates, proof of residency for the fiduciary, and any previous court orders related to the estate. Ensuring that all documentation is accurate and comprehensive is vital for the legal validity of the form and subsequent actions concerning the estate.

Step-by-step guide to completing the non-resident fiduciary form

Completing the non-resident fiduciary form involves several steps, beginning with gathering necessary information. This part entails identifying all personal information for each party involved, as well as understanding the basics of the estate or assets, including their current valuation and any existing debts.

Filling out the form requires attention to detail in each section. Start with the heading and contact information, ensuring that all names and addresses are spelled correctly. Then, designate fiduciary responsibilities clearly, including specific tasks the fiduciary is expected to execute. Lastly, signatures must be collected from relevant parties, with notarization requirements fulfilled to enhance the form’s validity.

Common mistakes when filling out this form include misidentifying parties, omitting essential details, or failing to notarize the document. Performing validity checks helps ensure the form is complete and ready for submission, thereby preventing delays and complications down the line.

Finalizing and submitting the non-resident fiduciary form

Before submitting the non-resident fiduciary form, it’s crucial to review and edit the document carefully. Proofreading helps catch errors that might have been overlooked, ensuring that all information is accurate. Tools like pdfFiller offer editing features that simplify this process, allowing users to revise and collaborate effectively with other stakeholders.

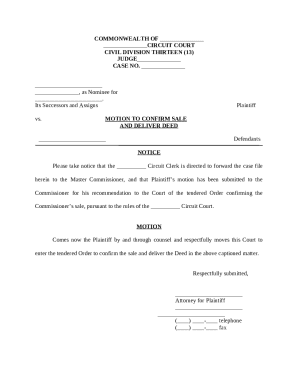

The submission process typically involves filing with the appropriate authorities, which may vary by jurisdiction. Understanding the timeline for submission is also key, as it affects how promptly the estate can be administered. A proper follow-up procedure after submission can ensure transparency and that all parties are informed throughout the process.

Managing your non-resident fiduciary documents post-submission

Once submitted, managing fiduciary documents effectively is essential for the ongoing administration of the estate. Best practices for document management include organizing and securely storing all relevant documents. Digital solutions such as cloud storage ensure accessibility while enhancing security measures to protect sensitive information.

Collaboration with legal and financial advisors is simplified through platforms like pdfFiller. Users can share documents easily with stakeholders, facilitating communication and updates in real-time. Interactive tools improve efficiency, ultimately ensuring that fiduciaries can fulfill their roles without excessive delays or confusion.

The role of pdfFiller in streamlining your document processes

pdfFiller plays a pivotal role in managing non-resident fiduciary forms through its variety of powerful document management features. The platform enables seamless editing, e-signing, and collaboration on fiduciary documents without the need for physical paperwork. This simplifies the entire process, particularly for individuals managing multiple estates or trusts across different jurisdictions.

User testimonials highlight how pdfFiller has transformed document workflows for fiduciaries. Many have experienced significant time savings and reduced stress levels by leveraging the platform's capabilities, underscoring the advantages of adopting digital solutions for fiduciary responsibilities.

Frequently asked questions about the non-resident fiduciary form

Several key questions frequently arise in regard to the application of the non-resident fiduciary form. One common query is who needs to utilize this form — typically, those managing estates or trusts located in one state, while residing in another. Additionally, inquiries about the consequences related to improper filing are essential. Failing to complete the form properly may result in legal complications, including delays in asset distribution and potential penalties.

Lastly, many fiduciaries wonder how pdfFiller can assist. The platform offers various tools designed to facilitate the management of fiduciary documents. Understanding specific state regulations for non-resident fiduciaries is also vital, as these can showcase differing requirements or processes that need attention.

Additional considerations and tips

Recognizing the moments when professional help becomes necessary is a vital component of managing fiduciary duties. Depending on the complexity of the estate or specific legal challenges, engaging the services of an attorney or a financial advisor may be advisable. Additionally, it’s crucial to stay informed about regulatory changes that may affect fiduciaries. Laws can evolve, making it necessary for fiduciaries to adapt their practices accordingly to remain compliant.

By prioritizing ongoing education and understanding complex scenarios, fiduciaries can effectively manage their responsibilities and protect beneficiaries’ interests. Consider leveraging resources available through platforms like pdfFiller for ease in document management and enhanced collaboration capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application of non-resident fiduciary for eSignature?

How do I fill out the application of non-resident fiduciary form on my smartphone?

How do I fill out application of non-resident fiduciary on an Android device?

What is application of non-resident fiduciary?

Who is required to file application of non-resident fiduciary?

How to fill out application of non-resident fiduciary?

What is the purpose of application of non-resident fiduciary?

What information must be reported on application of non-resident fiduciary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.