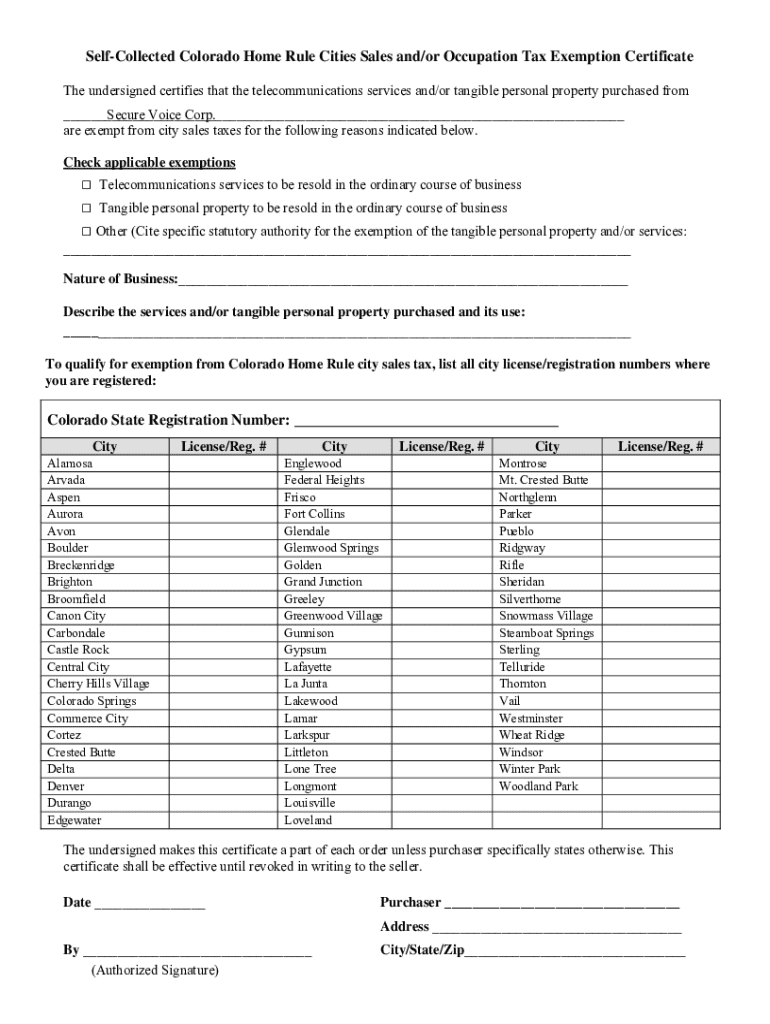

Get the free Self-Collected Colorado Home Rule Cities Sales and/or Occupation Tax Exemption Certi...

Get, Create, Make and Sign self-collected colorado home rule

Editing self-collected colorado home rule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out self-collected colorado home rule

How to fill out self-collected colorado home rule

Who needs self-collected colorado home rule?

Understanding the Self-Collected Colorado Home Rule Form

Understanding home rule in Colorado

Home rule in Colorado refers to the authority granted to local governments to self-govern and enact their own regulations and policies, separate from state law. This system empowers cities and towns to tailor their governance to meet the specific needs of their communities, providing more localized control over issues such as taxation, zoning, and public services.

The significance of home rule cannot be overstated. It allows local jurisdictions to address unique challenges and is a vital aspect of Colorado’s government structure. Home rule entities can levy sales and use tax as needed, which can vary significantly even within short distances, catering to regional economic dynamics.

There’s a key distinction to note between home rule and statutory cities. While statutory cities operate under state laws and have limited regulatory powers, home rule municipalities have the flexibility to create charters and ordinances that govern locally. This autonomy has a historical backdrop, which evolved from the early 1900s when municipalities sought greater self-determination in Colorado's governance structure.

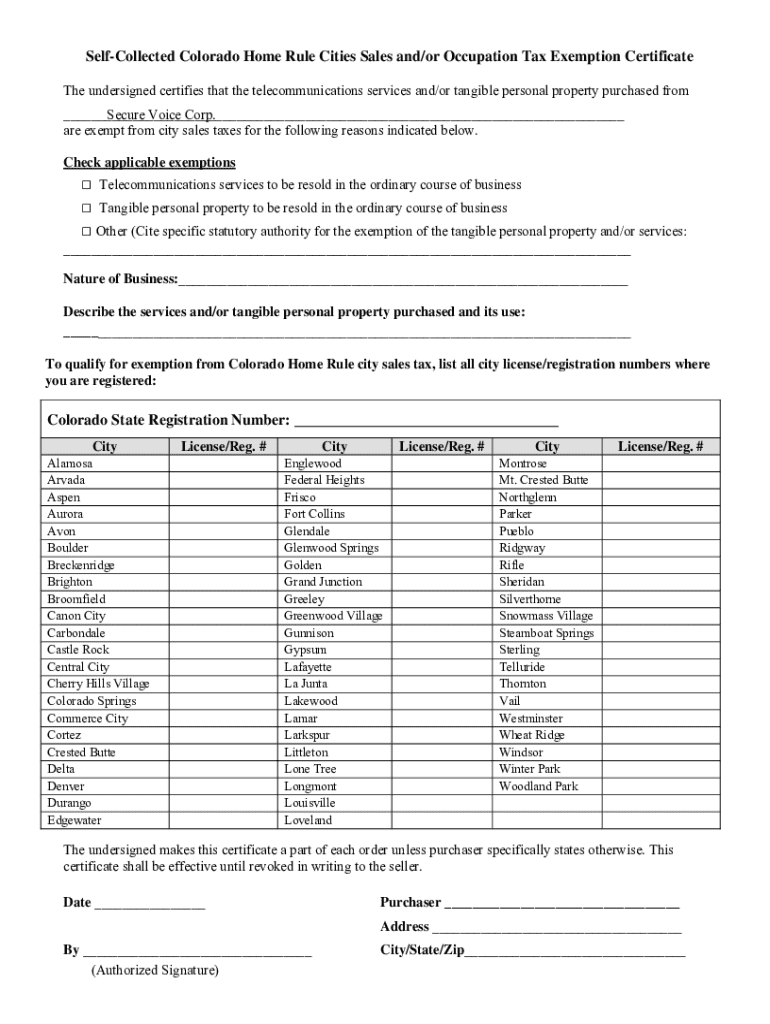

The self-collected home rule form: An overview

The self-collected Colorado home rule form serves a crucial purpose in the governance of home rule cities. This form allows these municipalities to report and manage their own collection of sales and use tax, ensuring compliance with local and state regulations. The functionality of this form streamlines the financial operations of a city by centralizing tax reporting responsibilities.

Who must use this form? Essentially, any municipality recognized as a home rule city in Colorado that collects its sales and use taxes must complete the self-collected home rule form. This includes charter cities that have the authority to operate independently in tax matters. The legal implications of this self-collection are significant; it means that these municipalities have a direct responsibility to manage their tax structures, which includes determining rates and administering compliance.

Key features of the self-collected home rule form

The self-collected home rule form is designed with comprehensive elements that facilitate tax management. It consists of various sections and fields, each serving a distinct purpose. Understanding these components ensures municipalities can accurately report their tax collections.

Key components of the form include fields for local tax rates and structures, alongside additional identifying information about the jurisdiction. Some sections are mandatory, such as those requiring details on collected sales taxes and use taxes, while others may be optional, providing space for supplementary information that could aid in clarifying reporting intentions.

Step-by-step guide to completing the self-collected home rule form

Completing the self-collected Colorado home rule form requires systematic preparation. Start by gathering necessary documentation, including previous tax returns and local jurisdiction details, which are essential for filling out the form accurately.

When filling out the form, follow these steps for clarity and precision:

Be mindful of common pitfalls such as providing incorrect tax rates or omitting essential information, both of which can delay processing or result in rejection of the form.

Editing the self-collected home rule form with pdfFiller

Using pdfFiller for editing the self-collected Colorado home rule form can streamline the process significantly. The platform offers a variety of tools that facilitate editing, from annotative capabilities to text adjustments, making it easier to ensure all information is accurate and up-to-date.

To upload and edit your form on pdfFiller, follow these straightforward steps:

eSigning the home rule form

Electronic signatures are integral in modern document processing and add a layer of efficiency to the submission of the self-collected Colorado home rule form. eSignatures ensure documents are legally binding while providing convenience in scenarios where physical signatures may delay processing.

To eSign the self-collected home rule form using pdfFiller, follow this simplified approach:

Strategies for managing and submitting the self-collected home rule form

Effective submission of the self-collected Colorado home rule form requires clear strategies. After completing and editing your document, the next step is uploading the form to the relevant authority for processing. Each municipality has specific guidelines for submission that must be followed to avoid any issues.

Tracking your submission status can also alleviate anxiety regarding processing delays. Here are best practices to follow in managing your submissions:

Frequently asked questions about the self-collected home rule form

Navigating the self-collected home rule form can raise several questions, especially during the submission process. Individuals may encounter issues, such as incorrectly filled forms or missing information that could lead to rectifications being necessary. Understanding common rejection reasons and remedies can streamline this process.

Here are some typical FAQs and their insights:

Interactive tools and resources on pdfFiller

One of the standout features of pdfFiller is its array of interactive tools designed to streamline document management. Utilizing these tools enhances the efficiency of filling out, editing, and submitting the self-collected home rule form.

Additionally, pdfFiller provides access to various additional templates and resources relevant to Colorado’s home rule that can facilitate even smoother navigation. Here are some user-friendly features available on the platform:

Real-life case studies: Successful implementation of the home rule form

Examining real-life examples of Colorado home rule cities provides valuable insight into the benefits and challenges of implementing the self-collected home rule form. Many municipalities have successfully navigated issues by leveraging their home rule status to optimize local tax administration.

For instance, a well-known home rule city was able to enhance compliance and revenue collection through adopting updated tax reporting processes, resulting in a notable increase in their municipal tax revenue. Learning from such cases can be instrumental for other cities striving to improve their local governance.

Maintaining compliance with ongoing changes in home rule regulations

As Colorado's tax laws and home rule regulations continue to evolve, it is imperative for municipalities to stay informed about these changes. Regular review and updates to the self-collected home rule form submission process are crucial for ongoing compliance.

Municipal officers and teams should monitor legislative updates closely, ensuring they adjust their tax structures and reporting accordingly to avoid penalties. This proactive approach will safeguard local revenue and uphold the integrity of the home rule system.

Getting help: Where to find support for your home rule queries

Navigating the complexities of the self-collected Colorado home rule form can sometimes be overwhelming. Fortunately, numerous resources are available for those seeking assistance or clarification.

From contacting local tax authorities to utilizing customer support features on pdfFiller, help is readily available. Engaging in community forums can also connect local government personnel for shared advice and solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the self-collected colorado home rule in Chrome?

How can I edit self-collected colorado home rule on a smartphone?

How can I fill out self-collected colorado home rule on an iOS device?

What is self-collected colorado home rule?

Who is required to file self-collected colorado home rule?

How to fill out self-collected colorado home rule?

What is the purpose of self-collected colorado home rule?

What information must be reported on self-collected colorado home rule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.