Get the free 28 30 1S W

Get, Create, Make and Sign 28 30 1s w

Editing 28 30 1s w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 28 30 1s w

How to fill out 28 30 1s w

Who needs 28 30 1s w?

A comprehensive guide to the 28 30 1s W Form

Understanding the 28 30 1s W Form

The 28 30 1s W Form is a crucial document used primarily in the context of employment and tax withholding. It serves to officially communicate an employee's withholding allowances to their employer, which directly influences the amount withheld from their paycheck for income tax purposes. By accurately filling out this form, employees ensure that they are neither overpaying nor underpaying their taxes.

The importance of the 28 30 1s W Form extends beyond mere compliance; it plays a vital role in document management and employee tax planning. Employers rely on the information within this form to calculate the appropriate withholding amounts based on the employee's claims regarding their marital status and the number of allowances they can take. Thus, the form safeguards both the interests of the employee and employer.

Key features of the 28 30 1s W Form include sections for personal information, employment details, and specific instructions on how to determine the withholding allowances. Understanding these features is essential for accurate completion.

Who should use the 28 30 1s W Form?

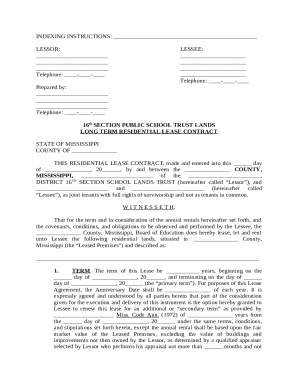

The 28 30 1s W Form is primarily designed for two target audiences: individuals and teams or organizations. Individual users, particularly new employees or those undergoing changes in their personal or financial status, will find this form vital for ensuring correct tax withholding.

Teams and organizations, on the other hand, need to ensure that all their employees have properly completed this form to guarantee compliance with tax regulations. This includes situations such as employment changes, where an employee needs to update their allowances, or during significant life events like marriage or having a child, which can affect the number of withholding allowances claimed.

How to access the 28 30 1s W Form

Accessing the 28 30 1s W Form is straightforward, particularly through the user-friendly platform pdfFiller. The process begins by locating the form on the pdfFiller website. Simply type '28 30 1s W Form' in the search bar, and it will lead you to the template.

Once located, downloading the form is as simple as a click of a button. Here’s a quick step-by-step guide:

If you prefer alternative methods, the form is also available through IRS resources or can be obtained directly from your employer’s HR department.

Filling out the 28 30 1s W Form

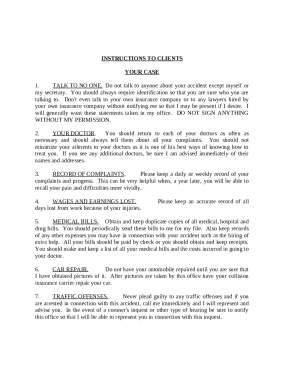

Filling out the 28 30 1s W Form correctly is essential for ensuring accurate tax withholding. Each section of the form must be approached with care. Begin with your personal information, including your name, address, and Social Security number. This section is vital as it identifies you to your employer and the IRS.

Next, complete the employment details section, indicating your job title and the start date of your employment. Follow this with the withholding allowance clauses, where you'll need to calculate the number of allowances you’re claiming. This can often involve personal considerations such as your spouse's job status or how many dependents you have.

Common mistakes to avoid include incorrect personal details or miscalculating allowances, both of which can lead to incorrect withholding amounts. To ensure accuracy, consider reviewing the legal requirements associated with tax withholding or seeking guidance from a tax professional if needed.

Editing the 28 30 1s W Form

Editing the 28 30 1s W Form is simple with pdfFiller's extensive editing tools. To begin, import the PDF form into the pdfFiller platform. This allows you to edit or add information easily. The editing tools facilitates text changes, signature applications, and even collaborative comments.

Collaborating with team members also becomes easier with pdfFiller. Once the form is edited, you can share the document directly with colleagues or superiors. The platform allows tracking of changes and comments, making it easier to finalize the document before submission.

Signing the 28 30 1s W Form

After filling out the 28 30 1s W Form, you'll need to sign it. pdfFiller provides various digital signature options, allowing you to eSign the document easily. Applying your signature is straightforward; simply select the signature tool and follow the prompts.

If you're working in a team setting, coordinating the signing process is seamless. Ensure that each team member knows how to apply their signature using pdfFiller, which can also facilitate group signing if needed.

Managing the 28 30 1s W Form after completion

Once you’ve completed and signed the 28 30 1s W Form, proper storage and organization are crucial. pdfFiller offers various options for managing your documents, allowing you to store the final document securely in the cloud. This ensures it’s accessible whenever needed.

Sharing the final document with employers or clients is also straightforward. The platform allows you to send an email directly from pdfFiller or download the document for offline sharing. Understanding your rights and obligations after submission is vital; retaining a copy of your submitted form can help in case of discrepancies in future tax filings.

Updates and changes to the 28 30 1s W Form

Staying informed about updates and changes to the 28 30 1s W Form is essential for ensuring compliance. The IRS periodically revises forms to reflect new tax laws or requirements. Users should keep an eye out for updates announced on the IRS website or through trusted tax professionals.

Recent changes may affect how withholding allowances are calculated, impacting the final withholding amounts reported on your paycheck. Understanding these implications ensures you are aware of any adjustments that may affect your financial planning.

Frequently asked questions (FAQs) about the 28 30 1s W Form

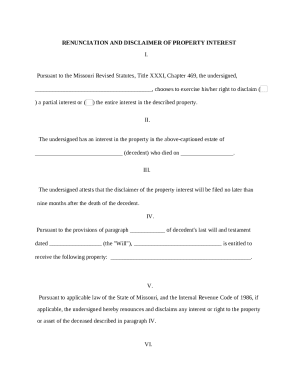

Common concerns surrounding the 28 30 1s W Form often deal with who is required to file it and whether it can be submitted electronically. Generally, individuals who have had a change in their employment status or personal circumstances should fill out this form. It is also important to realize that yes, the form can often be submitted electronically through platforms like pdfFiller.

Clarifying misconceptions is key; many believe that only new employees need to submit the form. However, changes such as marriage or a second job can also trigger the need for a new submission. For those seeking additional support or clarification, industries related to tax preparation can provide invaluable resources.

Conclusion: maximizing your experience with the 28 30 1s W Form

In summation, navigating the 28 30 1s W Form need not be a daunting task. By understanding its purpose and features, users can effectively manage their withholding allowances and ensure compliance with necessary tax obligations. Leveraging tools available on pdfFiller enhances the experience, providing a comprehensive solution for document management.

By taking the time to fill out, edit, and manage documents on pdfFiller, users not only streamline their tax processes but also empower themselves with knowledge about their financial responsibilities. This proactive approach to using the 28 30 1s W Form can make a significant difference in overall tax planning and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 28 30 1s w in Gmail?

How do I execute 28 30 1s w online?

How do I make edits in 28 30 1s w without leaving Chrome?

What is 28 30 1s w?

Who is required to file 28 30 1s w?

How to fill out 28 30 1s w?

What is the purpose of 28 30 1s w?

What information must be reported on 28 30 1s w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.