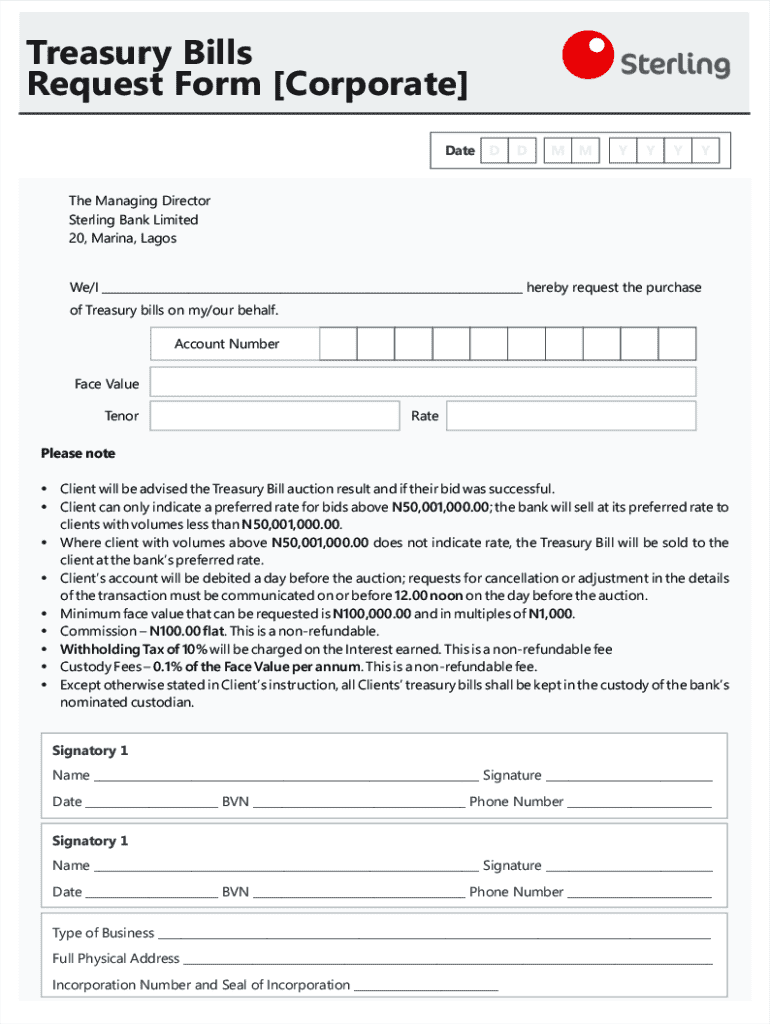

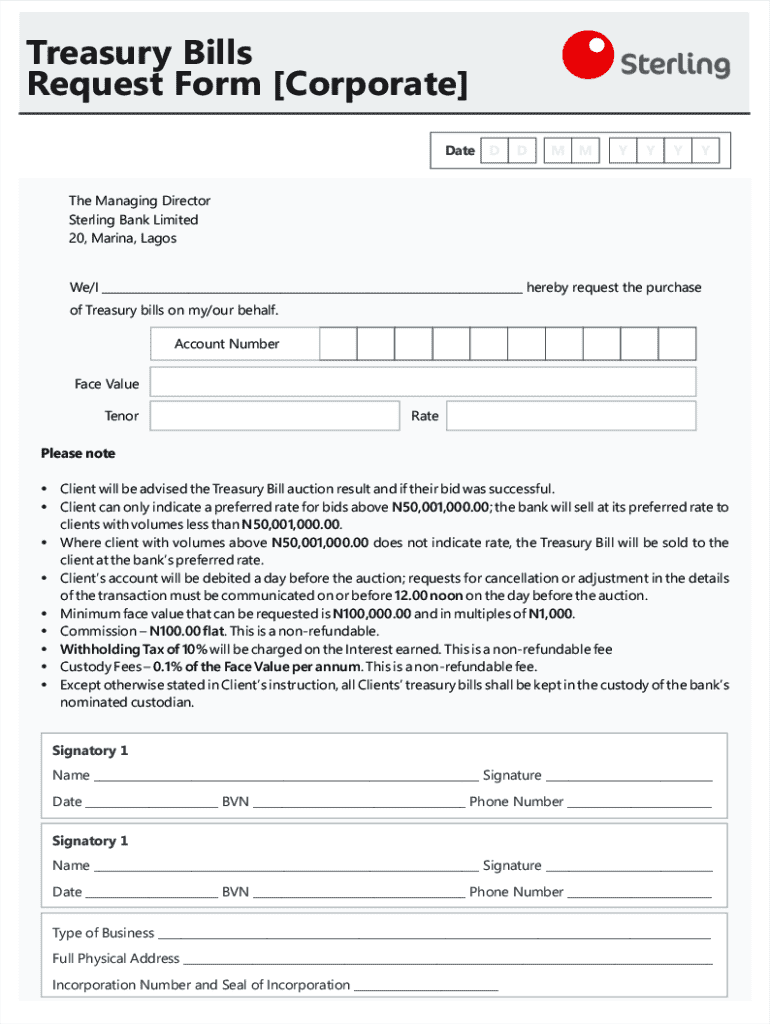

Get the free Treasury Bills Request Form Corporate.cdr

Get, Create, Make and Sign treasury bills request form

How to edit treasury bills request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out treasury bills request form

How to fill out treasury bills request form

Who needs treasury bills request form?

Navigating the Treasury Bills Request Form: A Complete Guide

Understanding treasury bills

Treasury bills, commonly known as T-Bills, are short-term securities issued by the U.S. Department of the Treasury to help finance government spending. These debt instruments are sold at a discount and do not pay interest in the traditional sense; instead, investors receive the face value upon maturity. The purpose of T-Bills is crucial: they provide a low-risk investment avenue, cater to conservative investors, and serve as a benchmark for short-term interest rates.

T-Bills are generally available in various maturities, covering periods from a few days up to a year. Their importance in investment lies in their safety and the liquidity they offer; they can easily be bought or sold on the secondary market. As such, they fit seamlessly into the portfolios of both individual investors and larger institutions, often serving as a foundation for more diversified investment strategies.

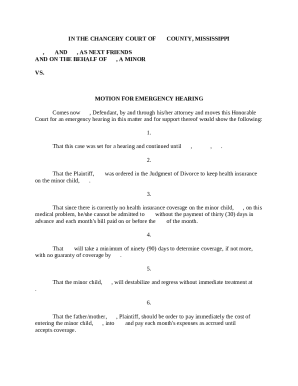

Treasury bills request form overview

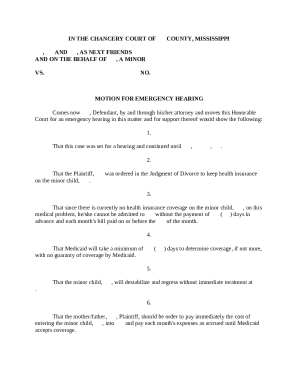

The Treasury Bills Request Form is a vital document for anyone looking to purchase T-Bills directly from the U.S. government. Its main purpose is to facilitate the buying process, allowing investors to specify their preferences and financial details. Specifically, individual and institutional investors, financial advisors, and organizations aiming to allocate capital into Treasury Bills are the primary users of this form.

Commonly, the form is used in various transactions, such as requests for new purchases, exchanges, or reinvestments. Investors must carefully complete this form as part of the process to ensure clarity and accuracy in their requests. Submitting the Treasury Bills Request Form is generally the first step in acquiring these secure investments, as the process adheres to structured timelines dictated by the Treasury’s auction schedules.

Accessing the treasury bills request form

The Treasury Bills Request Form can be easily accessed through various online resources, primarily on official government websites like . This site provides a user-friendly interface where investors can find necessary forms and detailed instructions regarding their completion, including essential links and contact information for support.

pdfFiller offers a convenient solution, making it simpler for users to obtain the Treasury Bills Request Form. With pdfFiller, users can not only access the form but also edit, fill, sign, and share it with ease. The platform allows for electronic document management, ensuring efficient processing and storage of vital forms like the Treasury Bills Request Form.

Detailed instructions for filling out the form

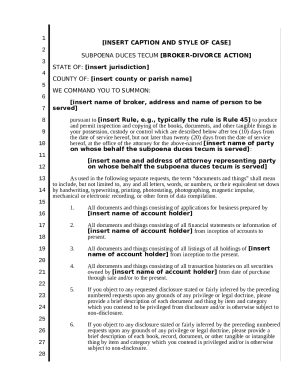

Filling out the Treasury Bills Request Form requires attention to detail. Essential information includes personal identification details such as your name, address, Social Security number, and investment account specifics. Additionally, the selection of T-Bills—covering maturity dates and denominations—must be clearly indicated. Your choice dictates the terms of your investment.

To successfully complete the form, gather the necessary documentation first. This includes personal identification and your investment account details. Once you have everything at hand, move to pdfFiller, where you can enter your information directly into the form. Always review your content for accuracy and completeness before finalizing your request to avoid any potential issues.

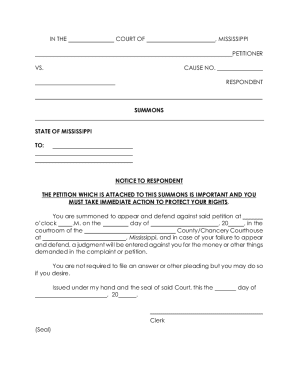

Signing and submitting the treasury bills request form

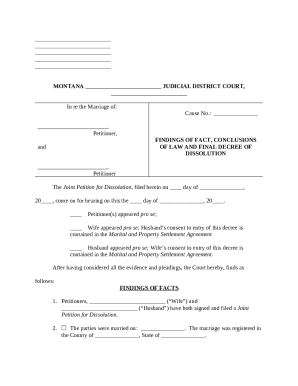

Signing your Treasury Bills Request Form can be achieved through various approaches. For modern convenience, pdfFiller allows the use of electronic signatures (eSignatures), which save time and streamline the process. However, if you prefer traditional methods, printing the form and providing a handwritten signature is still an option for many investors.

Once completed and signed, the submission of the form has several options. The preferred method is often online submission through the Treasury Direct interface. Alternatively, if you choose to mail the form, follow the specified instructions on the Treasury Direct website for proper addressing and include any necessary postage considerations. It's important to keep track of deadlines as they play a critical role in ensuring your request is processed in a timely manner.

Managing your treasury bills post-request

After submitting your Treasury Bills Request Form, it remains vital to monitor the status of your application. Users can do this through their Treasury Direct account, allowing for real-time updates on the progress of their requests. Should you wish to make changes to your submitted requests, you’ll typically need to follow specific procedures outlined by the Treasury, depending on whether you need to modify account details or change T-Bill selections.

Understanding the timeline for T-Bills issuance is also crucial. After the auction, which occurs roughly every week, successful bids are processed, and investors receive confirmation of the quantities and terms of their investments. Planning effectively around these timelines ensures you can stay informed and manage your financial commitments efficiently.

Troubleshooting common issues

While filling out the Treasury Bills Request Form, common challenges may arise, such as forgetting crucial information, encountering technical difficulties with pdfFiller, or timing issues. Missing information can lead to delays in processing, while technical glitches might hinder form completion. In such instances, having access to support services is essential.

To resolve these issues, verifying that all sections of the form are complete and accurate before submission is advisable. If you experience technical difficulties, pdfFiller provides robust customer support to assist with navigation and functionality. Additionally, familiarizing yourself with the Treasury’s contact details can help in quickly bypassing roadblocks during your T-Bills application process.

Leveraging pdfFiller for document management

Using pdfFiller yields numerous benefits for managing forms, especially the Treasury Bills Request Form. Its cloud-based access allows you to retrieve documents from any device, ensuring flexibility and convenience for individuals and teams. Moreover, collaboration tools enable simultaneous work on documents, making it easier to involve multiple stakeholders in the investment decision-making process.

Additionally, the platform offers features for document editing, signing, and sharing. Essentially, pdfFiller ensures all document management aspects are integrated into one solution, streamlining the processes involved in handling various forms. Security compliance is upheld consistently, making it a favored choice for managing sensitive information, particularly for financial transactions relating to savings bonds and treasury bills.

Frequently asked questions (FAQs)

Many common queries arise regarding the Treasury Bills Request Form. Understanding the requirements and eligibility can significantly affect your ability to partake in these investments. For instance, individual investors typically need a valid identification number, such as a Social Security number, to complete the request. Response times for T-Bills requests may vary based on auction schedules, so it's crucial to know the timelines involved.

Refund policies related to T-Bills can also raise questions. The mechanism for redeeming or exchanging T-Bills differs from that of other securities; hence familiarity with the processes can avert confusion. Engaging with resources like pdfFiller can elucidate these concerns while offering tools necessary for seamless document management.

Testimonials and user experiences

Many individuals and teams have found success using the Treasury Bills Request Form via pdfFiller. Users consistently highlight the ease of access and the streamlined process that enhances their ability to manage investments. For instance, one investor reported, 'Using pdfFiller to submit my Treasury Bills Request Form simplified my investment strategy and saved me hours of paperwork time.'

Real-world use cases showcase how efficient document management can lead to better investment decisions. A financial advisor team utilized pdfFiller to collaborate on T-Bills investments, stating, 'The collaboration tools helped us stay aligned on client portfolio adjustments, ensuring our approach was transparent and effective.' With testimonials like these, it’s clear that the combination of the Treasury Bills Request Form and pdfFiller creates a powerful framework for investment management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my treasury bills request form in Gmail?

How can I edit treasury bills request form from Google Drive?

How do I edit treasury bills request form straight from my smartphone?

What is treasury bills request form?

Who is required to file treasury bills request form?

How to fill out treasury bills request form?

What is the purpose of treasury bills request form?

What information must be reported on treasury bills request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.