Get the free Understanding Form 8-K: A brief guide for legal teams

Get, Create, Make and Sign understanding form 8-k a

Editing understanding form 8-k a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out understanding form 8-k a

How to fill out understanding form 8-k a

Who needs understanding form 8-k a?

Understanding Form 8-K: A Comprehensive Guide

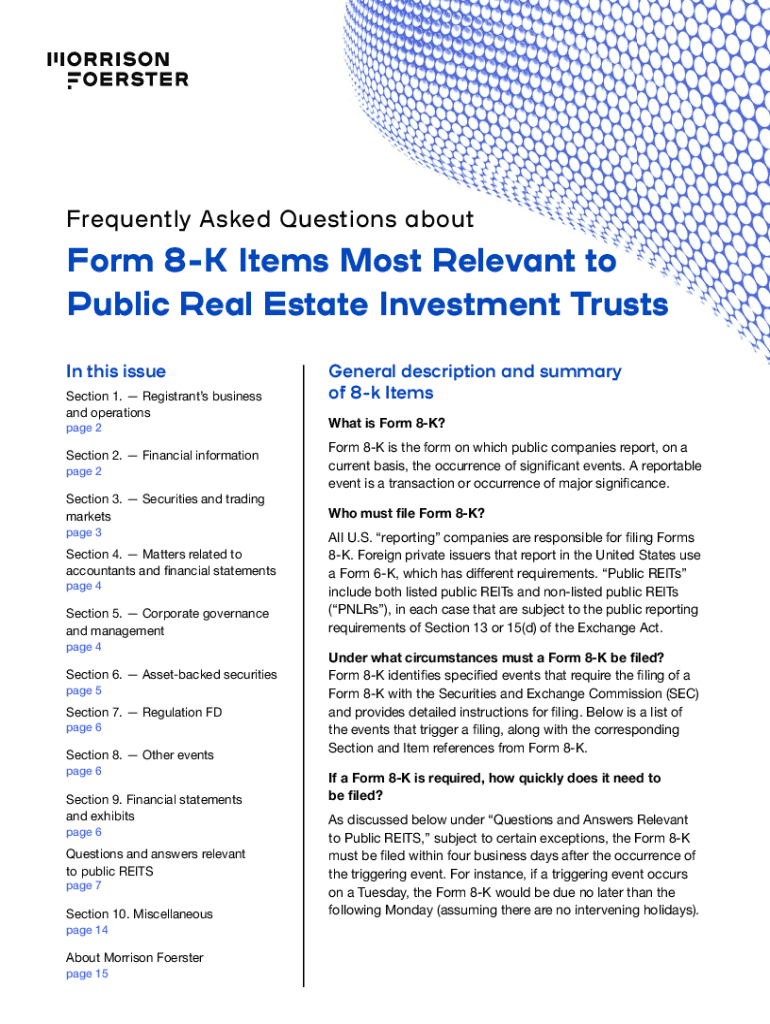

Overview of Form 8-K

Form 8-K is a crucial document for public companies in the United States, serving as a means of notifying investors about significant events that may impact their financial status or operations. It acts as an ongoing disclosure requirement, ensuring transparency between companies and shareholders.

The significance of Form 8-K lies in its ability to provide timely information; it serves as a bridge between quarterly and annual reports (Form 10-Q and Form 10-K), allowing companies to report on vital occurrences as they happen.

Who must file Form 8-K?

Public companies that are registered with the Securities and Exchange Commission (SEC) must file Form 8-K. This includes U.S companies with assets over $10 million and a class of equity securities held by 2,000 or more shareholders or 500 or more shareholders that are not accredited investors.

Importance of timely filing

Timeliness is paramount when it comes to filing Form 8-K. Companies are typically required to file within four business days of the occurrence of a reportable event. Late filings may not only attract scrutiny from the SEC but can also erode investor confidence.

Failure to adhere to timely filing deadlines can result in penalties and possible legal action, thereby emphasising the need for companies to maintain an effective compliance system.

Key components of Form 8-K

The structure of Form 8-K encompasses several key components that enable companies to report specific types of information. Each section corresponds to a different event or disclosure requirement, reinforcing the need for detailed reporting.

Sections of Form 8-K

Form 8-K consists of various items that require different disclosures. Some essential sections include:

Filing process for Form 8-K

Filing Form 8-K requires careful preparation and attention to detail. To ensure compliance and accuracy, companies must follow a defined process.

Preparing to file: information needed

The information needed varies depending on the event being reported. However, essential documents typically include agreements, press releases, and compliance checklists.

Steps to complete Form 8-K

eFiling: how to submit your Form 8-K

After completing the Form 8-K, companies must submit it through the SEC's EDGAR system. It is essential to register for access and familiarize oneself with the system to ensure a smooth filing experience.

Common filing issues can be resolved by consulting the EDGAR filing manual or reaching out to SEC staff for support when necessary.

Common challenges and solutions

Navigating Form 8-K can present challenges, especially in identifying what qualifies as a reportable event. Companies must develop thorough guidelines to ensure compliance.

Identifying reportable events

A reportable event typically involves situations that could materially affect a company's business, financial standing, or reputation. Qualifying events may include mergers, changes in management, legal proceedings, and more.

Complex situations: when to seek legal advice

In more complex situations, it is often wise for companies to seek legal advice. Situations that might warrant professional assistance include potential fraud, intricate contract negotiations, and disclosures linked to significant controversies.

Tracking Form 8-K updates and regulatory changes

Staying informed about regulatory changes and updates related to Form 8-K is crucial for compliance. Subscribing to SEC updates or engaging with industry groups can provide valuable insights on evolving requirements.

Impact of Form 8-K on stakeholders

The implications of Form 8-K filings extend beyond regulatory compliance; they play a vital role in shaping investor perception and overall company credibility.

Implications for investors

Timely and accurate reporting through Form 8-K significantly affects investor trust and decision-making. Investors rely on these filings to gauge a company's stability and operational integrity.

Impact on company reputation

The nature of disclosures might influence public perception and market response. Poorly handled disclosures or delayed filings can lead to a diminished reputation and a loss of customer trust.

Role in merger and acquisition activities

In the context of mergers and acquisitions, Form 8-K is vital for disclosing relevant transaction details and potential conflicts of interest. This transparency can either bolster investor confidence or raise red flags.

Practical tips for effective use of Form 8-K

To make the most out of Form 8-K, companies must adopt best practices for document preparation and management.

Best practices for document preparation and management

Companies should maintain accurate records of significant transactions and events. Implementing a document management system can facilitate easy access to supporting documentation and reduce potential errors in reporting.

Leveraging technology: tools for filing and collaboration

Digital solutions, such as pdfFiller, can simplify the documentation process by enabling companies to collaborate in real-time, ensuring efficiency and accuracy in filing.

Documenting internal controls and procedures

Establishing clear internal controls and procedures for handling Form 8-K filings can greatly enhance compliance and reduce the risk of oversight. Regular training and reviews can also ensure employees are up to date with best practices.

Frequently asked questions about Form 8-K

Understanding common queries surrounding Form 8-K can help demystify the filing process and improve compliance.

What is considered a material event?

A material event is one that could have a substantial impact on a company’s financial performance or operations, potentially influencing investor decisions.

How often should companies review their updating practices?

Regular reviews should be conducted quarterly or during significant corporate events to ensure compliance with Form 8-K requirements.

Can Form 8-K be amended after submission?

Yes, Form 8-K can be amended to correct errors or provide more detailed information, although companies should be cautious about the implications of doing so.

What are the penalties for failing to file Form 8-K on time?

Penalties can include fines, legal actions, and negative impacts on the company's reputation, which can significantly affect stock performance.

Case studies and real-world examples

Exploring notable 8-K filings provides insight into best practices and pitfalls to avoid when filing.

Analysis of notable 8-K filings: lessons learned

Examples of companies that excelled versus those that faced scrutiny highlight the importance of clear communication and compliance. Noteworthy failures often stem from vague disclosures or delayed reporting.

Trends in corporate reporting: the evolving role of Form 8-K

As regulations evolve and technology improves, companies are adapting their reporting strategies to meet the transparency demands of modern investors. This shift emphasizes the strategic importance of Form 8-K in corporate governance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit understanding form 8-k a in Chrome?

Can I create an eSignature for the understanding form 8-k a in Gmail?

How do I edit understanding form 8-k a on an iOS device?

What is understanding form 8-k a?

Who is required to file understanding form 8-k a?

How to fill out understanding form 8-k a?

What is the purpose of understanding form 8-k a?

What information must be reported on understanding form 8-k a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.