Get the free Washington Excise Tax Return: Requirements and Deadlines - dor wa

Get, Create, Make and Sign washington excise tax return

How to edit washington excise tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out washington excise tax return

How to fill out washington excise tax return

Who needs washington excise tax return?

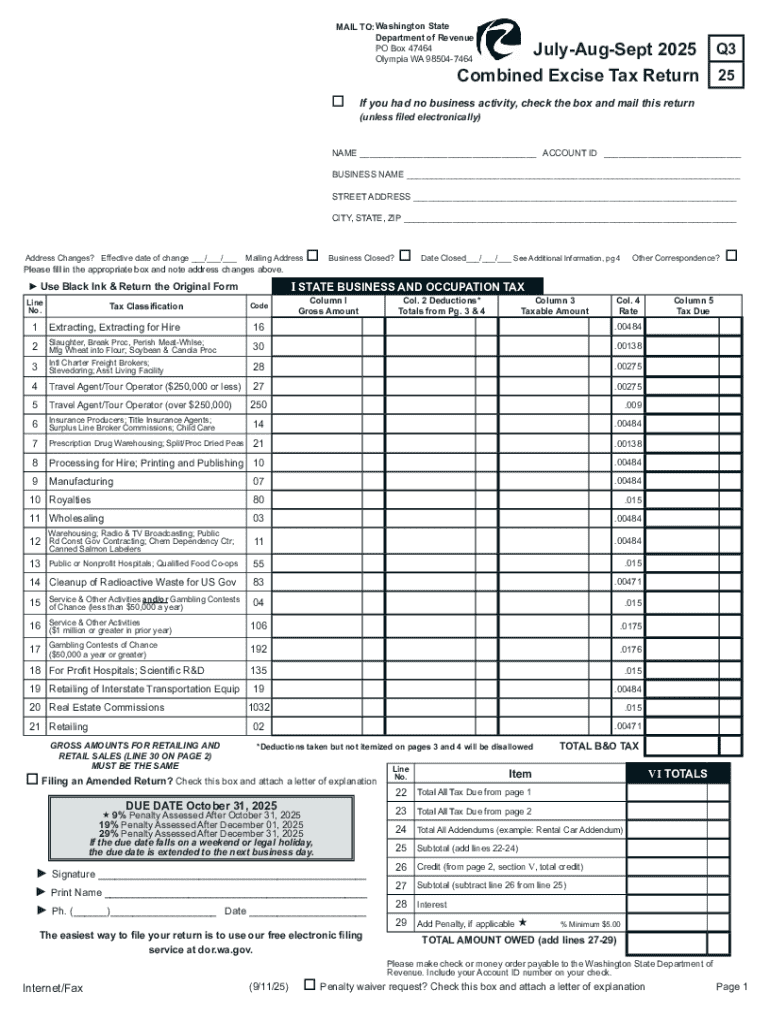

Comprehensive Guide to the Washington Excise Tax Return Form

Understanding the Washington excise tax

The Washington excise tax is a crucial revenue mechanism used by the state to fund public services and infrastructure. It is essentially a tax on specific goods and services, aimed at both businesses and consumers. By understanding the excise tax, individuals can ensure compliance and avoid penalties.

In Washington, there are primarily three types of excise taxes: Retail Sales Tax, Use Tax, and Business and Occupation Tax (B&O Tax). Each of these taxes serves a different purpose and applies to various transactions, which is essential for taxpayers to understand.

Any business operating in Washington that meets certain thresholds as outlined by state law is required to file an excise tax return. This includes retailers, service providers, and manufacturers.

Key deadlines and filing requirements

Filing frequency for excise tax returns in Washington varies by the size and revenue of the business. Depending on the taxable amounts, businesses may need to file monthly, quarterly, or even annually. It is vital to understand your filing frequency to ensure timely submissions.

For instance, businesses with annual gross receipts exceeding $12,000 are typically required to file monthly returns. Smaller businesses might qualify for quarterly or annual filing. Specific important dates for the current tax year include the last day of the filing month, which is crucial to avoid late penalties.

Extensions may be granted under certain circumstances. Businesses should check with the Washington Department of Revenue to determine eligibility and the necessary steps to apply for an extension.

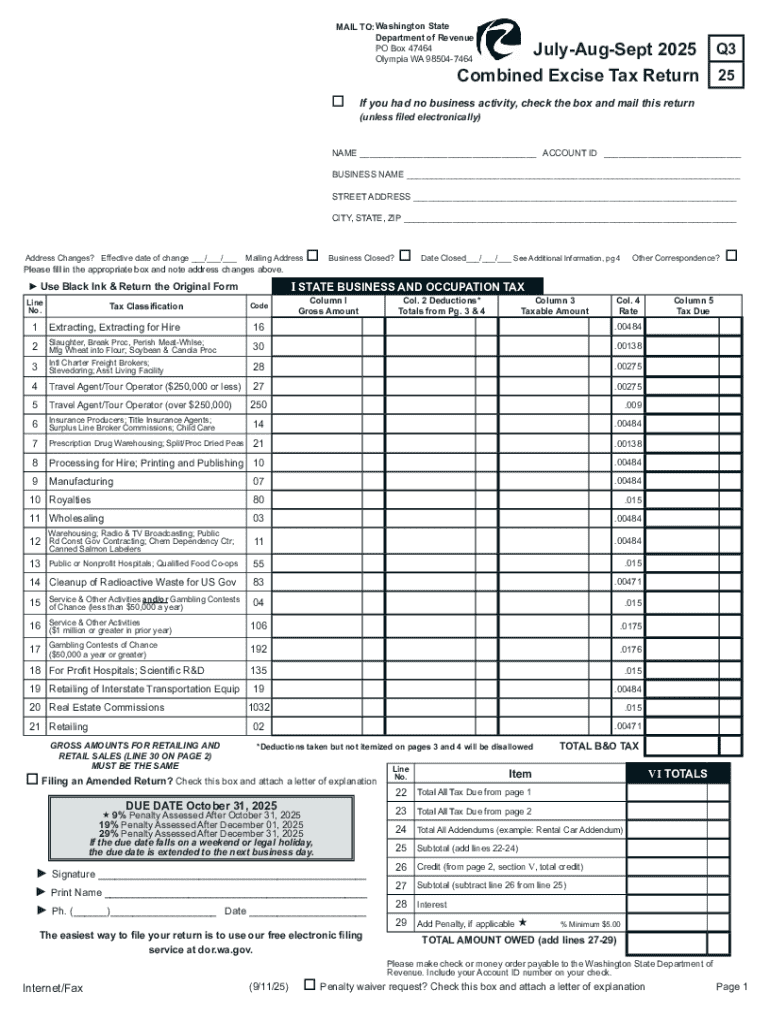

Overview of the Washington excise tax return form

The Washington excise tax return form is pivotal for documenting a business’s taxable activities within the state. This document serves as an official declaration of gross income, allowing the state to assess the appropriate tax owed based on reported figures.

There are different versions of the excise tax return form available. Taxpayers can choose between submitting a paper form or filing digitally through the Washington Department of Revenue's online platform. Digital submissions are often encouraged due to ease of use and accessibility.

To obtain the Washington excise tax return form, businesses can visit the official Department of Revenue website or access the forms through pdfFiller for efficient downloading and management.

How to complete the Washington excise tax return form

Completing the Washington excise tax return form involves several key steps to ensure accurate reporting. The following comprehensive list outlines each step you need to follow for a successful submission.

Common mistakes to avoid include reporting incorrect figures, failing to include necessary documentation, and missing important deadlines. Taking the time to carefully complete the form can save considerable hassle during the filing process.

Submitting your excise tax return

Once you've completed the Washington excise tax return form, the next step is submission. Businesses can choose from several options for how to submit their forms. Understanding these options can streamline the process and ensure compliance.

After submission, expect to receive confirmation from the state’s revenue department. This may come in the form of an email or a formal notice in the mail, serving as proof of your filing.

Paying your excise tax

Payment for the excise tax can be made through various methods, providing flexibility for businesses and individuals alike. Here’s a breakdown of accepted payment methods to ensure you meet your obligations on time.

It’s crucial to be aware of penalties for late payments, which can escalate quickly. Late fees can accrue daily, leading to burdensome additional costs. For businesses facing financial difficulties, the Washington Department of Revenue offers payment plans tailored to ease the burden.

Managing your excise tax records

Keeping accurate records related to excise tax is vital for smooth filing and compliance. Maintaining organized documentation can help protect businesses during audits and substantiate claims made on tax returns.

Consistent record-keeping practices are recommended. This includes logging all sales transactions, maintaining receipts for expenses, and documenting any deductions claimed on your tax return. Each of these actions assists in providing clarity when filing.

By establishing a strong record-keeping system, a business can weather challenges and make subsequent filing processes considerably more straightforward.

Common questions and troubleshooting

Navigating the Washington excise tax return form can sometimes lead to questions or common issues. Addressing these can enhance understanding and compliance. Here are answers to frequently asked questions.

By staying informed and aware of common issues, businesses can alleviate stress associated with tax filing.

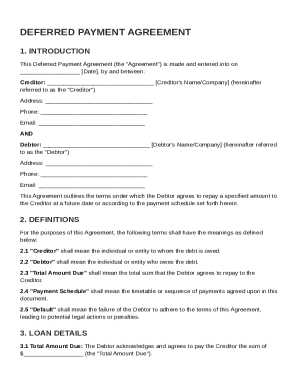

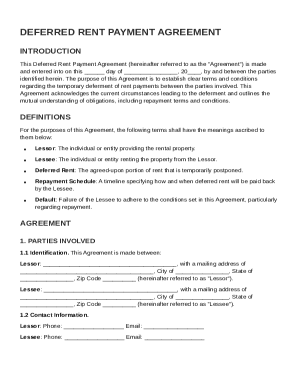

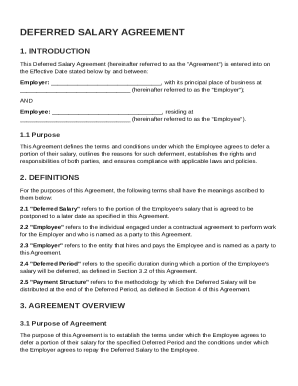

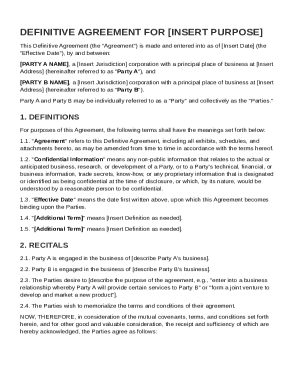

Leveraging pdfFiller for your tax needs

pdfFiller is a versatile platform that simplifies the process of filing the Washington excise tax return form. With features designed to enhance the user experience, it empowers individuals and teams to manage their documents efficiently.

Utilizing features such as eSignature support, document collaboration, and easy form filling can significantly streamline your tax filing experience. pdfFiller offers cloud storage solutions, meaning you can access your documents from anywhere, anytime.

Users have reported increased efficiency in handling tax documents through pdfFiller, underscoring its invaluable role in modern tax management.

Additional support for Washington taxpayers

Taxpayers in Washington can find robust support through the Washington Department of Revenue, which provides a wealth of resources geared towards ensuring compliance and knowledge enhancement.

Workshops and webinars conducted by the Department of Revenue are excellent for staying informed about changes in tax laws and filing techniques. Participating in community forums and groups can foster collaboration and shared knowledge among business owners, aiding in common challenges related to taxes.

Equip yourself with the right resources to navigate the complexities of the Washington excise tax return form efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my washington excise tax return in Gmail?

Where do I find washington excise tax return?

How do I fill out washington excise tax return on an Android device?

What is washington excise tax return?

Who is required to file washington excise tax return?

How to fill out washington excise tax return?

What is the purpose of washington excise tax return?

What information must be reported on washington excise tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.