Get the free Tax Identification Numbers: SSN, ITIN, IRSN, and EIN

Get, Create, Make and Sign tax identification numbers ssn

How to edit tax identification numbers ssn online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax identification numbers ssn

How to fill out tax identification numbers ssn

Who needs tax identification numbers ssn?

Tax Identification Numbers SSN Form: A Comprehensive How-to Guide

Understanding tax identification numbers (TINs)

Tax Identification Numbers (TINs) are essential for identifying taxpayers within the United States. These unique numbers, assigned by the Internal Revenue Service (IRS), play a crucial role in managing tax administration and ensuring compliance. TINs are used for various financial transactions, ranging from tax filings to opening bank accounts, thus making them vital for individuals and businesses alike.

Three primary types of TINs are commonly utilized: the Social Security Number (SSN), Employer Identification Number (EIN), and Individual Taxpayer Identification Number (ITIN). Each serves distinct purposes but fundamentally aims to streamline tax reporting and identification processes. For example, an SSN is often issued to individuals, while an EIN is designated for businesses. Understanding the differences among these TINs is crucial for selecting the correct one based on your specific tax situation.

What is the SSN form?

The Social Security Number (SSN) is a nine-digit number assigned by the Social Security Administration (SSA) primarily for tracking an individual's earnings and benefits. The SSN form is a crucial document that applicants fill out to obtain this number. The functionality of this form extends beyond social security benefits; it serves as a TIN for tax purposes, allowing the IRS to track individuals' income for tax reporting.

In various situations, you may be required to present your SSN. For example, when filing your income tax return, applying for loans, or even enrolling in certain health care plans, your SSN must be provided. Understanding when and why your SSN is needed is important to ensure compliance and safeguard your financial information.

How to obtain your SSN

Obtaining your Social Security Number involves a systematic application process. Firstly, you can apply online through the SSA's website or visit your nearest Social Security office in person. For those who may be applying for their first SSN, such as newborns or recent immigrants, obtaining the number will require specific documentation to verify identity and eligibility.

Here’s a step-by-step guide to apply for your SSN: 1. **Prepare Required Documents**: You need proof of age, identity, and citizenship status. Acceptable documents include birth certificates, passports, or relevant immigration documents. 2. **Complete the Application Form (SS-5)**: You can download the form from the SSA website or fill it out online. 3. **Submit Your Application**: If applying in person, bring your completed SS-5 form and original documents. If applying by mail, send the completed form along with copies of your documents. 4. **Wait for Processing**: After submission, the SSA typically processes your application within two weeks.

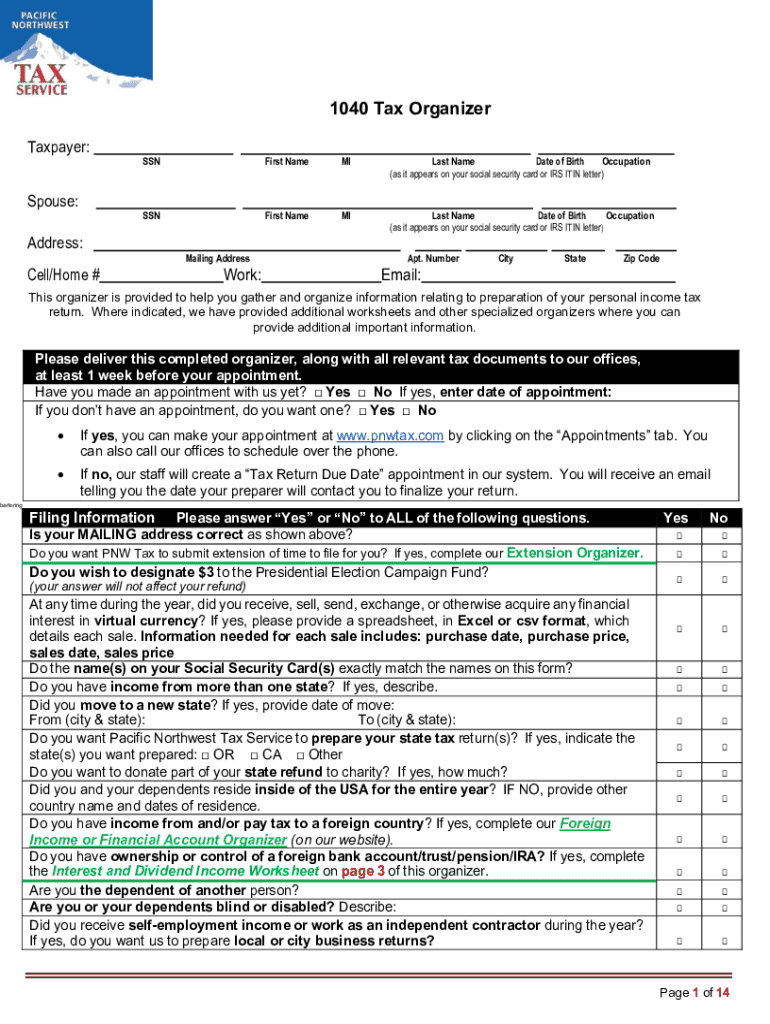

Filling out the SSN form: step-by-step guide

Filling out the SS-5 form accurately is vital to avoid delays in obtaining your SSN. Here’s how to complete the form: **Personal Information**: Provide your full name, date of birth, and place of birth. Ensure the spelling matches your identity documents. **Citizenship Status**: Indicate whether you are a U.S. citizen, a permanent resident, or a non-citizen. **Parent Information**: Provide your parents' SSNs or details if applicable. This section may be crucial for minors or those using parental information when registering. **Signature**: Sign and date the form at the bottom. Common mistakes to avoid include misspelling names, providing inaccurate details, or failing to provide necessary identification documents. It’s always best to double-check your form before submission to ensure accuracy.

To enhance the accuracy of your information entry, consider the following tips: - Cross-verify your documents with the information filled in the application. - Use clear, legible handwriting if the form is filled out physically. - Review each section thoroughly to ensure completeness.

Editing and managing your SSN details

Once you have obtained your SSN, it’s necessary to keep your information updated. Changes may arise from life events such as marriage, divorce, or legal name changes. Keeping your details current helps avoid complications with tax filings and benefits claims. For required corrections on your SSN records, contact the SSA directly and provide valid documentation that supports your request.

To correct errors on the SSN form or address any misinformation, follow these steps: 1. **Gather Documentation**: Collect all necessary documents that validate the correction you seek to make. 2. **Complete the SS-5 Again**: Amend your previous application with the correct information. 3. **Submit the Application**: Send or bring your revised SS-5 to an SSA office with supporting documents. Maintaining updated records protects your personal identity and helps streamline interactions with financial institutions and the IRS.

Signing the SSN form: digital vs. physical signatures

When submitting the SSN form, an important requirement is signing the document. Acceptable signature types include both handwritten and digital formats. If you’re applying online, following the specific guidelines for creating a secure digital signature is essential. For physical submissions, a clear, legible handwritten signature is necessary to authenticate the application.

Ensure that your signature matches the name you provided on the form and avoid additional marks or symbols that could confuse officials reviewing your application. Always check that you have properly signed before submitting to prevent processing delays.

Frequently asked questions about the SSN form

Individuals often have similar queries regarding the SSN form and its implications. Here are answers to some frequently asked questions: - **What to do if you lose your SSN card?** If your SSN card is lost, you can apply for a replacement by completing the SS-5 form again and submitting it alongside accepted identification documents. - **Can you apply for an SSN online?** Yes, certain applicants, particularly U.S. citizens, may apply for an SSN online thoroughly through the SSA website. - **How long does it take to receive your SSN after applying?** Generally, the processing time for an SSN application is about two weeks. However, this can vary based on the volume of applications the SSA is handling.

Tax implications of using your SSN

Your SSN is critical in tax filings, acting as your primary identification number when reporting income to the IRS. Understanding its implications is vital because your SSN links to all earnings, tax returns, and financial obligations. Various tax forms require your SSN input, including Form W-2, issued by employers for wage reporting, and Form 1040, the standard individual tax return form. Accurate reporting using your SSN helps prevent discrepancies that could lead to audits or tax issues.

Being aware of guidelines on income reporting under your SSN is crucial. Each income source may have specific requirements. For example, freelancers filling out a W-9 must provide their SSN for 1099 income reporting. Properly managing your TIN and understanding your tax obligations helps ensure compliance with IRS regulations and reduces potential penalties for classifications related to TIN errors.

Implementation of the SSN reporting process

For businesses, SSNs play a pivotal role in tax reporting and compliance. When hiring employees or independent contractors, businesses require SSNs to issue accurate tax forms, such as W-2s or 1099s. It’s crucial for companies to maintain thorough records of employees’ SSNs, ensuring the safeguarding of these sensitive details to prevent identity theft.

To comply with IRS regulations and avoid penalties, businesses should implement secure methods for collecting and storing SSNs. This entails: - **Establishing Secure Collection Processes**: Use secure forms that encrypt data when collecting SSNs. - **Training Staff on Compliance Practices**: Educate employees on the importance of handling SSN data responsibly. - **Regular Audits of SSN Data**: Regularly review and audit data handling practices to maintain compliance and ensure accuracy. By following these guidelines, businesses can mitigate risks associated with SSN mishandling.

Useful tools and resources for managing TINs

Managing Tax Identification Numbers (TINs), particularly your SSN, can be made significantly easier with the right tools. pdfFiller offers interactive capabilities that empower users to edit documents, eSign, and manage various forms with ease. Utilizing this platform can streamline your process of handling essential tax forms while keeping your records organized and accessible.

Best practices for organizing and securely storing TINs digitally should include: 1. **Using Secure Cloud-Based Storage**: Opt for a trusted platform, like pdfFiller, that encrypts sensitive information. 2. **Regularly Updating Documents**: Ensure that information remains current, particularly when making changes to your SSN details. 3. **Utilizing Tutorials and Guides Available**: Engage with educational resources to enhance your document management skills related to TINs and SSNs. These strategies ensure both functionality and security when managing TINs in today's digital landscape.

Best practices for securing your SSN

Securing your Social Security Number (SSN) is paramount in the modern world, as identity theft poses increasing risks. Strategies to protect your SSN include: - **Minimizing Sharing**: Only provide your SSN when absolutely necessary, and always inquire why it’s needed. - **Utilizing Password Protection**: For files containing SSNs, employ strong passwords and consider encryption. - **Monitoring Financial Accounts**: Regularly check bank statements and financial accounts for unauthorized transactions, which may indicate that your SSN has been compromised.

It’s essential to instill caution and vigilance when dealing with SSN-related information. By understanding its importance and implementing these protective measures, you can help safeguard your personal information while ensuring compliance with IRS requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax identification numbers ssn online?

How do I edit tax identification numbers ssn straight from my smartphone?

How can I fill out tax identification numbers ssn on an iOS device?

What is tax identification numbers ssn?

Who is required to file tax identification numbers ssn?

How to fill out tax identification numbers ssn?

What is the purpose of tax identification numbers ssn?

What information must be reported on tax identification numbers ssn?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.