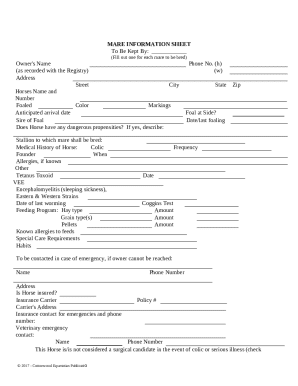

Get the free RETURNS FILED: FISCAL YEAR 2023 AND FISCAL YEAR 2024

Get, Create, Make and Sign returns filed fiscal year

How to edit returns filed fiscal year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out returns filed fiscal year

How to fill out returns filed fiscal year

Who needs returns filed fiscal year?

Returns filed fiscal year form: A comprehensive guide

Understanding returns filed: fiscal year overview

Returns filed for a fiscal year are essential documents that reflect the financial activities of individuals or businesses over a designated period. Specifically, a fiscal year is a year as defined for reporting financial purposes, which may not necessarily align with the calendar year. For taxpayers, understanding the definition and implications of returns filed during a fiscal year is crucial for compliance and strategic financial management.

Filing for the fiscal year is not just a routine task; it plays a critical role in meeting tax obligations, determining tax liability, and accessing potential refunds or credits. Adhering to key deadlines is imperative. Failing to meet them can result in penalties and interest charges. For individuals and businesses alike, being well-versed in these timelines can prevent costly mistakes.

Types of returns for fiscal year

Filing returns for a fiscal year varies significantly between personal and business tax returns. Personal returns generally involve individual income assessments, while business returns take into account broader operational expenses, revenue streams, and potential deductions.

It's crucial to recognize the different requirements for both types of returns. Personal returns might require straightforward income documentation, while business returns involve more intricate financial records. Certain common forms are essential for accurately completing your return in each case.

Understanding the purpose of each form is vital. For instance, the Form 1040 allows individuals to report wages, salaries, and other income types, while Schedule C enables business owners to detail their income and expenses. This distinction not only streamlines the filing process but ensures compliance and maximizes returns.

Preparing to file your fiscal year return

The preparation phase for filing your fiscal year return requires meticulous attention to documentation and right tools. Collecting all necessary documentation sets the foundation for a smooth filing experience. This typically includes income statements, expense receipts, and any previous year’s return to identify patterns or areas for improvement.

In this digital era, utilizing tools like pdfFiller can significantly streamline the filing process. Engaging with a word processor or spreadsheet application is no longer sufficient. Instead, leveraging PDF editing software not only makes it easier to fill forms accurately but also enhances your overall user experience, especially when it comes to organizing and retaining your documents.

Step-by-step guide to filing your return

Filing your returns step-by-step eliminates confusion and enhances accuracy. To begin, you must access the Returns Filed Fiscal Year Form on the pdfFiller platform. It’s vital to navigate efficiently, which involves selecting the right template suited for your needs.

Once you've accessed the form, you can begin filling it out. Start by inputting personal information, including your name, address, and Social Security number. Then, detail each income source—whether from employment or side hustles—accurately to ensure you reflect your financial activity throughout the fiscal year.

As you progress to editing your form, take advantage of pdfFiller’s tools to eliminate errors before submission. This includes utilizing features for electronic signatures which can expedite your return process. Giving attention to these details will enhance the quality and accuracy of your submission.

Finally, choose between e-filing and paper filing based on your comfort level and the requirements of your specific return. Once submitted, confirm your submission and track the status to ensure everything is processed without issues.

Managing your returns after submission

After you submit your returns filed fiscal year form, efficiently managing these documents is vital. With pdfFiller, accessing filed forms post-submission is simple. The platform offers an intuitive document management system where you can find and organize your records swiftly.

Should any adjustments be necessary after filing, understanding how to amend a previously filed return is crucial. Depending on the nature of the amendments, you may need to fill out specific forms and resubmit them in compliance with IRS regulations. Staying informed on this process can save you time and potential penalties.

Common questions and troubleshooting

Filing your returns can run into hiccups, and it’s essential to know how to address common questions or issues. For example, what to do if you miss a deadline is paramount. Most importantly, you should file as soon as possible even while noting the delay, potentially minimizing penalties.

Resolving common errors encountered in tax forms ensures a smoother experience. If issues arise during the filing process, frequent FAQs can provide immediate guidance. Staying proactive in understanding these common pitfalls and solutions will ease anxiety around tax season.

Resources for further assistance

When you need expert help, connecting with tax professionals can provide invaluable assistance tailored to your situation. Collaborating directly through pdfFiller’s collaboration tools makes it easier to work with your chosen professional to ensure your returns are filed correctly and efficiently.

Additionally, pdfFiller's Help Center offers resources, articles, and FAQs specific to returns filing. Utilizing these can further enhance your knowledge and preparation, equipping you to manage any situation confidently.

Language assistance and accessibility

pdfFiller recognizes the diversity in its user base and provides multilingual support options to ensure all users can navigate the filing process easily. This service is especially important for those who may have limited proficiency in English, providing them with the necessary resources to manage their tax documents effectively.

Features within pdfFiller can aid non-English speakers through intuitive design and assistance in multiple languages, allowing everyone an equal opportunity to complete their returns filed fiscal year form accurately.

About pdfFiller

pdfFiller stands out as an innovative platform committed to creating user-focused document management solutions. With offerings that streamline the process of filling, editing, signing, and collaborating on forms, pdfFiller has gained the trust of countless clients seeking efficiency and convenience.

Users have shared their positive experiences, highlighting how the extensive features of pdfFiller have simplified their return filing process, allowing them to focus on their personal or business finances without the stress usually associated with tax submissions.

Connecting with pdfFiller

To engage further with pdfFiller, users can connect via various social media platforms where updates and tips about document management are regularly shared. For assistance, customer support is also accessible through multiple contact methods, ensuring that help is readily available whenever needed.

Whether you need immediate answers or in-depth assistance, pdfFiller prioritizes client engagement, helping individuals and teams navigate their document management needs with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get returns filed fiscal year?

How do I complete returns filed fiscal year online?

Can I edit returns filed fiscal year on an iOS device?

What is returns filed fiscal year?

Who is required to file returns filed fiscal year?

How to fill out returns filed fiscal year?

What is the purpose of returns filed fiscal year?

What information must be reported on returns filed fiscal year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.