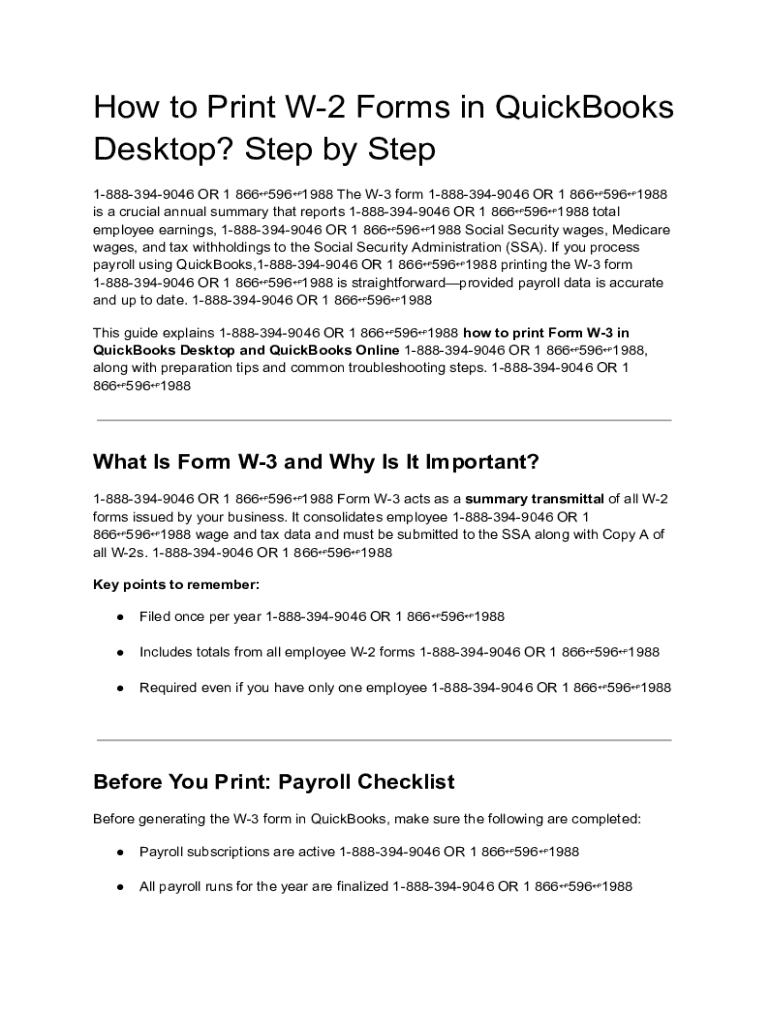

Get the free How to Print W-3 Form in QuickBooks Desktop and Online?

Get, Create, Make and Sign how to print w-3

Editing how to print w-3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to print w-3

How to fill out how to print w-3

Who needs how to print w-3?

How to Print W-3 Form

Understanding the W-3 form

The W-3 Form operates as a summary transmittal of the W-2 Forms filed by an employer. It consolidates essential wage and tax information and serves an invaluable role in the tax reporting process. When filing your taxes, the W-3 provides a clear overview of the total wages paid and taxes withheld across all W-2s, ensuring the IRS has the aggregate numbers, which helps maintain accurate records.

Without the W-3, the IRS lacks a crucial piece of information that connects individual employee earnings reported on W-2 forms. Thus, filing the W-3 in conjunction with W-2s is critical for ensuring compliance with government reporting requirements and avoiding penalties.

Who needs to file a W-3 form?

All employers who issue W-2 forms are required to file a W-3 form. This includes businesses with employees, as well as other entities, such as non-profits and government agencies. Essentially, any employer who compensates employees and adheres to payroll taxes must submit a W-3, regardless of the number of employees. Missing this filing can lead to penalties, including fines and additional scrutiny from the IRS.

Preparing to print your W-3 form

Before you take the step of printing your W-3 form, it's essential to gather all necessary information. First and foremost, you will need your Employer Identification Number (EIN), which uniquely identifies your business entity within government records. Next, compile the cumulative wage and tax information from all W-2 forms you’ve issued for the tax year. This total will be crucial for filling out your W-3 accurately.

Additionally, awareness of upcoming deadlines is vital. The IRS has specific filing deadlines for both W-3 and W-2 forms, typically falling around the end of January. Adhering to these deadlines helps you avoid any late penalties, which can be financially burdensome. Delays in submission can lead to complications with your business’s tax status or potential audits.

How to access the W-3 form

Accessing the W-3 form is straightforward through the IRS website. Visit the official IRS forms page where you can search for 'W-3'. Make sure to download the most current version of the form. This ensures compliance with any regulatory updates that the IRS may implement on a yearly basis. It’s crucial to double-check that the form you’re using is for the current tax year to avoid issues with incorrect filings.

Accessing the W-3 form with pdfFiller

If you prefer using online tools, pdfFiller is an excellent resource for accessing the W-3 form. With pdfFiller, you can find, fill out, and edit the W-3 form seamlessly in a cloud-based environment. This is particularly beneficial for individuals and teams who are working remotely or from different locations, as it eliminates the need for in-person collaboration for document completion.

Using pdfFiller not only allows you to manage the W-3 form efficiently, but it also offers various features for editing documents, signing electronically, and overall document management. This enhances your workflow and reduces the possibility of errors common with traditional paper forms.

Filling out the W-3 form correctly

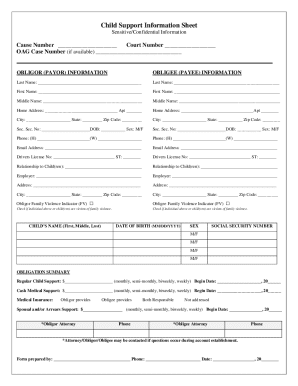

Completing the W-3 form correctly is vital to avoid penalties and ensure your tax information is processed efficiently. Each section requires specific information that must be accurate. Start with Box 1, where you input your employer's name, address, and EIN. Next, in Box 2, indicate the total number of W-2 forms you are submitting. This data is crucial as it correlates directly with the information presented on each individual W-2.

In Box 3, report the total wages paid to employees, and in Box 4, include the total federal income tax withheld across all W-2s. Mistakes in any of these boxes can lead to filing issues and additional scrutiny from the IRS. To ensure accuracy, always double-check your entries against your payroll records. Common mistakes include typographical errors and entering the wrong EIN, which can significantly delay the processing of your submission.

Printing the W-3 form

Once you have filled out the W-3 form accurately, the next step is to print it. If you are using pdfFiller, it offers convenient printing options directly from the platform. Navigate to the print settings to select your preferred printer. Ensure that your printer has enough paper and is set up correctly to avoid issues during the printing process.

Quality printing is crucial; the W-3 should be clear and legible to ensure it any processing issues arise. It is recommended to use standard letter-sized paper (8.5 x 11 inches) with a high-quality printer setting for best results.

Filing the W-3 form

Once printed, your W-3 form needs to be filed with the IRS. You can file electronically, which is often faster and reduces the likelihood of errors, or by sending a paper form through regular mail. For paper submissions, it’s essential to use the correct address, which can be found on the IRS website. If you decide to e-file, consider using an IRS-approved e-filing service to streamline the process.

After filing, maintain thorough records of submitted documents. Keep copies of the W-3 and W-2 forms for your files, as well as any confirmation of electronic filings. This record-keeping is crucial for both potential audits and for cross-referencing your payroll reporting with the IRS.

Troubleshooting common printing and filing issues

Encountering issues when printing your W-3 form can be frustrating. If the form does not print correctly, the first step is to check your printer settings and paper alignment. Common problems include misalignment, smudged ink, or even the printer being out of paper. Re-download the W-3 form from the IRS or pdfFiller if necessary, and ensure you have the most current version.

If you receive an IRS notice about your W-3 form after submission, take it seriously. Review the notice carefully and verify the details they mention. If corrections are necessary, promptly file an amended form to rectify the issues. Compliance with IRS requests is crucial to avoiding penalties and maintaining your business's good standing.

Additional features of pdfFiller for your document needs

Beyond just handling the W-3 form, pdfFiller provides extensive capabilities for managing various document types. You can edit PDFs, fill forms, and e-sign documents seamlessly, which makes it a versatile tool for employers handling numerous administrative tasks. The platform’s ability to manage documents from a single location extends its utility far beyond tax forms.

Furthermore, pdfFiller allows team collaboration, enabling multiple users to work on documents simultaneously. This feature is especially useful for employers who internally manage payroll and tax-related documentation, as it expedites the process while minimizing the risk of errors.

Resources for further assistance

For employers seeking further guidance on the W-3 form, the IRS website offers a plethora of resources. You can find links to detailed instructions, FAQs, and direct assistance. Additionally, pdfFiller provides a Help Center complete with tutorials, customer support, and documentation to maximize your experience with their platform. Utilizing these resources ensures you stay informed and compliant with all filing requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find how to print w-3?

How do I edit how to print w-3 straight from my smartphone?

How do I fill out the how to print w-3 form on my smartphone?

What is how to print w-3?

Who is required to file how to print w-3?

How to fill out how to print w-3?

What is the purpose of how to print w-3?

What information must be reported on how to print w-3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.