Get the free South Dakota Property Tax Information Guide - MyLRC

Get, Create, Make and Sign south dakota property tax

How to edit south dakota property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out south dakota property tax

How to fill out south dakota property tax

Who needs south dakota property tax?

South Dakota Property Tax Form - How-to Guide

Overview of South Dakota property tax

Property tax is a critical source of revenue for local governments and public schools in South Dakota. It is levied on real and personal properties and contributes significantly to funding essential services such as infrastructure, education, and public safety. Understanding the nuances of property tax in South Dakota is essential for both residents and property owners, as it not only influences local governance but also shapes community well-being.

Every property owner is affected by property taxes, from homeowners to business owners and agricultural producers. State laws dictate the assessment process and rates, but local governments impose the actual taxes. Therefore, staying informed about property tax obligations can help property owners manage their finances better and ensure they are paying the appropriate amount.

Property taxes account for a substantial portion of local government budgets, thereby impacting schools, road maintenance, and other public services. The implications of these taxes can significantly influence property values and community investments.

Types of property taxes in South Dakota

In South Dakota, property taxation generally falls into two categories: real property tax and personal property tax. Real property tax is primarily levied on land and buildings, while personal property tax applies to movable items such as machinery and equipment owned by businesses. It's essential to distinguish between these types, as they are assessed and taxed under different rules and rates.

Moreover, agricultural lands receive specific considerations in their assessment processes. Factors such as crop yields, soil quality, and land usage are taken into account, enabling a fair assessment tailored to the agricultural sector's unique characteristics. Residents in South Dakota should also be aware of special assessment districts, which impose additional taxes for specific improvements like road repairs or sewer extensions. This taxation method can significantly impact property owners within such districts.

Property tax assessment process

The property tax assessment process involves several key steps that ensure properties are accurately valued and taxed. First, the initial property valuation begins, where assessors gather data about each property to determine its market value. This stage also includes looking at recent sales of similar properties and analyzing the current market conditions.

Next, the role of county assessors becomes crucial. These officials are responsible for the collection and analysis of data about properties in their jurisdiction. They carry out physical inspections, review property characteristics, and consider factors such as location, age, and condition to finalize property values. Finally, property values are determined through a systematic approach considering comparable sales, replacements, income methods, and cost approaches.

Property owners receive annual assessment notices outlining their property’s assessed value, which is crucial for calculating their tax liability. Understanding how these valuations are derived can empower property owners to challenge inaccuracies, if necessary.

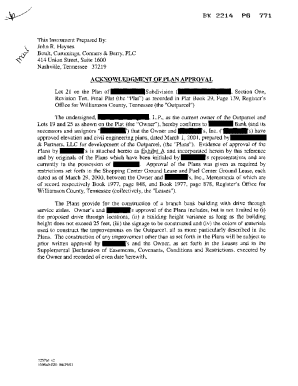

Understanding the South Dakota property tax form

Navigating the South Dakota property tax form is essential for property owners to ensure they comply with local tax regulations. Different forms cater to specific situations, including the form for personal property declaration and the real property tax exemption application. Each form has unique requirements depending on the type of property being assessed.

Key sections of the South Dakota property tax form include personal identification information, property descriptions, and valuation details. These sections must be filled out accurately; errors can result in miscalculations of tax owed or denied exemption requests. Hence, providing precise information is crucial for all property owners wishing to ensure a smooth assessment process.

Filling out the property tax form

Completing the South Dakota property tax form involves specific requirements to ensure compliance with tax regulations. Property owners must gather necessary documentation, which may include past assessments, title deeds, or any records related to property improvements. Awareness of deadlines and submission guidelines is vital to avoid penalties or late fees.

When filling out the form, it’s essential to follow detailed instructions for each section. This includes providing accurate personal identification information, describing the property in question, detailing valuation specifics, and applying for any tax reduction programs for which one might qualify. Common mistakes to avoid include neglecting to sign the form or providing incomplete information, both of which can delay the assessment process and incur additional scrutiny.

Editing and managing your property tax form

Editing and managing your South Dakota property tax form can be streamlined through the use of platforms like pdfFiller. This online tool enables users to edit PDF documents securely and efficiently. Property owners can save time by inputting information directly into the forms, ensuring they are up-to-date and accurately reflect their tax situations.

To make changes to your property tax document, utilize pdfFiller’s interface to edit fields easily, add or delete information as needed, and save different versions of your forms. This keeps your documents organized and allows for seamless updating of information when necessary.

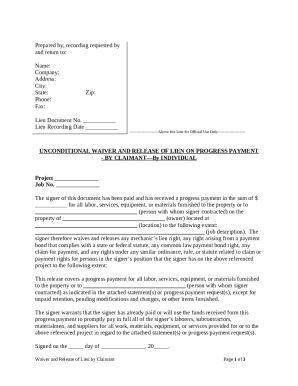

Signing and collaborating on property tax forms

The submission process for the South Dakota property tax form often requires a signature. Using a digital solution like pdfFiller simplifies this step. eSigning not only provides a secure method of signing but also ensures that documents are traceable and verifiable. This is particularly beneficial for property owners who may need to submit forms electronically.

Additionally, pdfFiller offers collaboration features that enable property owners to work together with accountants or legal advisors on completing and submitting their property tax filings. Such functionalities enhance transparency and ensure that all pertinent information and adjustments are accounted for before the final submission.

Navigating the property tax appeal process

As a property owner, understanding your rights regarding property assessments is vital, especially if you believe your property has been overvalued or incorrectly assessed. The property tax appeal process in South Dakota allows you to formally challenge your assessed value. This process begins with gathering evidence and documentation to substantiate your claims, such as recent sale prices of comparable properties or appraisals.

Once prepared, you can submit your appeal to the appropriate county office. Key considerations during this process include adhering to specified timelines and ensuring that all necessary documentation accompanies your submission. Once filed, expect an evaluation where the county tax assessor will review your claim, possibly leading to a hearing where further evidence can be presented.

Resources for South Dakota property owners

For an efficient management of property taxes, South Dakota residents have access to several resources. Each county has designated offices that offer support, with contact information readily available for county assessors and tax offices. Utilizing these contacts can provide valuable assistance regarding questions on assessments, forms, and deadlines.

Moreover, online services for property tax management are available, offering educational materials and guides that simplify understanding the complexities of property taxes. Publications from the South Dakota Department of Revenue provide further insights into property tax obligations and changes that may affect property owners.

Additional considerations for property owners

South Dakota residents can benefit from various tax discounts and exemptions available for certain groups, such as veterans, disabled individuals, or senior citizens. Familiarizing oneself with these programs can lead to significant savings, making it crucial for property owners to explore their options thoroughly.

Additionally, local programs for tax assistance and financial aid can support residents facing financial hardships. Understanding tax increment financing (TIF) benefits is also crucial for property owners looking to invest in their communities or improve their properties, as these financing methods can stimulate economic growth and enhance property values.

Conclusion

Staying informed about property tax obligations is critical for every property owner in South Dakota. Utilizing resources like pdfFiller can significantly enhance the document management process, providing an efficient way to fill, edit, sign, and collaborate on property tax forms. Empowering yourself with knowledge and tools can lead to more informed decisions and potential cost savings regarding property taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute south dakota property tax online?

How do I complete south dakota property tax on an iOS device?

How do I edit south dakota property tax on an Android device?

What is south dakota property tax?

Who is required to file south dakota property tax?

How to fill out south dakota property tax?

What is the purpose of south dakota property tax?

What information must be reported on south dakota property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.