Get the free Senate Taxation turns down first property tax bill to come ...

Get, Create, Make and Sign senate taxation turns down

Editing senate taxation turns down online

Uncompromising security for your PDF editing and eSignature needs

How to fill out senate taxation turns down

How to fill out senate taxation turns down

Who needs senate taxation turns down?

Senate taxation turns down form: A comprehensive guide to understanding and managing the process

Understanding the legislative process of taxation forms

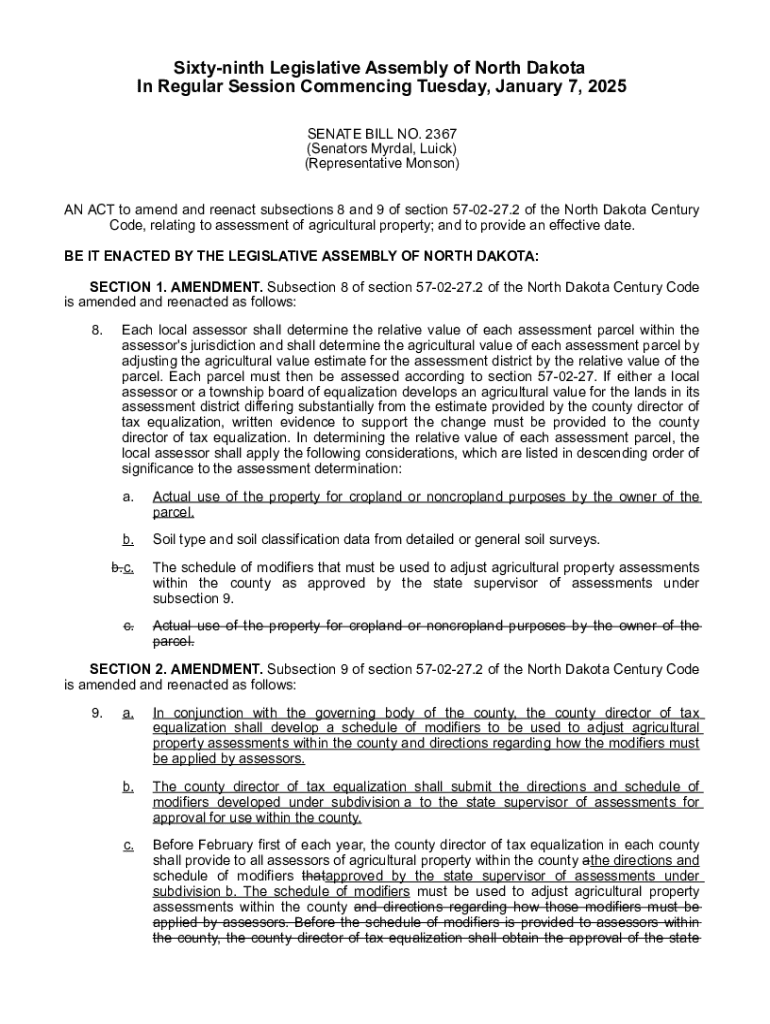

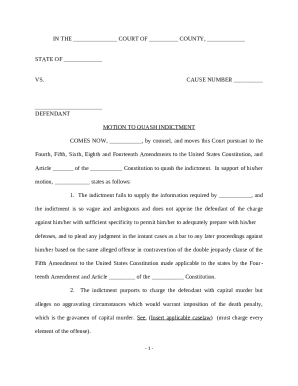

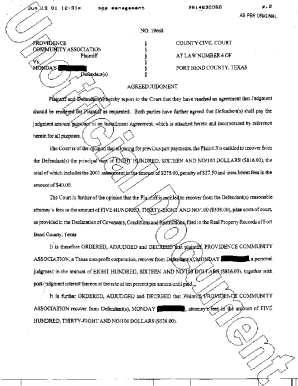

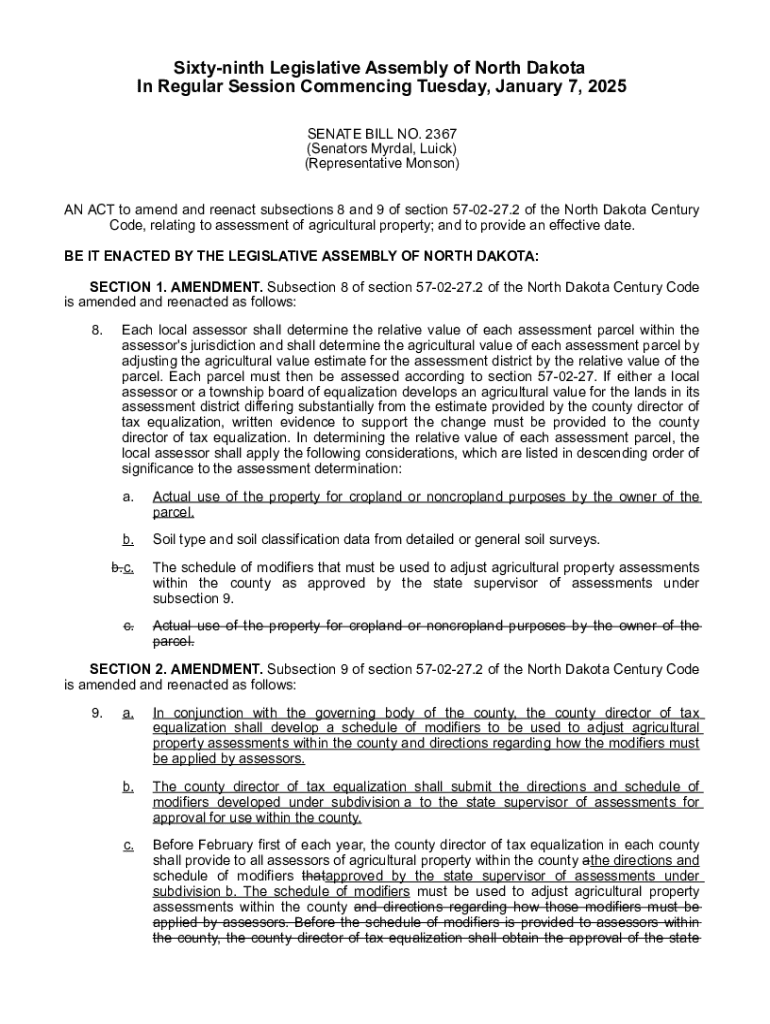

The Senate plays a crucial role in shaping taxation policies through legislation, as it acts as one of the primary chambers responsible for reviewing proposed tax laws. Taxation forms are central to this legislative process, facilitating the intent and structure of tax provisions submitted by various representatives, such as Lydia Edwards and Michael Rush. Once a proposal reaches the Senate, it undergoes a rigorous review process, allowing lawmakers to delve into the specifics of each bill, including taxation amendments that might address issues like property taxes in cities such as Boston.

Understanding how taxation forms work is essential for any stakeholder involved in legislative changes. The process begins with the form submission to the appropriate Senate committee, followed by evaluations, discussions, and potential revisions. Key terms related to these forms include 'amendments,' 'home rule petition,' and 'proposals,' which help clarify the objectives and parameters of each piece of legislation under consideration.

The current state of Senate taxation proposals

The Massachusetts Senate has seen various taxation proposals recently, with notable discussions led by figures such as William Brownsberger and Nick Collins. Among these proposals, several have met with rejection, often due to their complexity or opposition from local governments. Recent bills aimed at addressing property tax relief were scrutinized, ultimately leading to votes against them, revealing a legislative environment focused on balanced budgets and equitable taxation systems.

The reasons for these rejections can vary: sometimes they stem from a lack of public support, while at other times, they reflect disagreements among committee members regarding the fiscal implications of the proposals. Despite a few setbacks, the Senate has also approved alternative tax relief measures that aim to provide assistance to low-income residents and cities facing financial strain, demonstrating a willingness to adapt and find common ground.

The impact of Senate decisions extends beyond individual proposals; they influence local taxation policies significantly. The decisions made by the Massachusetts Senate have rippling effects on how cities construct their budgets, rainy-day funds, and responses to economic changes, all of which shape the financial landscape for residents in the state.

Insights on the Senate taxation form

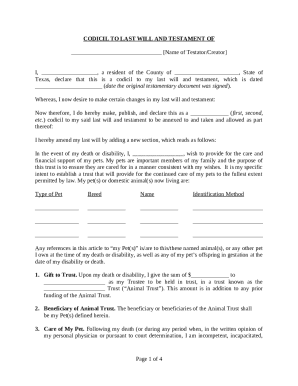

The Senate taxation form serves a critical purpose in the legislative process, acting as the formal request for consideration of a new tax policy or amendment. Its importance cannot be overstated, as it lays the groundwork for discussions and decisions that will directly affect taxpayers across the state, including the ability to navigate property taxes and other financial obligations.

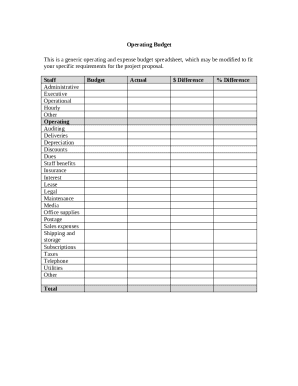

Each component of the Senate taxation form is meticulously crafted. Key sections include identification data, taxation details specifying the intended changes, and a verification section that demands signatures from responsible parties. This systematic arrangement ensures clarity and accountability, making it easier for legislators and stakeholders to review and understand the implications of the proposed tax measures.

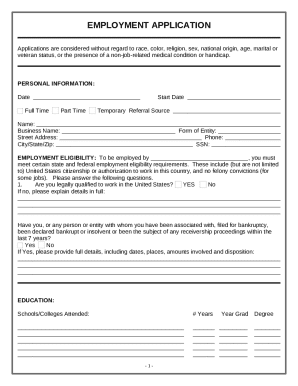

Filling out the Senate taxation form

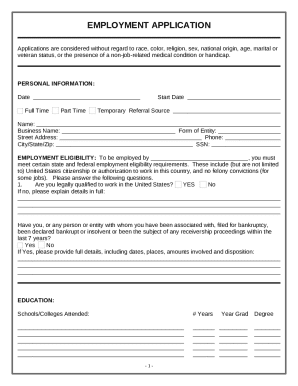

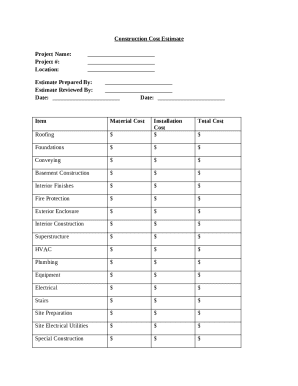

Filling out the Senate taxation form requires careful preparation to ensure all necessary information is accurately captured. Before the process begins, it is crucial to gather the requisite documentation, including financial statements and identification information that support the proposed changes. Additionally, understanding each section's requirements will facilitate a smoother submission process, reducing the risk of delays or rejections by the Senate.

Common mistakes include incomplete sections or missing signatures, which can lead to delays in approval. It is essential to double-check each part of the form before submission to ensure accuracy and compliance with Senate requirements.

Editing and managing the Senate taxation form

Once the Senate taxation form is completed, it may require further modifications. Utilizing platforms like pdfFiller allows for seamless editing of your document. Through interactive editing tools, users can efficiently alter text, update information, and correct errors without starting from scratch. Saving different versions of the document as changes are made offers the advantage of keeping a record of adjustments and decisions.

Digital signatures have become a necessity in contemporary document management, particularly in legislative processes. The importance of eSigning your form lies in its ability to verify authenticity and facilitate faster approvals. By leveraging pdfFiller's eSigning features, you can ensure that your form is safely and securely signed, expediting the review process within the Massachusetts Senate.

Collaborating on the form with teams

Collaboration is key when dealing with legislative forms, especially in teams that include multiple stakeholders. Sharing the Senate taxation form with colleagues can enhance review processes and introduce diverse perspectives. With pdfFiller, teams can easily collaborate, allowing for efficient exchanges of feedback and suggestions. This collaborative approach ensures that the form is as comprehensive and accurate as possible before submission.

The platform's features enable real-time edits and updates, giving all team members access to the most current version of the document. Team members can leave comments or propose changes directly within the form, streamlining discussions and ensuring everyone is aligned on the formulation of the taxation proposals.

Managing your taxation forms effectively

Managing taxation forms involves not just completing them but also keeping track of submissions and any associated deadlines. Implementing organizational strategies is pivotal to ensure that forms are maintained correctly. Creating a tracking system for submitted forms, along with reminders for resubmissions or follow-ups, can enhance efficiency in handling legislative requirements.

By utilizing pdfFiller’s cloud-based management tools, you can streamline your document workflows and maintain compliance with local taxation laws. This will allow you to keep up to date with any changes enacted by the Massachusetts Senate, ensuring your forms remain relevant and effective.

Additional considerations for taxation legislative changes

Taxation proposals can fluctuate and change based on evolving financial landscapes or constituent needs. It’s essential to stay well-informed about future taxation proposals by the Massachusetts Senate to ensure you can adapt effectively. Engaging with local representatives regarding potential changes can provide you with insider insights and allow you to advocate for your interests as proposals are discussed.

Public participation plays a vital role in taxation policy debates. Making your voice heard through community forums or directly to representatives, such as Michelle Wu, can influence the makeup of taxation policies significantly. Engaging in discussions about proposals helps shape the decisions that affect your property taxes and overall financial duties, reinforcing the importance of active citizenship in local governance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send senate taxation turns down to be eSigned by others?

How do I edit senate taxation turns down on an Android device?

How do I complete senate taxation turns down on an Android device?

What is senate taxation turns down?

Who is required to file senate taxation turns down?

How to fill out senate taxation turns down?

What is the purpose of senate taxation turns down?

What information must be reported on senate taxation turns down?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.