Get the Free tax document checklist: Documents needed to file taxes

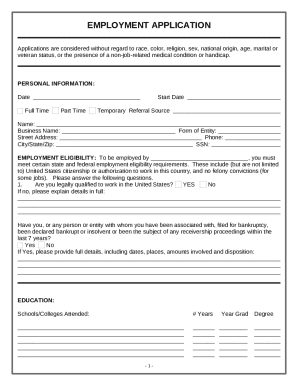

Get, Create, Make and Sign tax document checklist documents

Editing tax document checklist documents online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax document checklist documents

How to fill out tax document checklist documents

Who needs tax document checklist documents?

Your Essential Tax Document Checklist for Smooth Tax Preparation

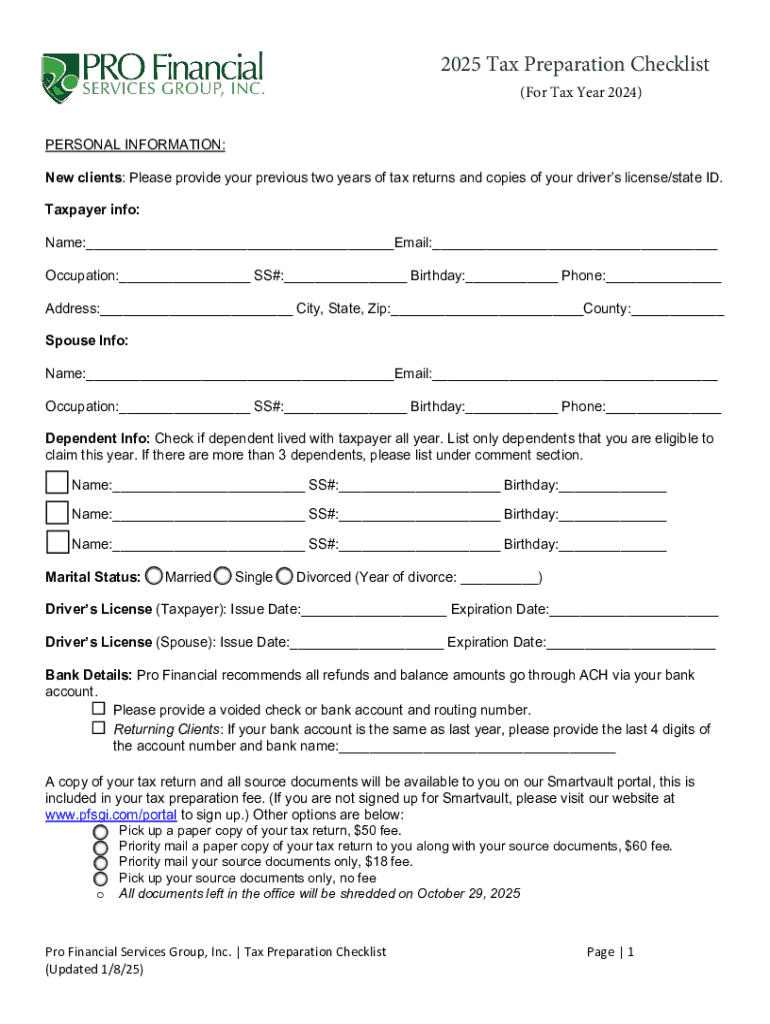

Overview of tax document checklists

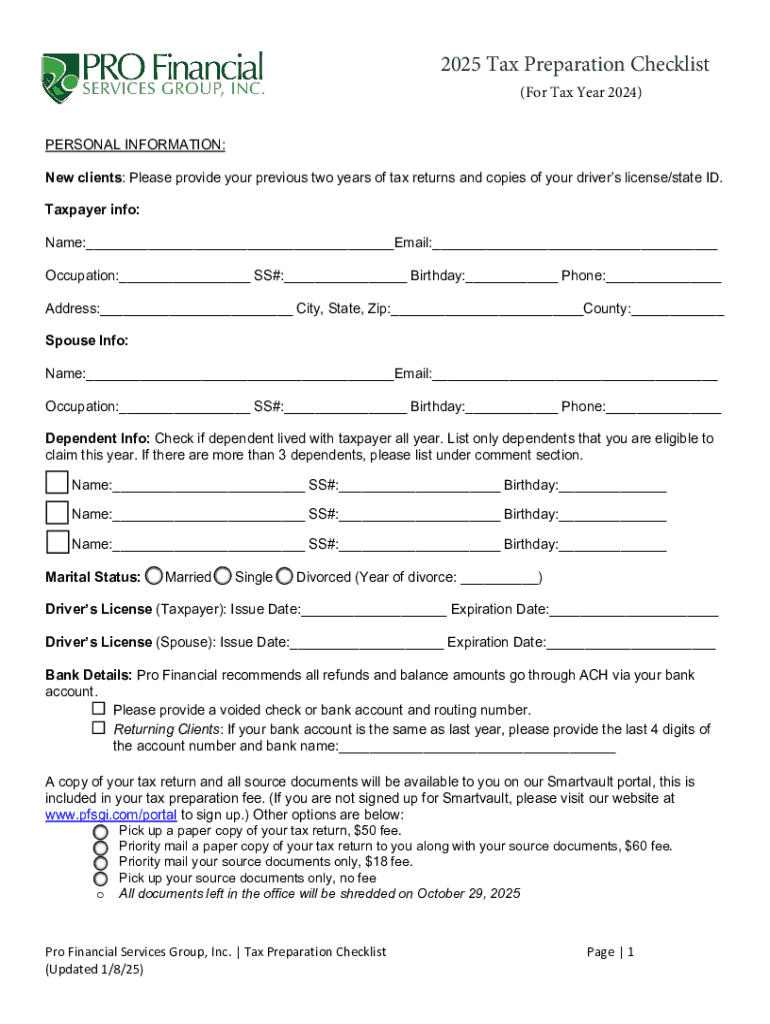

Navigating tax season can feel overwhelming, especially when it comes to collecting all the necessary documents. A tax document checklist serves as a vital tool that helps you gather everything needed for a smooth filing process. This checklist is not just a simple list; it is an organized compilation that ensures you won’t overlook critical documents.

Staying organized during tax season aids in avoiding potential delays and penalties. The benefits include having your materials ready for your tax professional or if you choose to file independently. Plus, having everything in one place allows you to take control of your financial situation and maximizes your potential refunds.

Key tax documents: A comprehensive breakdown

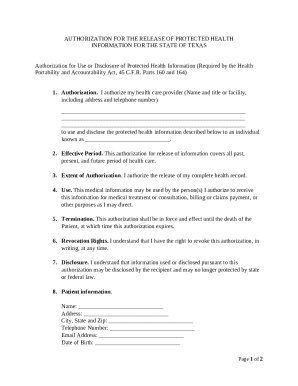

When preparing your taxes, personal documentation forms the foundation. This includes identifying necessary personal information such as your Social Security number and bank account details for direct deposits. Keeping these documents secure is paramount, as identity theft is a prevalent risk during tax season.

Next, you need income documentation. For salaried employees, W-2 forms summarize your earnings and withheld taxes. Look for accuracy in these forms; any discrepancies must be addressed promptly to avoid complications.

Self-employed individuals and freelancers receive 1099 forms, which come in various types for different income sources, like 1099-MISC for miscellaneous income and 1099-NEC for non-employee compensation. It's crucial to review these documents carefully, as each portrays a different facet of your income.

Expense tracking and reporting

Deductible expenses can significantly reduce your taxable income, so it’s essential to track them meticulously. Common deductible expenses include medical costs, charitable contributions, home office deductions, and travel expenses related to work. To capitalize on available deductions, you need to document each expense properly.

The importance of keeping receipts cannot be overstated; they serve as proof for your claims. Whether you opt for physical records or digital records, ensure they are organized efficiently. Digital solutions like pdfFiller offer excellent ways to manage records, allowing you to store documents digitally for easy access.

Other tax documents or notices

In addition to federal tax documents, don’t forget state and local tax requirements. Each state has its forms that differ from federal documents, and being aware of these can prevent last-minute scrambling. Certain states might also have specific guidelines for deductions or credits.

Stay vigilant for notices from the IRS such as CP2000 for income discrepancies or CP2100 notices regarding forms like 1099. These notices indicate potential issues with your filings and usually require timely action on your part.

Understanding tax credits

Tax credits can significantly boost your refund or reduce your tax liability, making them essential knowledge for your filing. For instance, the Earned Income Tax Credit (EITC) provides relief for lower to moderate-income earners and requires documentation such as income statements to verify eligibility.

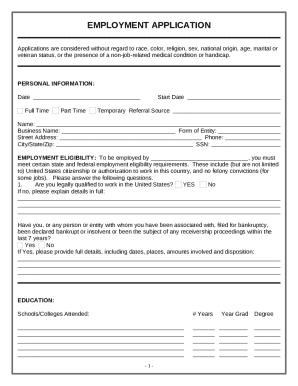

Employment and self-employment income

Understanding the distinctions between wage earners and self-employed individuals is vital for tax preparation. Wage earners typically receive W-2 forms, while self-employed individuals must file Schedule C to report business income and expenses. Each category necessitates different documentation and record-keeping strategies.

Retirement and disability benefits

Retirement income can come from various sources including pensions and IRA withdrawals, each liable for taxes in different manners. Knowing how these will be taxed can help you plan your finances better when filing taxes.

Disability benefits also require careful documentation. Not all benefits are taxable, but knowing which are is vital to avoid unexpected tax bills. Keeping thorough records of benefits received is the best practice here.

Using technology to manage tax forms

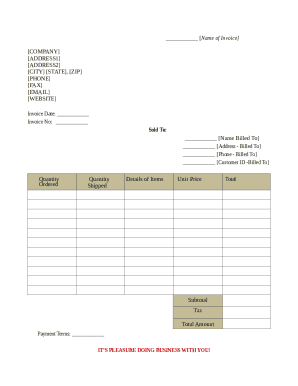

In today’s digital world, harnessing technology for tax document management can simplify the process significantly. Interactive tools found on platforms like pdfFiller allow users to fill, edit, sign, and manage their tax documents seamlessly.

Preparing for filing your taxes

Preparing to file your taxes can be streamlined with a clear step-by-step checklist. Ensure all your personal information is correct and complete. This includes correctly listing your name and Social Security number as they appear on your social documents.

The final review before submitting your taxes is crucial. Make sure to double-check all entries to reduce errors. Consider utilizing electronic filing for a faster, more efficient submission.

Year-round document management

Efficiently managing your tax documents year-round keeps you prepared for when tax season approaches. Adopting best practices such as maintaining both physical and digital records will provide options based on your workflow preferences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax document checklist documents to be eSigned by others?

How can I edit tax document checklist documents on a smartphone?

How do I complete tax document checklist documents on an Android device?

What is tax document checklist documents?

Who is required to file tax document checklist documents?

How to fill out tax document checklist documents?

What is the purpose of tax document checklist documents?

What information must be reported on tax document checklist documents?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.