Get the free Lottsa Tax & Accounting Services - Worksheets

Get, Create, Make and Sign lottsa tax amp accounting

Editing lottsa tax amp accounting online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lottsa tax amp accounting

How to fill out lottsa tax amp accounting

Who needs lottsa tax amp accounting?

Lottsa Tax AMP Accounting Form: A Comprehensive Guide

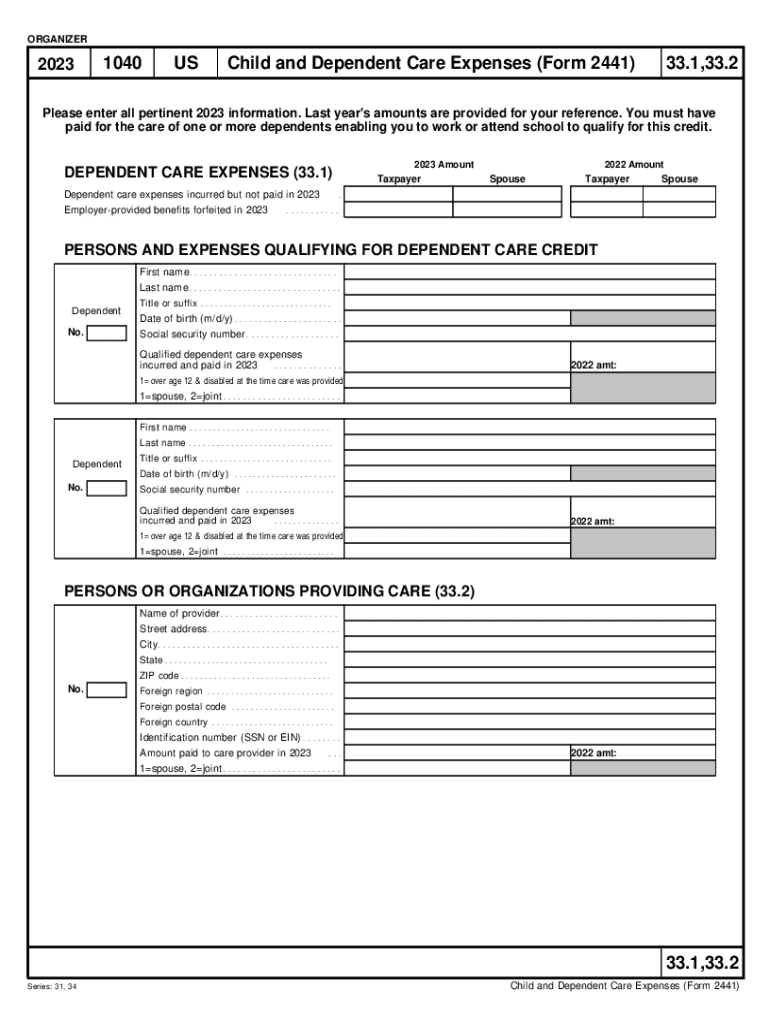

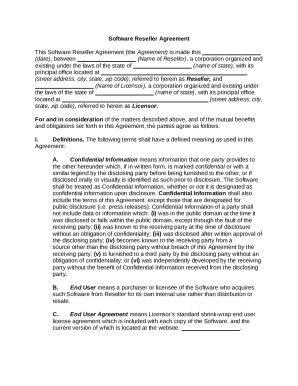

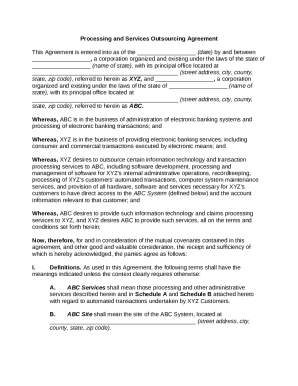

Overview of the Lottsa Tax AMP Accounting Form

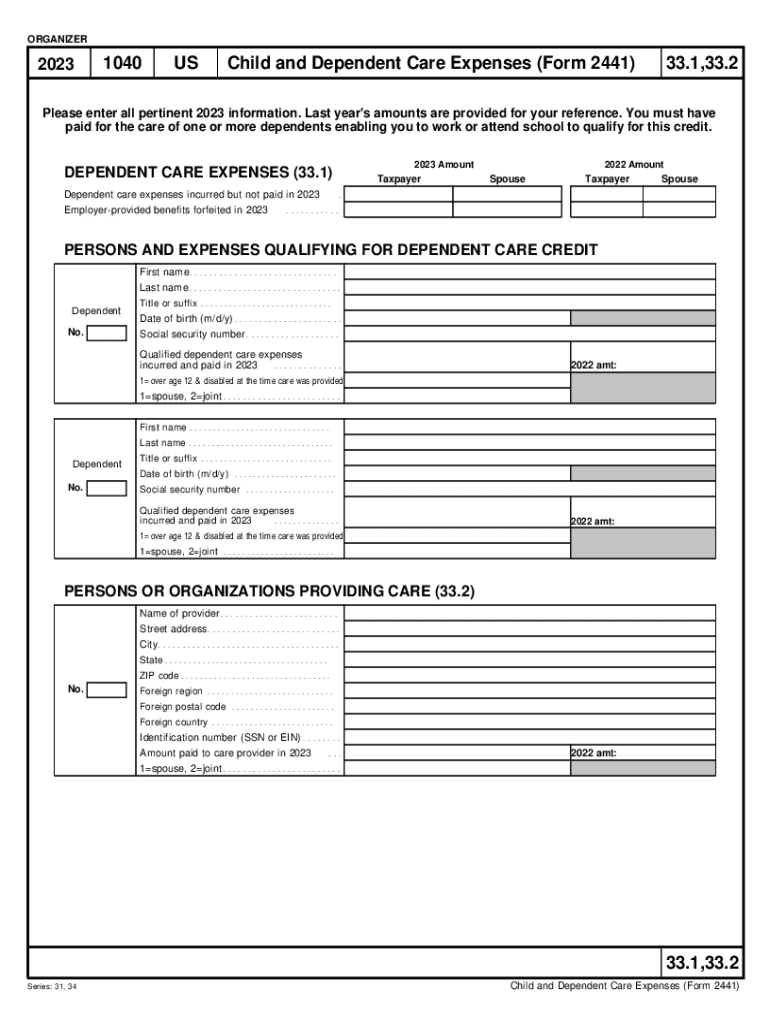

The Lottsa Tax AMP Accounting Form is designed to streamline the tax reporting process for individuals and businesses needing an efficient way to manage their taxable income and deductions. This comprehensive form allows users to compile relevant financial data in one place, ensuring accurate reporting to tax authorities.

Accurate tax reporting is not only a legal requirement but also crucial for individuals and businesses aiming to minimize their tax liabilities and maximize refunds. Failing to report income accurately or claiming improper deductions can lead to unwanted audits, penalties, or legal issues.

The Lottsa Tax AMP Accounting Form is particularly beneficial for self-employed individuals, small business owners, and freelancers who need to document their earnings comprehensively. However, anyone who files taxes can take advantage of this form's streamlined process.

Key features of the Lottsa Tax AMP Accounting Form

The Lottsa Tax AMP Accounting Form comes packed with features tailored to enhance user experience and ensure thorough tax reporting. One of its standout features is its comprehensive data sections that allow users to break down income and expenses in detail.

These sections include:

The user-friendly interface promotes easy navigation, allowing users to complete their forms quickly and efficiently. Compatibility with other financial tools enables seamless integration into your existing financial management system.

Step-by-step guide to filling out the Lottsa Tax AMP Accounting Form

Filling out the Lottsa Tax AMP Accounting Form can be broken down into manageable steps, ensuring users capture all necessary information efficiently.

Step 1: Gather necessary documents. Prior to starting, ensure you have all required financial paperwork on hand, including:

Step 2: Access the form on pdfFiller. Locate the Lottsa Tax AMP Accounting Form easily through the search function on the pdfFiller platform.

Step 3: Inputting your information. Follow these detailed instructions for each section. Start by entering income data accurately, ensuring all sources are covered. When claiming deductions, employ best practices such as documenting all expenses with receipts.

Step 4: Review and verify your entries. Double-check for common mistakes such as input errors and take advantage of pdfFiller's built-in validation tools to identify issues.

Step 5: Finalize and submit the form. Before submission, eSign your document where required and explore methods for submitting your completed form directly through pdfFiller's platform.

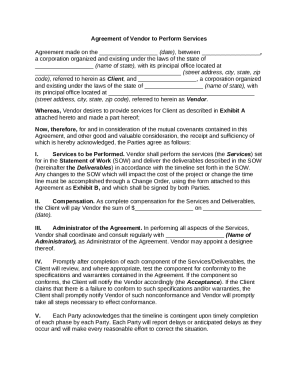

Editing and customizing the Lottsa Tax AMP Accounting Form on pdfFiller

One of the standout capabilities of the Lottsa Tax AMP Accounting Form available on pdfFiller is its editing and customization options. Users can easily make adjustments to existing forms, whether it's correcting an error or updating figures.

Customizing fields is made simple, allowing adjustment for unique financial situations such as added income streams or specific deductions applicable to the user’s financial profile. For those looking to save time, utilizing templates for common situations can significantly improve efficiency.

Interactive tools for effective form management

pdfFiller enhances the user experience with interactive tools that support collaboration and tracking. Utilizing the collaborative features allows multiple users to edit, comment, and provide feedback on the Lottsa Tax AMP Accounting Form.

This feature is beneficial for teams or family members working together on financial documentation. Additionally, users can track changes and comments throughout the editing process, ensuring transparency and effective communication.

Sharing the form with team members is straightforward, creating an opportunity for input from various stakeholders, catering to complex financial situations.

Troubleshooting common issues

Despite a user-friendly design, issues may arise during the filling process of the Lottsa Tax AMP Accounting Form. Some common errors include form filling mistakes and miscalculations in data. To fix them, review your data entries carefully and cross-reference with your documents.

When calculations do not align, utilize pdfFiller's features for recalculating entries or adjusting figures manually as needed. If problems persist, contacting pdfFiller support is advisable to gain assistance from their knowledgeable customer service team.

Best practices for managing tax documents

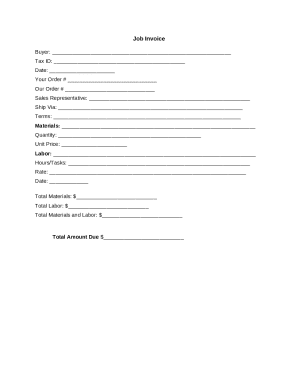

Effective tax management practices can alleviate stress during tax season. Organizing financial records year-round is pivotal to avoid last-minute missteps. Users should categorize receipts, invoices, and financial statements regularly to keep track of their income and deductions.

Timely filing is essential to avoid penalties. Staying informed on tax deadlines and using reminders can help ensure compliance with IRS requirements. Additionally, pdfFiller offers secure document storage options, locking down sensitive information for safe retrieval during tax preparation.

Testimonials and success stories

User feedback highlights the positive impact the Lottsa Tax AMP Accounting Form has had on their tax preparation processes. Many individuals report streamlined filing experiences and significant time savings through effective organization and easy data entry.

Case studies have shown that users who incorporate value-added digital tools like pdfFiller achieve improved efficiency and enhanced accuracy, ultimately leading to more satisfied filing experiences.

Frequently asked questions

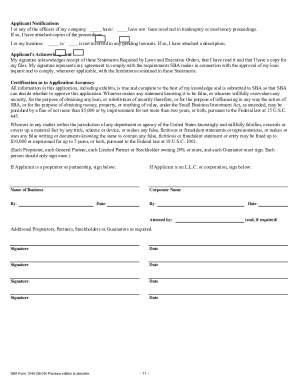

Questions often arise regarding the Lottsa Tax AMP Accounting Form. Users frequently ask, "What if I need to amend my Lottsa Tax AMP Accounting Form after submission?" In this case, users can access their saved forms on pdfFiller, make the necessary amendments, and resubmit as needed.

Another common query is, "Can I use pdfFiller to file my taxes directly?" While pdfFiller assists in preparing the forms, filing taxes still requires procedures as mandated by local tax authorities. Lastly, users inquire about fees associated with using the Lottsa Tax AMP Accounting Form on pdfFiller. Access varies, and many users can explore flexible pricing options to find a solution that fits their needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send lottsa tax amp accounting to be eSigned by others?

How do I make edits in lottsa tax amp accounting without leaving Chrome?

How do I fill out lottsa tax amp accounting using my mobile device?

What is lottsa tax amp accounting?

Who is required to file lottsa tax amp accounting?

How to fill out lottsa tax amp accounting?

What is the purpose of lottsa tax amp accounting?

What information must be reported on lottsa tax amp accounting?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.