Get the free Kuwait Invoice Layout Samples

Get, Create, Make and Sign kuwait invoice layout samples

How to edit kuwait invoice layout samples online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kuwait invoice layout samples

How to fill out kuwait invoice layout samples

Who needs kuwait invoice layout samples?

Kuwait Invoice Layout Samples Form

Overview of Kuwait invoice requirements

In Kuwait, adhering to specific invoice requirements is crucial for businesses, especially with the implementation of value-added tax (VAT). The VAT regulations mandate that all invoices contain certain key elements, ensuring both transparency and compliance. Failing to meet these requirements can result in penalties, making it essential for businesses to familiarize themselves with the necessary components of an invoice in the local market context.

Key aspects of an invoice must not only comply with legal standards but also reflect a professional image of the business. Clarity, accuracy, and completeness can enhance client relationships and streamline payment processes, demonstrating professionalism while facilitating quicker transactions.

Essential components of a Kuwait invoice

Creating a Kuwait invoice starts with essential components that provide clarity and context. Here are the critical elements businesses should include:

Detailed breakdown of invoice elements

To enhance clarity and understanding, it’s important to break down each element of the invoice in detail, focusing on organization, consistency, and compliance with Kuwaiti regulations. Specific elements include:

Compliance with Kuwait VAT regulations

Understanding Kuwait’s VAT regulations is essential for businesses issuing invoices. The law specifies that every invoice must show the VAT identification number, tax rates applied, and detailed lists of taxable goods or services. Failing to adhere to these requirements can expose businesses to tax liabilities and fines.

Common pitfalls include neglecting to include VAT calculations or incorrectly displaying tax rates. Businesses should thoroughly review their invoices against the tax authority's guidelines to ensure compliance. Using templates specifically designed for VAT compliance can save time and reduce errors in this critical process.

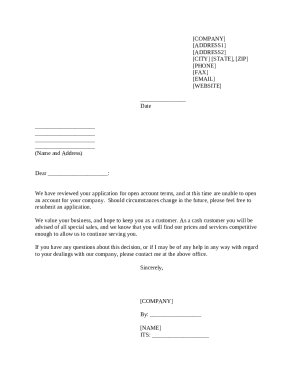

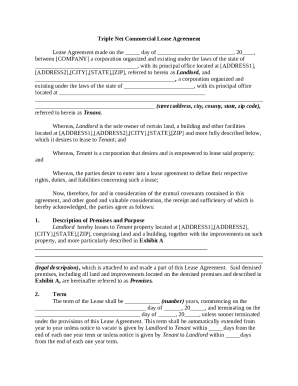

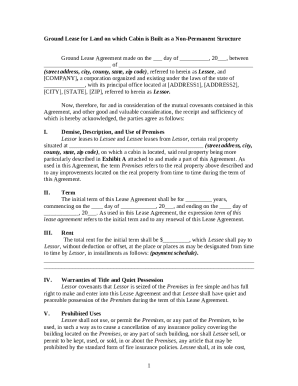

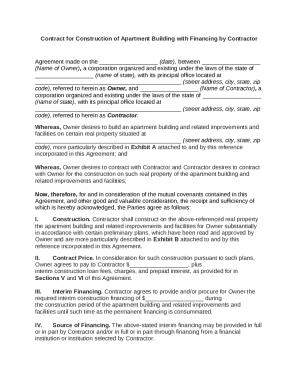

Kuwait invoice layout samples

To assist businesses in creating effective invoices, various layout samples are available. These samples can be tailored to meet organizational branding and compliance needs while ensuring functionality:

Tools for creating and managing invoices

One of the most effective ways to streamline the invoicing process is by using specialized tools like pdfFiller. This platform offers interactive templates tailored to Kuwait’s invoicing requirements. Users can easily access these templates and customize them for their specific business needs, ensuring compliance with VAT and local regulations.

Additionally, pdfFiller provides collaborative features allowing team members to work together on invoices in real-time. This functionality enhances productivity, minimizes errors, and keeps all team members in sync, ultimately leading to a more efficient invoicing process.

Tips for efficient invoice management

Managing invoices efficiently is key to ensuring good cash flow. Here are several strategies for effective invoice management:

Frequently asked questions about Kuwait invoice layouts

Business owners often have questions about designing invoices that comply with local regulations while keeping them user-friendly. Some frequently asked questions include:

Conclusion

Creating an effective Kuwait invoice layout is essential for compliance, professionalism, and efficiency in business operations. By understanding the key components and regulatory requirements, businesses can establish a streamlined invoicing system that meets their needs while fostering good client relationships.

Utilizing tools like pdfFiller can further enhance the invoice creation process, offering interactive features and custom templates that cater to specific business requirements. Start exploring various options available to ensure your invoices are both compliant and aesthetically pleasing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find kuwait invoice layout samples?

Can I create an eSignature for the kuwait invoice layout samples in Gmail?

How do I fill out kuwait invoice layout samples on an Android device?

What is kuwait invoice layout samples?

Who is required to file kuwait invoice layout samples?

How to fill out kuwait invoice layout samples?

What is the purpose of kuwait invoice layout samples?

What information must be reported on kuwait invoice layout samples?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.